European consumer sentiment 2026: Signals every retailer should watch

Written by

Kinga EdwardsPublished on

Stay informed on European consumer sentiment trends for 2026. Identify crucial signals that can guide retailers in making informed business decisions.

Retail in Europe enters 2026 with a familiar mood that sits somewhere between caution and calm rather than panic or excitement. Consumers feel steady but price-aware, and while they continue to buy and treat themselves, they now take more time to think through each decision. European consumer sentiment just shapes every shelf, every checkout, and every online cart as the year unfolds.

What matters now are not dramatic shifts or sudden reversals, but subtle signals that show up in small changes to confidence, priorities, and everyday trade-offs. Retailers who spot these signals early gain room to adapt, while those who overlook them often end up chasing demand that has already moved on.

This piece breaks down what European consumers are telling us right now. The information are grounded in the latest McKinsey ConsumerWise research on European consumer sentiment, tracking how people across key markets feel, spend, and adapt.

Consumer confidence feels flat, and that is the signal

Across major European markets, consumer sentiment barely moved heading into the end of 2025. Roughly half of shoppers described mixed feelings about the economy.

→ A smaller share felt optimistic.

→ The rest leaned pessimistic.

Stability here means people adjust. Consumers learned how to live with uncertainty. They stopped waiting for clarity and built habits that feel safe enough to maintain.

Retailers should read this as emotional fatigue. Shoppers are not reacting to headlines anymore. They rely on personal experience instead. Daily prices. Monthly bills. Job security close to home.

Confidence has turned inward. That matters more than macro optimism.

Personal finances feel stronger than the broader economy

An interesting split continues across Europe. Many consumers say their own finances feel stable, even while their view of the wider economy stays muted. This pattern showed up consistently across France, Germany, Italy, Spain, and the United Kingdom.

People trust what they control. Paychecks. Savings. Household budgets. They do not trust political signals or global news. That gap shapes spending behavior in quiet ways.

Shoppers keep buying essentials. They allow small indulgences. They hesitate on big commitments. Retailers who focus on daily relevance outperform those chasing aspirational messaging.

Personal stability drives decisions now. Not national confidence.

