Top online retail trade categories + turnover in Germany in 2025

Written by

Kinga EdwardsPublished on

Get a simple look at Germany’s online retail trade categories. See which niches grow fastest, where the money flows and how these trends shape your strategy for 2026.

Germany enters 2026 with one of Europe’s busiest e-commerce scenes. Every year, more people shift a part of their shopping online, and many companies now treat digital channels as the main place where business actually happens. The mix of convenience, huge product variety, fast delivery, and competitive prices keeps pulling shoppers in.

That’s why talking about online retail trade categories makes so much sense right now. These categories tell us where shoppers spend the most money, where online demand grows fastest, and where brands should focus their energy if they want a strong 2026–2027. Some categories explode online because they fit the digital mindset. Others remain slower because shoppers still want that in-store experience.

So let’s walk through the categories, see who’s winning, who’s catching up, and what all this means for retailers planning their next steps.

Germany’s online retail trade at a glance

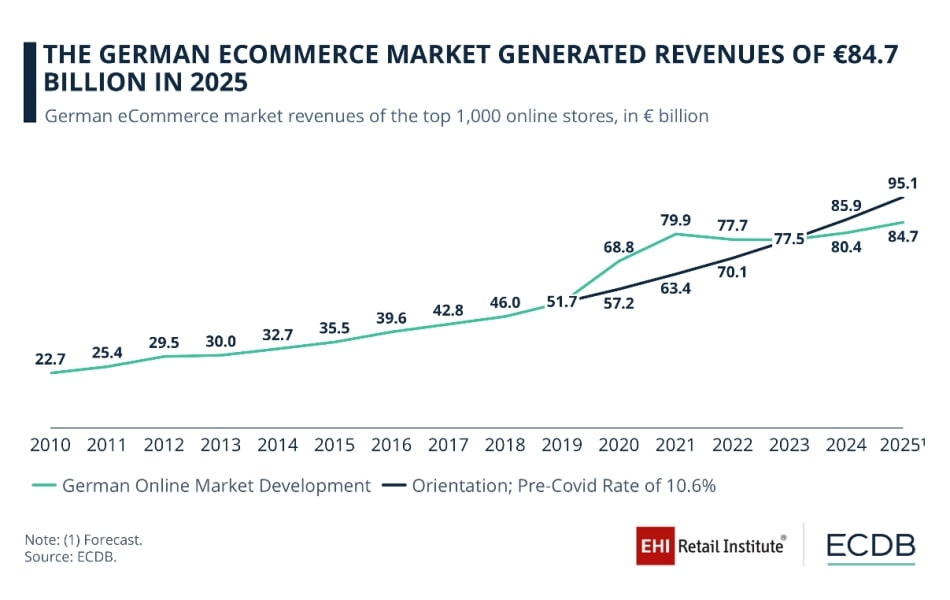

Germany’s e-commerce has been going strong for years. Within the last five years before the pandemic, e-commerce was already growing at 14%. That momentum didn’t slow down. If anything, it set the tone for the next half-decade. In 2025, Germany contributes to over 15% to the continent’s revenues, with e-commerce reaching €84.7 billion.

So, by 2026, online retail will sit at the heart of the country’s shopping habits. The line between “online” and “offline” becomes thinner every year, simply because customers expect companies to show up where they shop.

Another trend worth mentioning is the mix of product and service sales. In 2019, services already made up 39% of total e-commerce revenue. Fast-forward to 2025, and the share is even higher, mostly because travel, mobility, entertainment subscriptions, and digital goods keep expanding. Retailers that once sold only physical items now earn a chunk of their revenue from services linked to those items.

