Detailed Analysis of the HDE Consumption Barometer Data and Its Implications

Written by

Kinga EdwardsPublished on

Explore insights from the HDE Consumption Barometer to understand market trends and consumer confidence in Germany. Read our analysis!

There are many methods that experts use to analyze consumer behavior, and one of the most insightful is the HDE Consumption Barometer.

This tool measures consumer sentiment and spending habits, and provides a snapshot of economic trends and consumer confidence. Today, we’ll take it under our magnifying glass so you can check how – and why – it has changed over the last years.

Amazing insights ahead!

What is HDE Consumption Barometer Data?

The HDE consumption barometer is an essential tool for gauging consumer sentiment in Germany. Compiled monthly, the barometer’s findings are based on a survey managed by YouGov. Each month, approximately 2,000 households are surveyed, providing a representative sample of the German population.

The survey encompasses a set of six key questions. These questions assess expectations over the next three months concerning purchase intentions, saving habits, income prospects, economic outlook, and changes in interest and price levels.

Respondents rate their expectations on a five-step Likert scale ranging from “much less” to “much more.”

To compute the index, responses to these questions are assigned points from one to five. The average score for each question is calculated by summing the individual responses and dividing by the number of responses.

This method helps identify shifts in consumer behavior and sentiment more distinctly, as extreme values on the scale are weighted to highlight important changes.

On top of that, the survey employs a sophisticated weighting system for the answers to these six questions. This system adjusts for the varying influence each question has on overall consumer behavior.

Through understanding and analyzing these weighted responses, the HDE can more accurately forecast consumption trends, providing valuable insights into future economic conditions.

Analyzing the HDE Barometer

HDE Barometer today [April/May 2024]

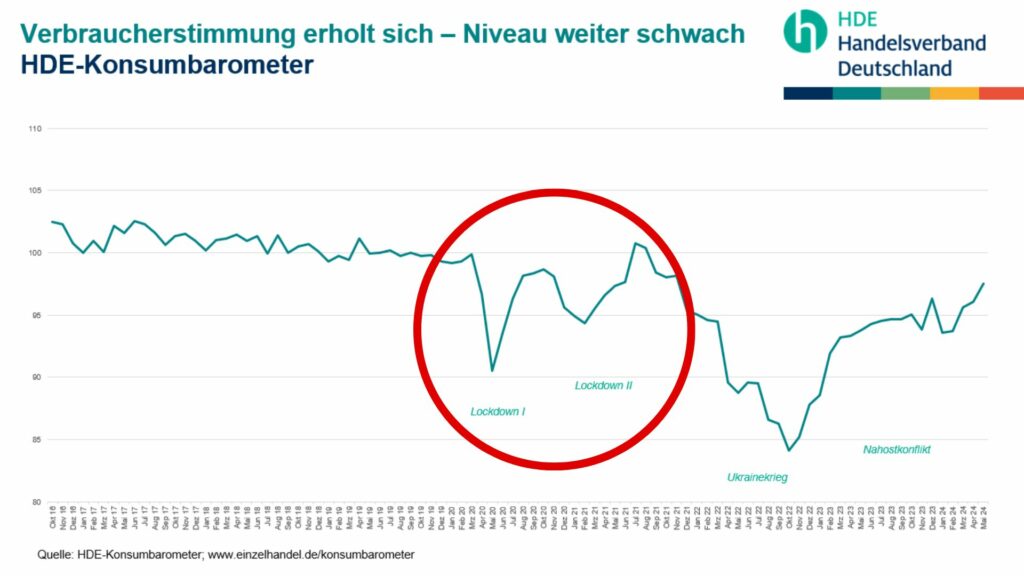

In April 2024, the HDE consumption barometer registered at 96 points. This figure stands in stark contrast to the baseline value of 100 set in January 2017. The drop to 96 signifies a noticeable yet unavoidable shift in consumer sentiment from that initial benchmark.

Let’s briefly analyze why there was a decrease and how it relates to broader economic conditions:

- The four-point decline in the index primarily stems from high inflation rates. When prices rise, consumers often hesitate to spend. They might delay purchasing big-ticket items or cut back on non-essential spending. It goes without saying that such a conservative approach to consumption directly affects the overall sentiment index.

- Moreover, that ongoing inflation not only impacts immediate purchasing decisions but also shapes broader consumer attitudes towards the economy. It leads to a greater sense of uncertainty about financial stability, which can lead to pessimism.

- Then, this sentiment was evident in the lowered index value for April 2024, as it reflects broader concerns over the economic landscape that influence consumer behavior and confidence.

However, May 2024 marked a significant improvement in consumer sentiment, as evidenced by the rising HDE consumption barometer. The index climbed for the fourth consecutive month, reaching its highest level since the end of 2021.

There are many factors contributing to the rise and identifying the causes:

- The primary factor behind the improved consumer sentiment in May was the decline in inflation rates. As inflation began to ease, individuals felt more comfortable making purchases that they might have previously postponed. Lower inflation often leads to more stable prices, which can encourage spending on both necessities and discretionary items.

- In addition to the reduction in inflation, other positive economic indicators played a role in boosting consumer confidence. These may include a steady job market, increasing wages, or favorable government policies that enhance financial security. When consumers feel secure in their economic prospects, their willingness to spend increases, thereby lifting the overall sentiment index.

