European ecommerce overview: Germany

Written by

Kinga EdwardsPublished on

Discover key trends and insights into e-commerce in Germany. Explore the latest stats and opportunities shaping the German online market.

After a few shaky years (inflation, supply-chain glitches, cautious consumers), German e-commerce is firmly on the rebound. Brands and retailers are rethinking how to reach German customers. They’re doubling down on speed, trust, and convenience. If you’re curious where opportunities lie — how Germans are shopping, paying, what they expect — this article will help you avoid pitfalls and win in e-commerce in Germany.

We’ll walk through: what the overall market looks like now; what consumers are doing; how people want to pay; what role social media is playing; and what it means for logistics. By the end, you’ll see what works (and what doesn’t) in 2025 & beyond.

Let’s get into it.

German e-commerce: the overview

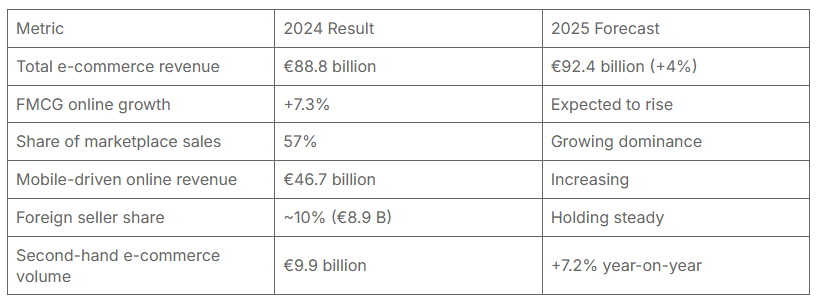

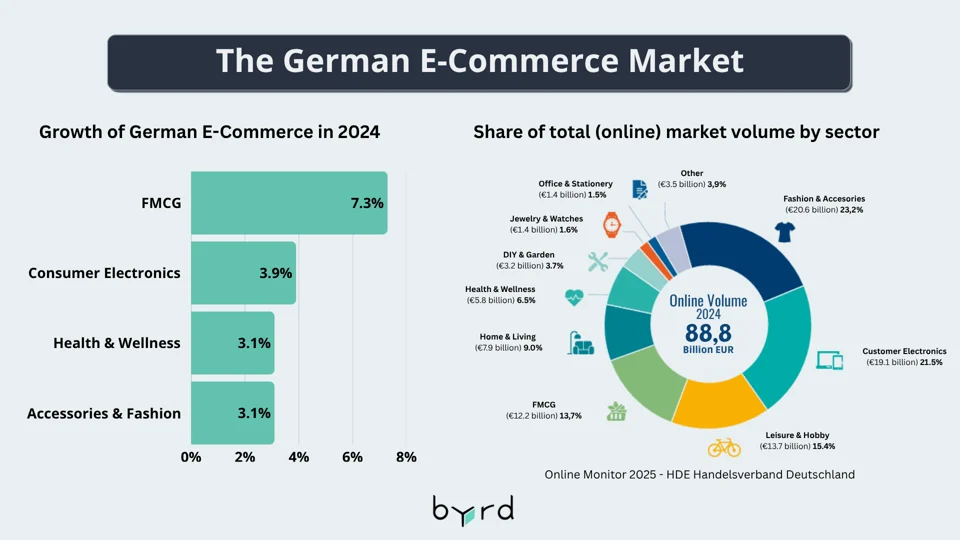

E-commerce in Germany is bouncing back. In 2024, total online sales (goods only) climbed ~3.8% to about €88.8 billion. In 2025, this number is expected to reach €92.4 billion. The growth rate isn’t explosive (+4%), but steady. Also, BEVH & the EHI Retail Institute forecast ~2.5% growth in goods-ecommerce for 2025.

