The U.S. market: Expansion dream or operational headache for German e-commerce?

Written by

Kinga EdwardsPublished on

German e-commerce expansion is full of opportunity, but the U.S. market brings real challenges too. Learn how to expand e-commerce to the U.S. with smart localization, fulfillment strategies, and consumer insights.

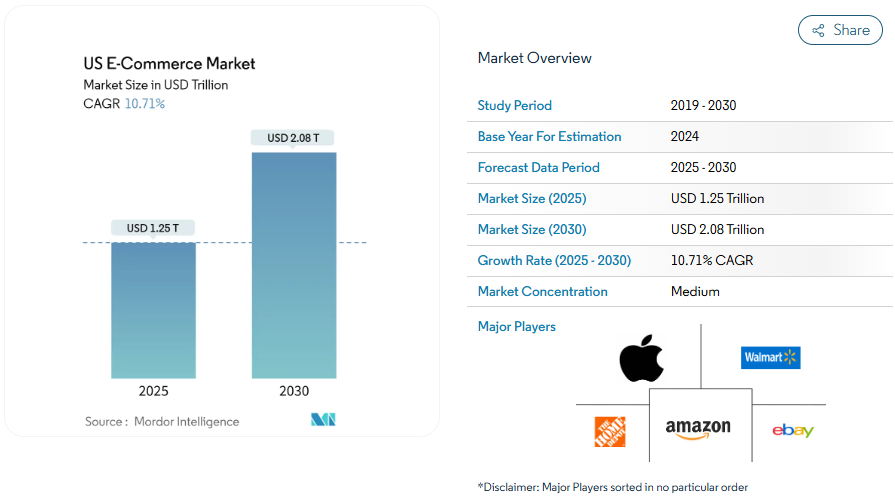

Ask about the dream market for German e-commerce expansion, and chances are the U.S. comes up fast. The country is massive, wealthy, and spends a ridiculous amount of money online. In 2025, U.S. e-commerce is valued at around $1.25 trillion, and it’s forecast to jump to $2.08 trillion by 2030. That’s a growth story most European markets can only think about.

The American consumer base is also enormous. More than 218.8 million people shop online in the U.S., with an average spend of over $5,381 per year. That means even a tiny slice of the pie could transform a German brand’s global footprint.

But what looks like a dream from Berlin or Munich can quickly feel like an operational nightmare once you’re in the trenches. Tariffs, customs, fulfillment, and even cultural quirks can make or break your expansion.

So, should German businesses pack their bags and go? Or hold back and rethink? Let’s look at why the U.S. is tempting, what headaches often show up along the way, and how to expand e-commerce to the U.S successfully.

Why the U.S. looks like a dream for German e-commerce expansion

Let’s start with the shiny side of the coin.

The U.S. e-commerce market is dynamic, tech-driven, and full of consumers who love to shop online. It’s projected to hit $2.08 trillion by 2030, with a CAGR of over 10,71%. Numbers like that are hard to ignore if you’re serious about growth.

For German e-commerce expansion, the appeal is obvious. You get scale, visibility, and the chance to be part of a market that sets global standards.

Marketplace dominance

Amazon is the undisputed heavyweight. It controls about 37.6% of U.S. e-commerce. Walmart holds around 6.4%, with Apple, eBay, and Target fighting for space. Then you’ve got fast-rising challengers like Shein, which now owns 50% of the U.S. fast-fashion niche.

This means German brands that want to expand e-commerce to the U.S. can’t really avoid marketplaces. Launching on Amazon isn’t optional, it’s table stakes. But it also means you can piggyback on their infrastructure — fast shipping, built-in trust, and access to millions of ready shoppers.

Mobile-first shoppers

Smartphones dominate U.S. e-commerce. In 2024, they accounted for 72% of all online transactions. People shop during their commute, on the couch, or while waiting for coffee. If your checkout isn’t optimized for mobile, you’ll lose customers fast.

That’s an opportunity too. German brands known for efficiency can stand out by creating friction-free mobile experiences. Add one-tap checkout, clean design, and mobile wallets, and you’re in the game.

Tech trends U.S. consumers already expect

Generative AI is reshaping U.S. e-commerce. About 62% of American shoppers say they’re more likely to buy when AI guides their shopping journey. Retailers use AI to recommend products, personalize offers, and even power conversational search boxes.

AR and VR are another big one. 90% of mobile shoppers in the U.S. are open to AR try-ons. Think of furniture that you can “place” in your living room or fashion items you can test virtually. For German e-commerce expansion, this means expectations are already sky-high. A simple static photo gallery won’t cut it.

A consumer base that loves international products

70% of U.S. consumers shopped online from abroad in the past year. They’re not shy about cross-border buying. In fact, they do it because they want unique products, better prices, or brands they can’t find locally. German businesses have a reputation for quality and precision. That plays well in a market where people want “different” and “better.”

So, in many ways, to expand e-commerce to the U.S. looks like a dream market for German sellers. But dreams have their flip sides.

