7 Things To Know About Polish E-commerce Consumers

Written by

Editorial TeamPublished on

(Source: Unsplash)

Polish consumers, much like people worldwide, have wholeheartedly embraced e-commerce and its possibilities, such as access to products and services from all over the globe. However, with inflation prompting them to examine every grosz spent carefully, consumers are now concentrating on making well-informed purchase choices and buying only what they genuinely require. How can foreign entrepreneurs enter this market and succeed in such a challenging environment?

In recent years, Poland has emerged as a rapidly growing e-commerce market, attracting numerous companies seeking success in the online sphere. 79% of Polish consumers are already making online purchases, and one-third are open to buying products from international stores.

Poles’ preference for low prices, observed throughout the years, has facilitated the swift expansion of foreign entities like AliExpress and Temu in the country. Even now, with nearly every young consumer buying online, mainly via smartphones, almost half are looking to save on their spending by looking for promos or buying larger quantities of products.

However, low price is not everything, as shown by Shopee’s failure to win the hearts of Polish people (the Chinese brand left the market at the beginning of 2023). Local consumers place greater trust in local brands, as evidenced by the market dominance of Allegro, which has withstood competition from giants like eBay and Amazon. Winning the hearts of those residing along the Vistula River is not an impossible feat. Still, it’s crucial to consider the factors influencing purchasing decisions in 2023 to achieve success in this market.

Consumers are making more informed purchases.

The foremost trend is undoubtedly global inflation, which has impacted consumers worldwide. Poles have a reputation for being price-conscious buyers, as the Polish economy, while developing in recent years, still needs to catch up to Western European counterparts. Inflation has further amplified this trend. Almost 7 out of 10 Poles find it challenging to save money and believe cutting down on expenses is necessary to build savings. Consequently, this has led to more cautious and reduced spending.

Sustainability also holds significance when making informed decisions, with 67% of consumers supporting a responsible retailer. A fascinating manifestation of this trend is the development of the VeloMarket, a marketplace that offers only tried eco-friendly products.

However, in recent years, owing to the intricate geopolitical landscape, this “responsibility” of e-stores has often had to go beyond merely aligning with sustainable development goals. The consumer expectations towards companies often involve severing connections with Russian or Belarusian markets. This shift is particularly relevant in light of the significant Ukrainian population in Poland.

What makes the Polish consumers tick?

The primary factors driving shopping preferences for Poles include competitive pricing, a broad product selection, swift delivery, and enticing promotions. Mostly online. As fuel prices continue to rise, consumers are increasingly inclined to opt for online shopping, saving money on transportation and time. This shift in behaviour applies to significant purchases like household goods, appliances, and consumer electronics, as well as smaller ones, notably clothing and fashion accessories.

Poles, much like the entire world, love a good Black Friday shopping, as it’s an excellent opportunity to benefit from promotions. Despite the economic slowdown this year, they conducted nearly 18 million transactions for the value of 2.8 billion PLN via the most popular payment method, BLIK. And this December, almost 9 in 10 Poles intend to use promotional offers when making their holiday purchases, with 3 out of 4 scaling back their spending in response to inflationary pressures.

