Top Insights on E-commerce in Italy

Written by

Kinga EdwardsPublished on

2022 marked a reality check for retailers and manufacturers. Inflation and a new experience for Italian ecommerce affected purchases due to increased prices and uncertainty. However, some sectors, such as Consumer Electronics, Food, and Home and Furnishing, were able to increase their year-end turnover.

Operators reorganized production and expect double-digit growth in 2023, but this growth will vary. Italian retailers will have to strengthen their relationship with the final customer, possibly through intermediation by artificial intelligence objects that will change ecommerce forever.

We invite you to read the article below or visit the full report.

E-commerce Condition

The number of internet users has surpassed 5 billion, with over 64% of the global population accessing the internet. The majority of users access the internet via mobile devices, and online buying has slightly decreased in the past year. However, the global ecommerce market is expected to surpass 6 trillion USD in turnover in 2023, to get to over 8 thousand billion USD in 2026.

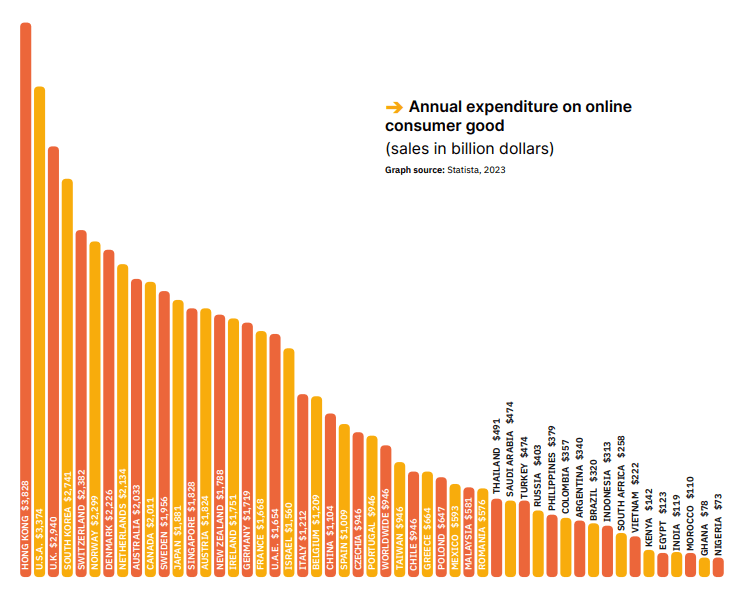

Fashion and consumer electronics are the most popular consumer goods purchased online, while food and tourism services saw significant growth in the past year. The Asia-Pacific region is leading the digital market, with the highest per capita expenditure on consumer goods in Hong Kong. Italy ranks 21st in the world with $1,212.

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

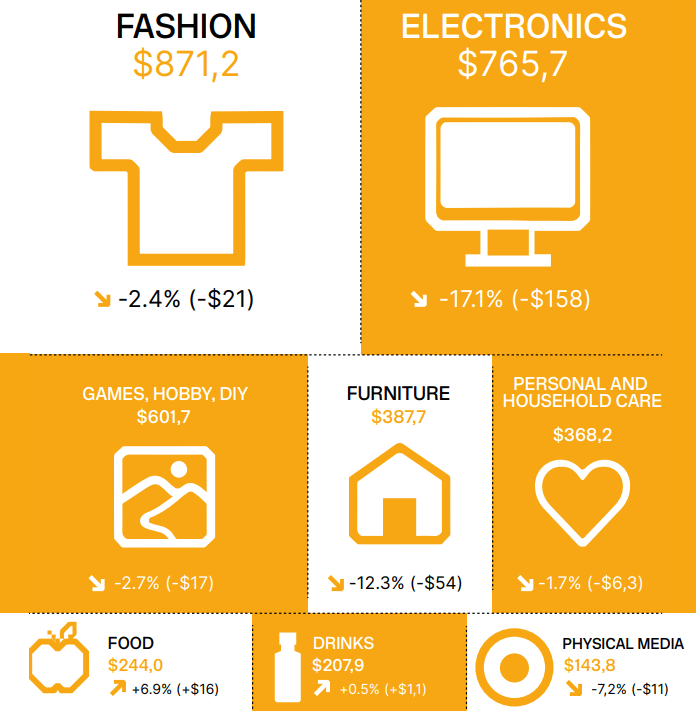

Here are also the main categories of online consumer goods worldwide that saw a decline in 2022.