Let’s talk about the headaches.

The operational headaches you can’t ignore

Now to the less glamorous side.

To expand e-commerce to the U.S. is tough because the country isn’t just one market. It’s 50 states, each with rules, taxes, and quirks. German brands that underestimate this complexity quickly hit walls.

Logistics pressure

Delivery is king in the U.S. Same-day or next-day is the new normal. Amazon covers 90 metropolitan areas with same-day service. Walmart is rolling out micro-fulfillment centers near urban hubs. Smaller players are also experimenting with dark stores and hyperlocal warehouses.

For a German e-commerce brand shipping from Europe, matching these standards is almost impossible. Cross-border shipping times simply can’t compete with domestic U.S. players. Unless you stock inventory inside the U.S., you’ll frustrate customers used to lightning-fast delivery.

And costs are rising. FedEx and UPS increased base rates by 5.9% in 2025, with oversized and remote fees adding another 10–12%. For small sellers, that’s a margin killer.

The returns crisis

Returns are a huge operational headache. In the U.S., total retail returns hit $890 billion in 2024, equal to 16.9% of annual sales.

E-commerce return rates are even higher: 17.3% compared to 10% for in-store purchases.

Fashion is the worst. Around 16% of online fashion sales end up being returned. That’s not just lost revenue. Returns add inspection, restocking, and shipping costs. In many cases, those eat up 20–30% of the original order value.

German businesses are often shocked by how liberal U.S. return culture is. “Free returns, no questions asked” is the baseline expectation. Brands that don’t play along risk abandonment.

Tariffs and trade policy

And then there are the 2025 tariff changes. The Trump administration introduced a 10% blanket tariff on all U.S. imports. On top of that, imports from China and Hong Kong face a whopping 125% reciprocal tariff.

For German e-commerce expansion, this means costs rise across the board. Even if you don’t source from China, the logistics chains you rely on might get pricier. Customs complexity increases, paperwork piles up, and landed costs become unpredictable.

Many brands will have no choice but to warehouse inside the U.S. to avoid customer frustration and spiraling expenses. That’s a big operational leap for a mid-sized German business.

The hidden cost of visibility

Logistics and tariffs aren’t the only headaches.

U.S. customer acquisition costs are among the highest in the world. Competition for attention is brutal. Amazon ads, Google Shopping, TikTok Shop — they’re all expensive playgrounds. Without a strong brand story and a hefty marketing budget, you’ll get drowned out fast.

German e-commerce businesses often underestimate this. In Germany, efficiency and product quality often drive growth. In the U.S., storytelling, influencer partnerships, and constant engagement are needed just to stay relevant.

Consumer realities that German businesses often overlook

This is where it gets interesting. Even if you solve logistics and tariffs, the consumer side can trip you up.

American shoppers are different. They’re open, diverse, and often more demanding. Germans tend to focus on efficiency and precision. Americans expect friendliness, service, and speed. If you don’t adapt, your expansion will feel tone-deaf.

For example, U.S. consumers love choice. They want multiple payment methods at checkout, personalized product recommendations, and flexible delivery options. If you offer a bare-bones experience, they’ll click away in seconds.

They’re also used to loyalty perks. Free shipping thresholds, points systems, early access to sales — all basics. German e-commerce businesses that only focus on product specs risk losing out to brands that create experiences.

And service matters. In Germany, customer service is efficient but often minimal. In the U.S., shoppers expect instant responses, 24/7 chatbots, generous guarantees, and a “customer-first” attitude. That’s a cultural adjustment many German companies underestimate.

Finally, branding. Americans buy into stories — heritage, values, even sustainability. German businesses actually have an edge here. “Made in Germany” signals quality. Tie that to eco-friendly practices, and you can win hearts. But you have to tell the story actively.

How to expand e-commerce to the U.S. the smart way

So, let’s be real. The U.S. is tempting, but walking in blind is a recipe for pain.

German e-commerce businesses need a smart, layered approach. Not just copying your German strategy and pasting it overseas.

Here’s how you can start:

Localize or fail

First things first: localization. And not just language.

Yes, English is the obvious step, but American English is a different beast than the “international” English that German brands often use. It’s more casual, it loves contractions, it avoids stiff formalities.

Take product sizing as an example:

- Sell shoes? U.S. sizes differ from EU sizes.

- Fashion? U.S. shoppers expect “small, medium, large” but also detailed fit notes — “runs true to size,” “slightly oversized.”

Fail to translate sizing properly and your return rate will skyrocket.

Localization also applies to your content. American shoppers connect with stories. A simple spec sheet about quality materials isn’t enough. They want lifestyle shots, reviews, and often influencer validation. Germans may buy because something “just works.” Americans buy because it fits their life story.

And let’s not forget payment preferences. Cards are still king in the U.S. German sellers entering the market without these options at checkout will lose customers instantly.

