Top Trends in Oil and Gas Industry 2023 [Deloitte report]

Written by

Kinga EdwardsPublished on

The oil and gas (O&G) industry is no stranger to volatility, but the present landscape brings a unique set of challenges. A Deloitte survey of industry leaders reveals intriguing insights into the sector’s future. Economic, geopolitical, trade, policy, and financial factors have triggered a significant readjustment in the energy market, highlighting the urgent need for increased investment and capital discipline.

In this report, we dive into the top insights and trends that are reshaping the O&G industry. Let’s start!

New Possibilities

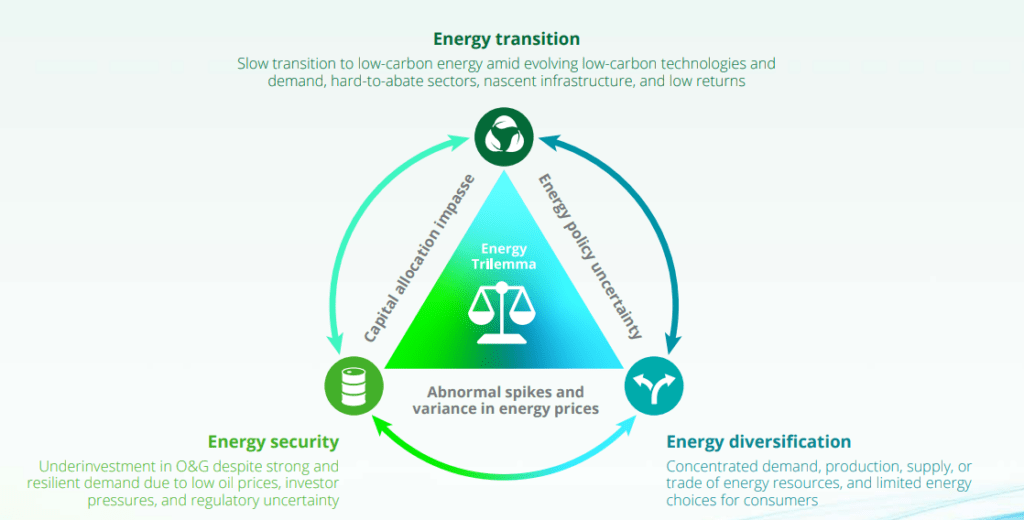

The oil and gas (O&G) industry has a history of experiencing supply disruptions and price volatility. However, the current situation is unique due to a combination of economic, geopolitical, trade, policy, and financial factors. These factors have intensified the problem of underinvestment and triggered adjustments in the broader energy market.

The industry is facing challenges in terms of:

- energy security,

- supply diversification,

- and the transition to low-carbon alternatives.

As a result of investor demands for financial discipline, O&G companies have reduced capital expenditures, resulting in a tight market in 2022. The disruption of energy trade between Europe and Russia has further escalated global gas prices, reaching levels significantly higher than US Henry Hub prices.

Despite the challenges, the O&G industry is expected to be in a strong financial position and maintain capital discipline in 2023. This could help address underinvestment in recent years and facilitate an accelerated energy transition. According to the survey, 93% of respondents remain cautiously positive or optimistic about the industry in the coming year.

Source: Deloitte, Oil and Gas Industry Outlook 2023

Trend 1: Strong balance sheets create opportunities for oil and gas companies

As a result of underinvestment, a rapid recovery in demand, and geopolitical developments, oil prices reached record highs in 2014, and upstream cash flows have reached record levels. In 2022, the O&G industry is poised to generate unprecedented free cash flows of $1.4 trillion in 2022, driven by an assumed average Brent oil price of $106/bbl. However, meeting the world’s energy demands while ensuring affordability remains a pressing concern.

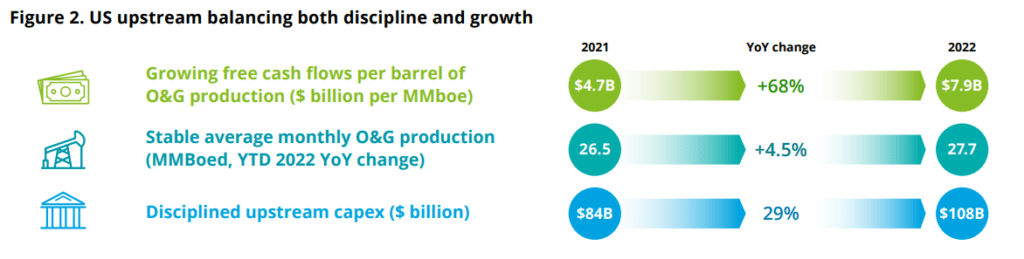

In 2022, average oil and gas production is up just 4.5% from last year, while free cash flows per barrel are expected to increase by almost 70%.

Source: Deloitte, Oil and Gas Industry Outlook 2023

Capex and production strategies vary across company groups and regions. Public E&Ps are deploying a cautious production growth strategy, while private E&Ps will likely ramp up capex to include an approximate 10% – 15% inflationary increase in their 2022 capital budgets. US-headquartered majors, on the other hand, are driving US shale production and capex growth by building and leveraging an integrated infrastructure.

Trend 2: Accelerating the clean energy transition with new policies

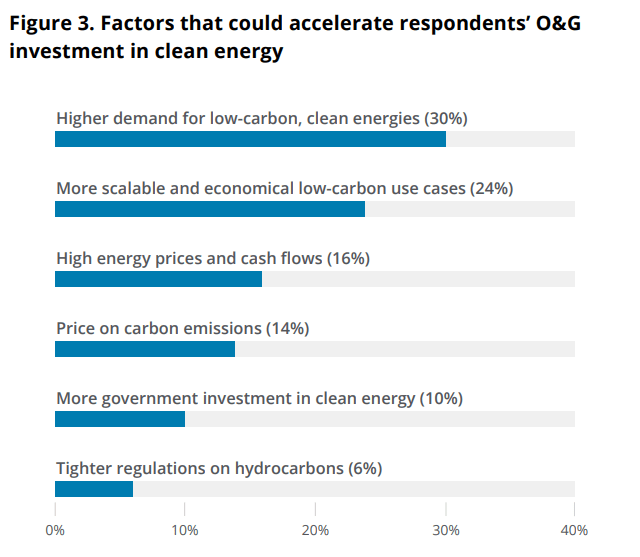

Escalating commodity prices and energy security concerns have spurred O&G companies to invest in clean energy. Clean energy laws passed in numerous countries and proposed SEC rules for clean energy disclosures are driving this shift.

Source: Deloitte, Oil and Gas Industry Outlook 2023

Sustained high natural gas prices could make green hydrogen and biomethane more attractive to future investments relative to blue hydrogen. However, challenges related to food inflation and new infrastructure may hinder the widespread adoption of biofuels.

Trend 3: Natural gas plays a new role in the transition to clean energy

The US and Europe are adjusting their energy policies, focusing on reducing emissions from natural gas rather than phasing it out completely. However, cleaner alternatives are being developed and implemented.

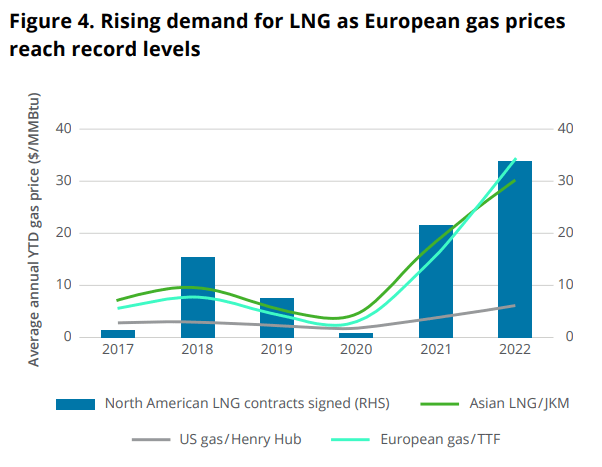

The EU taxonomy recognizes natural gas as environmentally sustainable, while the joint statement pledges to increase US liquefied natural gas (LNG) exports to Europe. The natural gas market is expected to remain tight in 2023, with growing demand from Europe and Asia absorbing additional LNG export volumes.

Source: Deloitte, Oil and Gas Industry Outlook 2023

North American LNG developers signed 34 million tonnes of long-term contracts in 2022, up 68% from 2021. From late 2022 to 2023, eight floating regasification units are expected to become operational in several European countries, increasing total import capacity by more than 20%. Also, the natural gas production of several countries, including Qatar and Israel through Egypt, has increased.

Trend 4: The refining industry responds to shifting energy demands

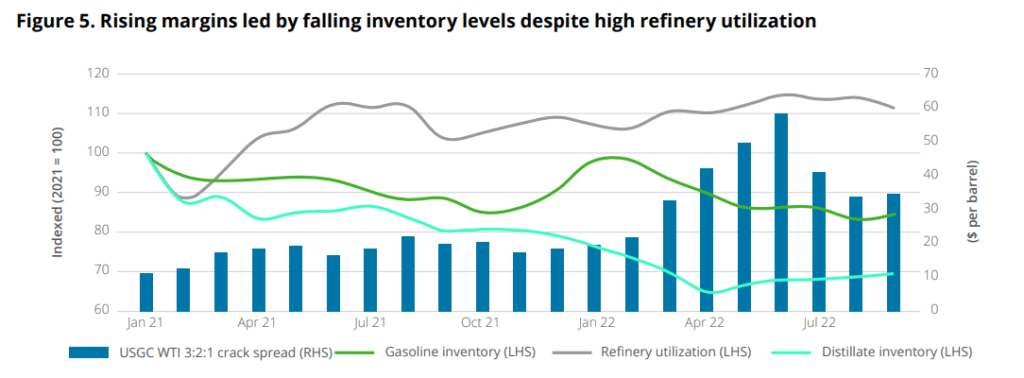

The refined product market experienced a strong rebound in 2022, driven by high oil prices, robust demand, and low inventory levels – US gasoline and distillate prices crossing $5 per gallon and $6 per gallon.

With average refinery utilization over 90% in 2022, the Gulf Coast 3:2:1 crack spread reached $60/bbl, driven by strong distillate demand and five-year low inventories. The high natural gas prices, however, led to a drop in gasoline demand to 8.5 million barrels per day in Q3 2022.

Source: Deloitte, Oil and Gas Industry Outlook 2023

Refineries are reevaluating their investment strategies, aiming to adjust product yields to high-margin petroleum and chemical products while exploring clean energy alternatives like renewable diesel. Nevertheless, obstacles such as food shortages, supply chain logistics, and low returns complicate the transition to renewable fuels.

Trend 5: Deal-making process reflects market trends

The oil and gas mergers and acquisitions (M&A) landscape has witnessed a changing trajectory in 2022. Geopolitical events and economic uncertainty significantly reduced the momentum of oil and gas M&A after a strong recovery in 2021. In essence:

- M&A in the upstream market has lost momentum,

- the value of oilfield services deals remained below US$10bn,

- and midstream M&A attracted renewed interest.

During this period, PE funds monetized their shale investments, midstream players acquired producing acreage, majors sold high-carbon assets, and investor interest shifted towards distribution and retail.

Source: Deloitte, Oil, and Gas Industry Outlook 2023

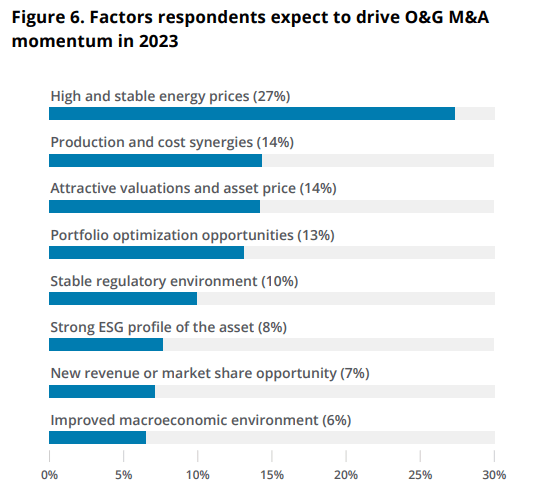

Capital discipline and an uncertain economic environment are expected to keep M&A in check in 2023, although stable energy prices may keep the momentum going in this area.

To sum up

As the O&G industry navigates an unstable landscape, adaptability and strategic decision-making become paramount. Industry players must strike a delicate balance between meeting energy demands, embracing sustainable practices, and exploring new avenues for growth. By leveraging these top insights and trends, the O&G industry can forge a path forward, embracing innovation and sustainability to thrive in an ever-evolving world.