Goodbye distance selling thresholds – Hello OSS: What will change for almost all European online merchants as of July 1st

Written by

Editorial TeamPublished on

On July 1st, Europe’s largest VAT reform will be implemented and the so-called One-Stop-Stop (OSS) will be launched throughout the EU. The goal behind it: This reform is intended to help simplify cross-border online trade in Europe and adapt it to the digital age.

In this article we explain what will change for almost every online merchant starting 1 July 2021, and whether the reform will really bring the promised simplification.

Until 30 June 2021: Country-specific distance selling thresholds

Almost 30 years ago, local distance selling thresholds for cross-border B2C sales were introduced in the EU so that small and medium-sized enterprises (SMEs) would not immediately be liable for VAT in every state to which they sell cross-border.

Until 30 June 2021, each EU state has its own threshold. Most are at EUR 35,000 (net) per calendar year. Only Germany, Luxembourg and the Netherlands have an individual distance selling threshold of EUR 100,000 (net).

Until this distance selling threshold is reached, online merchants can pay VAT on the sales they generate in their respective country of residence. Only when the threshold is exceeded does the VAT have to be paid in the recipient country. From then on, local registration with the respective tax authority in the destination country is mandatory, and the same applies to the ongoing submission of VAT returns.

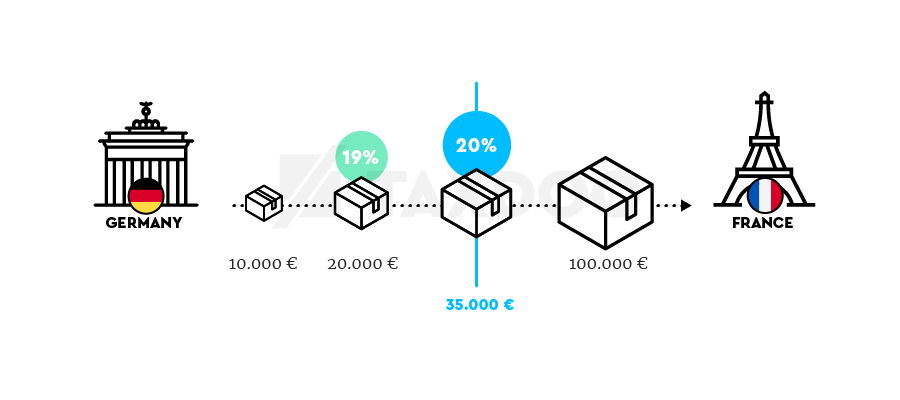

In summary, the logic of country-specific distance selling thresholds can be illustrated by the following example:

An online merchant sells goods cross-border from Germany to end customers in France. The sales are initially subject to the German VAT rate of 19 percent. As soon as the sales exceed the French threshold of EUR 35,000 (net), the German merchant must pay the VAT in the country of destination i.e., France.

The standard tax rate in France is 20 percent. If the distance selling threshold is exceeded, VAT returns must be submitted to the French tax office on an ongoing basis and the VAT for the aforementioned sales must be paid abroad. For this, registration with the local tax authorities is mandatory.

So far, so good: But these local, country-specific distance selling thresholds will not remain – from July 2021, VAT for cross-border B2C sales in the EU will follow a new system of rules.

From July 2021: Discontinuation of distance selling thresholds and the introduction of the One-Stop Shop

The thresholds described above will no longer apply as of July 2021. They will be replaced by a uniform EU-wide limit of EUR 10,000 (net) per calendar year, above which cross-border B2C sales must be taxed in the destination country. However, this limit does not apply to each individual EU country, but to all member states as a whole.

The EUR 10,000 (net) threshold will quickly be reached by the majority of online merchants, who will then be liable to pay VAT in every country to which they send even one parcel.

To avoid local VAT registration despite local tax obligations, the One-Stop-Shop (OSS) will be introduced to simplify cross-border online trade in the EU for online merchants.

