How to tap into Europe’s two most lucrative e-commerce markets

Written by

Editorial TeamPublished on

Switzerland and the UK are top choices for EU online retailers looking to expand beyond their borders, offering lucrative opportunities alongside unique challenges. Discover why these markets are worth the effort and how to navigate their complexities in our latest article! (Ad)

Commercial collaboration

In the world of cross-border e-commerce, two countries stand out when online retailers from the EU decide to expand beyond their domestic market: Switzerland and the United Kingdom. Both offer immense growth potential but also present significant challenges. Why the effort is worth it and how best to proceed is the focus of this article.

When EU-based online retailers consider expanding beyond their home market, two countries quickly come into focus: Switzerland and the United Kingdom. These markets provide excellent opportunities to boost shop growth. But what exactly makes Switzerland and the UK so attractive? Here is a brief overview:

Switzerland: Switzerland, with a population of 8.9 million, not only boasts the second-highest purchasing power on the continent, which is also three times higher than the European average, but also recorded an e-commerce market volume of approximately €14.7 billion in 2023—an increase of 3% compared to the previous year. Thanks to high price levels and low VAT rates, online retailers in Switzerland can benefit from higher profit margins. The high domestic price level also contributes to a strong preference for cross-border shopping. In 2023, cross-border purchases accounted for over 15% of the Swiss e-commerce market volume.

United Kingdom: With an e-commerce market volume of nearly €120 billion, the UK is Europe’s largest e-commerce market and the fourth-largest globally. The UK also has a strong inclination towards cross-border shopping. According to a study, almost half of British consumers (48%) prefer to shop online outside their domestic market, partly due to frequently lower prices in the EU compared to their local market.

Key considerations for cross-border e-commerce

Entering the Swiss and UK markets also comes with substantial challenges that online retailers must address. Both countries have customs borders, which involve administrative and technical requirements:

Fiscal representation: Retailers shipping to Switzerland or the UK are subject to VAT in those countries. To handle VAT payments, they need a local contact to represent their business to the tax authorities. This can involve establishing a local entity, such as a branch or domestic warehouse, or partnering with a local representative.

Customs registration: For cross-border shipping, shipments must be registered with customs for import. Regular shippers benefit from electronic customs registration, which enables smooth data transmission. To facilitate communication between systems, an API interface is essential, which requires significant technical expertise to set up.