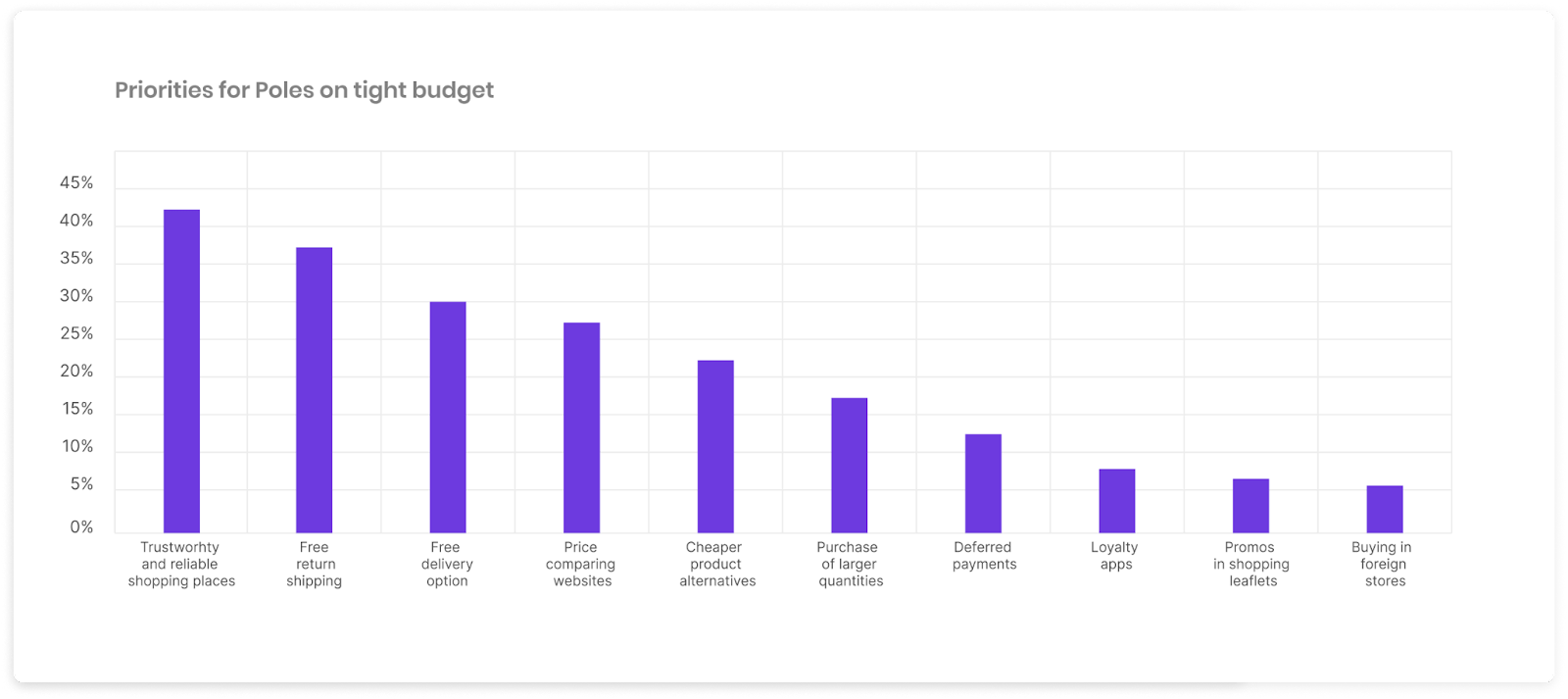

(Source: made by Alsendo.com)

Polish consumers are drawn to certain features when shopping on a tight budget. These include trustworthy and reliable shopping places (42%), the availability of free returns (36%), or free delivery options (30%). Approximately a quarter of them will place importance on websites that allow price comparisons and seek cheaper alternatives to the products they seek. Additionally, 2 in 10 budget-conscious shoppers will purchase larger quantities of desired outcomes to secure better pricing.

Where do Poles buy?

Estimates from Dun & Bradstreet Poland suggest that by the end of 2023, approximately 65,000 online stores will be operating in Poland. Despite this amount, e-commerce still represents only 8-10% of the entire retail market, indicating a significant opportunity for further expansion.

Most Polish e-commerce markets are dominated by marketplaces, with Allegro leading the way. This platform, one of the symbols of a Polish success story, is used by 80% of local Internet users and has recently initiated expansion efforts abroad.

