Top used digital wallets in Germany

Written by

Kinga EdwardsPublished on

Read about the 17 top used digital wallets in Germany. From popular names like Apple Pay to more niche like Bakkt. All important information below.

Paying with a phone has become a normal sight in Germany. At the checkout, on public transport, or while shopping online, digital wallets show up in everyday moments without much thought. Some people use them because they’re fast or because they feel safer than cards or cash. But for many, it’s simply habit at this point.

With so many digital wallets available, each built for slightly different needs, it helps to look beyond the logos and understand what these tools actually do. This article takes a closer look at the digital wallets most commonly used in Germany in 2026 and explains how they fit into real-life payment habits.

Why digital wallets took off in Germany

The shift toward digital and mobile payments grew steadily over the past decade, and by the mid-2020s they became a mainstream part of everyday life. A mix of convenience, technology adoption, and changing consumer habits pushed wallet use forward.

Even though cash remains important in Germany, different payment options are growing rapidly. Around 60% of consumers now prefer contactless transactions for everyday purchases because they are fast and convenient, especially in retail environments where speed matters most.

Mobile wallets like Google Pay and Apple Pay are a big part of that trend. In 2024, the share of mobile payments — including wallet transactions via smartphones and watches — accounted for about 5.7% of all payments in Germany, more than double what it was five years earlier.

At the same time, digital payment methods in general (including digital wallets, card-based contactless, and online payments) are used regularly by over 70% of German consumers. That marks a clear shift from the past, when cash reigned far more completely in the payment mix.

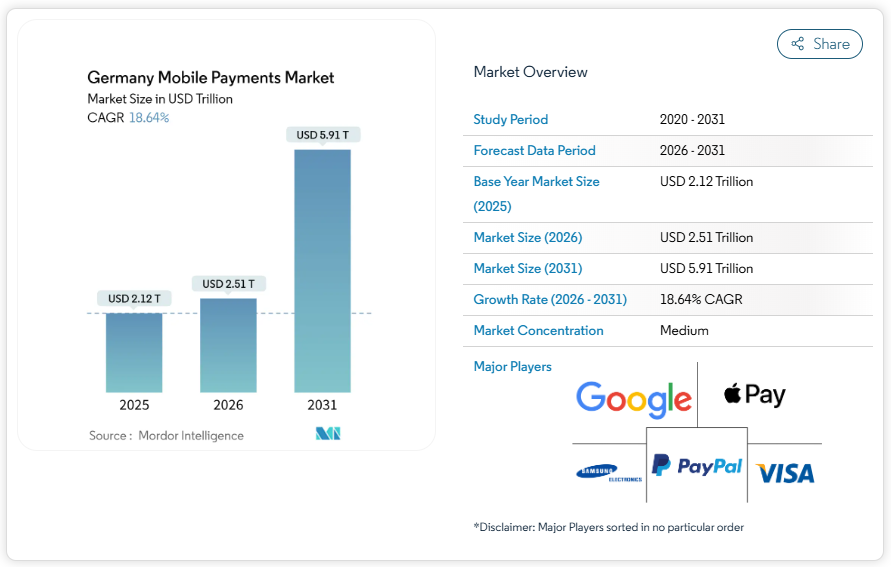

E-commerce also plays a part: digital wallet transaction value in online commerce is expected to grow significantly, driven by rising online shopping volumes and faster checkout preferences. Moreover, Germany’s mobile payments market is large and expanding, with projections estimating it at about $2.51 trillion in 2026 and continuing strong growth through the decade.

So yes, digital wallets are no longer “the future” in Germany. They’re already part of everyday life. People use them to pay in supermarkets, send money to friends, store tickets, manage subscriptions, and increasingly to handle crypto or cross-border payments.

And below is a practical look at 17 digital wallets commonly used or encountered in Germany. You will find there both mainstream giants and niche tools with loyal audiences.

Google Pay

Google Pay is one of the most commonly used digital wallets in Germany for everyday payments. Many users rely on it for supermarkets, pharmacies, public transport, and small daily purchases. It works wherever contactless card payments are accepted, which makes it easy to adopt without changing habits. People often start using it accidentally, then keep using it because it saves time. Once cards are added, payments feel almost invisible.