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

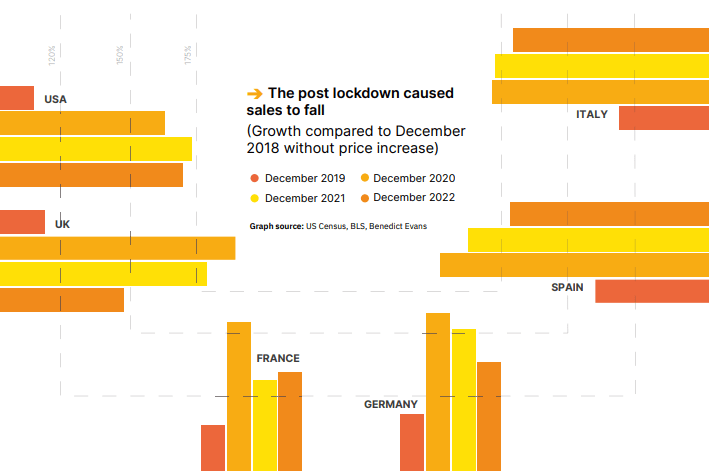

While the growth of lockdown saw a three to four-year growth in one, it also generated a lock-in effect due to those who were forced to buy online but preferred to buy in-store.

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

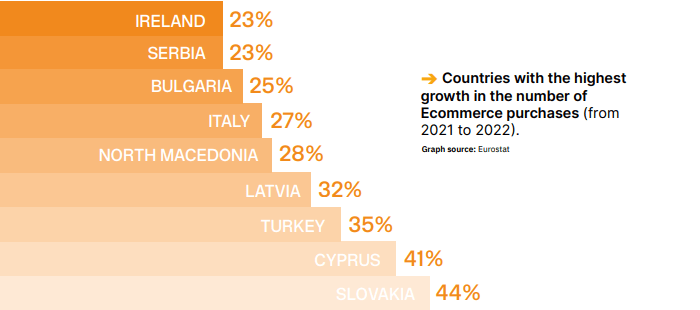

In Europe, 60% of citizens buy online, and the ecommerce turnover accelerated in 2021, but it fell back to 2020 values in 2022, with the over-55s seeing a slight drop in internet users for the first time.

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

E-commerce in Italy

In 2022, about one million people returned to offline life after being forced into the digital world due to lockdown. Online penetration among the Italian population (aged 2 and over) reached 75.1% in January 2023 (-1.2% compared to the previous year) with 44 million single monthly users. Geographically, the most well-connected area is the northwest with 64.7% of Italian adults, while the south and islands are close with 58.6%. Islands with 58.6%.

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

Those who stayed online, however, spent more time online, increasing from 2h28’ to 2h40’ on an average day. When it comes to access devices, mobile is the device of choice, with 49.6% of Italians spending time on it.

Italy’s e-commerce turnover in 2022 is estimated at EUR 75.89 billion, with an annual growth of 18.58%.

The positive impact of leisure is due, in particular, to the growth of online gaming, as well as purchases related to hobbies and sports. Food, Consumer Electronics, Fashion, and Publishing all showed growth or stability, while Health and Beauty/Home and Furnishing closed the ranking.

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

Looking ahead, the growth of Ecommerce in Italy is expected to continue in the coming years. The COVID-19 pandemic has accelerated the adoption of online shopping, and many consumers have discovered the convenience of buying products and services from the comfort of their own homes.

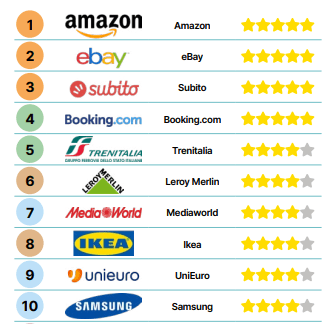

The top 10 e-commerce sites in Italy are as follows:

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

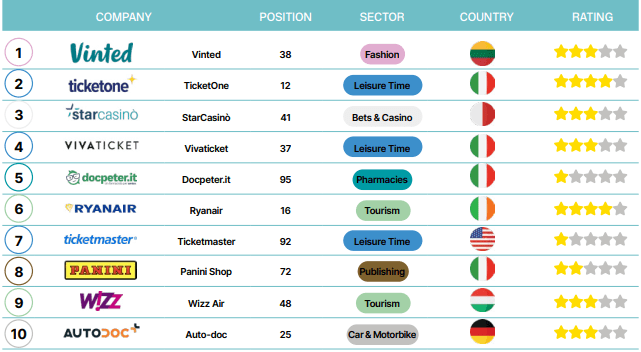

And top 10 fastest-growing e-commerce companies are:

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

On average, an Italian Ecommerce site is expected to grow by 17.26% in terms of turnover by 2023.