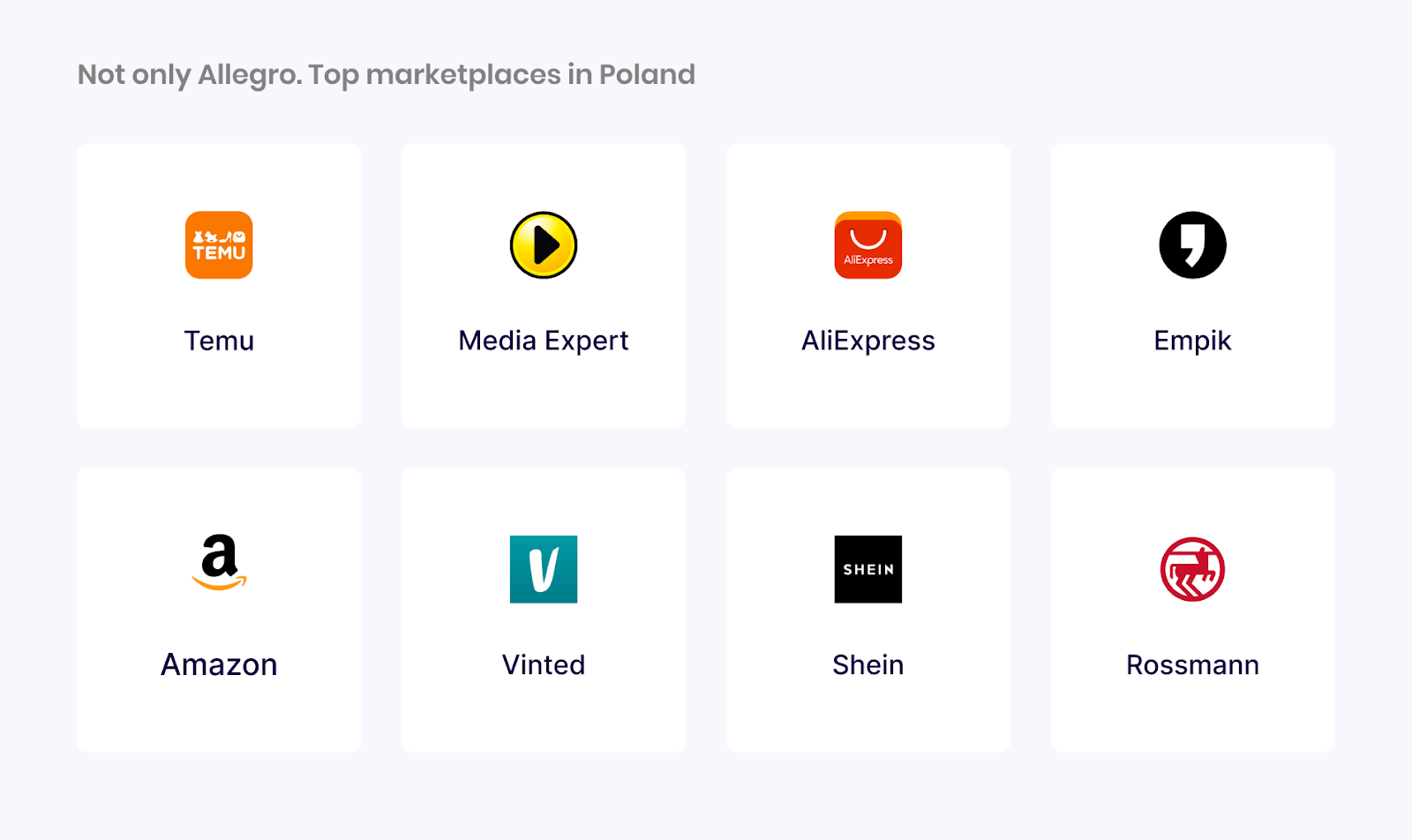

In total, 7 in 10 Poles purchase online on marketplaces, mainly due to the competitive prices. Some of the other popular platforms, as indicated by the October statistics, include:

- In just five months, Temu, a Chinese retailer, rapidly gained nearly 11 million users.

- Media Expert is an electronics-focused retail network with nearly 10.5 million users.

- AliExpress – the Chinese e-commerce giant, ranking Poland as its second-largest market, boasting 8.7 million users here.

- Empik – originally a retail network specialising in books, Empik has expanded its offering by introducing a marketplace, now used by 7.7 million users.

- Amazon – although present in Poland for over a decade, Amazon launched its Polish version in March 2021 and has since attracted 6.3 million users.

- Vinted is an international e-commerce store with approximately 6.3 million users in Poland.

- Shein is another Chinese fast fashion store with around 6.1 million users.

- Rossmann is a beauty store with nearly 6 million users.

(source: made by Alsendo.com)

Polish users value marketplaces primarily for their security and the convenience of purchasing from various sellers within the same platform. This integrated approach simplifies tracking deliveries and offers enhanced buyer protection in case of any issues.

Social commerce is also experiencing significant growth in Poland—approximately one in ten Poles purchases through social media platforms at least once a week. Notably, for over half of Generation Z globally, TikTok has become the preferred search tool over Google – Poland is no exception here. Consequently, nearly one-third of sales for companies in Poland are generated through social media channels.

What payment method will an average Pole use to pay?

(Source: Adobe Stock)

The undisputed leader among Polish payment methods is BLIK – a locally developed payment solution created by Polish banks. It lets users purchase in physical stores and online by generating a payment code to verify the transaction. This year, a contactless version of BLIK was introduced, attracting nearly 2 million users within one quarter. These users have used it in 128 countries around the world.