- Together, these factors contributed to a more optimistic outlook among consumers, which is reflected in the steady rise of the consumption barometer through May 2024. This rebound is crucial as it suggests a potential revival in private consumption, which is a key driver of economic growth.

Changes as Indicated by the HDE Consumption Barometer

The barometer indicates that changes in consumer sentiment directly correlate with potential rises or falls in private consumption.

- When the barometer shows an uptrend, it typically signals that consumers feel confident about their financial stability and future economic conditions. This confidence translates into increased spending on goods and services, which is a direct input to economic growth.

- Conversely, a downturn in the barometer suggests that consumers are becoming more cautious about spending, which can lead to a contraction in private consumption.

- Private consumption is a key component of Germany’s Gross Domestic Product (GDP) and acts as a primary driver of economic growth. It reflects the overall health of the economy; robust consumer spending usually indicates that the economy is doing well, as it suggests that individuals have enough disposable income to spend beyond their basic needs.

- Strong consumer spending can stimulate further investment in businesses, leading to job creation and wage increases, which in turn fuel an ongoing cycle of economic prosperity.

However, factors such as inflation, unemployment, and fiscal policies can influence consumer sentiment and thus impact private consumption:

- high inflation can erode purchasing power, leading to a decrease in consumer spending.

- If unemployment rates rise or if there are significant changes in government policies affecting taxation or social security benefits, these can also dampen consumer sentiment and reduce their spending levels.

Understanding these dynamics is crucial for policymakers, businesses, and investors as they navigate the complexities of the economy. Monitoring HDE consumption trends can help stakeholders anticipate economic shifts and implement strategies that capitalize on consumer trends or mitigate downturns.

Important Drop Moments

#1 Lockdown I and II Impact

The chart shows drops in consumer confidence during the periods labeled “Lockdown I” and “Lockdown II”. These drops likely reflect the uncertainty and economic disruption caused by COVID-19 lockdown measures.

After each lockdown, there is a recovery in sentiment, although it doesn’t immediately return to pre-lockdown levels. The prolonged nature of these dips suggests that consumers were deeply affected by the restrictions and potential economic fallout. As restrictions lifted, a slow but steady improvement indicates a gradual return to normalcy, albeit with lingering caution.

#2 Recovery Phases

Post-lockdown recoveries in consumer confidence suggest resilience and adaptability in consumer behavior, possibly due to easing restrictions, economic stimulus measures, or adjustments in consumer habits. Each recovery phase, while not restoring confidence to pre-pandemic levels, marks a significant rebound, reflecting optimism and adaptation to new conditions.

These phases are crucial for retailers and policymakers as indicators of when consumer spending might start to increase again. It also shows that recovery is possible even after significant downturns, provided there is adequate support and adaptation.

#3 Effect of the Ukraine Conflict (Ukrainekrieg)

There’s a noticeable and sharp decline in consumer confidence coinciding with the onset of the conflict in Ukraine. This could be attributed to concerns about geopolitical stability, economic impacts like rising energy prices, and general uncertainty affecting consumer outlook.

The immediate reaction to the conflict highlights the fragility of consumer sentiment in the face of international crises. This period likely saw a tightening of discretionary spending as consumers braced for potential economic strain, underscoring the direct impact of global events on national economic sentiment.

#4 Near East Conflict (Nahostkonflikt)

This event also correlates with a dip in the index, indicating that international conflicts have a notable effect on consumer sentiment in Germany, potentially due to fears about regional stability and its broader implications.

The timing of the drop suggests that news and developments in the conflict may directly influence consumer outlook and behavior. Such geopolitical uncertainties can lead to increased caution among consumers, potentially reducing spending on non-essential goods and services as they prioritize financial security amid uncertain times.

General Trends

Beyond these specific events, the index suggests a fluctuating but generally cautious consumer sentiment from 2020 to 2024. The overall recovery in consumer confidence seems gradual, with periodic setbacks aligning with external disruptions.

Projecting Future Consumer Behavior Trends and External Influences on the HDE Consumption Barometer

The insights gleaned from both current and past readings of the HDE consumption barometer provide a valuable foundation for forecasting consumer behavior trends in the upcoming months.

Based on the upward trend noted in the May 2024 barometer reading, it’s reasonable to predict a continuation of positive consumer sentiment in the near term, assuming stable conditions. This optimism is then bolstered by the recent decline in inflation and improvements in other economic indicators. If these conditions persist, we can expect an increase in consumer spending, which could further strengthen economic recovery in Germany.

However, several external factors could influence these projections. Key among them are economic policies enacted by the government, which can either boost consumer confidence or lead to caution. For instance, changes in tax rates, wage policies, or retirement benefits could directly affect disposable income levels and spending habits.

Global economic conditions are another critical factor. Germany, being a significant player in the global market, is sensitive to shifts in international trade dynamics, foreign direct investment flows, and global financial market trends. Any turbulence in these areas – such as trade conflicts, sudden shifts in oil prices, or international financial crises –could negatively affect consumer sentiment and spending behavior.

Domestic political stability also matters. Uncertainty regarding governmental policies or political unrest can undermine consumer confidence, leading to decreased spending and a more conservative approach to personal finances. Conversely, a stable and predictable political environment can bolster consumer confidence and encourage spending.