European Ecommerce Overview: Lithuania

Written by

Kinga EdwardsPublished on

Lithuania is one of the Baltic countries. It borders Poland, Russia, Belarus, and Latvia. It is a member of the European Union and NATO. The country has 2,818,272 inhabitants (November 27, 2025) and is slowly shrinking.

Yet, Lithuania is pretty busy online. And today, we will tell you more about e-commerce in this country.

What is popular among Lithuanians? How do they pay online? How do they shop? What social media do they use?

All inside!

Lithuania’s e-commerce overview

Most analyst reports put Lithuania’s e-commerce market somewhere around $1–3 billion in 2024–2025, depending on what they count (only B2C vs B2B, services, marketplaces). ECDB shows about $1.06 billion in 2024 with 15–20% growth year on year, while Mordor Intelligence reports the broader market, at around $3.18 billion in 2025, with a strong, 15.46% CAGR forecast up to 2030.

Online still makes up a modest slice of total retail. ECDB estimates that e-commerce accounts for about 5–10% of retail revenue and should stay in that band through 2025. So, it is important, but brick-and-mortar is still very present.

What do Lithuanians buy online?

- ECDB names Hobby & Leisure as the largest category, with about 26% of e-commerce revenue.

- Yet, there are also fashion and apparel – two other very popular segments. And let’s not forget strong demand in food and beverages, consumer electronics, and beauty and personal care.

On the player side, you see a mix of global and local brands. AliExpress, pigu.lt and Vinted are among the biggest online retailers, with Varle.lt, senukai.lt, and barbora.lt., leading local traffic rankings.

So, Lithuania’s e-commerce in 2025 is growing and maturing, not exploding but also not in decline. Growth is slower than during the COVID spike, yet forecasts still point up, supported by mobile shopping, strong marketplaces and a very active second-hand scene through Vinted and similar platforms.

Lithuanian consumers’ behavior

Lithuanians have different preferences depending on income or age group. Therefore, the market is experiencing high fragmentation. Wealthier customers often choose the brand as the main determinant of purchases, while prices are a determinant of quality for Lithuanians. Importantly, for these consumers, products from abroad are also synonymous with high quality. The Lithuanian economy is growing all the time, which builds consumer confidence. More and more customers pay attention to service and loyalty programs.

About 61% of the population aged 16–74 made at least one online purchase between 2022 – 2023. What they buy online says a lot: around 31% bought clothing, footwear or accessories; 16% bought cosmetics/beauty/wellness products. Services — like transport tickets, event tickets or bookings — are also popular.

Why go online?

Convenience is a big win. Many use mobile devices for shopping. Also, people appreciate easy access to global web shops — especially for clothes, cosmetics, gadgets or deals on household goods. Recent surveys suggest shoppers value good reviews: a majority tends to trust brands with positive feedback.

But when do Lithuanians go offline?

For daily needs — groceries, local shopping, immediate purchases — the physical stores remain relevant. Also older generations still rely on offline shopping, especially if they prefer paying in cash or want to avoid delivery delays. But overall, online buying is becoming a normal habit for a big part of the population.

All in all — Lithuanians are gradually embracing e-commerce. They are selective, value convenience, variety, and trust good reviews. But offline shopping remains relevant, especially for everyday goods or when people prefer immediate possession or traditional payment.

Payments in Lithuania

In Lithuania, online payment habits are quite diverse. The top methods for e-commerce payments in 2024 were credit and debit cards, capturing about 43% of online spending.

But Lithuanians believe in technology, too. Digital wallets and other newer methods are growing rapidly, with wallet payments rising at a strong rate – (21.6% CAGR) – through 2030.

Also, many people still use bank transfers. For some customers, paying by cash-on-delivery remains an option — in fact, around 64.9% of online stores offer CoD.

Pearl Services or Perlo Paslaugos is a company that operates terminals in Lithuania. It offers bank transfers, cash deposits, and withdrawals. Since 2011, it offers its services not only in Lithuania but also in other countries of the European Union.

Another player in Lithuania’s payment market is PayPost, which allows customers to send cash without having a bank account. Money can be withdrawn at the post office or at a PayPost outlet. There is also the possibility of a transfer to the account.

In short: cards are still the leading method. But bank transfers, digital wallets and instant payment systems are gaining ground. Cash-on-delivery still exists — especially among people who prefer flexibility or are cautious about online payments.