E-commerce Trends

👉 Inflation upsets the balance

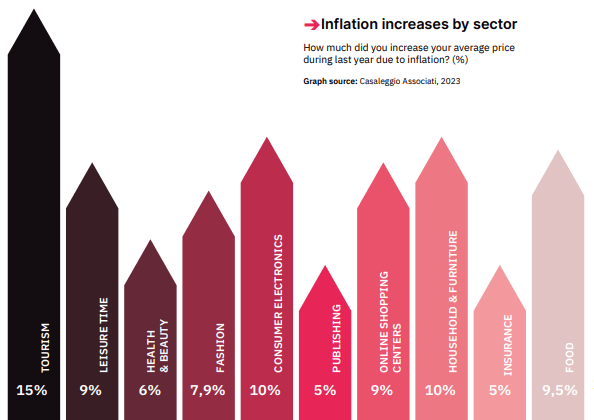

Inflation has been a significant concern in the Italian eCommerce industry, impacting operators differently depending on their products, raw materials, energy usage, and import/export practices. Hosts of short-term rentals had to bear higher heating and electricity bills, while retailers of low-entry products experienced a significant increase in volume. Some retailers lowered the number of discounts and promotions for stable prices, while others optimized their delivery service to compress the price. Moving production to Italy in 2022 also provided temporary transport cost advantages.

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

👉 AI-commerce

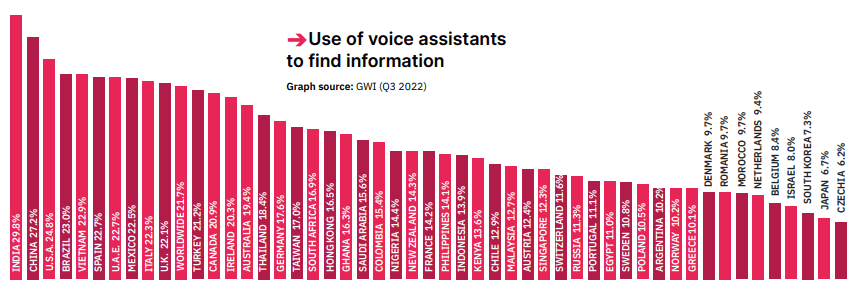

Italian eCommerce operators predict that Artificial Intelligence (AI) will significantly impact online sales within the next three years. AI would enable a new dimension of online shopping where customers can talk to AI-integrated assistants to find tailored solutions for their needs. This would replace the traditional approach of individually searching for products, resulting in a change in online shopping behavior.

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

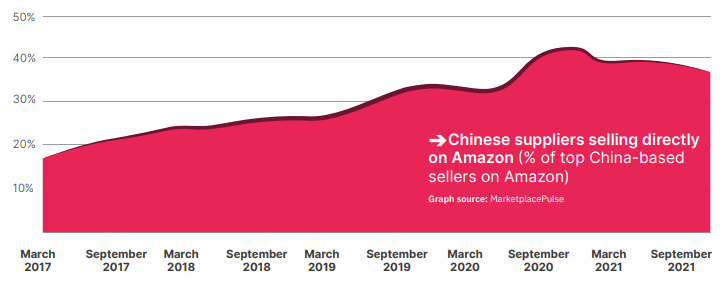

👉 (Chinese) suppliers go direct

Also, more and more Chinese suppliers are starting to sell directly to consumers, bypassing the traditional route of using intermediaries such as importers and distributors. This trend is driven by the rise of e-commerce platforms such as Alibaba’s AliExpress, which allow Chinese sellers to reach customers around the world without having to go through the middlemen.

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

👉 App commerce

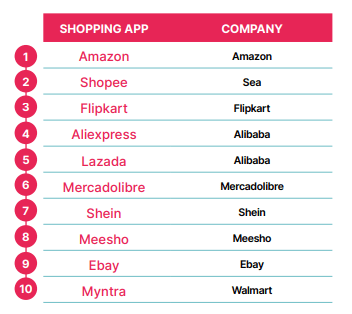

Established retailers and marketplaces are building customer loyalty by using apps to create a more personalized and direct relationship with customers. This strategy allows them to avoid intermediaries and offer services like notifications and geolocation.

The most used apps in the world are:

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

👉 Impact on the world (ESG)

In addition, Asian-owned operators in Italy tend to neglect ESG activities, but some marketplaces like Lyreco require minimum criteria to onboard products. The push towards sustainability comes from marketplaces, laws, and individual entrepreneurs. For instance, companies in Europe with over 200 employees will have to draw up a social report. Currently, sustainable product and packaging work is the most common strategy (26%), while only 8% prepare a sustainability report.