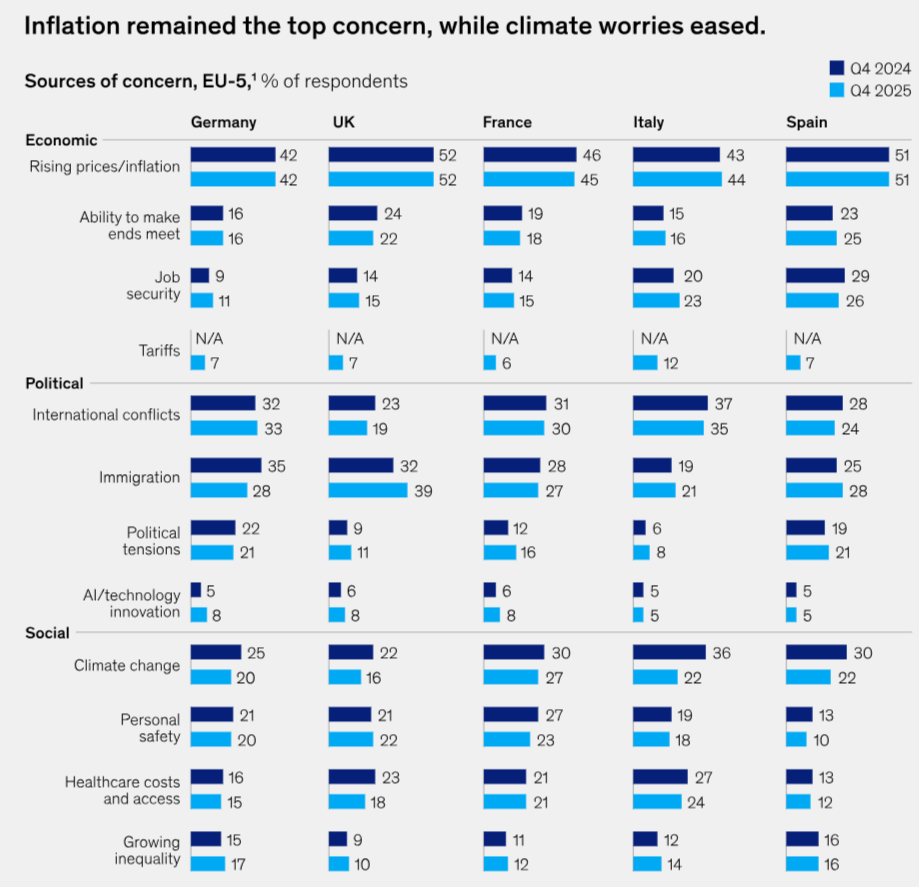

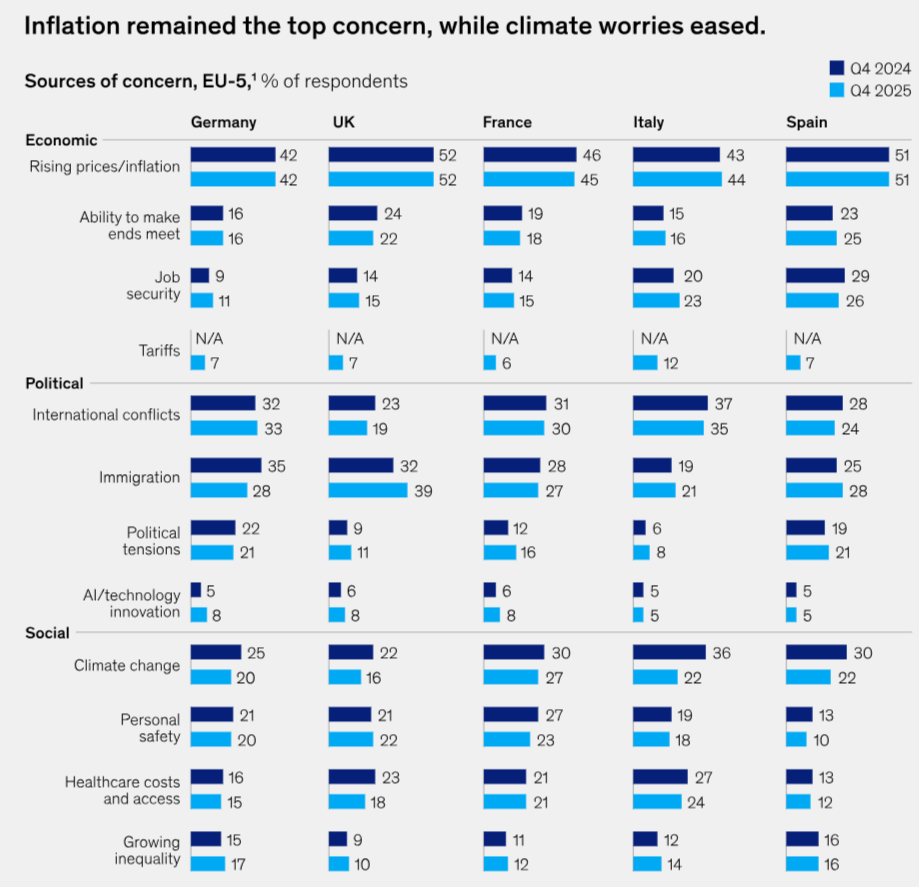

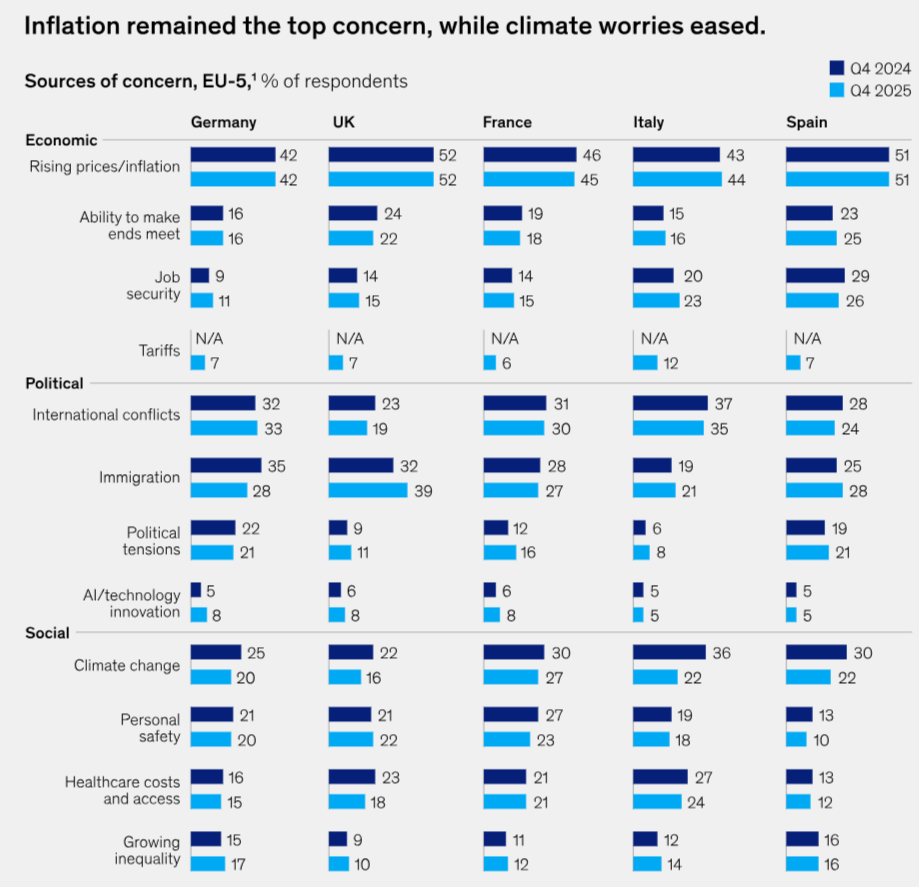

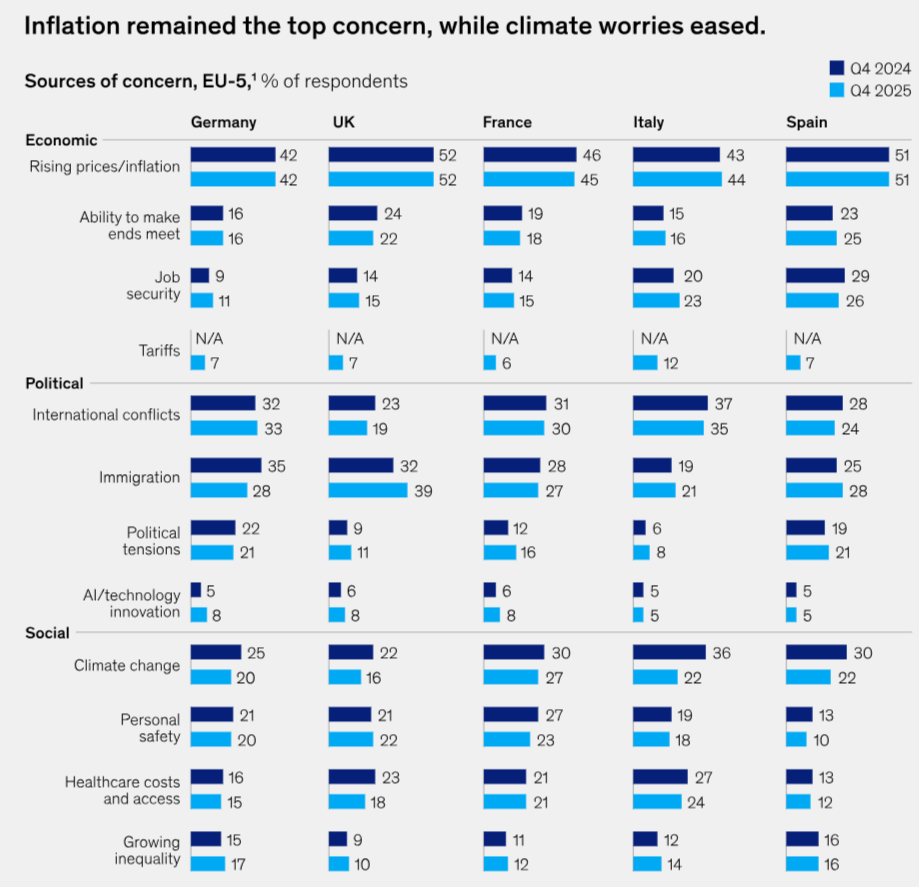

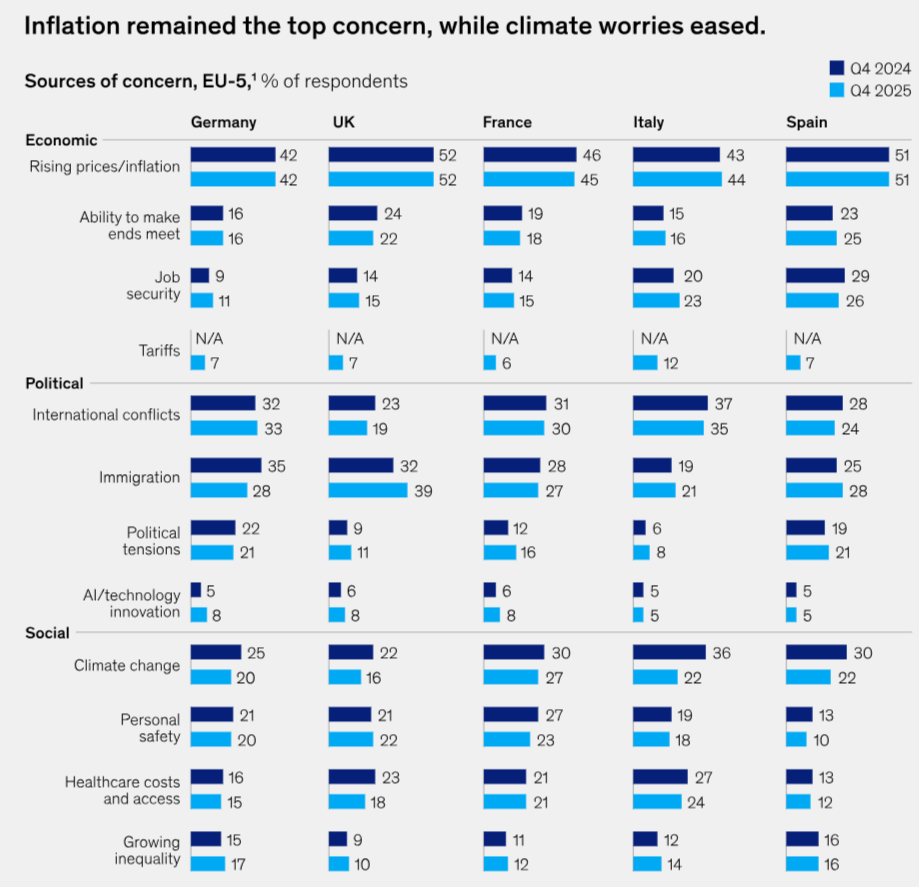

Inflation still leads every worry list

Inflation remains the top concern across Europe. In every major market, it ranked higher than job security, political uncertainty, or climate worries. Price pressure defines how consumers scan shelves and compare brands.

That pressure softened compared with earlier spikes. Shoppers noticed. Many maintained discretionary spending instead of cutting it fully. Holiday budgets survived in trimmed form.

This creates a narrow window. Consumers are not in survival mode. They still want value. They still want quality. They simply expect both together.

Retail pricing must feel fair, transparent, and predictable. Surprise increases break trust faster than ever.

Tariffs barely register for European shoppers

