Top streaming services in DACH

Written by

Kinga EdwardsPublished on

Looking for the best streaming services in DACH? Compare Netflix, Prime Video, Disney+ and local picks like RTL+.

Streaming habits in Germany, Austria, and Switzerland look similar on the surface. In practice, they differ in small but important ways. Language options, local platforms, sports rights, and pricing all change how people choose what to watch. That’s why “best” means something different in each DACH country.

And this guide looks at the most relevant streaming services in DACH.

It combines subscriber data, service availability, and pricing signals from Germany, Austria, and Switzerland. All platforms listed below are available in at least one DACH country. Some are strong across all three. Others are very country-specific. That difference matters when you’re choosing.

So, let’s take a look!

Netflix

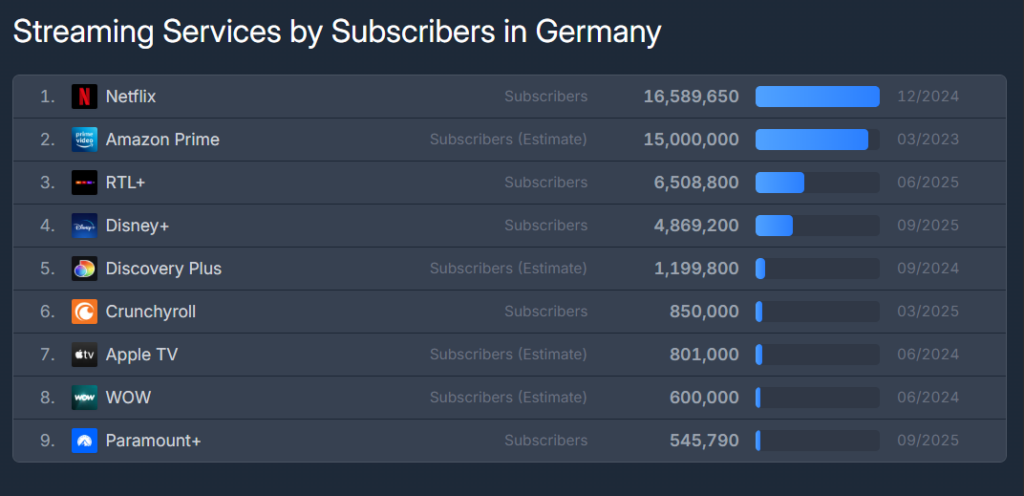

Netflix still sets the baseline for streaming services in DACH. It leads in subscriber numbers in Germany, Austria, and Switzerland, with a clear gap to the next platform in each market.

The strength of Netflix in DACH comes from consistency. The interface is familiar. The content mix works across borders. German audio and subtitles are standard, not an afterthought. Local originals are visible, especially in Germany. New releases land regularly, which keeps churn lower than many competitors.

Pricing pressure is real, especially in Switzerland, where Netflix sits among the most expensive mainstream options depending on the plan. Still, many households keep Netflix as their main service and rotate others around it.

Netflix works best as a “base subscription.” If someone in DACH only wants one streaming service, this is usually the default choice.

Amazon Prime Video

Amazon Prime Video comes very close to Netflix in Germany and remains a strong second across the region. Its position is unusual because many users don’t subscribe for video alone.

Prime Video benefits from bundling. Shipping, shopping perks, and video access sit under one price. That changes how people judge value. Even if Prime Video isn’t watched daily, it stays active.

Content coverage is broad. Hollywood films, German productions, and international series are mixed together. The interface is less focused than Netflix, and paid add-ons can confuse users. Still, for households already using Amazon, Prime Video feels like a low-friction choice.

Among streaming services in DACH, Amazon Prime Video is often the “silent second subscription.” It’s rarely the only one, but it’s hard to replace.

