Sum it up! Germany Online Market 2025

Written by

Kinga EdwardsPublished on

A practical look at German e-commerce 2025. Market size, shopper behavior, payments, returns, logistics, social media, and what to expect next.

German e-commerce 2025 feels calm on the surface, but busy underneath. After a few quieter years, online retail is moving again. Not with fireworks, but with steady steps. Shoppers are still careful. Brands are more selective. Platforms are stronger than ever.

This article breaks down German e-commerce 2025 in a simple, grounded way. No theory, just what matters right now, and why it matters if you sell online in Germany.

German e-commerce 2025 at a glance

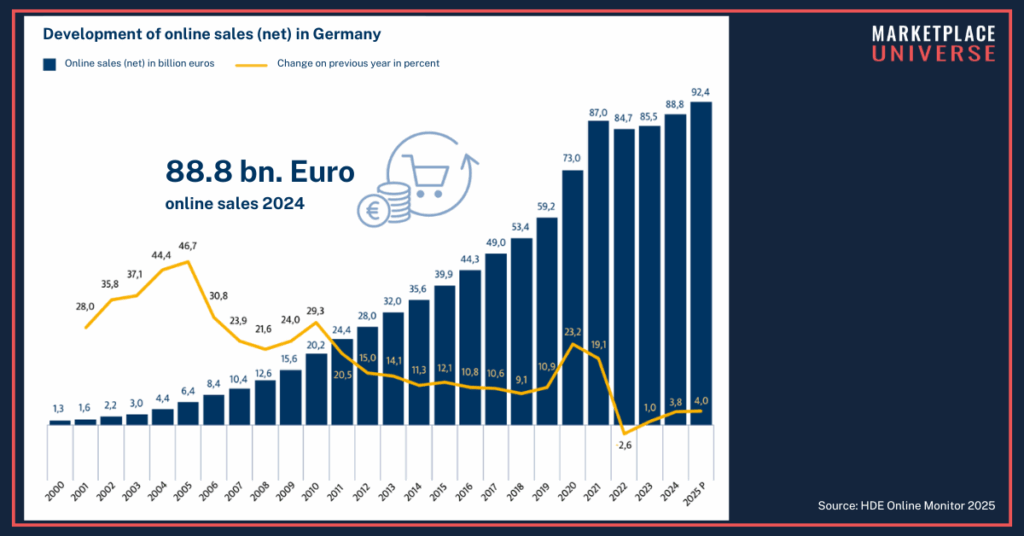

The headline number sets the tone. In 2025, total online sales in Germany are forecast to reach €92.4 billion. That figure matters less on its own, and more because of what it follows. After a decline in 2022 and almost flat growth in 2023, online retail finally moved forward again in 2024. The expected 4% growth in 2025 confirms that this was not a one-off rebound.

German e-commerce 2025 is about stability returning. Growth is moderate, not explosive, but it is broad enough to support long-term planning.

Germany also keeps its position as one of Europe’s largest e-commerce markets. The number of online shoppers, the average annual spend, and internet access levels all sit above the European average. This gives the market weight. It is big, predictable, and hard to ignore.

Penetration tells another part of the story. In 2025, e-commerce reaches around 66% of the population in Germany. That means two-thirds of people already buy online. Growth now comes less from “new users” and more from how often people buy, what they buy, and where they buy it.

So, German e-commerce 2025 is not about convincing people to shop online. That step is done. The real question is how value shifts inside the market.

Where growth really comes from in Germany

Well, here is the most important takeaway from German e-commerce 2025: All growth comes from marketplaces.

That is not an exaggeration. According to the data, other online channels together saw an average revenue decline of 5.4%, while marketplaces grew by 8.8%. Without marketplaces, German e-commerce would not have grown at all.

This explains a lot of frustration among brands and shop owners. Many feel the market is “growing,” but their own numbers do not reflect that. The reason is simple: Growth is concentrated.

Amazon remains the clear center of gravity. It holds 63% of the German online market. That share is split between two very different models. About 17% comes from Amazon’s own retail business, while 46% comes from third-party sellers using the marketplace.

All other marketplaces combined account for just 11% of total online sales. This includes well-known names like eBay, Otto, Zalando, and About You. The gap is huge.

For brands, this creates a structural challenge. Scaling outside Amazon in Germany is possible, but it is hard, expensive, and slow. Own webshops, D2C models, and smaller platforms face rising acquisition costs and limited reach. Marketplaces compress demand into fewer places, and Amazon absorbs most of it.