Moreover, compared with consumers in the United States, Europeans paid far less attention to tariffs and trade policy. Only a small share ranked these issues among their top concerns.

This difference reflects how consumers process economic information. European shoppers focus on visible prices and direct household impact rather than policy developments.

Retailers gain little from referencing trade dynamics. Clear pricing and straightforward communication resonate more strongly than abstract economic explanations.

Climate concern faded into the background

One notable shift in European consumer sentiment over the past year. Concern about climate change declined across all observed European markets. The drop was especially visible in Southern Europe.

This does not signal indifference. It signals priority sorting. When everyday costs rise, abstract risks slide down the list. Consumers focus on what affects them this month.

Retailers should be careful here. Sustainability messaging still matters. It simply works better when tied to savings, durability, or reduced waste at home.

Savings behavior looks familiar, with one clear exception

Most European households reported saving behaviors similar to last year. No major new patterns emerged in France, Germany, Italy, or Spain. People did not suddenly cut deeper or spend freer.

The United Kingdom stood apart. A noticeable share of UK consumers leaned more on credit cards for essentials. More households dipped into savings. Expense tracking increased.

This points to pressure without collapse. UK shoppers still spend, but with sharper limits. They favor comfort and control. Retailers serving the UK should expect higher sensitivity around payment options, promotions, and bundle value.

Essentials spending stays steady

Intentions around essentials and semi-discretionary goods changed very little quarter over quarter. Groceries and household items remained stable categories. There were no dramatic pullbacks.

