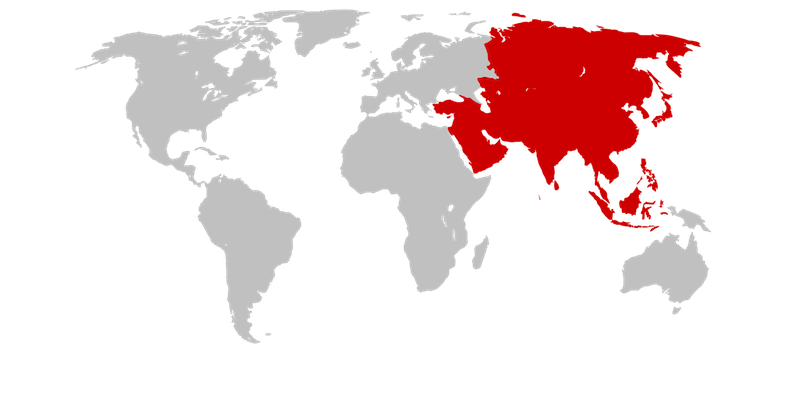

In our overview of leading marketplaces in different regions of the world, we already looked at top marketplaces in North America and top marketplaces in Europe.

Time for part three: Asia.

The scale and growth rate of e-commerce in Asia really sets it apart from other parts of the globe. The e-commerce market was expected to reach $2.05 trillion by 2023.

China, being the largest e-commerce market in Asia and globally, had a market size of $1.49 trillion in 2023. The widespread internet access, increasing availability of mobile devices, and a growing middle class have been primary drivers for this growth.

What’s more, Southeast Asia’s digital economy hit $100 billion in revenue in 2023. Its gross merchandise value (GMV) in this area was on an upward trajectory, set to reach $218 billion, growing 11% year-on-year.

Thanks to digital transformation, e-commerce in other Asian countries such as India, Indonesia, Malaysia, Philippines, Singapore, Thailand, or Vietnam is also growing exponentially.

For international sellers, Asia-based marketplaces are the first gateway to this region of the world, so we have collected 16 platforms that were the core of Asian e-commerce in 2023.

Alibaba

Alibaba is the giant of Chinese e-commerce and the World’s Largest B2B e-commerce marketplace. Its annual revenue for 2023 was $126.491 billion, which is a 6% decline from 2022

The primary revenue generator was e-commerce, through platforms like Taobao, Tmall, and Alibaba.com, where Alibaba charged merchants for services such as advertising and logistics and took commissions on sales.

Alibaba operates in more than 240 countries, and offers more than 5,900 product categories and around 2.8 million storefronts. It helps connect wholesalers based in China with businesses around the world on a single marketplace platform.

Suppliers manufacture and sell products in bulk to buyers looking for inventory for their companies.

The company also operates other huge and highly successful e-commerce sites such as AliExpress, TMall and Taobao.

The goal for Alibaba is to reach $1.4 trillion in GMV in 2024.

AliExpress

AliExpress is an Alibaba-owned marketplace that targets buyers outside China. It is Alibaba’s B2C international site offering international shoppers goods at factory prices without a minimum order size.

AliExpress has a global English site and operates in many languages: Russian, Portuguese, Spanish, French, German, Italian, Dutch, Turkish, Japanese, Korean, Thai, Vietnamese, Arabic, Hebrew, and Polish. The top three countries ranked by total spending on AliExpress are Russia, the United States and Spain.

In terms of product diversity and availability, AliExpress boasts over 100 million products across more than 10 categories.

In 2023, AliExpress demonstrated a growth in presence in the global e-commerce market. The platform received over 441 million visits from January 2023. This figure fluctuated slightly, with the number of visits dropping to 408 million in February before rising again by the end of March.

JD.com

JD.com is a prominent Chinese B2C e-commerce platform which continued to show strong performance and user engagement.

The platform had an impressive 569 million active users in 2021, highlighting its expansive reach in the e-commerce sector. Its annual revenue for 2022 was $151.69 billion.

JD.com is not only a major online retail platform in China but also ranks as the second-largest online store in the world. It has developed a comprehensive logistics system, offering efficient and swift delivery services. These factors contribute to JD.com’s status as a leading e-commerce platform, reflecting its ability to attract a large customer base and offer a wide range of products

Kaola

Kaola is a Chinese marketplace that is part of the NetEase group, a Chinese technology company. It is a popular cross-border shopping platform with 30 million active users. In December 2023, it had more than 131 visits per month.

It has a relatively young audience – over 39.1% of the Chinese consumers on the app are aged 24 years or younger. In this platform, sellers can set up a store on Kaola or sell wholesale to Kaola, which then resells to customers.

In 2022, Kaola generated more than $80 million in revenue.