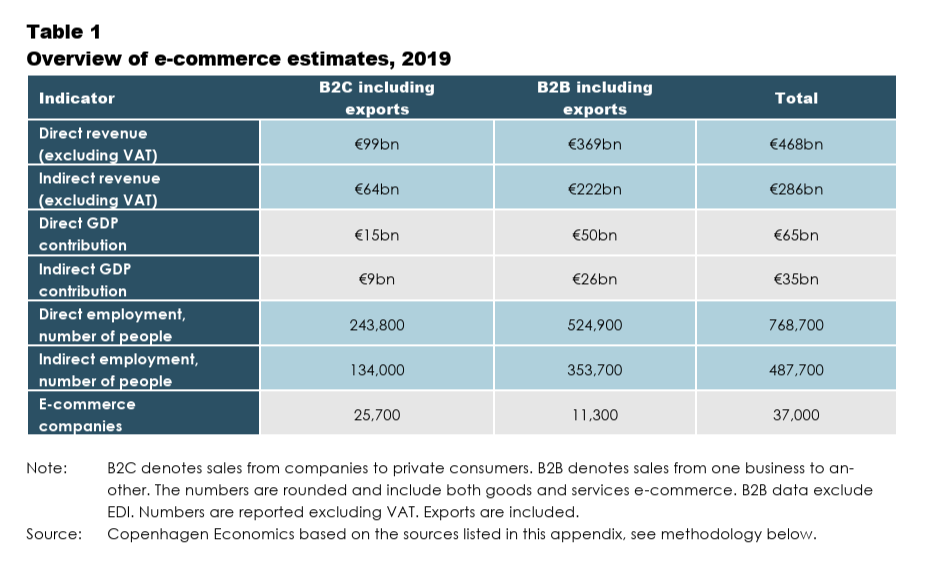

It’s also important to highlight the dynamic between B2C and B2B. Many people still imagine e-commerce as product sales to consumers. But B2B has been the silent giant for years. In 2019, B2B e-commerce revenue in Germany was three to four times larger than B2C. That trend keeps moving upward through 2025 as more industries digitise procurement and more suppliers rely on online systems rather than traditional sales processes.

So when we look at online retail trade categories, we’re really looking at where consumer-facing demand grows the most. And this helps both brands and sellers choose the right niches, the right products, and the right timing.

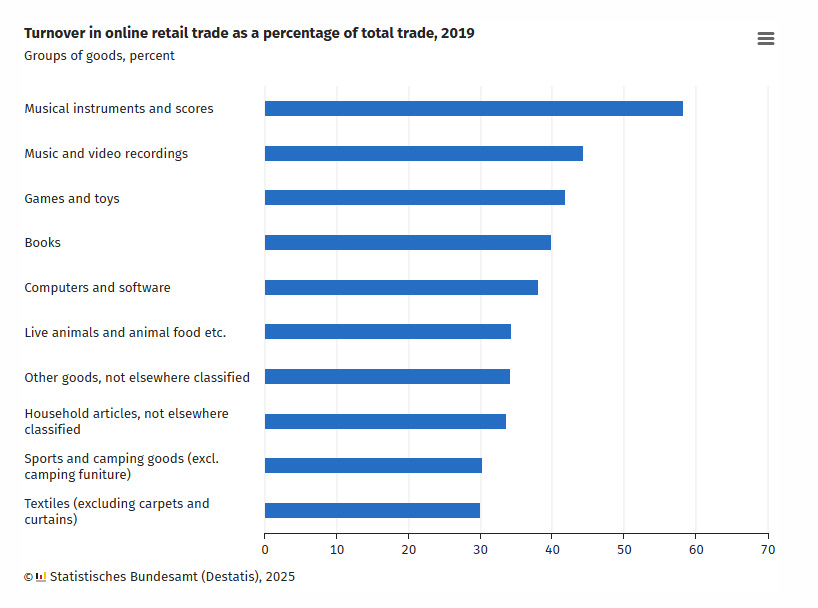

Online retail trade categories with the highest online share

Some product groups made the digital jump much faster than others. These are the categories where online already dominates. Their shoppers are comfortable buying without visiting a store, and brands in these categories face strong competition because everyone is already online.

Let’s look at the top categories with the highest percentage of turnover coming from online channels.

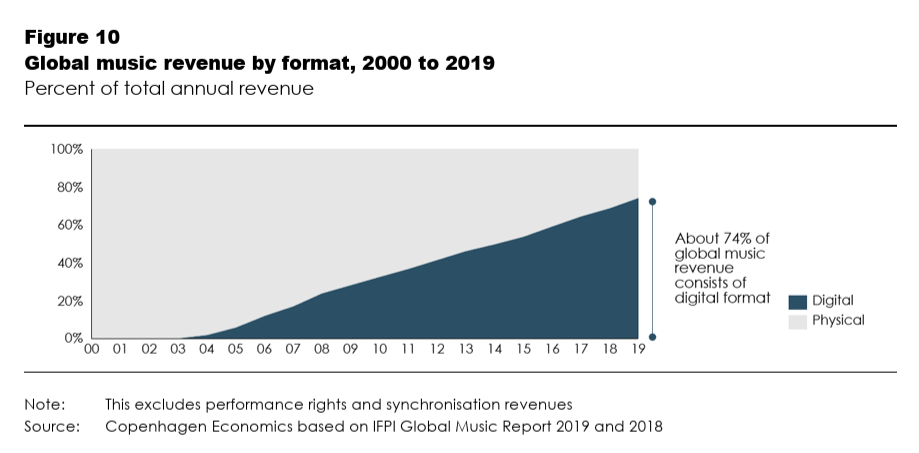

Music – around 74% online

Musicians love niche shops, global price comparisons, wide product variations, and specialist retailers. That’s why digital music formats accounted for 74% of total music industry revenue globally. By 2025, the share is even higher because more accessories and digital music products have moved online.