Seasonal spikes showed up where expected. Vehicles and toys moved due to timing, not confidence shifts.

This stability is powerful. It means households locked in routines. They found budgets that work. Retailers that fit into those routines stay relevant.

Being dependable beats being exciting in 2026.

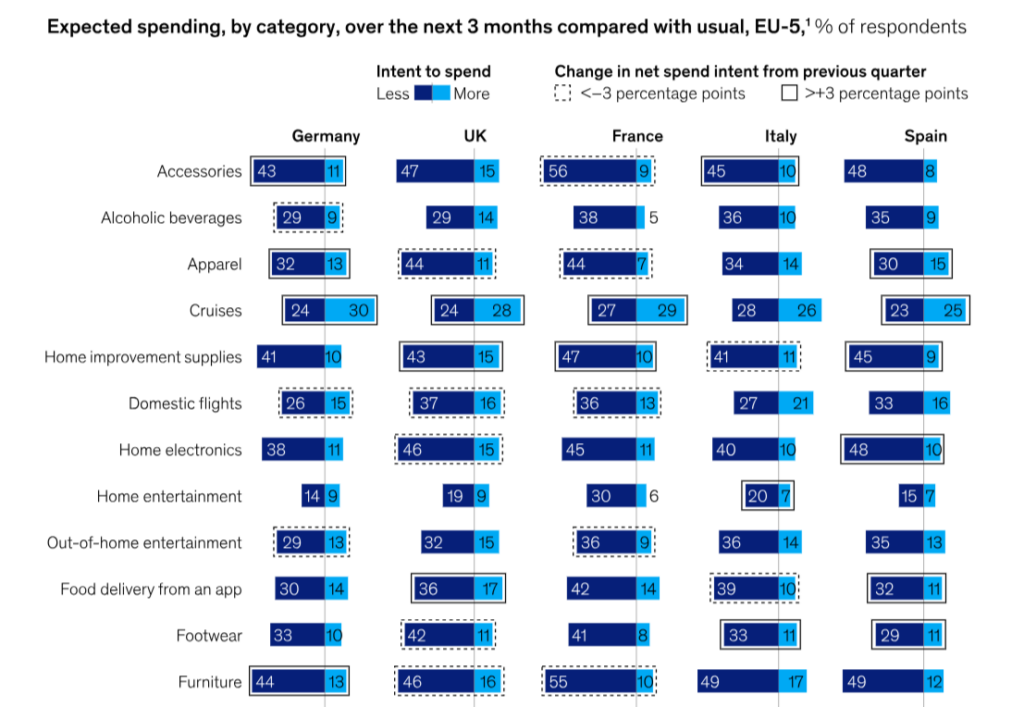

Discretionary spending tells a more nuanced story

Not all discretionary spending moves in one direction, and recent data makes that very clear. One category that stood out across Europe was cruises, where interest increased in most major markets. Older consumers were especially active here, which makes sense given their preference for predictable, well-structured experiences that remove planning stress and budget uncertainty.

At the same time, intent to spend on hotels and resort stays declined across the region. Traditional travel started to feel less appealing as prices fluctuated and extra costs became harder to estimate. Cruises, by contrast, contain pricing and a clear sense of value, which resonates strongly in a cautious spending environment.

This European consumer sentiment shift highlights a broader preference for simplicity when spending feels emotionally loaded. Consumers gravitate toward offers that feel easy to evaluate and hard to regret. Retailers connected to travel, leisure, or experience-based products benefit when they package value clearly and remove as many unknowns as possible from the decision.

Experiences win when they feel contained

Dining out remains a favored splurge among older consumers, reinforcing that experiences still matter when they feel manageable. The appeal lies in enjoyment without long-term commitment.

Experiences that come with clear boundaries feel safer. Consumers want to know what they are committing to before saying yes.

Retailers offering experiences benefit when packages are clearly defined and easy to understand, especially in a cautious spending climate.

Holiday spending stayed cautious but intact

Holiday budgets across Europe largely matched the previous year, with many consumers planning to maintain or slightly increase spending depending on local conditions. This stability suggests that households built realistic expectations and stuck to them.

Groceries accounted for the largest share of holiday budgets, followed by apparel, toys, and gift cards. Gift cards gained traction because they reduce risk and offer flexibility for both buyers and recipients.

