DACH trends for 2026

Written by

Kinga EdwardsPublished on

Find out what you’ll need to prepare for in 2026!

The DACH region goes into 2026 as a very online, very picky, and very price-aware group of shoppers. Internet use is close to universal. In Germany, around 95% of people aged 16–74 go online, and roughly 78% already buy online at least once a year. Austria and Switzerland sit in a similar high range for both internet use and online shopping.

That means one thing for you: in 2026, the question is no longer “will they shop online.” It is “where, how, and under which conditions.”

Below you’ll see a short DACH overview, then a deep dive into 12 DACH trends for 2026 that actually change how you should plan assortment, pricing, marketing, and logistics.

DACH e-commerce in 2025 – the baseline for 2026

The DACH region enters 2026 with high connectivity, but also high pressure on margins and trust.

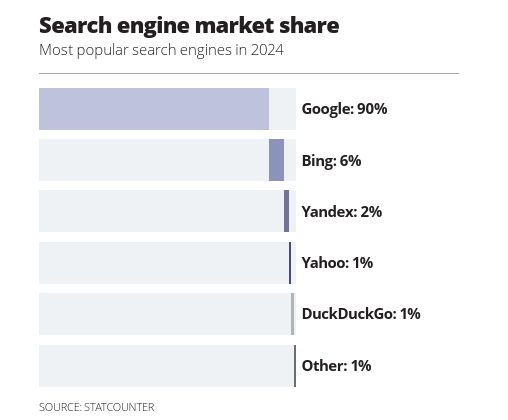

In Germany, search is still dominated by one player. Google keeps around 90% market share, with Bing at about 6% and the rest split between smaller engines. So when you plan SEO or retail media, search is still heavily Google-centric.

Online shopping is now “normal retail,” not a side channel. In Germany, e-commerce returned to growth with over 3% increase in the first two quarters of 2025 after a shaky macro period. Austria’s online retail also got back on the fast track in 2024 and is expected to keep growing through the mid-2020s.

Switzerland stays slightly different. E-commerce penetration by category is very uneven: food online is still only about 3% of grocery retail, while non-food is close to 19%. Home electronics sit around 54% online share, toys 35%, fashion and shoes about 30%, and home & living roughly 18%. That mix shapes where you can grow fastest in 2026.

To put it simply, the DACH stage in 2026 looks like this: high digital habits, squeezed margins, rising cross-border flows, and a clear split between premium local brands and ultra-cheap platforms.

How DACH shoppers buy today – payments, platforms, and expectations

Before we jump into detailed DACH trends for 2026, let’s see how rules and payments are shifting under your feet.

On the policy side, customs and parcel rules change the cost base. The EU moves ahead with a new Union Customs Code and a plan to charge a €2 handling fee on each non-EU e-commerce parcel, plus platform liability for unsafe or illegal goods. For DACH merchants, this reshapes sourcing from ultra-cheap marketplaces and pushes you to think harder about EU-friendly supply routes.

Germany’s updated postal law brings climate into everyday logistics. Operators with over €50 million domestic turnover must report greenhouse gas emissions, and a framework for “green labels” on parcels sits in the law text. That makes delivery emissions more visible for customers – and it nudges brands to tidy up last-mile choices.

Payments also get a more local flavor. In Germany, digital payments already cover nearly every second online purchase, with direct debit and invoice still over 10% each. BNPL sits in low single digits but is popular with younger shoppers. In Switzerland, a different pattern appears: invoice holds about 47% of e-commerce payments, Twint around 28%, and credit cards near 13%.

So in 2026, you sell into three markets that share EU-level rules on customs and consumer law, but act very differently in payments and logistics.

DACH trends for 2026 – where the real action will be

Let’s now walk through 12 specific DACH trends for 2026, starting with a little surprise – Asian platforms.

Asian platforms reset price anchors and customer expectations

Asian platforms are no longer “cheap curiosities.” They are core players. In Germany, only two of the most popular Asian platforms generate around €3.3 billion in sales and serve more than 14 million customers, with roughly 400,000 parcels per day in 2024.

For you, this means price anchoring changes.

Customers see €3 tops and €5 gadgets in their feeds every day. If you sell in categories where these platforms are strong – fashion, home, gadgets – “good enough” cheap items become the comparison baseline. That pushes you toward either premium positioning, bundles, or niche segments.