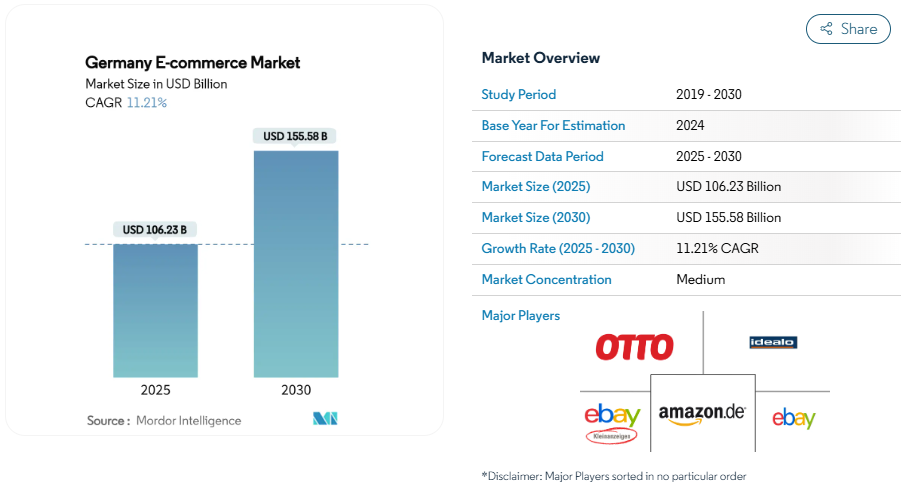

Germany remains one of the biggest online markets in Europe. Yet, it’s not just about size: maturity also has a value here. Many Germans already shop online. Penetration is high: around 66% of the population shopped online in 2025. And average revenue per user (ARPU) is healthy. This forecast puts e-commerce revenue at about $107.85 billion in 2025.

Moreover, according to Mordor Intelligence, the market size for 2025 is $106.23, and it’s expected to grow at a CAGR of 11,21% between 2025-2030.

Some product categories are pulling ahead. Fast Moving Consumer Goods – FMCG – (groceries, personal care, etc.) grew ~7.3% in 2024. Still, fashion, electronics, and home goods remain core pillars of the market, too.

Marketplaces are dominating. In 2024, about 57% of all online sales in Germany happened through marketplaces. Traditional single-brand webshops are struggling or declining in some segments. Here, Amazon.de leads.

And mobile is central. More than half of transactions (66%) happen via mobile devices. The share of mobile sales continues to rise.

E-commerce in Germany is mixed. Consumer confidence is low but slowly improving. Inflation and external pressures remain risks. Still, German e-commerce is seen as a growth pillar because customers are shifting more behaviours online, expecting better services, faster delivery, cleaner UX.

Consumer behavior

Most Germans are buying online regularly. Around 75% of consumers made an online purchase in the last month. Of that group, 43.6% bought something in the past week. Also, mobile and social channels are influencing impulse and regular buys.

People aged 18-49 spend the most online. Older age groups (50-60+, 60-plus) are closing the gap: more of them are active online, browsing, buying, especially for essential items.

Germans’ expectations are high. Growth is slower than in the pandemic boom years, but steadier and more sustainable. In the first half of 2025, revenue from goods sold online rose about 3.5% year-over-year, hitting €39.84 billion.

What’s interesting, recommerce/second-hand is hot. The market was ~€9.9 billion in 2024, up ~7.2% year on year. Fashion, books, electronics lead there.

Cross-border and foreign platforms like Shein are shaping behavior. About 10% of online sales in Germany come from foreign sellers (~€8.9 billion). And younger Germans are more likely to buy from abroad more frequently.

What influences whether someone buys?

It’s price, convenience, and trust. Free shipping, easy returns, and transparent costs matter a lot for e-commerce in Germany, too.

Germans are quite price-sensitive. Websites need to be high-quality, fast, and clear. Some loyalty helps, but surprise fees kill conversion.

So, what pain points & opportunities can we highlight for customers in the German e-commerce market?

Pain points:

- Many consumers abandon carts if delivery cost or shipping time is unclear.

- Returns are a challenge; recommerce shows there’s demand for second-hand or more sustainable options.

- Price competition (local vs foreign, marketplaces vs D2C) is intense; margins are squeezed.

Opportunities:

- Focus on essentials, sustainable goods, home & comfort.

- Nail mobile experience.

- Be transparent about shipping + returns.

- Build trust (brand, reviews, quality).

Payment methods

Of course, people want things simple, fast, secure. They don’t want surprises at checkout. If you want to be a winner in e-commerce in Germany, deliver what matters the most.

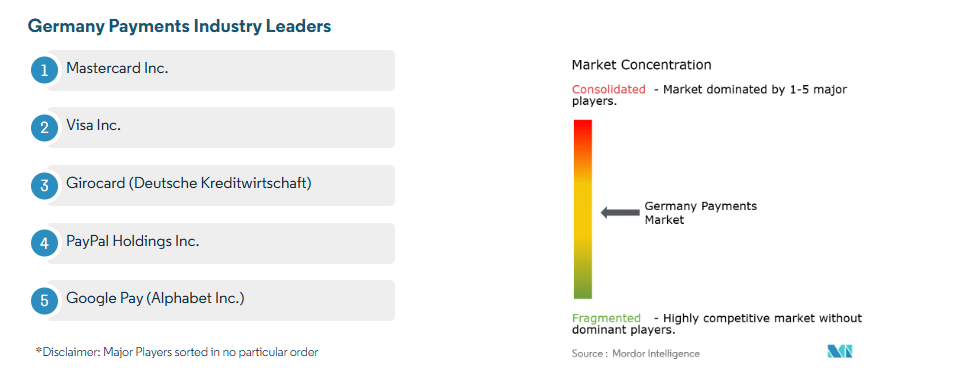

Among the German payments industry leaders are Mastercard, Visa, Girocard, PayPal, and, surprisingly, Google Pay.

