European ecommerce overview: Denmark

Written by

Kinga EdwardsPublished on

Discover the latest trends in Denmark’s e-commerce landscape. Explore insights, statistics, and growth opportunities!

Denmark often flies under the radar when people talk about major ecommerce markets – but it shouldn’t. This small but digitally savvy country continues to show strong online shopping trends year after year.

Denmark is the southernmost of the Scandinavian countries. Its official name is the Kingdom of Denmark. According to the International Monetary Fund (IMF), Denmark’s GDP in 2025 was estimated to be around $449.94 billion. While it has the lowest GDP among the Scandinavian countries, that doesn’t make it economically weak.

When it comes to e-commerce, this country is doing quite well. And today, we’ll tell you more about it. We will examine the key aspects of Danish e-commerce.

Let’s begin!

Danish e-commerce overview

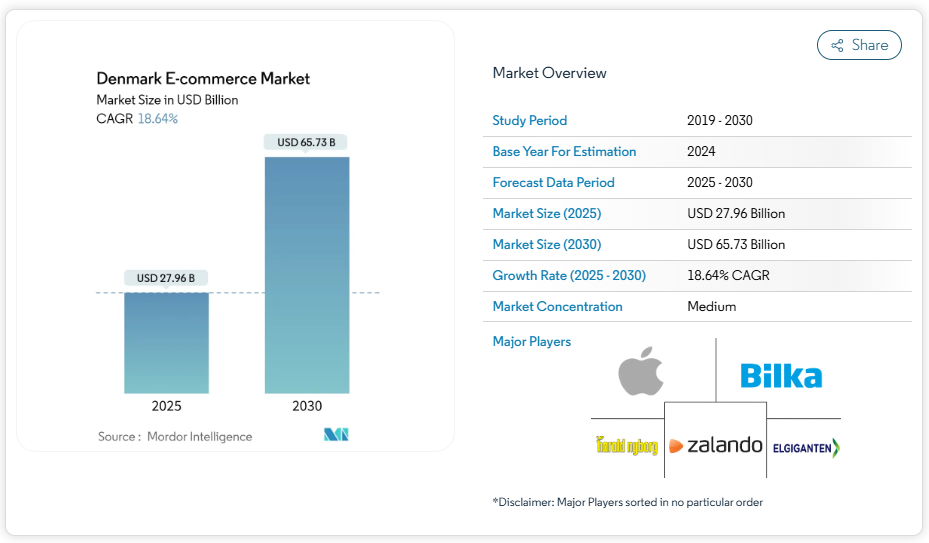

Denmark’s e-commerce market is thriving, with a projected revenue of $27.96 billion in 2025 and $65.73 billion in 2030. The annual growth rate (CAGR 2025-2030) is expected to show 18.64%!

It’s not surprising that Danish consumers have diverse shopping preferences. The leading Danish e-commerce categories are:

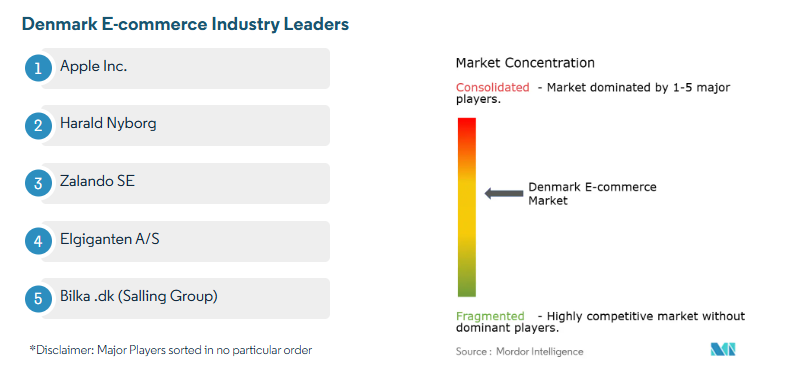

And what about leading online stores? Well, the Danish e-commerce scene is dominated by both international and local businesses. To the top 5 online stores in Denmark belong:

- Apple

- Harald Nyborg

- Zalando

- Elgiganten A/S

- Bilka .dk

Notably, three of the top five online stores are local Danish companies. Two more are from the U.S. and Germany, which highlights the significant presence of international retailers in the market.