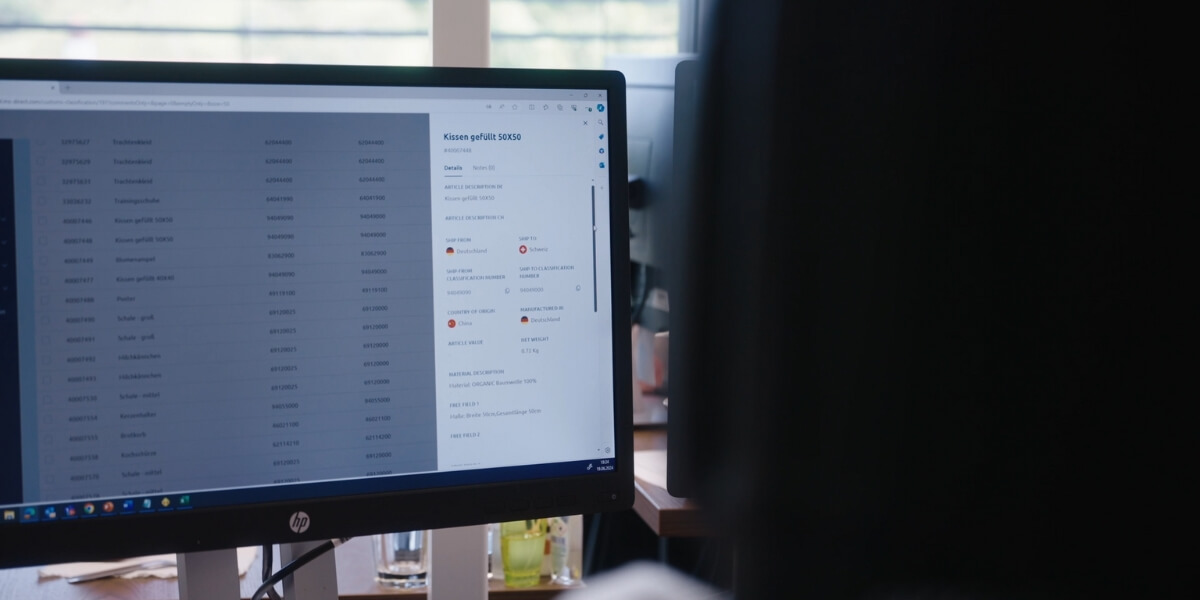

Accurate data management: Well-organised and up-to-date data management is crucial for successful cross-border shipping. Key details such as product descriptions, customs tariff numbers, prices, weights, and countries of origin must be accurately recorded and regularly updated. These details are required not only for electronic customs registration but also for VAT declarations. Incorrect or incomplete declarations can result in shipments being held at customs, leading to delays, increased administrative costs, and customer dissatisfaction.

Logistics challenges: Logistics is another critical aspect. Retailers aiming to ensure fast delivery must work with experienced carriers to avoid delays and provide effective tracking. Tracking increases transparency and enhances customer satisfaction.

Cross-border portals such as that of MS Direct simplify the management of cross-border shipments.

Customs clearance in Switzerland and the UK

Customs clearance for cross-border shipments involves two key questions: who bears the costs of customs clearance, and how are items declared? These issues are addressed by Incoterms. The two most relevant for e-commerce are:

Delivery-at-Place (DAP): Under the DAP model, the seller is responsible for delivering the shipment to the destination. However, the customer bears the cost of customs clearance. If these costs are not clearly communicated at checkout, unexpected fees may lead to frustration or even returns.

Delivery-Duty-Paid (DDP): Under the DDP model, the seller covers the costs and assumes responsibility for customs clearance. This method allows for either individual or consolidated customs clearance, each with its own advantages and disadvantages. Sellers must also account for VAT in the import country, requiring fiscal representation.

Individual vs. consolidated customs clearance

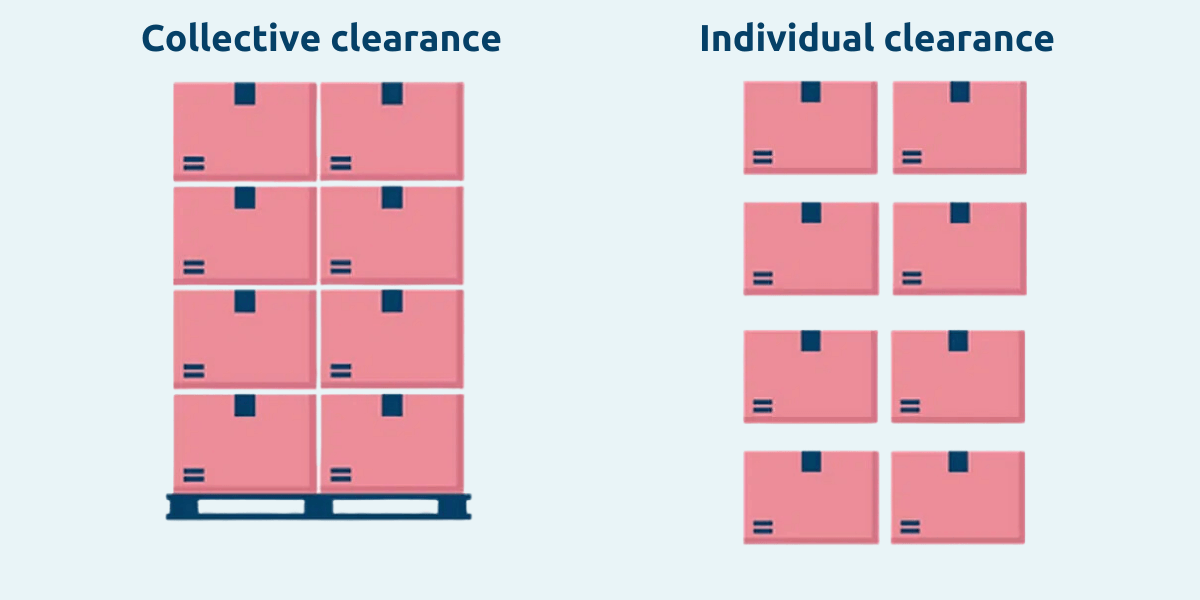

Once costs are clarified, the next consideration is how to declare items for customs. The options are individual or consolidated customs clearance. Each approach has advantages and disadvantages depending on the customs system and shipping volume.