Let’s start with PayPal, as for many, it remains queen of the castle. It accounted for 28% of all online purchases in Germany in 2023. That includes both marketplace & webshop purchases. Paying by invoice (aka “on account”) is still huge. It’s often #2 behind PayPal. It was about 27% of online purchase methods. Germans love to try first, pay later; trust & low risk matter.

Direct debit (Lastschrift) also has a solid share, too. Next, credit cards, which are lower than many markets expect, but still win customers’ hearts.

Other options, like local bank/payment transfers, voucher-ePay, are still part of the mix. These often don’t dominate individually, but together they form a meaningful share.

Also: digital wallets (other than PayPal) are growing. Apple Pay, Google Pay, etc. Germany is a bit slower than some countries in adopting “wallets everywhere” but momentum is there. Security (like PSD2), convenience (one-click, saved credentials), trust push them forward.

New player alert: Wero.

Wero launched mid-2024 and is rolling out more in 2025 for German e-commerce checkouts. It’s meant to replace Giropay/Paydirekt in part. It offers real-time bank payments tied to mobile apps/bank accounts. More people & merchants are starting to accept it.

Payment methods’ tips

What to watch in your offered payments, so you avoid losing customers:

- If checkout doesn’t offer their preferred method, Germans will abandon carts. Especially invoice/“on-account” or PayPal.

- Hidden fees or unclear charges (in shipping, tax, payment fees) kill trust.

- New payment methods (like Wero) need visibility & education. If customers don’t know them, they won’t click them.

- Security matters. Two-factor auth, fraud protection, and regulation (PSD2) all affect which providers people trust.

- Aim for UX: speed, minimal steps, especially in mobile.

What would we recommend from this for brands entering or growing in e-commerce in Germany?

- Always offer PayPal and invoice/on account for goods, if possible.

- Add direct debit & bank transfer options (or Wero where supported) — this helps people who don’t want cards or who worry about credit.

- Include credit/debit cards (Visa, Mastercard), but don’t rely on them only.

- If wallet options are available, integrate them. Build trust & ease.

- Make the payment method list visible early. Let people see they can pay in a trusted way before they add to the cart.

Starting can be that simple.

Social media

Social media is no longer just where Germans hang out, but where they shop, discover, and decide. In 2025, over 80% of Germany’s population will be active on social media. That’s over 67.8 million people.

To the most popular social media platforms belong WhatsApp, Instagram, Facebook, and TikTok.

People click, save, follow, and buy there. Social commerce is hitting its stride. The market is set to grow by about 8.8% annually to reach $6.19 billion in Germany 2025. Platforms like Instagram and Facebook account for over half of that revenue from embedded shopping experiences.

TikTok Shop is pushing in big. 2025 marks its launch in Germany with partners like AboutYou. Live selling, discount drops, influencer showcases — all parts of the strategy. It’s still early days for many merchants, but the momentum is real. If your target includes younger demos, you gotta have a TikTok-plan.

Germans trust social media for product research. A survey shows 82% of consumers use social media to discover or research products. That means brands need to show up before the cart, in their feed, stories, reels, videos. Shout louder there. Because if you’re not visible on social media early, you lose ground.

People tend to follow multiple networks. The average user holds 5.4 social media accounts. So, don’t put all your eggs on one platform. Cross-platform content matters. Reuse, repurpose, tailor.

Also: privacy & trust still weigh heavily. Germany has strong data protection expectations. If you push influencer marketing, social ads, in-app shopping, you need transparency. Permissions, data usage, cookies—all that must be clean. Violations hit reputation and conversion.

What works best:

- Influencers or creators who feel real. UGC (user-generated content) beats slick ads for many.

- Shopping features built into platforms: shoppable posts, live streams, and small storefronts in apps. If people can click to buy where they saw the product, conversion jumps.

- Content that entertains + informs. Germans like helpful product walkthroughs, demo videos, and reviews.

- Fast responses: people will DM or comment with questions. If you ignore, you lose trust.

Pain points brands need to solve:

- Poor integration of German e-commerce in social platforms slows down buying.

- Shaky visuals or vague content. If your reel is blurry or poorly lit, you lose.

- Slow load times, confusing links, or if the product page isn’t mobile-optimized.

- Inconsistent brand voice across platforms weakens trust.