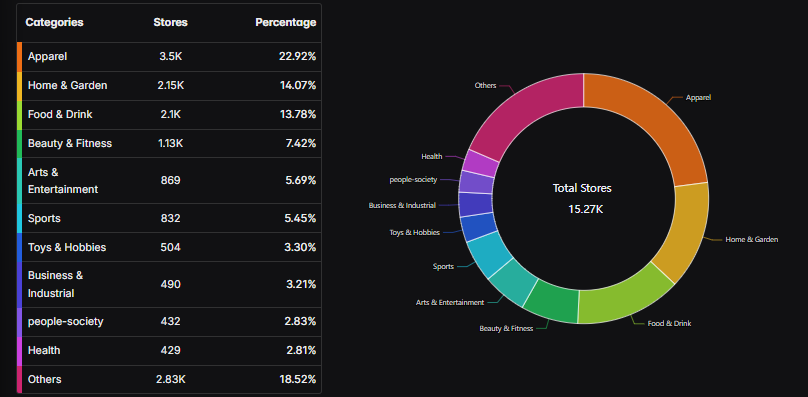

Going further, let’s check out the online store count in this country. According to Aftership, Apparel leads with 3.5K stores (22.92%), followed by Home & Garden (2.15K stores) and Food & Drink (2.1K stores).

The total number of e-commerce stores in Denmark exceeds 15.27K and shows a healthy level of competition and product variety.

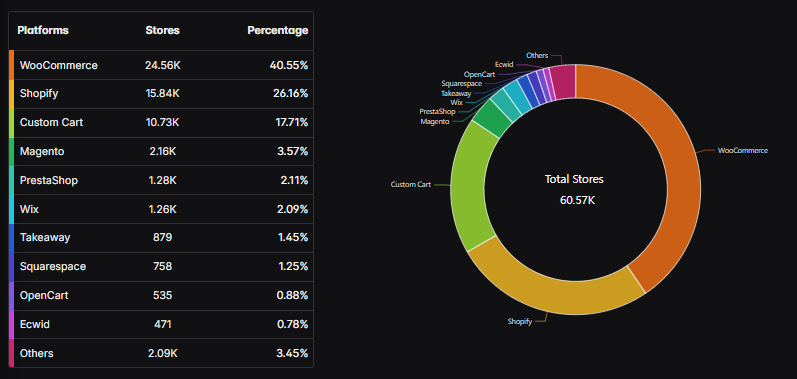

And what powers these stores? Platforms like WooCommerce, Shopify, Custom Cart, Magento, PrestaShop, and Wix are commonly used, each supporting everything from small boutiques to enterprise-scale operations.

So here’s a question for you: with all this momentum, where does your brand fit into the Danish e-commerce story?

Danish consumer behavior

Danish society has a lot of purchasing power (99%) that goes with a high-quality lifestyle. Both of these factors contribute to the silhouette of a demanding customer who requires high-quality and innovative products from manufacturers. After all, Danes are consumers who are considered to be one among the most demanding on the Old Continent. They have universal access to the latest technologies and can afford them.