Beyond in-store use, Google Pay is widely used for online shopping and app purchases. It simplifies checkout and reduces the need to enter payment details repeatedly. For Android users in Germany, it often becomes the default payment option. The wallet is not flashy, but its strength lies in consistency and wide acceptance.

Apple Pay

Apple Pay is deeply integrated into the Apple ecosystem and is widely used across Germany by iPhone and Apple Watch users. Many people use it for daily shopping, public transport, and contactless payments in physical stores. The experience feels smooth and predictable, which builds trust quickly. Paying with Face ID or a watch tap becomes second nature over time.

Apple Pay is also popular for online payments, especially within apps and on mobile websites. It reduces friction during checkout and helps users avoid account creation or form filling. For people already invested in Apple devices, Apple Pay feels like a natural extension of their phone rather than a separate wallet.

PayPal

PayPal remains one of the most trusted digital wallets in Germany, particularly for online payments. Many users prefer it because it acts as a layer between their bank account and online merchants. This creates a feeling of control and security, especially when shopping on unfamiliar websites. Refunds and disputes are another reason people rely on it.

Beyond shopping, PayPal is widely used for sending money to friends, paying for second-hand items, and receiving freelance income. Small businesses and online sellers often depend on it as a primary payment option. Its familiarity and broad acceptance keep it relevant despite newer wallets entering the market.

Amazon Pay

Amazon Pay is mainly used in Germany for online shopping outside of Amazon itself. It allows users to pay on other websites using their existing Amazon account. This removes the need to create new profiles or enter payment information again. For frequent Amazon customers, this feels convenient and familiar.

German users often choose Amazon Pay when speed matters. Checkout becomes quicker, especially on mobile devices. While it is not used in physical stores, it plays a strong role in e-commerce. For merchants, it can increase conversion rates by reducing checkout friction.

Apple Wallet

Apple Wallet is a digital organizer. In Germany, users store tickets, boarding passes, event access, and loyalty programs’ cards inside it. This reduces the need to search through emails or screenshots. Payments usually happen through Apple Pay, but Apple Wallet keeps everything connected.

For frequent travelers and event-goers, Apple Wallet simplifies daily logistics. It replaces physical cards and paper tickets. Over time, it becomes a central place for anything related to access and identity. Its value lies in organization rather than transactions alone.

Samsung Wallet

Samsung Wallet serves a similar role for Samsung users in Germany. It combines payments, stored cards, passes, and identity-related features in one app. Many users appreciate having fewer separate tools. Everything feels connected and accessible from one place.

Samsung Wallet is often used alongside Samsung Pay for everyday purchases. It grows into a personal hub rather than just a payment app. For users who prefer customization and control, Samsung Wallet fits naturally into daily phone usage and routines.

Venmo

Venmo has a limited but visible presence in Germany, mostly among expats and international users. It is mainly used for peer-to-peer payments rather than shopping. Splitting bills, sending small amounts, or settling shared expenses feels casual and fast.

The social feed and informal tone make Venmo different from traditional wallets. In Germany, it remains niche, but for certain groups it feels more personal than bank transfers. Its value lies in ease of social payments rather than wide acceptance.

NETELLER

NETELLER is commonly used in Germany by people dealing with international payments and digital services. It supports multiple currencies, which appeals to users working across borders. Many online professionals and traders rely on it for flexibility.

Users also value the loyalty rewards and additional features offered over time. NETELLER feels more like a financial tool than a casual wallet. It is often used as part of a broader online finance setup rather than for everyday shopping.

WeChat Pay

WeChat includes wallet functionality inside its broader messaging platform. In Germany, it is used mainly by people connected to China for payments, transfers, and services within the WeChat ecosystem. The wallet supports peer payments and merchant transactions where accepted.

For German users, WeChat’s wallet is not a standalone financial tool. It is part of a closed ecosystem used for communication and payments together. Its importance is situational, often tied to international commerce or personal connections. Outside that context, it sees limited everyday use.

Airtm

Airtm is a digital wallet focused on holding and moving digital dollars and other balances across borders. In Germany, it is mainly used by freelancers, remote workers, and users receiving payments from international platforms. The wallet allows users to receive funds, store them in a digital balance, and withdraw them to local bank accounts or other payment methods. It is often chosen when standard bank transfers are slow or unavailable.