Lazada

Lazada is a marketplace that remains a significant player in the Southeast Asian e-commerce market.

As of September 2023, the number of sales of Lazada Thailand’s home and lifestyle products was estimated at around 24.7 million. Health and beauty was next with about 16.7 million products sold.

Moreover, in 2023, Lazada recorded 35 million monthly visits in the Philippines – the top overall figure. It offers products in various categories ranging from consumer electronics to household goods and fashion.

It is also a really popular online platform on social media giants Facebook, Twitter, and Instagram.

Rakuten

Rakuten is a Japanese marketplace. Its revenue for the twelve months ending September 30, 2023, was $15.000 billion – a 0.49% year-on-year increase.

As of the second quarter of FY2023, Rakuten Group reported that the average number of monthly active users across its platforms in Japan reached approximately 40.5 million. This reflects an 8.2% year-over-year increase, indicating a steady expansion of Rakuten’s customer base.

Founded in 1997 in Japan, Rakuten has expanded globally by acquiring well-known names such as Play.com in the UK, PriceMinister in France, Buy.com in the US and many others. Like Alibaba and Amazon, Rakuten is one of the strongest international e-commerce brands.

Travel, footwear, and pets – these were some of the faster growing categories on Rakuten in 2023.

Shopee

Shopee is one of the leading mobile e-commerce platforms in Southeast Asia. It operates in Singapore, Malaysia, Thailand, Taiwan, Indonesia, Vietnam, and the Philippines. For example, Shopee’s sales in the Philippines reached $400 million USD and show a month-on-month increase of 15%.

In 2017, Shopee launched Shopee Mall with 200 brands in Singapore. The dedicated portal features thousands of products sold by leading brands and retailers in the region. A year later, it launched the China Marketplace portal that offers shoppers easy access to products from Chinese merchants.

Shopee started as a consumer-to-consumer (C2C) marketplace, but has since moved into both a C2C and business-to-consumer (B2C) hybrid model. It describes itself as a social mobile marketplace:

Snapdeal

Snapdeal is an India-based marketplace. It started in 2010 and has grown through strategic acquisitions by eBay. It promises to offer the best-priced deals on branded products from categories such as electronics, fashion and apparel.

In May 2023, it generated more than 15 million visits.

As part of their Snapdeal Plus program, the marketplace handles all storage, packing and delivery making it easy for international sellers to reach Indian customers.

Taobao

Taobao is a Chinese marketplace owned by Alibaba. Founded in 2003, Taobao Marketplace facilitates consumer-to-consumer (C2C) retail by providing a platform for small businesses and individual entrepreneurs to open online stores that sell to consumers in Chinese-speaking regions and abroad.

About 1.03 billion people in China were actively shopping on the platform on their mobile devices as of September 2023.

Moreover, Taobao was among the most popular shopping apps in the country, with more than 895 million monthly active users during the same period.

Tmall

Tmall is a Chinese B2C marketplace, also owned by Alibaba. Just like Taobao, it is one of the largest e-commerce marketplaces in the world.

Tmall sells branded goods to customers in China and neighbouring countries through special warehouses provided by the platform. It provides the complete shopping solution, while merchants only have to supply the product.

The platform saw a substantial increase in the number of brands, with 38,600 brands growing at a rate of over 100% compared to the previous year. Particularly notable was the performance during the Double 11 event, where 402 brands achieved sales exceeding 100 million yuan, showcasing Tmall’s strong appeal to global brands.

This growth highlights Tmall’s dominant position in the e-commerce market and its ability to attract a wide range of merchants and consumers, further solidifying its role as a key player in the industry.

Amazon

In 2023, Amazon India was the largest online marketplace in India, attracting more than 295 million visitors per month. This significantly outnumbered its closest competitor, Flipkart.

Amazon’s popularity in Asia can be attributed to several factors, for example wide product range, convenience, technological Innovation, brand trust, local adaptation, and competitive pricing.

Moreover, Amazon’s commitment to customer service, including easy returns and refunds, builds trust and reliability among consumers.

Flipkart

Flipkart is India’s second-largest marketplace with over 167 million visitors per month. These figures highlight the dominance of Amazon and Flipkart in India’s online retail space, with a substantial lead over other platforms in terms of user traffic.

Flipkart started in 2007 and grew to a real success story. Just like Amazon, Flipkart first sold books, but it quickly started offering products in many different categories.

Its success also stems from the fact that Flipkart was one of the first adopters of cash-on-delivery payments which proved successful in getting more customers to use the service. It has also invested in its own logistics service and own infrastructure to support the growing e-commerce industry in India.

As of 2023, Flipkart has significantly expanded its user base, and witnessed over 41 million new customers up until November 2023.

Coupang

Coupang is a popular e-commerce site and marketplace in South Korea. Starting as a daily deals site in 2010, Coupang has become then the fastest-growing e-commerce company in the world.