✅ Check our article on: how to compete with Chinese marketplaces beyond price.

Marketplaces + own shops = the default channel mix

In 2026, DACH shoppers still love marketplaces. Germany already saw online marketplace growth of around 4.7% in 2024 against about 1.1% for the overall online market. Yet, the share of transactions from Asian or China-based platforms jumped from 2% to 5.8% in one year.

Austria looks similar. Amazon keeps about 40% of local online sales, but Zalando, eBay, Shein, and vertical players split the rest. Switzerland has its own mix, with Digitec-Galaxus as a strong local marketplace.

DACH trends for 2026 are clear: you rarely live on one marketplace alone. Many merchants sell through their own shop, plus at least two platforms. That keeps customer acquisition diverse and spreads risk if one algorithm or fee structure shifts.

Social commerce and TikTok Shop reshape product discovery in DACH

TikTok Shop launched in Germany and is known by roughly one in three consumers, though only about one in forty has bought something so far. At first glance, that sounds tiny. At second glance, it is early-stage traction in a very large base.

Globally, TikTok Shop has millions of sellers and keeps expanding to new European markets.

For DACH, this means a few things in 2026:

- Social video becomes a normal product discovery route for young shoppers.

- “Live + influencer + checkout in-app” flows will sit next to classic Shopify or Magento checkouts.

- Brands that already run creator campaigns on TikTok can add direct product links, bundles, or time-limited drops without huge extra build.

Retail media becomes a must-have channel

Retail media networks are growing rapidly in DACH. Supermarket and marketplace groups across the region invest in data-driven ad units on their sites and apps, following the pattern set by large global players.

This gives you two big shifts in 2026:

- You can buy onsite ads very close to purchase, using first-party shopper data instead of cookie-based targeting.

- Retailers in Germany, Austria and Switzerland get a new profit stream at a time when product margins are under pressure.

Some “classic” paid search and social spend moves into retail media on Amazon, Zalando, local grocery chains, and marketplaces like Digitec-Galaxus.

Local wallets and invoices still rule payments

DACH shoppers love familiarity in payments. In Switzerland, invoices remain king, with Twint and credit cards at the podium. Twint processed around 773 million transactions in 2024 and now reaches well over half the population.

In Germany, digital payments already account for nearly every second online purchase, while SEPA direct debit and payment by invoice both retain double-digit shares. BNPL is still a low single-digit share but is clearly skewed toward younger buyers.

Austria shows similar patterns, with BNPL and mobile payment apps slowly gaining speed, especially in urban areas.

So DACH trends for 2026 in payments are about “and”, not “or.” You need mobile wallets, card rails, and invoices. If you strip out invoices or local favorites like Twint to save fees, conversion drops fast.

Customs reforms hit cheap imports and small parcels

The EU moves to tighten control of low-value parcels, which hits DACH directly. Customs handled around 4.6 billion e-commerce parcels entering the EU in 2024, with a very high share coming from China.

For 2026, the reform roadmap brings three big elements:

- New handling fees for e-commerce shipments into the EU.

- Removal of the duty exemption on parcels under €150.

- Clear platform responsibility for VAT, duties, and product safety checks.

This doesn’t only hit Chinese marketplaces. It also affects small sellers shipping from outside the EU into Germany or Austria. Costs rise, customs complexity grows, and product safety rules bite harder. Many DACH merchants react by shifting stock to EU-based warehouses or working with fulfillment partners inside the Union.

Circular commerce and re-commerce turn into real revenue streams

Used and refurbished products move from niche to mainstream in DACH trends for 2026. Germany runs a National Circular Economy Strategy that pushes longer product lifespans, better repairability, and more reuse.

Re-commerce – resale, refurbished, trade-in – grows fast in Germany as legal gaps close and consumer trust rises. Academic work on second-hand electronics shows strong purchase intention in Germany when trust, warranty, and environmental benefits are clear.

Austria and Switzerland also see more second-hand and recommerce platforms, and a rising interest in second-hand goods for both price and sustainability reasons.

For you, that opens two paths in 2026:

- Launch your own take-back, refurbished, or outlet channel.

- Partner with re-commerce players and sync stock through APIs.

Delivery emissions become a visible part of the buying decision

Germany’s modernised Postal Act includes emission transparency for large operators and space for climate labels on parcels. Postal services in Germany already lobby for CO₂ labels on parcels so customers can see the footprint.

