U.S. e-commerce outlook 2025/2026: Trends, data & what you should know

Written by

Kinga EdwardsPublished on

See what’s ahead for U.S. e-commerce in 2025 and 2026. This guide covers growth projections, shifting consumer behavior, marketplace competition, and tech innovations. Get clear insights into the United States.

The U.S. retail scene keeps moving fast, and the next years will add even more motion. Many German brands watch the American market closely because trends often appear there earlier. The U.S. e-commerce outlook for 2025 and 2026 shows strong demand, new shopping habits, and a bigger push for convenience. There is also a shift in how people discover products, which will matter for every brand planning expansion.

Let’s check out the details.

U.S. e-commerce market growth: 2025–2026 forecast

The American market is huge and continues to move toward online-first habits. The U.S. e-commerce outlook suggests growth will stay healthy through 2026, but shoppers will be more selective with how and where they spend.

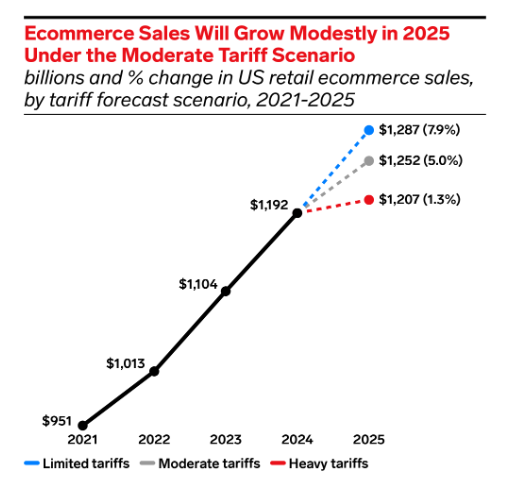

Some forecasts show U.S. e-commerce sales reaching above $1.2 trillion in 2025. Growth is expected to stay between 1.3 – 7.9% in 2025, which is calmer than previous years but still meaningful at this scale.

However, according to Statista, in 2025, the e-commerce market is projected to reach $1.17 trillion and by 2030 – $1.54 trillion.

Mobile shopping continues to expand in the U.S., and many ecommerce purchases come from mobile. This number can reach more in 2026, as shopping via phones is so easy and comfortable these days, and more people have access to the internet. (the internet penetration rate stood at 93.1%). Smoother apps, better product feeds, and easier payment methods support this shift.

Category performance also shows clear momentum. Grocery, beauty, home goods, and pet care keep climbing because U.S. shoppers made these categories part of their weekly routines. Same-day and next-day delivery options grow in major cities, encouraging more people to move everyday shopping online.

Retail media spending rises quickly too. It is expected to reach $100 billion in 2026. For German brands, this channel offers fast visibility when entering the market, especially on Amazon.

Overall? Growth is steady, competition is tight, and shoppers expect more clarity in every step.

2025 e-commerce outlook: Key trends shaping U.S. consumer behavior

This is where shopper expectations become clear. Convenience, transparency, and speed all shape the U.S. e-commerce outlook, and the benchmark content fits here smoothly.

Convenience will dominate

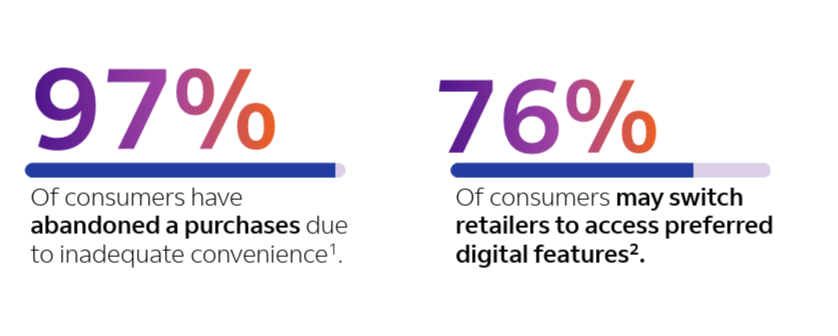

Convenience is now the number-one decision driver. Around 97% of shoppers have abandoned a purchase due to inconvenience. Another 76% said they would switch retailers to get better digital features. These numbers show how little patience shoppers have for friction.

People expect a clean shopping path: multiple payment options, flexible delivery dates, sustainability choices, and predictable communication. Brands entering the U.S. need to match these expectations because convenience translates directly into conversion.

Free shipping, returns, and ease

Free shipping still drives a huge part of U.S. online buying. More than 80% prioritize elements like home delivery (81%), free shipping (76%), and real-time tracking (68%). These numbers explain why shipping transparency has become the baseline.

At the same time, 38% of shoppers are willing to pay extra for upgraded convenience, such as faster delivery or easier access to limited-stock items. This split creates two consumer segments: people who want free basics and people who want premium speed.

Free returns also build trust. Many U.S. shoppers check return policies before committing, and unclear terms push them away. Minimum-order thresholds work well because they support free shipping without hurting margins.

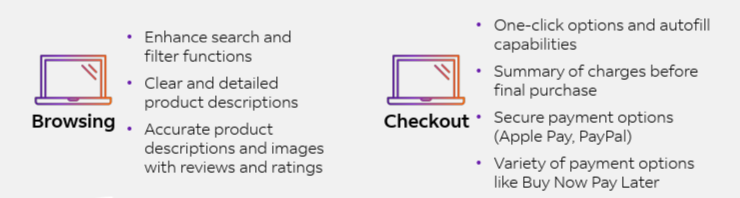

Browsing and checkout simplicity

U.S. shoppers want fast browsing, accurate product descriptions, and helpful imagery. They look for strong search filters that cut through noise and show exactly what they need. These habits directly influence conversion rates.

During checkout, people want one-click options, Apple Pay, PayPal, and BNPL tools such as Klarna. They move fast and expect the flow to support that speed. Many brands now use AI for personalized browsing paths and tailored product suggestions.

Shoppable video and social commerce

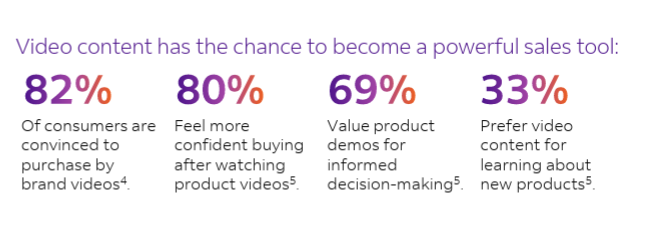

Video is one of the biggest growth areas in the U.S. e-commerce outlook and becomes more important through 2026. Around 81% of shoppers enjoy shoppable videos. Many feel more confident after watching product demos.

Numbers highlight this shift clearly:

- 82% feel persuaded by brand videos

- 80% feel more confident after seeing product videos

- 69% value demos for decision-making

This type of content helps users learn fast and decide faster. Brands pair education with entertainment, and it works. Live demos, short clips, and interactive video all help products stand out in crowded categories.

Marketplaces as the ultimate convenience

Marketplaces remain central to U.S. online shopping. Around 82% of consumers report high satisfaction on marketplaces. Another 52% feel comfortable buying from unfamiliar brands there. And 44% purchase from marketplaces at least once a week.

These numbers confirm that marketplaces act as discovery engines. Amazon leads in convenience and delivery. Temu and TikTok Shop grow fast thanks to low prices and viral content. The U.S. e-commerce 2026 landscape will push these three even further apart as they chase different consumer segments.

For German sellers, marketplaces can open doors quickly. Many brands start with a marketplace presence to build awareness, then move shoppers to their own store for deeper relationships.

Post-purchase experience as a loyalty driver

U.S. shoppers now judge brands as much on what happens after the purchase as before. Around 90% say post-purchase communication is as important as product quality, and 86% say it shapes repeat buying. This shift is powerful.

Consumers want reliable tracking, proactive updates, clear timelines, and fast issue resolution. Many are willing to pay a bit more when they know the service is dependable.

“Delighter” experiences

Beyond the essentials, shoppers respond well to small touches that make life easier. These include flexible delivery windows, immediate refunds, no-questions returns, and instant alerts. These “delighters” help brands stand out in a market where many companies match on price and speed.

The marketplace shake-up: Amazon vs. Temu vs. TikTok Shop

Marketplaces shape discovery, pricing, and expectations, and the U.S. e-commerce 2026 picture will look very different from today.

Amazon stays the strongest player. It continues to dominate convenience and delivery reliability. Amazon’s share of U.S. e-commerce sits around 37.8% in 2025. Fast fulfillment, Prime benefits, and a massive product range keep it ahead. For any foreign brand entering the U.S., Amazon often becomes the first major visibility channel.

Then comes Temu. Its growth is one of the biggest surprises in the market. The company offers about 2 million items, and plans to double it in the future. Low prices, gamified features, and aggressive promotions created a huge wave of new users. The platform pulls in shoppers who chase bargains and fun experiences, which sets it apart from Amazon’s efficiency-driven appeal.

TikTok Shop reshapes discovery even more. TikTok reports that nearly 80% of U.S. users notice ads and consider purchases. That reach puts TikTok in a unique position. It blends entertainment with shopping, and creators become the new storefronts. TikTok Shop’s U.S. GMV jumped in 2024 and continues to rise in 2025 as merchants test live shopping formats.

The competition between these three platforms creates very different paths for brands. Amazon helps with trust and logistics. Temu helps with scale at low prices. TikTok Shop helps with discovery, especially for visually strong products. The U.S. e-commerce outlook shows that buyers will shift across these platforms based on mood, price sensitivity, or entertainment value. German brands need to treat marketplaces as a portfolio, not a single-channel decision.

Technology & innovation accelerating U.S. e-commerce

This section focuses on the tech shaping the next wave of online buying. Innovation moves quickly in the U.S., and it drives many of the changes seen in the U.S. e-commerce 2026 forecast.

AI personalization and retail automation

AI drives smarter recommendations, faster merchandising, and better product discovery. According to Morgan Stanley, AI agents across e-commerce could contribute up to $115 billion in added sales by 2030. This shift is happening now. Many U.S. retailers already use AI tools to improve search, build bundles, and predict what customers might need later.

The biggest value shows up in personalization. Shoppers enjoy suggestions that feel human and relevant. AI filters noise and pushes the right products at the right time. This reduces browsing time and improves conversion. For German retailers entering the U.S., using AI-driven search and recommendations creates a stronger first impression because local shoppers expect speed and accuracy.

AI also supports customer service. Retailers use chat assistants for order tracking, exchanges, and product questions. These tools help teams handle higher volumes without long wait times. They also support the post-purchase experience, which matters for loyalty in a market where expectations grow every year.

Logistics, fulfillment, and the push for speed

Fulfillment gets faster every year. Amazon continues setting the bar. Reports show Amazon now delivers more than 60% of Prime orders the same or next day in major cities. This level of speed shapes customer expectations for the entire market.

Other players follow this trend. Target keeps expanding same-day programs. Regional carriers compete with last-mile speed. Smaller brands rely on 3PLs or fulfillment networks to match expectations without building their own warehouses.

Sustainability also affects logistics decisions. Many American consumers look for lower-impact delivery options. Retailers respond with batching, local micro-fulfillment, and cleaner packaging. These small moves influence loyalty because shoppers feel better about their choices without making major sacrifices.

German brands planning a U.S. entry should consider where their customers live. The U.S. is big, and shipping from one coast to the other takes time and money. Using distributed fulfillment or working with partners can shorten delivery promises and keep shipping costs predictable.

Economic headwinds and shopper sensitivity

The U.S. e-commerce outlook stays optimistic, yet not everything is growth-driven. Inflation eased in late 2024 but still shapes decisions. Essential spending rises faster than discretionary categories, and shoppers rethink impulse purchases.

Returns also impact margins. The return rate climbed to 16.9% in 2025. Brands now try to reduce friction without encouraging excessive returns. Clear size guides, better product photos, and post-purchase education help reduce costs while keeping shoppers happy.

Regulation plays a role in 2026. Several states tighten rules on data use, subscriptions, and dark patterns. Retailers face more oversight, which pushes them to improve transparency. German brands entering the U.S. should treat compliance as early preparation, not a late-stage fix.

A final pressure point is consumer fatigue. After years of heavy promotional cycles, American shoppers show stronger price awareness. Tools like price trackers and coupon extensions grow in adoption. This drives brands to rethink promotional strategies and focus more on value, reliable delivery, and post-purchase care.

Key opportunities for German e-commerce merchants

This section ties everything together and shows where German brands can gain ground in the U.S. e-commerce 2026 landscape.

Use marketplaces as launchpads

Marketplaces offer instant reach. Amazon builds trust. Temu brings traffic. TikTok Shop delivers discovery. Each one serves a different part of the shopper journey. German brands that combine these channels grow faster and attract diverse audiences.

Invest in convenience

Convenience beats almost everything else. Smooth navigation, transparent shipping, strong search tools, reliable tracking, and easy returns all shape conversion. Benchmarks show how much people value these elements. Brands that deliver on convenience build loyalty without heavy marketing spend.

Use video to explain and inspire

Shoppable video is growing fast. Short explainers, demos, before-and-after clips, and lifestyle moments help shoppers feel confident. The numbers from the benchmark prove how strongly video influences purchasing. German retailers can stand out by designing videos that teach, show, or entertain.

Build a strong post-purchase engine

Post-purchase care carries a lot of weight in the U.S. market. Clear notifications, fast refunds, easy returns, and helpful support all support long-term growth. This area often separates brands that stay and brands that struggle.

Go local where possible

The U.S. is large. Fulfillment works better when inventory stays close to customers. Using distributed fulfillment or 3PL partners improves delivery speed and reduces abandoned carts.

Conclusion

The U.S. e-commerce outlook for 2025 and 2026 shows a market full of opportunities but also high expectations. Shoppers move fast, look for value, and stick with brands that make life simple. German retailers that understand these habits and adjust their approach will find strong demand and a large, diverse audience ready to buy.