Coupang has succeeded in the Asian market through innovations that meet the needs of local consumers. This includes such things as same-day delivery.

As of November 2023, Coupang had around 147.6 million users on its online marketplace, showing growth compared to the previous month.

Zalora

Zalora is an online marketplace focusing on fashion. It was launched in 2012. It operates in more than 20 countries, including Indonesia, Hong Kong, Singapore, and Taiwan.

The Zalora marketplace targets retailers who want to offer their diverse customer base everything they love. Zalora has also launched its own fashion and lifestyle magazine.

Zalora has more than 50 million unique users and its estimated annual revenue is currently $589.9M per year.

Xiohongshu

Xiohongshu is a relatively new social networking and e-commerce site in the Asia-Pacific region, specifically China. It targets a younger demographic, so it surprises with its attractive design and user experience.

It allows foreign brands to reach Chinese youth by offering products in the fashion, cosmetics and personal care categories.

The app was approaching $500 million in profit in 2023. It also wanted to reach 200 million monthly active users in China in September 2023.

Instamojo

Instamojo is India’s #D2CTech all-in-one platform. It transitioned from being a payment links company to an all-in-one platform for businesses, providing comprehensive services for businesses.

It is widely used by small businesses and entrepreneurs to sell digital products, such as eBooks, music, software, directly to the public.

In 2023, Instamojo recorded significant growth, achieving a 150 percent year-on-year growth and becoming EBITDA profitable.

FAQ

What is an online marketplace and how does it differ from traditional e-commerce platforms?

An online marketplace serves as a digital platform where multiple third-party sellers can offer their products or services, unlike traditional e-commerce platforms which typically represent a single brand or business. This model provides direct access to a diverse range of goods, from consumer goods to fresh food, catering to various consumer needs.

Why are online marketplaces becoming increasingly popular in Southeast Asia?

Southeast Asia’s rapidly growing internet economy and the rise in digital payments have made online marketplaces more accessible. The region’s diverse logistics infrastructure also supports efficient cross-border e-commerce, allowing local sellers to easily connect with Chinese consumers and other international markets.

What are some of the largest online marketplaces in Southeast Asia and how do they impact the e-commerce space?

Some of the largest online marketplaces in Southeast Asia include Lazada and Shopee. They significantly contribute to the region’s e-commerce market by offering a platform for both local and international businesses, enhancing the gross merchandise volume and expanding the reach of Southeast Asian countries in the global market.

How do cross-border e-commerce platforms benefit sellers in Southeast Asia?

Cross-border e-commerce platforms provide Southeast Asian sellers with the opportunity to expand their market reach beyond local consumers to international audiences, including the lucrative Chinese market. This expansion helps in leveraging the first mover advantage in emerging product categories and targeting a broader audience.

What role does logistics infrastructure play in the success of online marketplaces in Southeast Asia?

A robust logistics infrastructure is crucial for the success of online marketplaces in Southeast Asia. It ensures efficient handling of orders, from same-day delivery to international shipping, thereby enhancing customer satisfaction and facilitating the growth of the e-commerce market in the region.

How do online marketplaces cater to the needs of Chinese consumers?

Online marketplaces cater to Chinese consumers by offering a wide range of product categories, including popular consumer goods and fresh food items. They also provide multiple payment methods, including digital payments and escrow services, ensuring a seamless shopping experience for Chinese buyers.

What advantages do online sellers have in using popular e-commerce platforms in Southeast Asia?

Online sellers benefit from the established storefronts of popular e-commerce platforms, gaining direct access to a large base of monthly visitors and a diverse target audience. This early adoption of digital platforms gives sellers a competitive edge in the rapidly evolving internet economy of Southeast Asia.

In what ways do international businesses leverage the e-commerce market in Southeast Asia?

International businesses leverage the e-commerce market in Southeast Asia by partnering with top online marketplaces to gain exposure in the region. This allows them to tap into the growing consumer base in Southeast Asian countries and benefit from the region’s increasing cross-border e-commerce activities.

How does the business model of third-party marketplaces differ from traditional e-commerce platforms?

Third-party marketplaces operate on a business model that allows multiple sellers, including global brands and local businesses, to list their products on a single platform. This contrasts with traditional e-commerce platforms where a business sells its own products through an established storefront.

What future trends are expected in the e-commerce space in Asia Pacific, particularly in South Korea and other countries?

Future trends in the e-commerce space in Asia Pacific, including South Korea and other countries, are likely to focus on enhancing the customer experience through advanced digital payments, expanding product categories, and improving logistics for faster delivery. Additionally, there’s an increasing emphasis on integrating AI and machine learning for personalized shopping experiences, as well as a growing interest in sustainable and ethical business practices within the e-commerce sector.

Read more from E-commerce Germany News: