Omnichannel in Europe

Written by

Editorial TeamPublished on

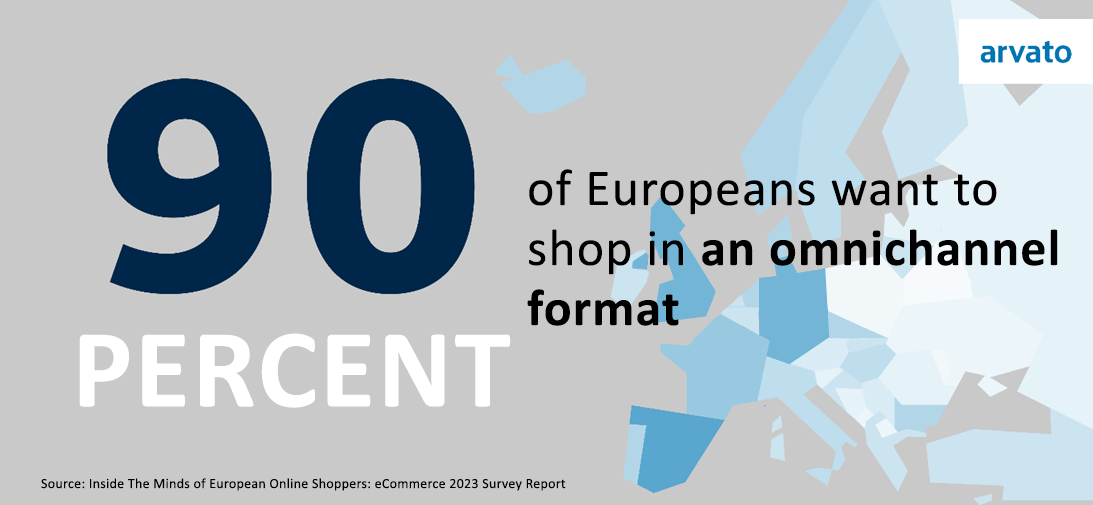

90 percent of Europeans want to buy omnichannel, according to the eCommerce 2023 Survey Report1. This shows that shopping between channels, searching for information, receiving shipments or making returns should be done both online and offline. And it is a must-have. So what does omnichannel shopping look like in Europe?

Shopping and e-shopping have undergone a huge transformation in Europe in recent years. Both have undoubtedly been influenced by the pandemic, the instability of the economic and business situation, the growing awareness of consumers and changes in their behaviour. As a result of the pandemic, shopping was only possible online. With closed shops, limited mobility in cities and many other restrictions, brands with their own e-stores recorded higher sales, while those that had not previously opted for e-revolution had to do their homework at an accelerated pace and invest in e-commerce, or they would have ceased to exist. Customers learned how to buy groceries online and got rid of worries about freshness or transport. It turned out that (almost) anything can be bought, returned or exchanged online.

When things got back to normal, consumers’ joy of shopping in brick-and-mortar stores and the need for physical contact with products did not stop the growth of e-commerce. It has also stayed with us because we have become accustomed to doing many things online: working, learning, travel planning, banking and even participating in art and culture. However, customer expectations from services and products available in the digital channel are increasing year on year. We want simplicity, transparency, excellent product descriptions, photos and videos, virtual try-on, product presentation in context, reviews and many other factors that – importantly – have become not a ‘nice-to-have’, but a ‘must-have’ of an online shop, shopping platform or app.

In search of opportunity and consistency

Consumers are migrating between channels because they are looking for price bargains. Indeed, it is no longer convenience, but the search for discounts and good deals that has become the key motivation for ROPO (research online -purchase offline) or reverse ROPO shopping. Europeans are adept at shopping in both channels, so they act on the principle ‘it doesn’t matter where I buy, as long as it is cheaper’.

However, it is not just price in omnichannel shopping that matters. The key is to provide the customer with a consistent shopping experience – no matter where they are or where they buy: in a brand’s shop or e-store, in a marketplace, in a social commerce formula or in a pop-up store. Surely, the future will belong to those brands that understand the new customer, constantly monitor their behaviour and market micro-trends, plan the customer’s shopping paths to meet their needs for convenience, value for money and gaining experience. And to those that invest in new technologies and perform advanced analytics on their marketing and sales activities. For nothing is permanent.

