European Ecommerce Overview: the Czech Republic

Written by

Kinga EdwardsPublished on

A practical overview of Czech e-commerce. Market size, customer behavior, payments, social media, and logistics explained simply.

Czech e-commerce is in a very “grown-up” phase right now. Online shopping in the Czech Republic feels normal, expected, and woven into everyday life. People order online without overthinking it. Businesses treat e-commerce as a core channel. And the market keeps moving forward at a steady, realistic pace.

This article gives you a clear overview of Czech e-commerce as it looks today and where it’s heading in 2026. We’ll walk through how big the market is, how Czech customers behave online, how they prefer to pay, where social media fits in, and how logistics shape the buying experience.

If you’re selling online, planning to enter the Czech market, or simply want to understand how Czech e-commerce works right now, you’re in the right place.

Czech e-commerce overview

Czech e-commerce in 2025–2026 feels like a market that’s past the early excitement and is settling into real, consistent growth. Online shopping isn’t new here. It’s deepening. People buy more frequently, new categories keep taking share, and businesses of all sizes are figuring out how to win attention. If you’re thinking about selling online in Central Europe, Czech e-commerce is a landscape worth understanding up close.

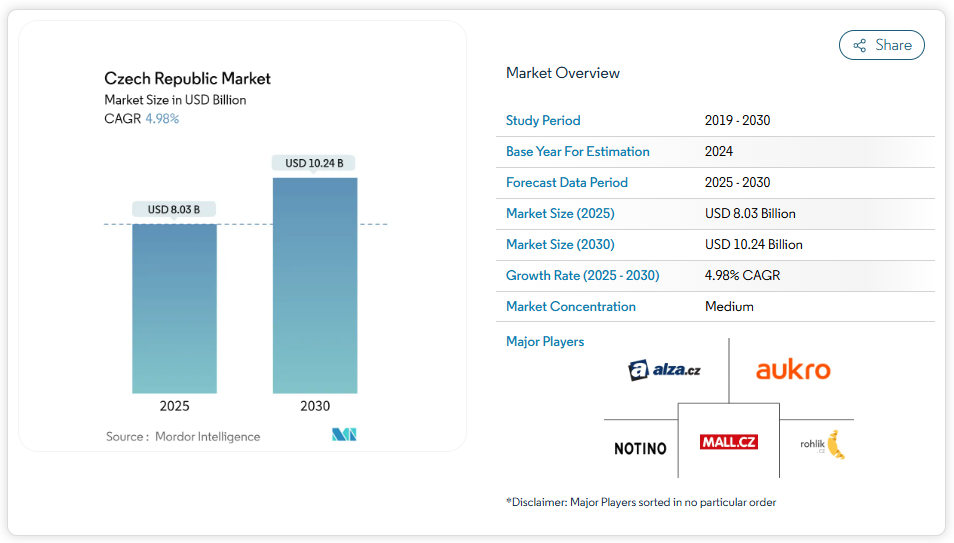

At a high level, the market keeps expanding. Analysts estimate that Czech online retail revenue reached roughly $8.03 billion in 2025 and that it will continue growing toward about $10.24 billion by 2030 at nearly a 5 % annual pace. That’s steady expansion – a solid and predictable.

Czech e-commerce doesn’t leap every year, but it sticks to a trend of gradual volume growth as more consumers get comfortable buying things online and the infrastructure matures with them.

You can feel this across mobile, marketplaces, and everyday goods as well as tech products.

So, yes, that’s the big picture: online shopping is a normal part of Czech life now, and it’s slowly taking more of retail spend year after year.

Customer behavior

Talking about Czech e-commerce without looking at how people behave would miss the heart of this story. So let’s zoom in on what people actually do when they shop online here.

First, internet access is high — most adults in the Czech Republic go online regularly. One survey series indicates that around 84% of Czech internet users buy from domestic e-shops. That tells you right away: locals trust local sites for online purchases.

Online shopping isn’t rare. Czech shoppers are included among populations where a big chunk of people buy online. These kinds of trend snapshots suggest habits like browsing before buying, using comparisons, and leveraging online convenience to skip trips to physical stores.

Plus, people have their patterns. Research into Czech online shopping behavior finds that a noticeable share of internet users shop regularly online — including some who shop at least once every few weeks. That means repeat behaviour, not just “try it once.”

Categories matter too. Electronics, fashion, home goods and increasingly food & daily grocery items are turning up in baskets more often. Some of this shift is driven by convenience and availability of delivery options, but the deeper story is that online channels have earned trust over years.

There’s also sensitivity to price and practical value. Czech shoppers still pay attention to how much things cost, how long delivery takes, and the overall clarity of the checkout process. That shapes which shops they come back to — and which they don’t.

So in plain terms: Czech people shop online often enough that repeat customers are now the norm, not the exception. They’re comfortable with online retail, familiar with digital options, and price-aware at the same time.

Payments in the Czech Republic

Now let’s talk about one of the practical parts that directly affects conversion: payment.

For Czech e-commerce, payment methods are a mix of traditional and digital. Cashless is now the mainstream vibe, but older habits haven’t disappeared entirely.

Across the market, digital payment methods are used in about 60% of all online purchases. That includes cards, online transfers, wallets and fast payment options. Local processors like PayU and Paysara are known among Czech shoppers, alongside global methods.

That’s important because payment influences both completion rates and customer satisfaction. If you don’t support the ways people like to pay, you’ll see carts abandoned.