Individual customs clearance:

Each shipment is declared and cleared individually. This method is typically used for low shipment volumes. However, it requires more time as each package must be processed separately.

Consolidated customs clearance:

Multiple shipments are grouped and cleared together. This is common for larger shipment volumes or items with high return rates. It requires less administrative effort as only one declaration is needed for multiple shipments.

The choice of customs clearance procedure has an impact on costs and processing time.

Specifics of Swiss customs

Since 1 January 2024, Switzerland no longer imposes customs duties on industrial goods. Import declarations, however, remain mandatory but have been significantly simplified. Costs incurred during importation include VAT at a rate of 8.1%.

Specifics of UK customs

UK customs differentiate between “Low Value” and “High Value” goods. Under the “Simplified Declaration” process, shipments valued under £135 do not require full customs declarations. Such orders are usually duty-free, with only import VAT applicable. However, low and high-value orders must be itemised on separate consolidated invoices. The UK imposes a 20% VAT rate on most imports, requiring careful management to avoid penalties.

Is partnering with a cross-border specialist worth it?

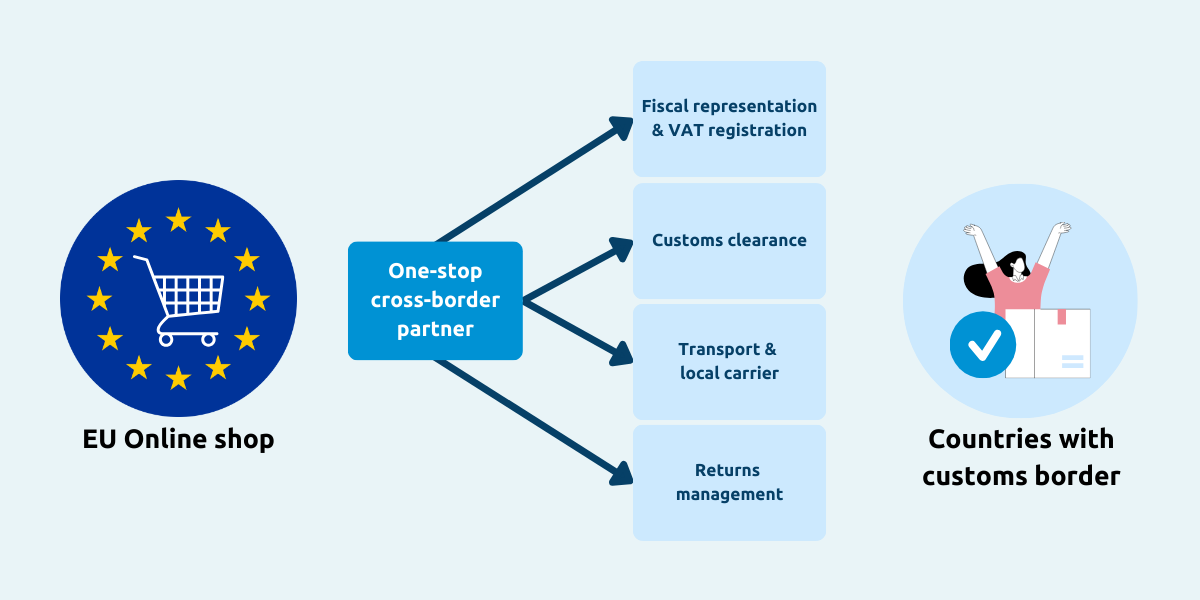

Given the complexity of cross-border shipping, many online retailers collaborate with cross-border specialists like MS Direct to reduce effort and cost. In many cases, working with a specialist is worthwhile. Numerous providers are available, but key factors to consider when selecting a partner include:

Software: Good cross-border specialists provide user-friendly software that automates customs declarations and ensures clear and audit-proof VAT and customs documentation. Ideally, they also assist in setting up API interfaces.