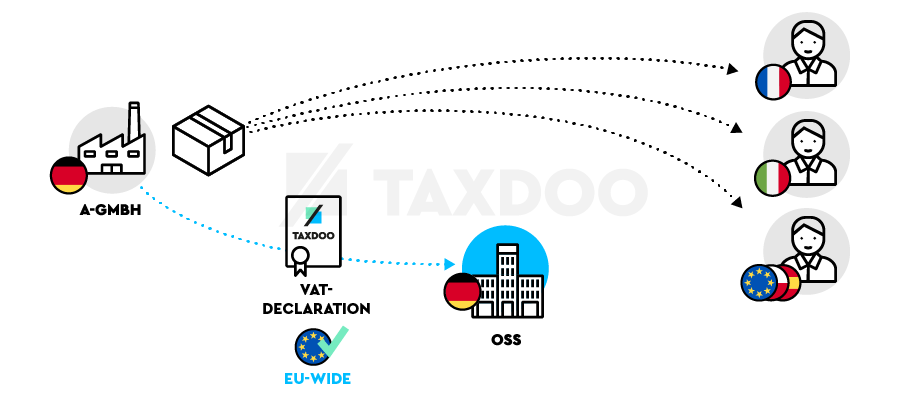

In concrete terms, this means that online merchants will be able to declare their sales centrally and in a standardised form via the One-Stop-Shop in their country of residence from 1 July 2021, as soon as they exceed the distance selling threshold of EUR 10,000 (net) per calendar year.

It should be noted that each EU country has its own One-Stop-Shop through which all cross-border B2C distance sales in other EU countries can be declared. In Germany, the Federal Central Tax Office (BZSt) is responsible for this platform. The VAT is then paid in total in the country where the online merchant is based, i.e., for German online merchants in Germany, for French online merchants in France, and so on. The VAT debt can be settled in the One-Stop-Shop, after which the money is automatically transferred to the respective EU states by the relevant tax authority.

OSS returns are submitted quarterly, and this must be done within the month following the end of the previous quarter. This means that the months of July, August and September are bundled and declared in October.

Local registrations in the various EU states are no longer necessary when using the OSS in connection with cross-border B2C distance sales – the same applies to the continuous submission of VAT returns. However, other types of transactions, such as the use of foreign warehouses or local B2C sales, still lead to a registration obligation in the respective countries, as only cross-border B2C distance sales can be reported via the OSS. In addition, there are other special features that go hand in hand with the OSS:

- Those who report their cross-border B2C sales via the One-Stop-Shop are no longer required to issue invoices for these sales.

- The reporting period is always quarterly.

- The payment deadline is the end of the month following the respective quarter.

Note: The use of the OSS is voluntary. Alternatively, local VAT registration can also be carried out.

OSS registration via My BOP

Registration for the German OSS has already been possible since April 2021 via the online portal “My BOP” of the Federal Central Tax Office (BZSt).

Important to note: Anyone who has already exceeded the distance selling threshold of EUR 10,000 (net) as of 01/07/2021 and does not register early for the use of the OSS (before 1 July 2021) is excluded from its use in the first quarter. OSS registration is then only possible in the following quarter.

This means that online merchants would then be required to declare their cross-border distance sales locally – in every country to which they send even one parcel.

What happens with the Mini-One-Stop-Shop?

The Mini-One-Stop-Shop (MOSS) was previously used to report cross-border digital services to private customers. The MOSS will be integrated into the One-Stop-Shop (OSS) from 01/07/2021.

Thus, as of July 2021, there will no longer be a separate MOSS procedure and the OSS will become the single point of contact for cross-border distance sales and digital services.

Those who are already registered for the Mini-One-Stop-Shop do not have to register for the OSS, as automatic registration for the OSS will take place.

The big crux: the OSS is not suitable for all transactions

So far, so good: But the new VAT reform has a catch. Only cross-border sales to end customers in the EU, i.e., distance sales, can be reported via the One-Stop-Shop.