Lithuanian social media

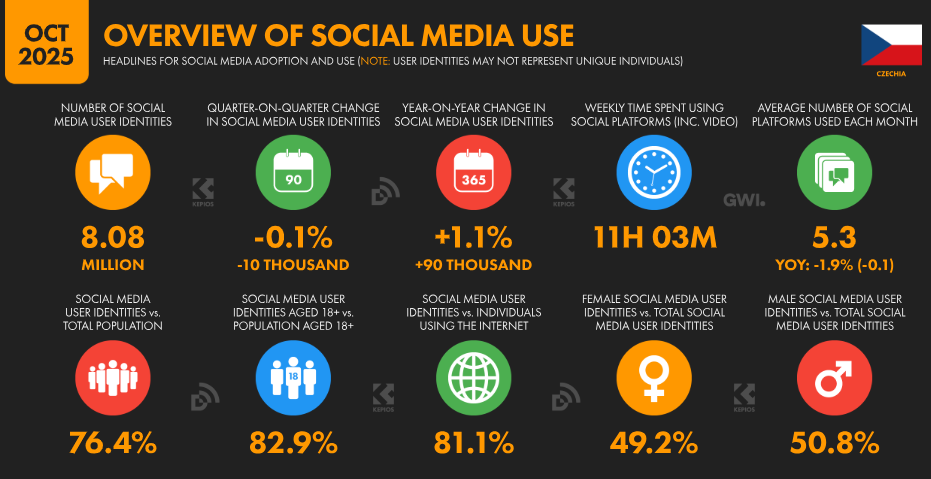

Social media is a natural part of Lithuania’s e-commerce and daily life for many people. Around 73.3% of the population had social-media user accounts. Most Lithuanians are online — internet penetration sits near 89.5%.

When it comes to platforms:

- Facebook remains the most used social network. In 2025, about 79–80% of Lithuanians had Facebook accounts.

- Next in line is Instagram, used by roughly 39–40% of the population.

- Messaging and social-chat platforms are also big: Messenger counted around two million Lithuanian users by 2025.

User demographics show more women than men on some platforms. For Instagram in 2025, about 58% of users were female. The strongest age groups skew younger — many users are in their 20s and early 30s.

So what draws Lithuanians to social media?

First — connection. They use platforms to chat, share, get news, stay in touch with friends. The high mobile internet penetration makes access easy everywhere. Additionally, many look for information online: shops, deals, opinions. Social media doubles as a starting point for that. This overlaps strongly with their growing online shopping habits. Many internet users browse goods and services, and look up information about products.

All in all — social media in Lithuania is widespread, especially among younger and middle-aged segments. People use it to stay connected, browse ideas, discover products and enjoy content.

Logistics in Lithuania

Lithuania’s logistics sector plays a big role in the economy — transport & logistics contribute roughly 12% of national GDP.

The overall transport & logistics industry stayed strong. Road-freight volumes grew sharply. At the same time, warehousing and storage services remain stable, with the warehousing market in 2025 estimated at around €195.7 million.

An important road is the north-south highway. This country is key in rail transport thanks to the railway line connecting Scandinavia with Central Europe. There is also Saulė (Sun Train), which connects Europe and China – thanks to this line, the cargo route takes only ten days. Lithuania also plays a crucial role in the European Union’s Trans-European Transport Networks project – the Baltica Railway. It aims to connect Finland and the Baltic countries.

But it’s not all smooth: logistics companies say they struggle with labor shortage — there is a lack of qualified drivers and specialists. Because Lithuania’s e-commerce keeps growing, many carriers and warehouses are upgrading: new logistics-information systems, better automation, aiming for faster, more accurate deliveries. Parcel-delivery and courier services (domestic and international) are seeing increased demand — boosted by online shopping and cross-border trade.

So bottom line: Lithuania’s logistics is quite robust today. It supports growing e-commerce. But the sector needs more workforce and continues to adapt — more automation, smarter warehousing, and faster parcel delivery.

To sum up

Lithuania’s e-commerce is a small country with a tech-savvy population and a strong online presence. E-commerce keeps growing at a steady pace. People buy more online each year, especially clothes, beauty products, hobbies, and everyday essentials. Local and global players like Pigu, Barbora, Senukai, AliExpress, and Vinted shape the market.

And there is a lot of place for new retailers.

If you are aiming into this country to expand your business, research the market, partner with domestic brands, and listed customers. We have hope that thanks to our article you have gathered some useful information.