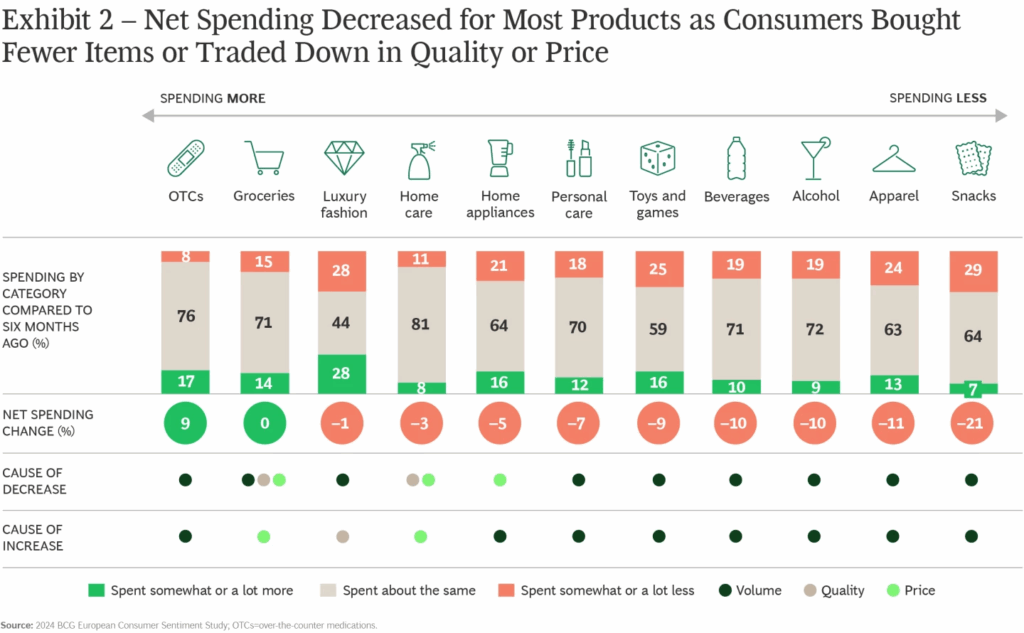

However, not everything sounds so pretty. Most Danish households faced higher prices while income and savings stayed flat, which forced many to prioritize essentials. Groceries held steady, and over-the-counter medicines even saw a 9% spending increase, but nearly all discretionary categories dropped — snacks by 21%, apparel by 11%, alcohol and beverages by 10%, and toys by 9%.

Still, sentiment is slowly improving. More Danes now expect incomes and savings to rise by year’s end, especially among younger generations who also feel less pressure from inflation.

So we can’t say now that Danish society is strongly consumerist. It’s more cautious, practical than it used to be. It’s shaped by economic realism rather than impulsive consumption.

The frequency of online shopping varies across age groups. Approximately 42% of individuals aged 18 to 49 engage in online shopping weekly, while only 15% of those aged 65 to 79 do the same. The generational shift towards digital purchasing habits is really seen, though.

What else can be said about Danish customers is that they like to buy from foreign companies. So yes, cross-border shopping is doing well. As far as 54% of Danish consumers shop online from foreign retailers at least once a month. Younger consumers, particularly those aged 18 to 29, are more inclined towards international purchases.

In addition, with increased online shopping also comes increased return rates. In the first quarter of 2024, 33% of consumers returned an online order. But that’s not all – 8% returned more than half of their recent purchases. The highest return rates are observed among the 18-29 and 30-49 age groups.

There are also loyalty programs, which resonate well with Danish consumers. A substantial 75% express satisfaction with their current loyalty platforms, and 50% of brands are considering revamping these programs to enhance customer engagement.

Payments in Danish e-commerce

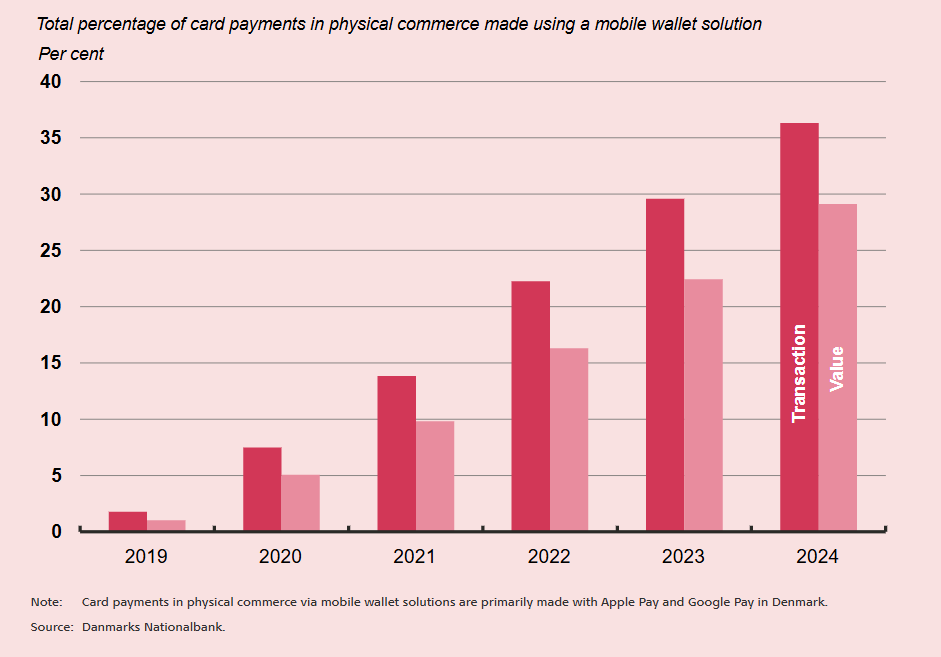

Denmark is at the forefront of digital payment adoption. As of 2025, 90% of in-store payments are digital, with physical payment cards being the most commonly used method. However, mobile payments have gained significant traction in recent years, reshaping the card payment market in Denmark.