BLIK is the preferred payment method for 70% of consumers, followed by online transfers at 38% and cards at 34%. Electronic wallets are favoured by only around 2 in 10 Poles. However, it is worth noting that most of the payment methods will collaborate either way. BLIK is available only in the bank apps, so the ability to wire money with a transfer is pretty close. Some of the largest processors, such as PayPal or PayU, will offer the ability to pay in several ways, including BLIK or BNPL.

(Source: made by Alsendo.com)

When talking about BNPL, you need to know that 7 in 10 Poles will abandon their e-cart if there is no deferred payment method available in the e-store.

Fast delivery – mostly with PUDOs

(Source: InPost https://inpost.pl/dla-prasy)

Regarding deliveries, another Polish innovation is taking the lead – InPost’s Paczkomaty®, which has established an extensive network of Pickup and Drop-off Points (PUDOs) throughout the country, inspiring competitors to follow suit. According to Kantar, by the end of 2023, an estimated 20,000 parcel machines will operate, providing approximately 20 million Poles with convenient access to these facilities. This is an absolute phenomenon in Europe – only Denmark and Finland have more machines per capita.

These self-service PUDOs are available 24/7, allowing consumers to collect or send parcels at their preferred times swiftly. This enhances customer convenience and reduces delivery costs and the carbon footprint associated with shipping. It’s a win-win situation for both consumers and courier companies. As a result, 81% of consumers buying online receive the delivery to Paczkomat®, 43% pick home or workplace delivery through courier companies, and nearly 2 in 10 opt for shipping to a partner point (i.e. a local laundry or grocery store cooperating with a particular courier company). The most popular courier companies for delivery to PUDOs are InPost, followed by Orlen Paczka and Allegro One Box.

When it comes to delivery to home or workplace, Poles most often pick:

- DPD (37%),

- InPost (33%),

- DHL (14%)

- Pocztex (7%).

Much like their counterparts worldwide, Polish consumers prioritise fast and hassle-free delivery. For 64%, costless delivery is the most important and valuable feature of online shopping. Additionally, at least one-third of Polish consumers express that the availability of free delivery would encourage them to shop online more frequently. Another crucial factor is the ability to track shipments in real time, with 34% of Poles preferring an exact delivery date provided before completing their checkout.

To sum up, the clients love receiving free features and being kept up to date about the potential delivery timeline and any disruptions to it. Even Alsendo’s internal data confirms that approximately 85% of messages regarding delivery status are being read. This is a noteworthy percentage, particularly in an era when many emails often go unread. For this reason, one of the services for sellers offered by Alsendo that receives a lot of attention is the Innoship platform, which enables personalisation of the emails with delivery status, i.e. by adding a banner informing about promotion or a link to a social media profile.

Innoship, a part of Alsendo Group, is an advanced delivery management platform that empowers retailers to improve the customer experience by optimising the delivery process. The platform offers a broad range of last-mile delivery options for retail and e-commerce businesses, making advanced technology accessible to retailers of all sizes. Innoship’s solutions allow for efficient management of courier contracts, automation of deliveries, and a better shopping experience for customers, all while minimising shipping costs.

Don’t forget about returns.

Only 17% of Polish consumers have never returned a product to a store. The option to make free returns is a significant motivator for half of Polish shoppers, with one-third of them picking parcel machines to send the order back to the e-store. However, since free delivery and free returns come with substantial logistics costs, sellers must strike a careful balance. They should offer customers incentives to make purchases while ensuring their profitability is not compromised. It might also be a good idea to take advantage of the opportunities provided by technological platforms such as Apaczka. pl, which makes it easy to connect with multiple courier companies, integrate the delivery services with marketplaces, and track all packages with every courier within one interface.

(Source: made by Alsendo.com)

Polish market in a nutshell

In summary, the Polish e-commerce market presents a promising opportunity for foreign entities aiming to capture consumers’ attention and wallets. However, to succeed in this market, it’s crucial to offer local payment – including deferred ones – delivery options and customer support in the local language to address any issues. For smaller brands, the most effective entry strategy into Poland appears to be through local marketplaces, facilitating connections between buyers and sellers while ensuring high transaction security. Additionally, building a strong social media presence is advisable, given the increasing number of Poles researching and making purchases through social commerce channels.

One thing is certain – entering Poland demands a long-term strategy. This is evident from Amazon’s gradual but steady expansion, in contrast to Shopee’s attempt to swiftly capture the Polish market. This ultimately led to its rapid disappearance due to a lack of profitability despite becoming one of the most recognised e-commerce brands.

***