Moreover, streaming changed the game. Physical media used to dominate, but online shops and digital downloads became the main driver. Even physical CDs and vinyl get more exposure online than in stores. In 2025, this category stays deeply digital.

Games and toys – around 42% online

Parents and hobbyists love the convenience here. Online gives them variety, reviews, bundles, better pricing and seasonal deals. The category continues growing because new games, collectibles and toy brands scale faster online than in brick-and-mortar.

Books – roughly 40% online

Germany has a strong reading culture. Readers browse online for prices, formats and availability. Back in 2019, around 40% of book sales were online. The 2025 share is even higher, especially thanks to audiobooks and e-books.

Computers and software – about 38.1% online

People buy laptops, accessories, tablets and software mostly online because the comparisons are easier and delivery is quick. It’s one of the top categories shaping digital behaviour. In 2025, the demand rises further due to remote work and home-office upgrades.

But that’s not all. The turnover in online retail trade for other categories was as follows:

Across all these categories, the same pattern shows up: buyers want details, reviews, comparisons and transparency. And this is where online retail shines. The turnover in these online retail trade categories keeps growing year after year. For brands planning to expand in 2025 or 2026, these are safe spaces because customers already prefer the digital route.

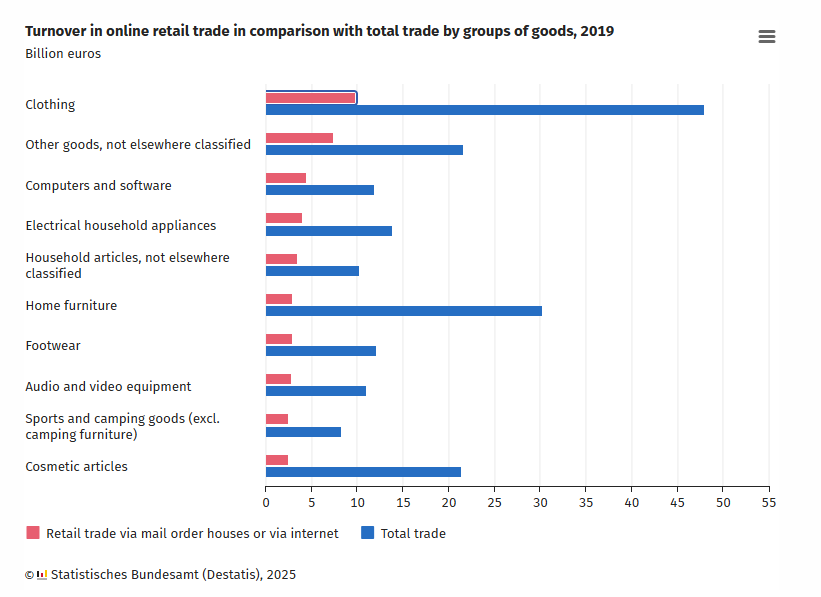

Online retail trade categories with the largest turnover

Now let’s shift from percentages to euros. Some categories don’t have the highest online share, but they generate massive revenue. These are the heavy hitters — the ones with large customer bases, broad appeal and high purchase frequency.

Clothing – the biggest online turnover

Clothing led with online revenue close to €10 billion already back in 2019. And total clothing retail turnover (online + offline) was close to €48 billion. Even though the online share was around 20.5%, the category dominates because Germans buy clothes frequently and have strong seasonal patterns.

Marketplaces and online fashion stores continue taking more share away from physical shops. Shoppers expect quick delivery, easy returns, and detailed size guidance. Anyone entering this category needs to prepare for strong competition and fast-changing trends.

Other goods – €7.4 billion

This is a mixed basket, with the online retail trade at the level of €7.4 billion. It includes niche and specialty items that don’t fit traditional retail categories. Many of these products sit in fast-growing online niches. The demand in 2025 comes from hobbyists, collectors, DIY fans and small home-improvement projects.