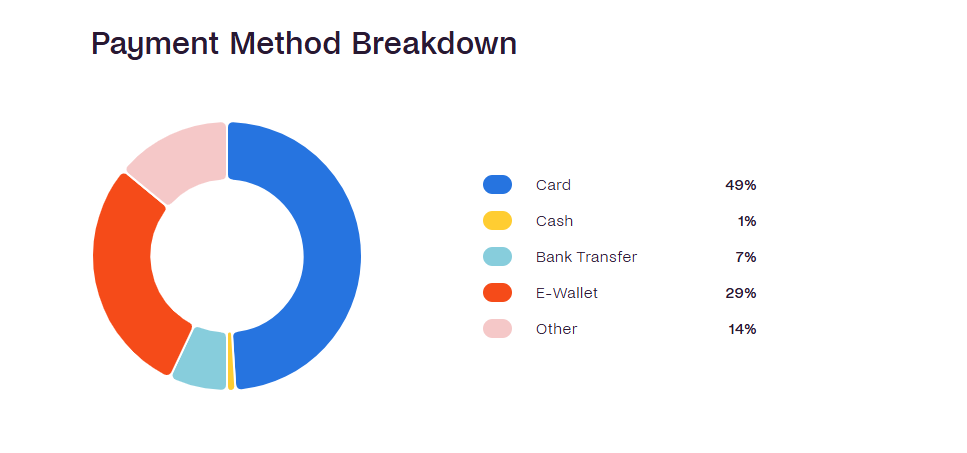

In the realm of e-commerce, the preferred payment methods are:

- Cards: 49%

- E-wallets: 29%

- Bank transfers: 7%

- Cash: 1%

- Other methods: 14%

We can see the dominance of card payments, with a significant portion of consumers also utilizing e-wallets and bank transfers.

Cards are really strong in Denmark. Denmark’s Nationalbank also shows them as the most used payment method in physical commerce, when using a mobile wallet solution.

The Buy Now, Pay Later (BNPL) market is experiencing robust growth in Denmark. Between 2025 and 2030, the BNPL market is expected to grow by 8.5% annually, reaching approximately $9.50 billion.

Plus, Denmark’s integration into the TARGET Instant Payment Settlement (TIPS) system in March 2025 marks a significant advancement in the country’s payment infrastructure. This integration means a lot. It facilitates the settlement of instant payments in central bank money and enhances the speed of transactions

Social media in Denmark

Denmark is a digitally connected nation. As of January 2025, 78.3% of the population (approximately 4.69 million people) are active on social media. Among adults aged 18 and above, this figure rises to 86.2%.

In early 2025, the most popular platforms include:

- Facebook: 3.45 million users (57.6 percent of the total population)

- Messenger: Messenger ads reached 3.00 million users (50.1%)

- Instagram: 2.60 million users (43.4%)

- LinkedIn: 3.70 million users (61.8%)

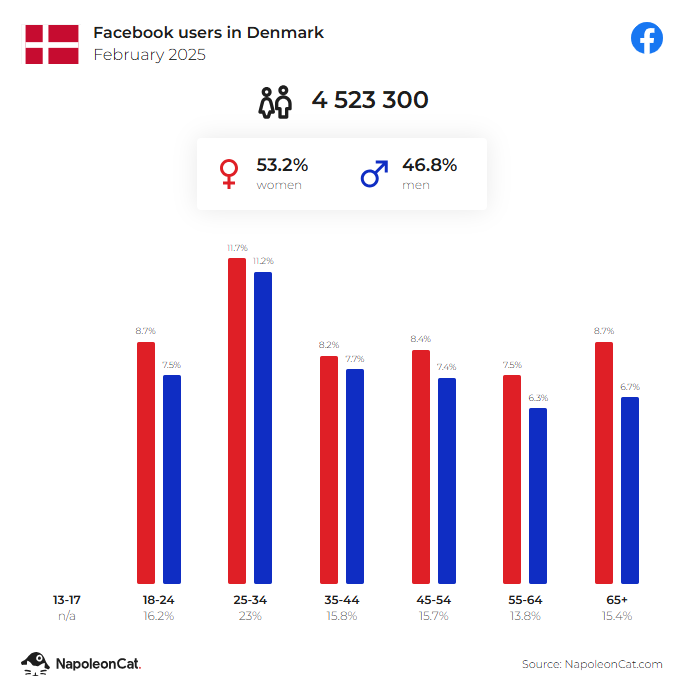

Moreover, from NapoleonCat’s resources, we can see that in February 2025, most Facebook users were women – 53.2%.