What Germans buy online

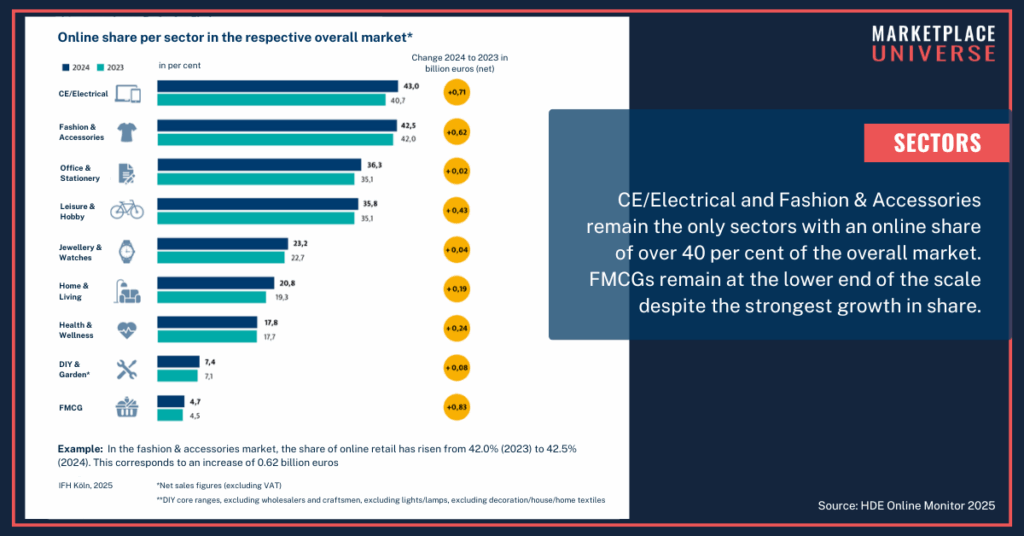

Four categories dominate online revenue in German e-commerce.

- Fashion and accessories remain the largest, generating €20.6 billion and accounting for 23.2% of total online sales.

- Electronics follow closely with €19.1 billion, or 21.5%.

- Hobby and leisure products come next with €13.7 billion.

FMCG deserves special attention. While it still represents a smaller share overall, it was the fastest-growing category, increasing by 7.3% year over year. That growth lifted FMCG online sales to €12.2 billion.

Penetration rates show how different these categories really are. Electronics lead with an online share of 43%, meaning almost one in two electronics products is now bought online. Fashion follows closely at 42.5%. FMCG, despite its strong growth, still has a low online penetration of 4.7%.

This contrast explains why FMCG is watched so closely. Even small shifts in buying behavior can move large volumes.

Inflation also shapes category demand. German consumers have adjusted spending habits, leaning more toward essentials such as groceries, home care, and beverages, while cutting back on discretionary categories like luxury fashion and large home appliances.

How German shoppers behave online

On average, German online shoppers place 35 orders per year, with an average basket value of around €52. This shows steady engagement, but not reckless spending. Purchases are frequent, but controlled.

One of the more interesting shifts appears in age groups. While total online shopper numbers grow only slightly, the 55+ segment shows the strongest increase, rising by 1.4% year over year. Older consumers are becoming more comfortable online, especially for repeat and practical purchases.

Mindset matters a lot in Germany. Shoppers are generally risk-averse and expect high product quality. Trust plays a big role. Clear product information, transparent pricing, and reliable delivery matter more than flashy campaigns.

Language is part of trust. Online stores are expected to be in German. English-only sites struggle to convert, even when prices are competitive. This is less about language skills and more about comfort and clarity.

Cross-border shopping and low-price platforms

Around one quarter of German online shoppers deliberately buy from foreign shops. China leads clearly. Nearly half of all cross-border orders are placed there. Austria, the Netherlands, and the United States follow at a distance.

The impact is measurable. About €8.9 billion of Germany’s online revenue flows abroad, which equals roughly 10% of total e-commerce sales.

Low-price platforms play a major role in this shift. Two of the most popular Chinese platforms together generated between €2.7 and €3.3 billion in Germany, based on 14.4 million customers, each placing around eight orders per year with an average value of €25.

Trust is the weak spot. Many German shoppers associate these platforms with poor quality and safety concerns. As a result, only one in three customers shops there again, and just 25% recommend them to others.