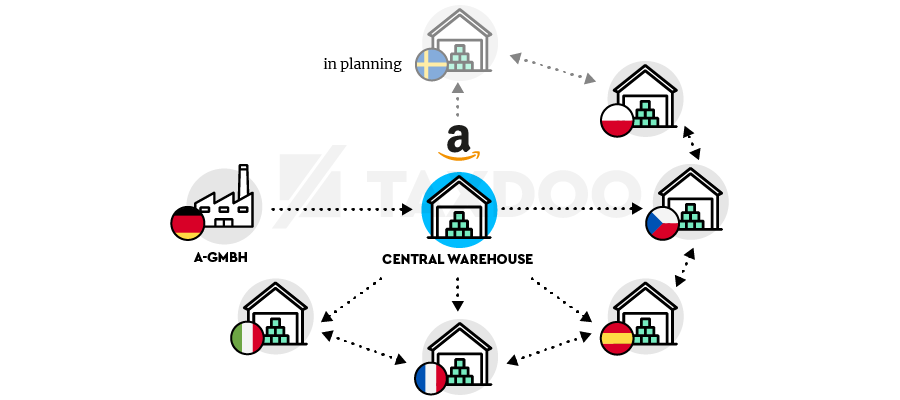

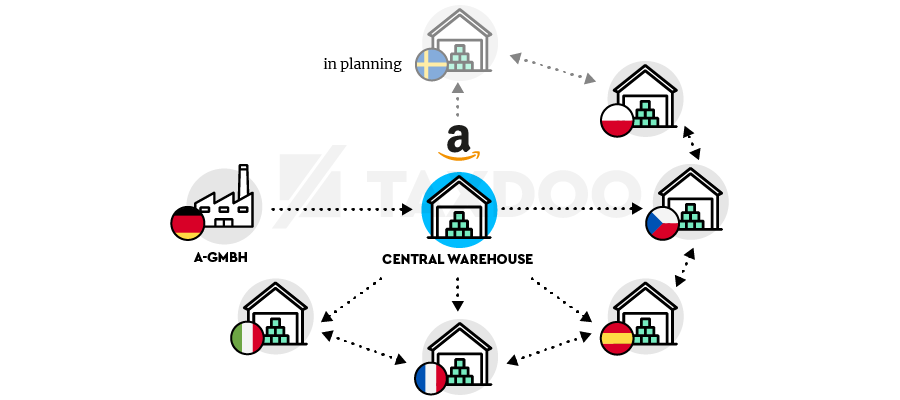

In concrete terms, this means that if online merchants use the cross-border logistics structures of the large marketplaces – such as within the framework of Amazon PAN EU or CEE – local VAT registrations must continue to be maintained in parallel with the use of the OSS.

In this case, local registrations must continue to be made in other EU countries, because the use of fulfilment centres generates a whole series of transactions (intra-Community shipment/purchase) which – just like B2B sales – cannot be declared via the One-Stop-Shop.

In addition, online merchants cannot report B2C sales within a country and input taxes via the OSS. In this case, local registrations and the filing of continuous returns in the respective EU states are still obligatory.

Summary: What do online merchants now have to consider?

In the area of online trade, the OSS will be a fundamental relief for companies that ship products from a central warehouse to other EU states to end consumers (B2C).

For online merchants who also use the cross-border fulfilment structures of Amazon or other marketplaces, the OSS will lead to an increase in complexity. They will have to deal with both the One-Stop Shop and local tax registrations in other EU countries. That is why it is important to build two compliance strategies:

Online merchants should ensure from July 2021, that:

- They can determine the EU-wide tax rates for their products in their sales markets –ideally via the customs tariff number

- They register for the One-Stop-Shop, where relevant

- They must identify their distance sales and then report them via the OSS, all other transactions (B2B transactions, input taxes and local sales) still via local registrations in other EU countries

- If point 3 applies, they do not report transactions twice (OSS and local registration) or not at all!

At Taxdoo, we also offer an OSS solution – which means that you can continue to get everything you need from a single source. For more information, click here.

Dr. Moritz Lukas is Vice President of Sales and authorized signatory of Taxdoo GmbH. After studying business administration, Moritz worked as a consultant in a leading management consultancy for several years. He then decided to focus on getting his PhD in finance. Moritz has been responsible for Sales at Taxdoo since 2017 and in this role he is in daily contact with online merchants and their tax consultants, in order to discuss suitable solutions for the VAT challenges of cross-border online trading.