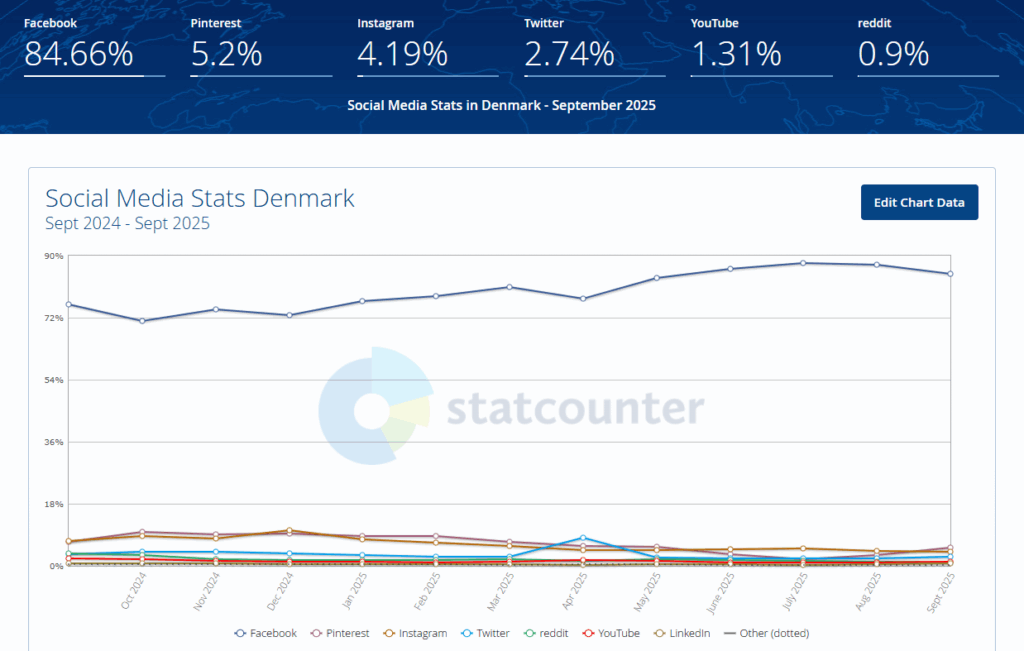

So yes, Facebook remains the most visited social media website in Denmark, followed by Reddit and Instagram. Plus, in terms of market share, Facebook leads with 84.66%, followed by Pinterest at 5.2%, and Instagram at 4.19%.

Interestingly, 94% of Danish children have a social media profile before the age of 13, with 48% starting as early as the age of 10.

Danish logistics

If you are betting that the logistics in Denmark are at a very high-tech level, then, well, you are just right. The country’s strategic location and advanced infrastructure make it a pivotal hub in the Nordic region. But let’s go to the numbers.