Regulators are watching closely. The EU has already discussed steps like a €3 fee per parcel from China and possible changes to the €150 duty-free import threshold. These measures will not reshape the market overnight, but they signal rising pressure.

In German e-commerce 2025, cross-border platforms are impossible to ignore. They reset price expectations, increase competition, and force local sellers to sharpen their value story.

Payments and returns in German e-commerce 2025

German e-commerce 2025 is built on familiar payment habits. The most commonly used methods remain purchase on invoice, PayPal, direct debit, credit and debit cards, and mobile wallets such as Apple Pay and Google Pay. This mix reflects how German shoppers think. They want control, flexibility, and time to check what they receive.

Invoice payments play a special role. Many shoppers still expect to receive goods first and pay later. It reduces perceived risk and builds trust, especially for first-time purchases. PayPal sits close behind, valued for speed and buyer protection. Cards and wallets matter, but they rarely replace the need for at least one low-risk option.

Returns are just as important. In Germany, online customers have the legal right to cancel and return purchases within 14 days, without giving a reason. This rule shapes shopper behavior. People order more freely when they know returning is simple and protected by law.

Return volumes are high. Germany is known for especially high return rates in fashion, where 15.3% of online purchases were returned in 2023. Shoppers often order multiple sizes or styles, keep one, and send the rest back. This behavior is widely accepted and expected.

Logistics and fulfillment expectations

Germany handles enormous parcel volumes every year. Online shopping is deeply embedded in everyday life, and delivery performance directly affects trust. When delivery fails, the entire brand impression suffers.

With generous return rights and high fashion return rates, reverse logistics must work smoothly. Delays, unclear processes, or slow refunds damage confidence fast.

German shoppers expect reliability above all. They value clear delivery windows, predictable tracking, and smooth handovers. Speed matters, but consistency matters more. A package that arrives when promised builds more trust than one that arrives early but without notice.

Reverse logistics deserve equal attention. Easy returns, fast processing, and transparent refunds are part of the core experience. Shoppers rarely praise good returns. They only notice when something goes wrong.

Social media and mobile commerce in Germany

Mobile commerce already plays a major role. In 2023, 64% of online purchases are made via smartphone. This makes mobile usability a baseline requirement. Slow pages, cluttered layouts, or unclear buttons quickly push users away.

Social platforms remain central to online life. Facebook, Instagram, and YouTube continue to play an important role in how Germans discover brands and products. Each serves a slightly different purpose. Instagram supports visual inspiration. YouTube supports longer explanations and reviews. Facebook still connects brands with older audiences.

Social media rarely replaces the webshop. Instead, it feeds the decision process. People see products, check reactions, watch reviews, and then buy through familiar checkout flows. Trust still lives on the website, not inside the app.

Second-hand and recommerce as a real market

Second-hand e-commerce adds a large, often overlooked layer to the German market. In 2024, pre-loved products generated an estimated €9.9 billion in additional revenue, outside standard retail figures.

Growth has been strong and steady. Over the past five years, the second-hand market grew by an average of 11% per year, with a 7% increase from 2023 to 2024.

Demand concentrates in clear categories. Fashion and accessories lead, where second-hand accounts for 17% of all online purchases. Books follow with 16% (ben 1). Electronics, home and living, and DIY products also play an important role.

Several platforms dominate this space. Consumer-to-consumer marketplaces such as Vinted, eBay, and Kleinanzeigen lead in general resale. In electronics, Refurbished, Backmarket, and MediaMarktSaturn shape the refurbished segment.

Even brands that sell only new products are affected. Recommerce changes price expectations, product lifecycles, and customer attitudes toward ownership. German e-commerce 2025 increasingly includes resale thinking, whether brands participate directly or not.

What German e-commerce 2025 signals for 2026

The user base continues to grow. The number of e-commerce users in Germany is expected to increase from 47.68 million in 2025 to 51.77 million by 2029. Growth slows compared to earlier years, but it remains consistent.

Market value projections point in the same direction. German e-commerce is expected to grow at an average annual rate of 7.13% from 2025 to 2029, reaching a market volume of $142 billion by 2029. This suggests steady expansion.

What does this mean for 2026 in practical terms?

- Marketplaces will remain central.

- Price pressure will stay high, driven by global platforms.

- Returns will continue to shape margins.

- Essentials and value-driven categories will keep gaining relevance.

German e-commerce 2025 already shows the pattern. 2026 will likely reinforce it.

Brands that focus on operational clarity, realistic pricing, and predictable customer experience are better positioned than those chasing rapid expansion without structure.