Computers and software – €4.5 billion

This category had both high turnover and a strong online share. Germans continue upgrading home offices, gaming setups, workstations and digital tools. With AI-powered apps and remote work trends growing, this category performs very well in 2025 and 2026.

Electrical household appliances – €4.0 billion

Not the fastest-growing online retail trade category, but very reliable. Items like refrigerators, vacuum cleaners, coffee machines and kitchen tools earn billions every year.

Household articles + home furniture = €6.5 billion

People have spent more time improving their homes since the pandemic. This created strong demand for online furniture and accessories. Even though customers still visit showrooms, online sales keep rising because delivery options and return policies have improved significantly.

Footwear – €3.0 billion

Germans buy millions of pairs every year, and marketplaces push heavy volume. Brands that invest in accurate sizing tools win here.

Audio and video equipment – €2.8 billion

From headphones to home cinema, buyers compare specs online anyway. Turnover stays high and stable through 2025 (ben1).

Sports and camping goods – €2.5 billion

Outdoor lifestyle stays popular. Germans love hiking, cycling, camping, and fitness. That makes this category consistently strong, both in turnover and online adoption (ben1).

Cosmetic articles – €2.5 billion

Beauty and skincare thrive in digital channels. Not the highest turnover, but strong enough to be noticed. Influencers, reviews, and bundles keep pushing this category forward.

When you put all these categories together, the picture is clear: online retail trade categories grow in different rhythms, but clothing, electronics, furniture and niche goods keep pulling the biggest revenue numbers.

Services, marketplaces, and B2B – the hidden side of online retail trade

When people talk about online retail trade categories, they usually picture physical goods. But Germany’s e-commerce structure is much broader.

Services play a huge role

Back in 2019, services made up 39% of all e-commerce revenue. Categories like mobility, event tickets, digital entertainment, software subscriptions, travel and education all sit within the online retail ecosystem. In 2025, this share is even higher because customers move more lifestyle choices — from gym classes to learning platforms — into digital environments.

Marketplaces drive a big part of turnover

Online marketplaces represent about half of German B2C online purchases. This is huge. Marketplaces create visibility for smaller brands and make it easier to enter big categories. Marketplace sellers enjoy instant exposure to millions of shoppers without building their own store from scratch.

B2B dominates the background

This part often stays invisible to consumers. But German B2B e-commerce turnover was around €369 billion in 2019 and has kept growing. The most important categories here are ICT equipment, office supplies, and foodservice goods.

If you’re a brand thinking of entering B2B or expanding into services, this hidden world offers plenty of opportunities — especially if your product solves operational or workflow problems for companies.

What these numbers mean for retailers and brands

The data shows which online retail trade categories are strong in 2019. But how do you use this knowledge in 2026?

Choose your category carefully

A high online share means customers already prefer buying that category online. Good examples: books, gaming, toys, computers. This gives you instant reach, but also sharper competition.

A high turnover category means huge demand. Great examples: clothing, furniture, appliances. Entering these means big potential, but also bigger budgets for ads, logistics and returns.

Look for the “sweet spot”

The sweet spot sits right in the middle: decent turnover, strong growth, manageable competition. Categories like sports goods, cosmetics and hobby items often live in this zone.

Adjust your approach to the category

- Some categories need visuals (fashion)

- Some need specs (electronics)

- Some need trust and community (toys, hobby goods)

- Some need great logistics (appliances)

The category tells you how to build your product pages, how to set prices, how to present benefits and how to handle returns.

Watch how customer behaviour shifts

By 2026, most Germans shop through their phones, so mobile-first design stops being optional. Younger shoppers check reviews, scroll social media for inspiration and trust video content more than product descriptions. They want proof, not promises. Older shoppers still value familiar brands, clear information and straightforward delivery options. Different groups move differently, and every online retail trade category feels that in its own way.

This is why category data matters. It shows you where attention grows, where budgets shift and where new habits form. It helps you plan your assortment, shape your messaging, choose the right channels and fine-tune logistics strategies.

When you understand these patterns, you spot emerging opportunities in 2026 before everyone else — and you know exactly where your next step should lead.

Last words

Germany’s online retail trade categories keep shaping how people shop, and the trends are easy to spot once you look at the numbers. Some categories win through strong online habits, others win through pure volume, and many keep growing because shoppers expect convenience, choice and quick delivery.

For retailers, the real advantage comes from knowing where the demand sits and how fast each category moves. When you match your product, your messaging and your logistics to the right category, you give yourself a smoother path into 2026.

The data helps — the strategy makes it work.