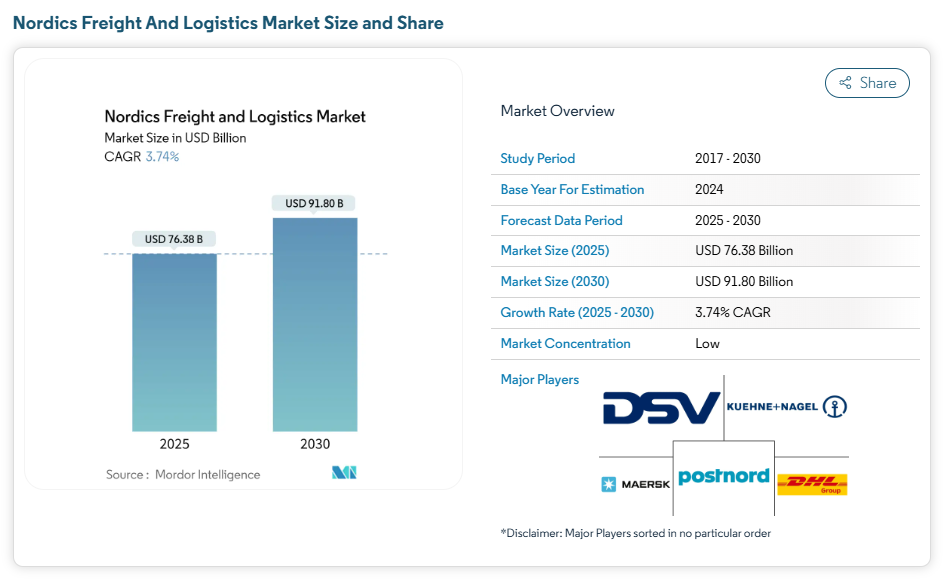

The Nordics Freight and Logistics Market is projected to reach $76.38 billion in 2025, with Denmark playing a crucial role in this expansion. The market is expected to grow at a CAGR of 3.74% to reach $91.80 billion by 2030!

Major players in Denmark’s logistics sector include A.P. Moller – Maersk, DHL Group, PostNord, DSV A/S (incl. DB Schenker), and Kuehne+Nagel. They offer a range of services from freight forwarding to warehousing.

Denmark’s road freight logistics market is also on an upward trajectory, projected to grow at a CAGR of 1.96% between 2025 and 2030, to $4.387. The country’s extensive road network, spanning over 73,000 km, facilitates efficient transportation.

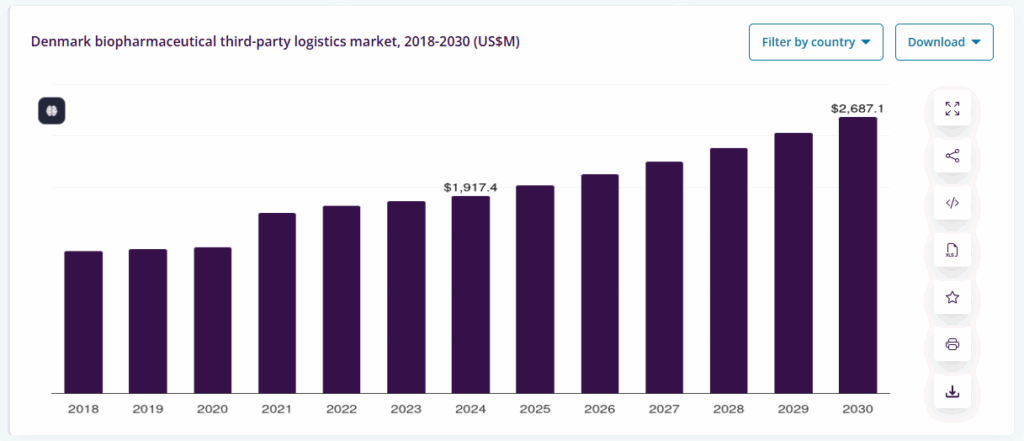

In the realm of third-party logistics, Denmark’s biopharmaceutical logistics market generated a revenue of $1,917.4 million in 2024 and is expected to reach $2,687.1 million by 2030 (CAGR of 5.9%). The non-cold chain logistics segment was the largest revenue generator in 2024.

Moreover, Denmark’s logistics infrastructure is highly regarded, with a Logistics Performance Index score of 4.1 out of 5 in 2022. The score reflects the quality of trade and transport-related infrastructure.

As we can see, with these developments, Denmark continues to strengthen its position as a logistics powerhouse in Europe. Add to this that road freight revenue is projected to reach DKK 55.16 billion by 2026, and we have a market that’s resilient and primed for long-term competitiveness in Northern Europe’s transport network.

To sum up

So, what did we learn about Danish e-commerce?

It’s thriving. It’s fast. And it’s full of opportunity.

People in Denmark are online constantly. They shop often, they return things freely, and they’re happy to buy from both local and international stores. Yet, they become a little bit more cautious.

Cards are still the go-to payment method, but mobile wallets and BNPL are catching up quickly. Social media? Practically everyone’s on it. Facebook still leads, but Instagram and Messenger aren’t far behind. And when it comes to logistics, Denmark delivers. Literally. Whether it’s road freight, pharma shipping, or next-day parcel drop-offs, the infrastructure’s in great shape.

The real question is: where do you fit into this picture?

If you’re eyeing the Danish market, now’s a pretty great time to step in. There’s a solid customer base, clear digital habits, and strong backend support. Just make sure you’re ready to meet their expectations—fast service, smooth returns, and solid online experiences.

We have hope that you will find this Danish e-commerce overview helpful enough to conquer the Danish e-commerce market!

***