Top challenges in German logistics for Q1 2026

Written by

Kinga EdwardsPublished on

A practical look at German logistics challenges in Q1 2026, from slow growth and trade uncertainty to cyber risk, labor gaps, and rising costs.

Q1 2026 is shaping up to be a “keep your balance” kind of quarter for German logistics. Not a disaster movie, but more like a season where small shocks stack up, and even well-run operations feel the drag.

The German logistics challenges sound broad, but the pressure points are pretty concrete: weaker growth, messy trade signals, more cyber risk, tight labor, rising cost items, and infrastructure that keeps demanding patience.

Let’s break it down in plain language, with the freshest data we can lean on.

A cautious 2026 start: low growth and lots of “it depends”

But first, let’s see how hard the environment is, before we even talk about trucks, warehouses, or systems?

The outlook for 2026 is muted. The logistics association BVL expects only 0.5% real growth for German logistics in 2026. And because the environment is jumpy, they didn’t publish one neat prediction. They published scenarios: an optimistic 1.1% and a pessimistic -0.4%.

That matters in Q1 because it changes behavior.

When the year begins with “best case / worst case,” companies plan differently. They commit less. They keep options open. They try to protect cash while still funding what keeps service levels stable.

If you zoom out beyond logistics, the mood across German business is also cautious. A December 2025 Ifo survey said 26% of German companies expect business to deteriorate in 2026.

So yes, German logistics challenges in Q1 2026 start with psychology and carefulness.

Trade policy uncertainty makes planning feel slippery

Trade policy uncertainty is repeatedly called out as a top risk for logistics heading into 2026. And it’s not just “politics.” It’s the daily operational stuff that hangs off it:

- customer forecasting,

- inventory positioning,

- contract lengths,

- lane planning,

- customs complexity,

- and risk buffers.

Germany’s Economy Ministry warned in 2025 that exposure to tariff uncertainty was “exceptionally high” with pressure on exports and industrial production.

Even when nothing changes overnight, uncertainty changes decisions. Some shippers front-load. Others pause. Some redirect flows. Others keep inventory closer “just in case.” That is a real operational headache because logistics networks love stable patterns.

And it’s not only Germany. The OECD flagged trade policy uncertainty as a factor weakening growth prospects into 2026.

In Q1 2026, this shows up as more “scenario lanes” and more contingency. It also shows up as tougher conversations with customers. They want flexible capacity and stable pricing at the same time. That’s rarely realistic.

Cyber risk keeps climbing, and logistics is a tasty target

Why is cybersecurity now a core operations issue? Because there is an expected increase in cyberattacks, which can eat a meaningful share of IT budgets. And outside the benchmark, the wider signal is loud too.

A Reuters report on a Bitkom survey said cyberattacks cost the German economy almost €300 billion over the past year.

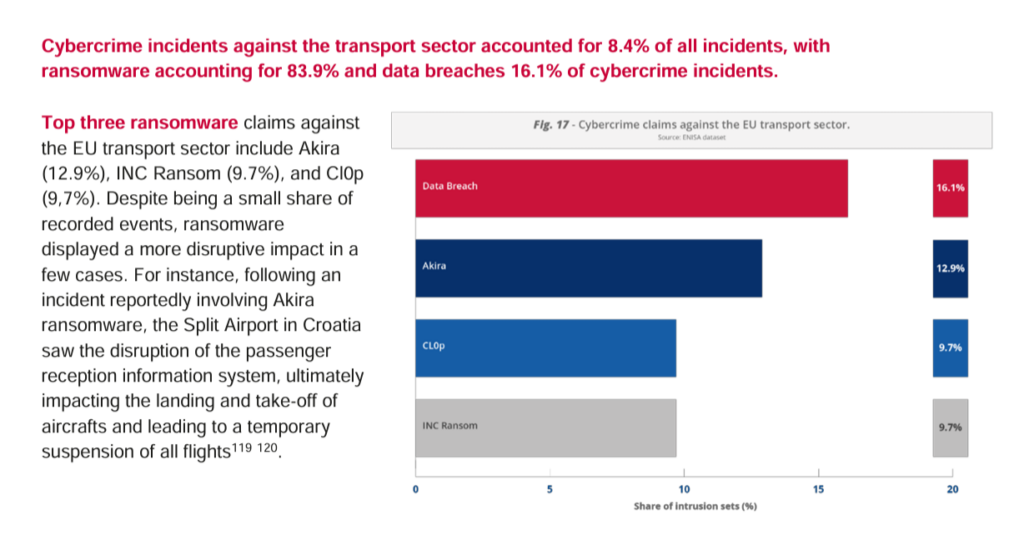

At the EU level, ENISA’s 2025 threat landscape notes that cybercrime incidents against the transport sector accounted for 8.4% of all incidents, and within cybercrime incidents, ransomware made up 83.9%.

Why does logistics get hit so often? Because it’s perfect leverage. Disrupt a transport management system, a warehouse execution flow, or a booking interface, and the business pain is immediate.

There’s also a very practical Q1 2026 angle here: budgets.

When cyber risk rises, money and talent get pulled into protection and recovery planning. That can slow other projects like process improvement, visibility upgrades, or automation rollouts.

So one of the biggest German logistics challenges is boring but true: keeping the operation running even when systems wobble.

Labor shortages keep biting, especially on the road

Germany’s logistics labor problems didn’t vanish. If anything, they got more stubborn. The road freight side is the loudest example.

IRU warned that Europe’s driver shortage is on track to worsen sharply by 2026 if action isn’t taken, with unfilled positions projected to rise dramatically.

In Germany specifically, industry reporting through 2025 keeps pointing to driver scarcity and rising personnel costs as a continuing pressure on the trucking market.