Build fulfillment nodes

This one’s big. Shipping from Germany to the U.S. sounds amazing — “we’ll send directly from our warehouse in Munich!” — until customers start asking where their parcel is after day three.

The reality: Amazon is already in 90 U.S. metro areas with same-day delivery. Walmart has dark stores popping up within 5 miles of demand hubs. Consumers expect packages in 1–2 days max, and many won’t even consider brands that can’t match this.

So, what’s the play? Partner with a U.S.-based 3PL (third-party logistics provider). They’ll store your stock closer to customers and handle last-mile delivery.

- Yes, it costs more.

- Yes, it means upfront investment.

But without it, you’ll bleed revenue through abandoned carts and angry reviews.

Another tactic is micro-fulfillment. Smaller warehouses embedded in key urban zones cut delivery distances and speed up order processing dramatically. For German e-commerce expansion, even piloting with a micro-fulfillment partner in New York or Los Angeles can show you what’s possible.

Adjust pricing models

Pricing is a minefield in the U.S.

New tariffs are reshaping everything. This means that you need to build tariff costs into your pricing strategy. Too many brands enter with “European prices + shipping” and quickly realize they’re losing margin or scaring off customers. Americans are price-sensitive but also expect transparency. If shipping or duties pop up unexpectedly at checkout, they bounce.

One smart move is to bundle costs upfront. Build customs duties, handling, and even partial returns risk into the sticker price. Many brands also use duty-inclusive pricing models, so customers see one clean number.

Pick your entry strategy: marketplace or DTC?

Here’s the million-dollar question. Should you launch on Amazon first or go direct-to-consumer (DTC) with your own Shopify store?

Marketplaces are easier for trust. After all, over 60% of U.S. product searches start on Amazon, not Google. For German e-commerce businesses, that’s huge. If you’re not on Amazon, you’re invisible to the majority of shoppers.

The downside? Fees, less control, and being compared side by side with cheaper competitors.

DTC gives you brand control. You own the customer relationship, the data, and the story. But traffic acquisition is brutal. CAC in the U.S. is sky-high, and platforms like TikTok or Meta Ads require constant testing. Many German brands underestimate just how much they’ll need to spend on performance marketing just to get noticed.

The smartest path? Hybrid. Start on a marketplace to gain traction and proof of concept, then use that visibility to funnel loyal customers to your own shop.

Play the niche card

The U.S. market is massive. That’s both a blessing and a curse. Competing directly with Amazon Basics or Walmart in generic categories? Good luck. Instead, German businesses should double down on niches.

Americans crave uniqueness. That’s why 43% buy abroad to access brands not available locally, and 35% want specialty products.

German precision, sustainability, or craftsmanship are strong selling points. Whether it’s eco-friendly home goods, high-quality kitchenware, or niche fashion, these angles resonate.

Position your brand not as “cheaper” but as “better, rarer, smarter.” That’s how you build loyalty in a sea of sameness.

Risk mitigation for German e-commerce expansion

Okay, so how do you reduce the headaches?

#1 Pilot before you go big

Don’t send your entire catalog across the Atlantic right away. Start with a small product line that has universal appeal. Test demand, returns behavior, and ad performance. Expand once you know the ropes.

#2 Duty drawback and smart compliance

One of the most overlooked strategies is duty drawback. If you import products into the U.S. and then re-export them (say to Canada or Mexico), you can recover up to 99% of duties and fees. Many German brands don’t know this exists. It’s worth working with a compliance partner to explore.

Also, accurate HS codes, country-of-origin documentation, and proper product labeling aren’t just paperwork. They’re cost savers. Mistakes lead to delays and fines.

#3 Nearshoring and fulfillment flexibility

If tariffs on Asia keep escalating, German brands can look at nearshoring. Mexico, for example, could serve as a production hub to feed both the U.S. and Latin America. Inventory closer to end customers means fewer surprises and better delivery times.

Flexible fulfillment is also key. Don’t lock into one carrier. Mix UPS, FedEx, USPS, and even regional couriers. Costs vary, and options protect you from sudden surcharges.

#4 Invest in customer support

This might sound “soft,” but it’s critical. Americans expect friendly, fast support. Think live chat, phone lines, generous return policies, and proactive updates. A U.S.-based customer service rep can often make the difference between loyalty and a lost customer.

For German businesses used to efficiency-driven, no-frills service, this is a big adjustment. But it’s one of the easiest ways to win U.S. shoppers.

Last words on German e-commerce expansion to the U.S.

So, is the U.S. market an expansion dream or an operational headache? The truth is, it’s both.

On one side, you’ve got scale like nowhere else: hundreds of millions of shoppers and an appetite for international brands. On the other side, you’ve got rising tariffs, logistics chaos, brutal CAC, and consumers who expect everything yesterday.

For German e-commerce expansion, the U.S. is worth it — but only if you go in with open eyes. Think smart localization, invest in fulfillment, prepare for high returns, and never underestimate cultural differences.

The dream is alive, but it takes careful planning to avoid the nightmare.

***