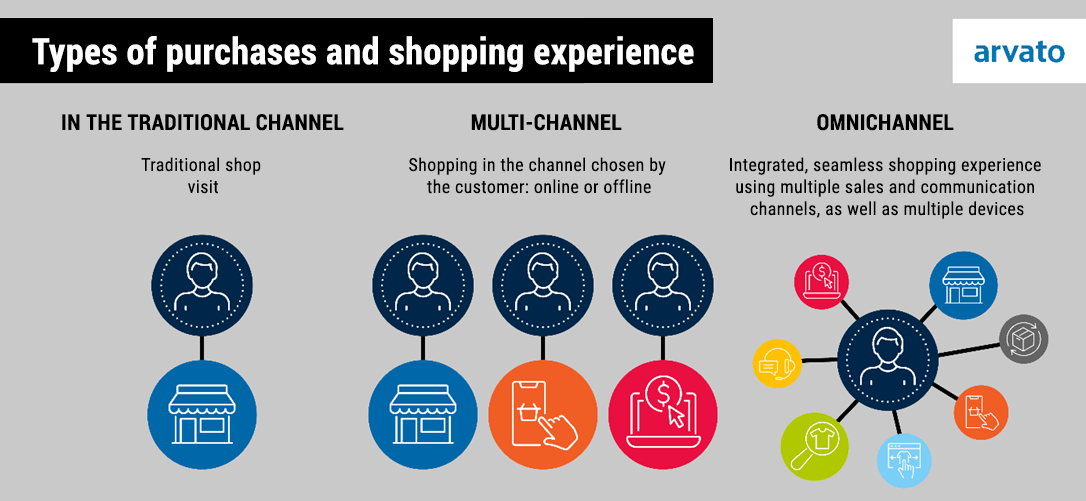

However, we must remember that omnichannel sales, and communication in general, is not just about being present in several channels, but above all about linking them, making them consistent, creating points of contact between them, and integrating their effects. Communication that flows seamlessly into sales, the purchase of an item combined with the consumption of branded content, a personalised message that loyalises and values that are shared by the brand and its customers – this is modern-time omnichannel. It is the creation of a brand presence across multiple channels online (website, e-commerce, app, marketplaces, social media, email, messaging, chatbots) and offline (retail shop, events, pop-up stores, call centres) while providing a seamless experience throughout the customer journey. Omnichannel should therefore use technology not only to integrate online and offline channels, but more importantly to ensure customers switch effortlessly between them and enjoy the benefits of each formula.

An omnichannel strategy is all about supply chain flexibility, real-time data and behavioural analysis, fast user interactions through e-commerce integration with mobile apps or social media and, in addition, immediate action.

These elements help meet customer requirements, streamline the flow of goods from suppliers and, above all, foster engagement and loyalty.

The new consumer has one identity online and offline at the same time, so we cannot separate our activities, strategies or messages. Shopping is changing. For consumers’ needs are changing again and again, their awareness, their attachment to brands, but also their suspicion of them, is growing. But one thing is certain – we need to be where the customer is; with the experience they need at that moment and the product they expect.

ROPO, reverse ROPO and cross-channel behaviour

In order to track the percentage of people buying in both channels, but especially those buying multichannel and cross-channel, it is necessary to take a look at the statistics of classic weekly shopping in individual European countries. Thus, in Germany, 82 per cent of consumers go for stationary shopping, but as many as 45 per cent also shop online during the week. In the Netherlands, these proportions are as follows: 80 per cent retail vs. 37 per cent online, while in Italy: 75 per cent offline vs 34 per cent online. Data shows that between 20 and 45 per cent of consumers in European countries shop online (at least once a week and in parallel with traditional shopping) 2.

81 per cent of global retail shoppers conduct online research before buying3. In Europe, however, this is just over 40 per cent of 2023 shoppers4, while 47 per cent say they are more likely to buy online if there is an in-store return option5. Worth noting – the majority of such research (77%) is made from mobile devices6.

In Poland, treated as one of the leaders in e-commerce, as many as 74 per cent of consumers see the advantages of multi-channel shopping, and for 75 per cent it is crucial that the products of the brands they like and buy are available in multiple channels, i.e. offline, online, mobile (apps) and even social commerce7.

Omnichannel customers appreciate being able to use multiple points of contact between retailers, in all kinds of combinations and locations: a smartphone app to compare prices or download coupons and digital tools in the shop itself, such as an interactive catalogue or tablet. They buy online and pick up their purchases in-store or vice versa, additionally choosing the most convenient form of delivery or parcel collection. Each such point of contact and each place: app, digital tool, social network and showroom should be treated as a separate channel – in a full multidimensional omnichannel strategy.

The more channels consumers use, the better, and the multi-platform ones are ‘more valuable’ to brands and businesses. According to research by Harvard Business Review – they spend an average of 4 per cent more each time they shop in-store and 10 per cent more online than single-channel shoppers, and – surprisingly – with each additional channel used, they spend more money in-store8. Another interesting observation about the strengths of omnichannel operations is that, in addition to larger shopping baskets, omnichannel customers are also more loyal and more likely to recommend a brand or company.

***

Beyond any doubt, it is fair to say that omnichannel – understood as the full multi-channel customer experience with a brand and with other users – will shape current and future commerce. It is a strategy of sales, marketing, communication and many other disciplines, all of which have one goal – to capture the consumer’s attention, encourage contact with the brand or purchase, and then tie them in for as long as possible. When developing a strong omnichannel strategy, it’s crucial not to overlook the importance of efficient logistics. Integration is key to ensuring that customers, whether shopping online or in physical stores, have seamless access to the full range of products. Collaborating with a reliable service provider is essential, and Arvato is undoubtedly among the top choices for such partnerships.

Jadwiga Żurek – Arvato