In Austria, online retailers invest more in electric vehicles, reusable or plastic-free packaging, and smarter routing. The focus is on lower emissions while keeping delivery fast enough.

Switzerland runs many pilots with electric last-mile vehicles and city logistics, but same-day delivery still covers only about 5% of non-food parcels, while more than 70% of parcels use next-day priority delivery.

So, this trend push you to:

- Test greener shipping options and show their impact at checkout.

- Trim packaging volume so you pay less for air.

- Work with carriers that already track emissions and share that data.

Pickup, lockers, and ship-from-store gain share

Home delivery remains the default, but pickup options gain ground. In Austria, pickup points and “pick-from-store” gain momentum, especially as delivery fees become more common for home drop-off. In Switzerland, same-day is rare and costly, so priority next-day plus pickup stays the practical standard.

German cities add more parcel lockers and shared delivery models, backed by dialogue between the regulator and carriers written into postal law.

Consider this trend, as:

- Click-and-collect is worth the extra operational work, especially for grocery, fashion, and DIY.

- Lockers and pickup spots help cut failed delivery attempts and emissions.

- Ship-from-store can turn physical shops into micro-hubs and speed up local orders without giant new warehouses.

Cloud migration and AI move from buzzwords to operations

Many retailers move software off-premise to cloud infrastructure, often because their vendors shift to cloud-native products rather than from pure enthusiasm.

AI use is no longer a theory. DACH merchants use it day-to-day for:

- Predictive modelling and pricing.

- Text creation and translation for product pages.

- First-level customer support through chatbots.

Backend teams also start to use code-assist tools to speed up development.

So DACH trends for 2026 call for a boring but important task: audit your stack. Which tools still sit on local servers? Where does manual work slow down catalogue updates, content, or support? Then move those parts to cloud products through a structured software migration process that already includes AI helpers instead of chasing “big AI projects” with no clear ROI.

Regulatory pressure on platforms raises the bar for compliance

DACH enters 2026 with a much tougher regulatory climate. Customs rules tighten, VAT checks get stricter, and platforms face more responsibility for what sellers put online. Low-value imports no longer slip through easily, and the new Union Customs Code brings handling fees, more documentation, and tighter product-safety controls. Platforms react fast: onboarding becomes stricter, random audits increase, and anything that looks risky gets removed before it causes trouble. (ben 1 + web)

Payments join the pressure. The updated Consumer Credit Directive puts BNPL and invoice payments under sharper supervision, especially for younger shoppers. Small merchants can’t just plug in a checkout tool and hope for the best — disclosures, credit flows, and fee transparency must be spotless if they want to keep conversion stable.

What looks like extra paperwork actually becomes a competitive edge. Sellers with clean product data, proper certificates, and transparent logistics get faster approvals and fewer takedowns.

Gen Z pushes for proof, not slogans, on sustainability and pricing

Gen Z shoppers in DACH come into 2026 with sharper expectations. They don’t buy vague eco claims or soft marketing lines. They want proof: recycled-material percentages, carbon-neutral data, repair options, and circular programs they can actually see. If brands can’t show the “how,” Gen Z scrolls on.

This is a generation that reads product pages like checklists. They compare sustainability claims, look for transparent pricing, and notice instantly when discounts feel artificial. If a brand inflates “original prices” or hides shipping fees until checkout, trust collapses.

Pricing clarity matters as much as sustainability. Gen Z prefers simple, predictable structures — fair base prices, honest promo logic, and no “gotchas” at checkout.

For merchants, the opportunity is big: Gen Z rewards brands that talk plainly. Show sourcing. Show packaging choices. Show why the price is the price.

So what do DACH trends for 2026 mean for you?

DACH trends for 2026 tell a pretty sharp story. Shoppers are fully digital, but not careless. They chase low prices, then still expect invoice, solid delivery, and local service.

If you sell into Germany, Austria, or Switzerland, this year is a good moment to tidy your mix: strengthen marketplaces and social commerce presence, add local payment comfort, start a re-commerce or outlet line, and bring emissions data into logistics decisions.

The DACH region will stay one of Europe’s toughest but most rewarding e-commerce zones. With these trends in mind, you can shape offers, tech, and operations for the next two years instead of reacting once changes hit.