Holiday spending now reflects practicality more than tradition. Retailers benefit when gifting feels easy to manage and socially safe, especially in uncertain times when overcommitting feels uncomfortable.

The United Kingdom shows deeper cutbacks

Among UK consumers, the pressure on discretionary spending became more visible than in other European markets. Intent to spend fell across several higher-ticket categories, including hotel stays, domestic flights, and jewelry, pointing to a more defensive mindset when it comes to larger commitments.

At the same time, smaller indulgences held their ground. Food delivery, home décor, and entertainment at home remained popular, suggesting that shoppers still seek comfort but prefer options that feel flexible and easy to reverse. This split shows how financial pressure reshapes behavior rather than stopping spending altogether.

UK consumers appear to be managing stress by shrinking the scale of indulgence rather than eliminating it. Retailers who understand this dynamic can position products as low-risk treats that fit naturally into everyday life, instead of framing them as rare or exceptional purchases.

Splurging exists, but it changed shape

Across Europe, intent to splurge increased slightly compared with the previous quarter, with the clearest movement visible in the United Kingdom. More consumers planned indulgences across both discretionary and essential categories, which signals a subtle but important shift in how splurging is defined.

Today, a splurge often means permission rather than excess. Shoppers give themselves room to buy better groceries, upgrade everyday products, or choose comfort over the cheapest option. These decisions feel controlled and intentional rather than impulsive.

Retailers who continue to associate splurging only with luxury or celebration risk missing this change in mindset. Shoppers increasingly frame splurges as reasonable upgrades that support daily comfort, which opens space for premium versions of ordinary products.

Generations spend emotionally differently

Generational differences remain strong when it comes to emotional spending. Gen Z stands out as the group most likely to plan splurges, with a clear focus on self-expression and entertainment at home. Apparel, beauty products, and streaming services continue to dominate their indulgence choices.

Older generations lean in a different direction. They are more likely to spend on essentials and dining, where quality and reliability matter more than novelty. Grocery upgrades and restaurant visits carry emotional weight for these consumers.

These patterns reflect different definitions of reward. Younger consumers seek identity and expression, while older consumers prioritize comfort and shared moments. Retail assortments perform best when they acknowledge both motivations without forcing a single emotional narrative.

Younger consumers trade down more often

Trading down remains a common behavior across Europe, even as broader economic signals stabilize. Adjusting pack sizes, switching brands, and buying less per trip have become embedded habits rather than temporary responses.

Younger consumers report the highest levels of trade-down activity, which reflects strategy rather than disengagement. They actively compare prices, evaluate value, and optimize every purchase decision they make.

This behavior challenges retailers to justify price differences clearly. Younger shoppers respond well to transparency and consistency, while vague promises or image-driven positioning lose influence in a value-focused environment.

Omnichannel habits stayed the default

European consumers continue to blend online and in-store shopping without strong loyalty to either channel. Convenience and experience mix naturally depending on the moment, the product, and the level of urgency.

Retailers no longer compete channel against channel. They compete on continuity, including inventory visibility, consistent pricing, and familiar service standards across touchpoints.

Shoppers expect coherence rather than novelty. Any friction along the journey breaks trust quickly, especially when switching channels feels harder than expected.

Shopping timing spreads wider

Holiday shopping timelines varied widely across Europe. Some consumers started early, others waited for known promotional moments, and a noticeable share opted out of holiday shopping altogether.

This dispersion complicates forecasting and campaign planning. Demand spreads across longer periods, and traditional peaks lose their sharp edges. Retail calendars now require flexibility and ongoing relevance. Promotions work best when they feel appropriate at any entry point, not tied to a single moment.

Europe feels calmer than the United States

European consumers appeared less reactive to global trade news than their US counterparts, with sentiment remaining steadier overall. This calm reflects adaptation. Consumers adjusted expectations and routines instead of reacting emotionally to headlines.

Retailers benefit from this steadiness, since dramatic messaging rarely drives demand in an environment shaped by quiet pragmatism.

What European consumer sentiment means for retailers in 2026

European consumers enter 2026 cautious, capable, and selective. They balance restraint with moments of comfort and respond strongly to clarity and consistency.

Retailers that perform well focus on transparent pricing, dependable routines, and small upgrades that feel earned rather than indulgent.

Advantage emerges when retailers stop guessing and respond directly to how consumers actually behave. That alignment defines success in the year ahead.