Airtm also supports currency conversion and peer-based transactions to move money efficiently. Users typically do not use it for everyday shopping. Instead, it functions as a transfer and storage layer between global payment systems. For German users with income from outside the EU, Airtm fills a practical gap.

Uphold

Uphold is a digital wallet that combines asset storage with basic trading functionality. In Germany, it is commonly used to hold cryptocurrencies, stablecoins, and traditional currencies in one account. Users can move value between assets without using external exchanges. This makes it appealing to people who want simplicity rather than advanced trading tools.

The wallet supports multiple asset types and shows balances clearly in a single interface. German users often treat Uphold as a long-term holding wallet rather than a payment tool. It is less about daily transactions and more about managing and reallocating value over time. For users exploring digital assets cautiously, Uphold offers a controlled environment.

Cash App

Cash App is a mobile wallet designed primarily for peer-to-peer payments. In Germany, its use is limited and mostly tied to users with international connections. The wallet allows users to send and receive money quickly using simple identifiers rather than bank details. This makes transfers feel informal and fast.

In addition to payments, Cash App offers access to basic investment features, including stock and crypto purchases. German users who adopt it usually do so for its simplicity rather than its full feature set. It is not widely accepted for merchant payments locally. Its role remains niche and focused on person-to-person transfers.

Stocard

Stocard is a digital wallet designed specifically for loyalty cards. In Germany, it is widely used to store supermarket, pharmacy, and retail loyalty cards digitally. Users scan their phone at checkout instead of carrying physical cards. This reduces wallet clutter and simplifies shopping routines.

The app also surfaces available discounts and rewards linked to stored cards. German users typically open Stocard several times a week while shopping. Payments still happen through separate wallets or cards. Stocard’s value lies in organization and convenience, not financial transactions. It solves a narrow problem and does it consistently well.

Bakkt

Bakkt is a digital asset platform that combines wallet functionality with loyalty and crypto features. In Germany, it is used mainly by users interested in digital assets beyond simple storage. The wallet allows users to manage cryptocurrencies and loyalty points within one ecosystem. Its focus is on connecting different forms of digital value.

Bakkt is not commonly used for everyday payments in Germany. Instead, it appeals to users exploring new financial models and asset interoperability. The platform positions itself between traditional finance and digital assets. For German users, Bakkt is more exploratory than practical, but relevant in discussions about future wallet use.

Any.Cash

Any.Cash is a digital wallet and exchange-focused platform used by a small but specific user base in Germany. It allows users to deposit balances, exchange funds, and withdraw to cards or other e-money services. Transactions are designed to be quick and direct, with minimal interface complexity.

The wallet emphasizes speed and accessibility rather than broad consumer features. German users who choose Any.Cash typically already understand digital finance tools. It is not aimed at mainstream retail payments. Instead, it serves users who want fast balance management and flexible withdrawal options without relying on traditional banking workflows.

P100

P100 is a wallet that combines traditional payment features with cryptocurrency storage. In Germany, it is used by people who want to manage both fiat and digital assets in one app. The wallet separates active balances from self-custodial storage, giving users more control over asset security.

Users can move funds between wallets depending on how they plan to use them. This structure appeals to users who actively manage risk. P100 is not focused on daily retail payments. Instead, it targets users who want structured control over digital assets while still having access to traditional payment tools.

Zelle

Zelle is a bank-linked payment service used almost exclusively for US-based transfers. In Germany, it appears only among users who maintain US bank accounts. The service allows direct transfers between bank accounts without holding a wallet balance.

There are no added features such as cards, asset storage, or merchant payments. Zelle’s purpose is narrow and specific. For German users who can access it, Zelle is used for fast personal transfers with trusted contacts. Its relevance is limited, but its function is clear and reliable within that context.

Last words

Digital wallets in Germany serve very different purposes, even if they look similar at first glance. Some are designed for quick in-store payments, others for online shopping, loyalty cards, or handling money across borders. The best choice often comes down to how people pay day to day, not which app has the longest feature list. As payment habits continue to evolve, wallets that match real behavior tend to stick around.

For users, the goal is simple: fewer steps, less friction, and tools that work when needed without getting in the way.