Disney+

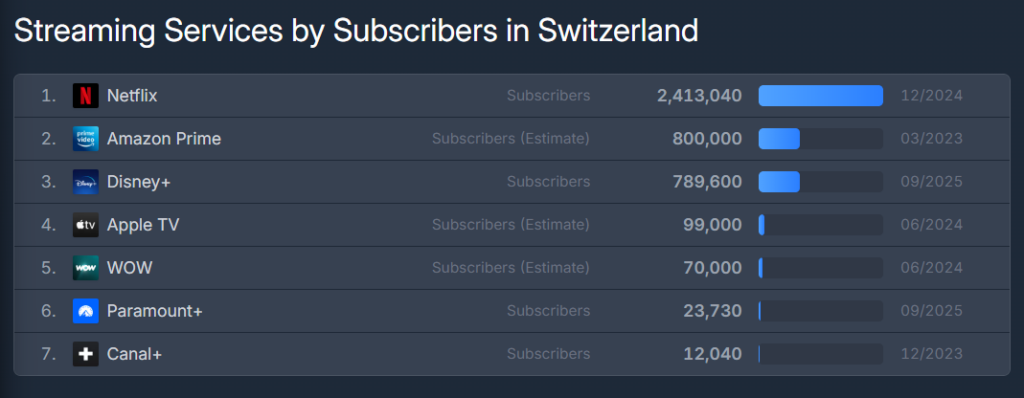

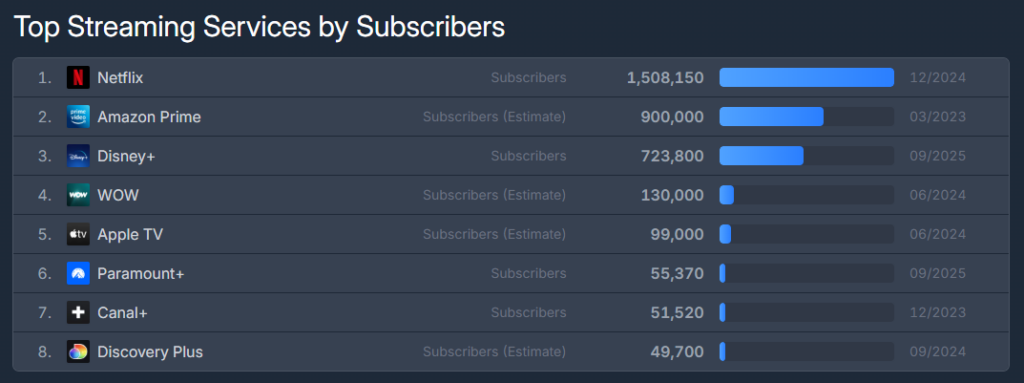

Disney+ holds a solid mid-top position across all three countries, with similar subscriber patterns in Germany, Austria, and Switzerland.

Its appeal is clear. Families, franchises, and familiar brands drive usage. German dubbing is strong. Kids’ profiles work well. Parents know what they’re paying for.

The downside is content rhythm. Outside major releases, some users pause subscriptions. Pricing in Switzerland reflects the premium positioning, especially for higher-quality plans.

Disney+ works best as a focused add-on. It’s not always an everyday service, but it fills a clear role in DACH households with children or franchise fans.

RTL+

RTL+ is a uniquely German force among streaming services in DACH. Subscriber numbers in Germany place it firmly in the top tier locally. Its strength does not translate equally to Austria or Switzerland, where usage is far lower or absent.

The platform leans into German-language content, live TV elements, reality formats, and local exclusives. That’s exactly why it works. It solves a local demand that global platforms do not.

For users who follow German TV personalities or want catch-up access to local shows, RTL+ feels relevant. For others, it feels narrow.

RTL+ is a reminder that local platforms still matter in DACH, especially in Germany.

WOW (Sky streaming)

WOW occupies a specific niche in all DACH countries, with modest but stable subscriber numbers. It’s closely tied to Sky’s content and sports positioning.

The appeal is access to premium series and live sports without a long contract. That flexibility matters. Sports fans use it seasonally. Series viewers dip in for specific releases.