There’s also some historical preference for cash methods — in Czech online shopping surveys, things like COD (cash on delivery) were once a strong share of payments, roughly a third in older snapshots — and many shoppers like the idea of flexibility.

But credit cards, debit cards and bank transfers are eating into that space, especially among younger, more tech-native buyers. Mobile wallet use and contactless connections are also steadily rising as more devices and banking apps support them.

One nice detail to watch is how mobile influences payments. A large share of all online transactions happens via smartphone (70%!). That means payment flows that are smooth on phone screens matter a lot here.

In practical terms for online sellers:

- make sure your checkout supports cards, quick transfers, and local wallets;

- think mobile-first;

- and don’t assume that only credit cards are good enough.

Doing payments well reduces friction, boosts completion rates, and builds trust — and in Czechia, that shows up in repeat business.

Social media

To understand Czech e-commerce, you need to understand where people spend their time online. Social media plays a real role here, mostly at the discovery and inspiration stage, less at direct checkout.

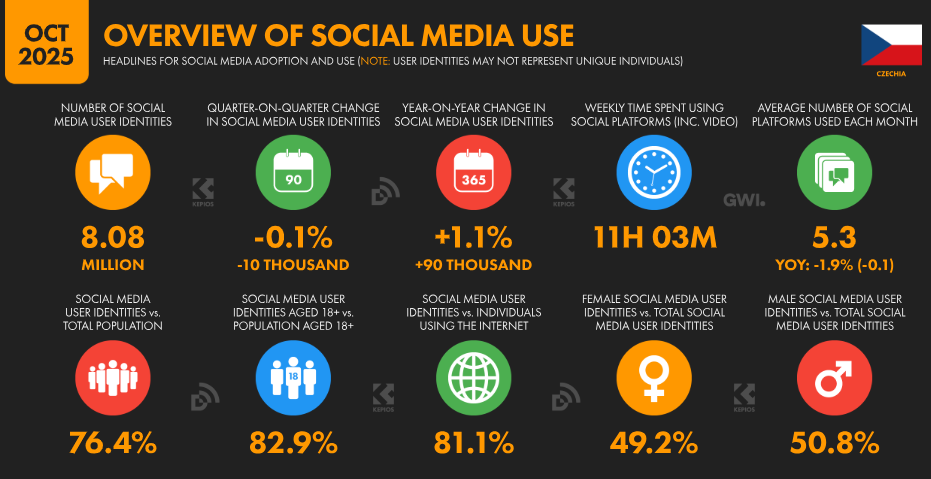

In 2025, the Czech Republic counts around 8.08 million social media users, which equals roughly 76.4% of the population. That’s a high share for a country of this size and shows how embedded social platforms are in daily routines.

The most-used platforms are stable and predictable. Facebook, Instagram, YouTube, and Messenger lead in reach, while TikTok keeps growing, especially among younger users. According to the same 2025 dataset, YouTube reached 8.08 million users in Czechia in late 2025, while Facebook had 5.00 million users in Czechia in late 2025.

For Czech e-commerce brands, this matters because social media is less about instant buying and more about decision support. People scroll, compare, read comments, and watch videos before they buy. This aligns with regional consumer studies showing that Central European shoppers prefer to confirm trust and value before spending online.

Social commerce exists, but it’s still soft. Checkout usually happens on the webshop, not inside the platform. Social channels act like shop windows and recommendation engines. If a brand looks unreliable on social, shoppers hesitate. If it looks active, transparent, and responsive, trust rises.

For 2026, the direction is clear. Short video keeps growing. Product explainers, reviews, and creator-style content gain more weight than polished ads. Czech e-commerce brands that treat social media as a trust layer, not a sales shortcut, tend to perform better.

Logistics in the Czech Republic

Logistics is where Czech e-commerce quietly wins or loses customers. Not with speed alone, but with reliability and choice.

The Czech Republic sits in a strong geographic position in Central Europe, and that shows in delivery networks. The country has one of the highest parcel volumes per capita in the region, driven by dense urban coverage and cross-border flows.

What matters more than raw volume is how people want parcels delivered. Czech shoppers value flexibility. Home delivery is still the default, but out-of-home delivery points and parcel lockers are widely used and expected. Local operators and international carriers have expanded pickup networks steadily, responding to demand for convenience and predictable timing.

Returns are also part of the logistics picture. Czech return rates are lower than in Germany, but they are rising as fashion and lifestyle categories grow online. Reports focused on Central Europe point out that easy returns are now considered a basic expectation, not a bonus.

From a seller’s point of view, logistics costs are becoming more visible. Fuel prices, labor, and packaging affect margins. That’s why many Czech e-commerce businesses focus on optimizing delivery partners and encouraging pickup options that reduce last-mile pressure.

Conclusion

Czech e-commerce in 2025 is no longer a market in transition. It’s a market in routine growth. People buy online often, trust local e-shops, and expect things to work smoothly. Payments need to feel familiar. Social media needs to feel human. Logistics needs to feel reliable.

Heading into 2026, the signals are steady rather than dramatic. Market size keeps expanding. User numbers rise slowly but consistently. Mobile and social influence grow, but checkout habits remain grounded. The brands that win are the ones that reduce friction, respect local behavior, and focus on long-term trust.

Czech e-commerce doesn’t reward shortcuts. It rewards clarity, consistency, and realistic execution. If you build for how people actually shop here, not how trends look on slides, the market stays open and welcoming.

If you are interested in getting to know Slovaks ecommerce habits too, you can find some information about it here.