Fiscal Representation: Specialists can take over fiscal representation for your shop.

Country Coverage: If shipping to multiple countries with customs borders, it is advantageous to partner with a provider offering comprehensive services across all relevant markets.

Experience: Your customs partner should be flexible in choosing the best customs clearance option for your shipments to optimise costs.

Logistics: Some specialists also support cross-border logistics planning, helping you build customer-friendly supply chains. Ideally, they manage returns processing and re-import clearance.

A good cross-border partner can provide a one-stop solution for all your cross-border shipments.

Adapting your shop to the target market

Expanding into new markets involves more than shipping products and handling customs clearance. It also requires tailoring your online shop to meet local expectations. Key areas to focus on include:

Domain: Consider creating a market-specific domain (.ch for Switzerland, .co.uk for the UK) to strengthen brand trust. A local domain can also improve search engine rankings in those markets, making it easier for customers to find you.

Language: Swiss consumers expect to shop in their native language, whether it is German, French, or Italian. Similarly, British consumers expect British English. Ensure your website is fully translated, including product descriptions, customer service information, and FAQs.

Currency: Display prices, including VAT, in the local currency—Swiss Francs (CHF) and British Pounds (GBP)—to facilitate a seamless checkout experience.

Payment methods: Different countries prefer different payment methods. Credit cards are still the most common method in both countries. Additionally, TWINT is popular in Switzerland, while PayPal remains a favourite in the UK.

Product range: Adjust your product range based on market demand, as not all products perform equally well across countries.

Recommendations for cross-border e-commerce

Customer satisfaction is the most critical factor for success, especially in cross-border e-commerce. Along with adapting your shop, ensuring a positive post-purchase experience is essential. Stand out by getting everything right, from shipping to returns.

Fast delivery: Delivery speed remains crucial in cross-border e-commerce. According to a study by MS Direct, delivery times to Switzerland should not exceed five days, while UK consumers expect shorter delivery times, averaging three days. Leading examples include Mango, which delivers from Madrid to Switzerland within 48 hours, customs included.

Duty-free deliveries: Unexpected customs charges frustrate cross-border customers. Ideally, customers should not even be aware of the customs process, receiving their orders duty-paid. The DDP model has become standard and is now expected by most customers. While it incurs higher costs, it prevents customer dissatisfaction and enhances loyalty. If you choose not to cover customs fees, clearly indicate potential charges during checkout to avoid surprises at delivery.

Local return handling: Returns are an inevitable part of e-commerce and are equally important in cross-border transactions. Complicated return processes deter customers. Efficient return handling, such as collecting and processing returns in the destination country, offers significant advantages. It allows customers to return items to a local address and often results in faster refunds. Retailers benefit from quicker inspections and consolidated returns to the main warehouse. According to an MS Direct study, local return handling is already standard practice in the UK.

Conclusion

Switzerland and the United Kingdom offer incredible opportunities for European e-commerce businesses, albeit not without challenges. Retailers are advised to familiarise themselves with the customs and VAT regulations of these countries and ensure customer-friendly delivery and return processes. Given the complexity of entering these markets and planning cross-border shipments, many online retailers find it worthwhile to collaborate with a cross-border specialist like MS Direct. These experts not only provide advanced software solutions for customs declarations and documentation but also help establish robust supply chains. Ultimately, success in cross-border e-commerce lies in meticulous planning.

About the Author:

MS Direct is an e-commerce service provider based in Switzerland, Germany, and the United Kingdom. With over 45 years of experience in e-commerce logistics and cross-border operations, MS Direct has developed modern solutions to ensure smooth and hassle-free cross-border shipping. As a full-service provider, they cater to all European countries with customs borders.

***