Pricing in Switzerland places WOW among the higher-priced options, especially for premium tiers. That reinforces its “selective use” role.

WOW is not a mass platform. It’s a targeted one. In the DACH region, that’s enough to keep it relevant.

Apple TV+

Apple TV+ remains smaller in scale but steady across Germany, Austria, and Switzerland. Subscriber numbers are modest compared to Netflix or Prime Video, but engagement is often strong.

The catalog is smaller. That’s intentional. Apple focuses on original content only. Production quality is high. Release volume is controlled.

Apple TV+ works best for viewers who want fewer choices but higher consistency. It’s rarely the main subscription. It’s often paired with one larger service.

Among streaming services in DACH, Apple TV+ feels calm and curated. That’s exactly why some users stick with it.

Paramount+

Paramount+ is present across DACH but remains a smaller player in each country. Its position is clearer in Switzerland, where pricing transparency highlights its lower-cost entry options with ads.

The catalog leans toward US content, familiar franchises, and selected originals. German localization exists but is not as deep as Netflix or Disney+.

Paramount+ works well as a budget-aware add-on. It’s often activated for specific shows, then paused. That pattern is consistent across the region.

Discovery Plus

Discovery Plus sits on the niche side of streaming services in DACH, with limited but measurable usage in Germany and Austria.

The platform targets factual entertainment, reality formats, and lifestyle content. It doesn’t compete directly with Netflix or Disney+. It complements them.

Discovery Plus works for viewers who know exactly what they want. For everyone else, it feels optional.

Crunchyroll

Crunchyroll stands out by being narrow and strong at the same time. In Germany, it holds a visible subscriber base driven by anime fans.

Localization is solid. Community loyalty is high. Churn is lower than expected because the content focus is clear.

Crunchyroll proves that streaming services in DACH don’t need mass appeal to survive. They need relevance.

DAZN

DAZN is not a general streaming service, but it plays a major role in the DACH ecosystem. Subscriber data is global, but usage in Germany, Austria, and Switzerland is closely tied to sports rights.

For many users, DAZN replaces traditional sports TV. For others, it’s an occasional subscription tied to specific leagues or seasons.

DAZN’s pricing and focus make it a “single-purpose” service. That’s fine. It does exactly what users expect.

MUBI

MUBI operates quietly but consistently across DACH. Subscriber data is global, but its presence in Germany, Austria, and Switzerland is visible through partnerships and curated offerings.

The platform focuses on arthouse films and rotating selections. That attracts a very specific audience.

MUBI is rarely a first subscription. It’s a second or third one, chosen intentionally.

Joyn

Joyn is relevant mainly in Germany, with subscriber data reflecting local reach rather than regional dominance. Its mix of live TV and on-demand content places it between traditional broadcasting and streaming.

For users who want free or low-cost access to German TV content, Joyn makes sense. For others, it’s secondary.

Joyn reinforces a pattern seen across streaming services in DACH: local platforms succeed when they solve local viewing habits.

Pricing pressure in Switzerland

Switzerland shows the widest price spread among streaming services in DACH. From free options funded by public fees to premium plans close to CHF 30 per month, the gap is visible.

This affects behavior. Swiss users rotate subscriptions more often. Ad-supported plans gain traction. Bundles matter.

Price sensitivity is higher than many assume, even in high-income markets.

How people actually choose streaming services in DACH

Most households don’t compare every platform. They follow simple rules:

- One main service for everyday viewing

- One or two add-ons for specific content

- Seasonal subscriptions for sports or releases

That pattern repeats across Germany, Austria, and Switzerland. The names change. The behavior stays the same.

What to take away

Streaming services in DACH are not about finding the single best platform. The aim is to build a mix that fits language needs, content habits, and budget comfort.

Netflix and Amazon Prime Video anchor most setups. Disney+ and Apple TV+ add focus. Local platforms like RTL+ and Joyn fill regional gaps. Sports and niche services rotate in and out.

If you understand that rhythm, choosing becomes easier. And cheaper.