Logistics

Logistics is quietly becoming the backbone of success for German e-commerce. Customers want their orders on time, cleanly packed, and honestly communicated. If logistics messes up, the rest of your German e-commerce strategy crumbles.

Take on-time delivery. In Germany’s delivery landscape from Q1 2024 to Q1 2025, 97.42% of all parcels arrived on schedule. But there’s a catch: first attempt delivery success dropped to 80.42%, showing that more parcels require multiple tries or re-deliveries. That adds cost. That hacks trust.

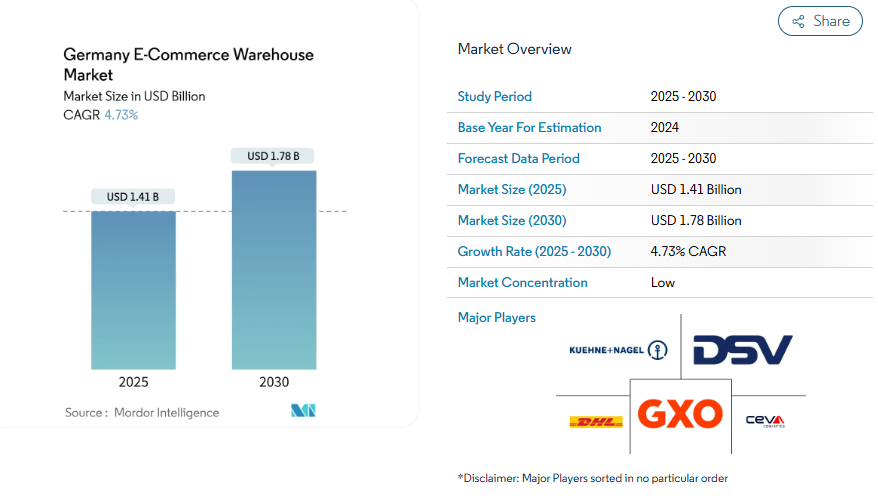

Then you’ve got warehousing & fulfillment. The warehouse market for e-commerce in Germany is expected to hit $1.41 billion in 2025, growing steadily through to 2030.

Automation is the name of the game: more robotics, more micro-fulfillment hubs, more value-added work (like returns handling, packaging, climate control). Businesses that don’t optimize their warehouses will lag.

Also, consumers are using more PUDO (pick-up/drop-off) points. They like locker systems that save failed deliveries and ease urban congestion. Carriers that lean into it are winning customer satisfaction and cost savings.

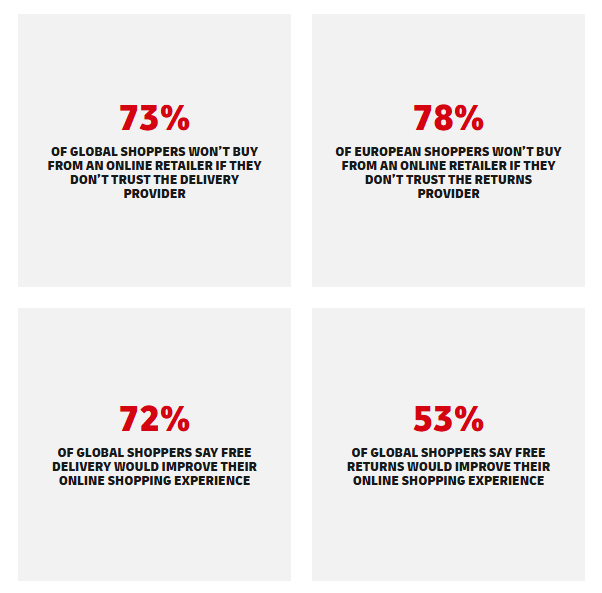

Also: transparency of delivery windows (when exactly the package shows up), efficient returns, and communication matter deeply in e-commerce in Germany. As many as 73% of German shoppers will abandon a purchase if they don’t trust the delivery provider.

So for businesses aiming to scale or enter German e-commerce, one thing is obvious: invest in logistics.

Make warehousing surgical, last-mile transparent, and delivery performance high.

Because logistics is part of the product.

Last words on German e-commerce

German e-commerce in 2025 feels like a market that knows what it wants.

Growth is steady, with consumers spending billions more each year. They’re picky, but also open to new ideas — if you meet their standards. From how they browse on mobile to how they pay at checkout, to how they expect parcels to arrive, every detail matters.

What’s clear is that e-commerce in Germany isn’t a guessing game. You’ve got the data, the trends, the numbers. People shop often, they stick to trusted payment methods, they scroll social platforms for inspiration.

If you’re planning to grow here, don’t just think about selling. Think about building trust at every touchpoint.

That’s the story of German e-commerce in 2025 — challenging, exciting, and very much worth the ride.

***