This hits Q1 2026 in a very unromantic way: reliability. Even if demand is “only slightly up,” capacity can still feel tight in certain regions, lanes, or peak days because the labor pool isn’t elastic.

For shippers, the pain point is missed delivery windows and less flexibility. For carriers, the pain point is higher staffing costs and harder recruitment. For 3PLs, it’s the constant puzzle of covering peaks without burning teams out.

German logistics challenges often look like systems and assets. In Q1 2026, it’s also about whether you can staff the plan you promised.

Cost pressure shows up in more line items than you want

One clear 2026 cost signal is toll policy. Toll Collect, the official toll operator, notes that from 1 July 2026 the truck toll will apply to vehicles with a technically permissible maximum laden mass of over 3.5 tonnes.

Even if that mid-year change is outside Q1, it affects Q1 planning. Budgets get rewritten early. Pricing talks start early. Fleet decisions get pulled forward.

There are also changes around exemptions. DKV Mobility notes that emission-free HGVs were exempt until 31 December 2025, and from 1 January 2026, a reduced toll rate applies for certain cost components.

Then you’ve got softer cost pressures that still hurt:

- higher wage expectations in a tight labor market

- insurance premiums reacting to costly weather events

- financing that remains expensive enough to make fleet upgrades feel painful

The Q1 2026 reality is that cost pressure is a messy bundle. And it shows up in every quote, every tender, and every “can you hold the rate?” conversation.

Rail disruptions and corridor renovations complicate freight planning

Germany is doing large-scale rail work, and that’s good long term. In the short term, it’s disruptive. For freight, that disruption is very real in Q1 2026.

DB Cargo notes that the Hamburg–Berlin line has been closed since 1 August 2025 for major overhaul work, with the closure running until 30 April 2026.

That’s not a minor route. It’s one of the key axes in the German rail network. When it closes, freight gets diverted, schedules stretch, and reliability takes a hit. It can also push volumes back onto roads, which then pushes the road network harder too.

There’s also a broader industry concern about freight reliability during corridor renovations. UIRR describes rail freight reliability as “at rock bottom” and calls out rising costs from cancellations, diversions, and delays.

So if you’re managing multimodal flows in Q1 2026, one of the biggest German logistics challenges is simple: plan for rail variability. Then plan again.

Port congestion and inland waterways can still throw curveballs

Even when warehouse and road operations are smooth, ports can jam. And when ports jam, everything behind them gets noisy.

In 2025, the Financial Times reported Europe facing severe port congestion, including in Hamburg, linked to a mix of tariff disruption, redirected flows, and constraints like shallow Rhine water levels affecting barge operations.

That matters for Q1 2026 because congestion effects don’t always reset neatly at New Year. Backlogs, schedule unreliability, and equipment imbalances can linger.

If you rely on “just-in-time,” the pain point is stockouts. If you carry inventory, the pain point is capital tied up. Either way, German logistics challenges in early 2026 include dealing with uncertainty at the edges of the network.

Sustainability and compliance pressures keep moving from “project” to “reality”

A lot of sustainability requirements used to live in slide decks. In 2026, more of them live in contracts, cost models, and reporting.

Shipping ETS coverage ramps up. A logistics industry note explains that ETS coverage for shipping emissions increases to 70% in 2025 and reaches 100% by 2026 (for relevant routes and vessels).

On the roadside, CO₂-differentiated tolling is expanding across Europe, and Germany’s policies around exemptions and toll structure are evolving into 2026.

The Q1 2026 challenge is to be operational: measure, report, budget, and keep margins intact while customers ask for lower emissions and lower prices in the same email.

Automation, digitalization, and AI are the hopeful lever, with limits

The sector is placing hope in efficiency gains from automation, digitalization, and AI. That’s fair. It’s also where reality hits quickly.

Automation helps most when you already have clean processes. If your inbound data is messy, if exceptions are constant, or if workflows differ by customer, automation projects can stall.

AI can help with forecasting, routing, exception handling, and customer comms. But it still needs good data, and it still needs humans who trust the outputs.

A practical way to think about this for Q1 2026: tech is a pressure-release valve, not a magic button. It’s worth pursuing. It just needs a disciplined scope.

A Q1 2026 playbook that actually helps

First, start with what you can control.

If you’re staring down German logistics challenges in Q1 2026, these moves usually create the most relief per unit of effort:

Run your operation on scenarios, not a single forecast.

That matches the reality of 2026 planning, where even industry forecasts come with multiple paths.

Build “cyber downtime” into continuity planning.

Assume disruption is possible. Train teams on manual fallbacks. Know which processes must keep moving if systems go dark. The risk level supports this mindset.

Get ahead of cost conversations early.

If toll scope changes in mid-2026, Q1 is when customers start asking what it means for them. Don’t wait.

Treat rail as valuable but variable.

If corridor work affects your lanes, build buffers and alternatives. The Hamburg–Berlin closure alone shows why.

Make service promises you can keep.

In a cautious economy, reliability becomes a competitive advantage. Not a flashy one. A real one.

Last words

German logistics enters Q1 2026 in a careful, demanding phase. Growth is limited, planning feels less predictable, and pressure comes from many directions at once. Trade uncertainty, cyber risk, labor gaps, cost changes, and infrastructure work all shape day-to-day decisions. None of these challenges stands alone, and that’s what makes the situation harder.

What helps most right now is realism. Teams that plan with scenarios, protect operational continuity, and stay transparent with partners are better positioned to handle German logistics challenges in early 2026.

There is still room to improve efficiency and resilience, but progress comes from steady execution, not big promises. In this environment, reliability, flexibility, and clear priorities matter more than speed or scale.