👉 (Economically) sustainable growth: and positive EBITDA

Moreover, in the current monetary climate, negative EBITDA is no longer sustainable for most companies. The top retailers with negative EBITDA are mostly funded by external groups seeking market share growth. The focus is shifting to economically sustainable growth for the coming year, with investment capacity expected to tighten even further.

Your e-commerce company can adopt such strategies:

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

Online Marketing

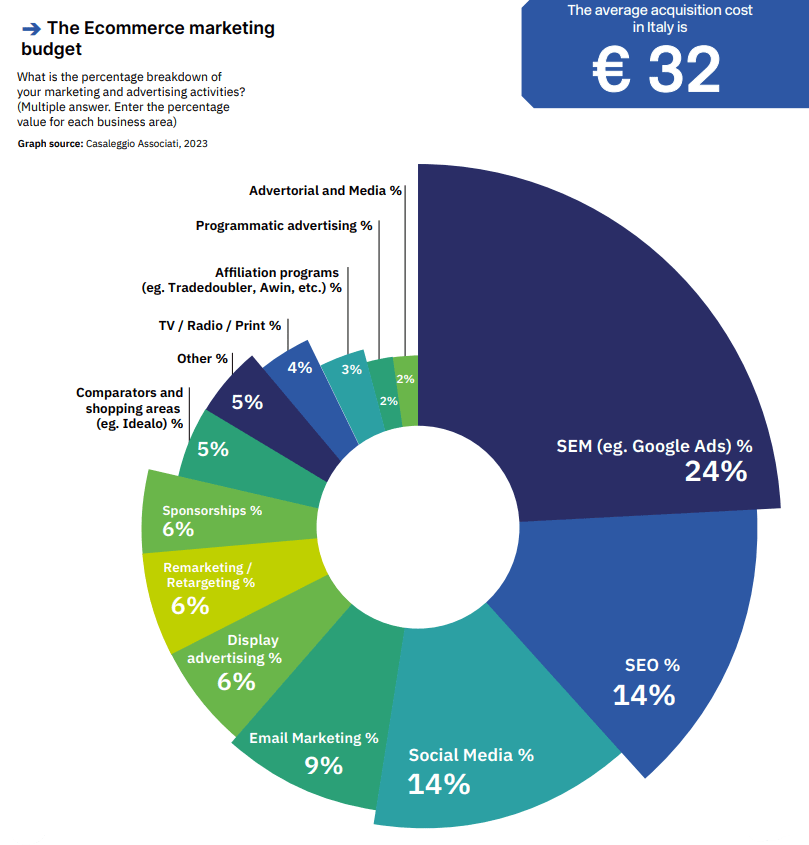

Online marketing is changing due to the use of different media by various generations, the digitalization of processes, and new regulations such as the cookieless era. It is essential to have an overall marketing and loyalty strategy rather than just promoting products and websites.

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

In Italy, the average cost of customer acquisition is EUR 32. SEM, SEO, and social media are the top three investments in marketing activities, followed by email marketing, display advertising, comparators, sponsorships, remarketing, retargeting, and affiliation. Traditional media such as TV, radio, and print have dropped to a 4% investment.

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

Companies dissatisfied with promotional results invest in traditional media. Advertising repositioning on retailers and marketplaces directly has accelerated, with the US investment in retailers up to 10% in 2022.

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

Selling Abroad

Online spending per capita in Italy lags behind other European countries. Italian Ecommerce companies selling abroad increased to over half in 2022, with multilingual websites being the main strategy for international presence. Food and Home-Office and Furniture sectors have a stronger presence abroad, while shopping centers and consumer electronics are less prevalent.

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

Sales from abroad increased by 56% of surveyed companies, with foreign presence noted in various countries. Transport costs posed a challenge for international sales in Italy, leading to significant growth for operators with distributed logistics bases.

Source: Casaleggio Associati, Ecommerce in Italy 2023 report

To Sum Up

Overall, the future of Ecommerce in Italy looks bright, with opportunities for growth and innovation. Retailers who are able to adapt to changing consumer preferences and embrace new technologies are likely to thrive in the years ahead.

However, there are still challenges to overcome, such as the digital divide that affects certain areas of the country, especially in the South and Islands. Either way, the Italian market is worth looking at, and we hope you have become more familiar with it.

Sign in to our newsletter and be in touch with the most important news. 👇