Key Takeaways from the State of German SaaS Pricing Report

Written by

Kinga EdwardsPublished on

In a market as diverse as Germany’s, understanding the state of SaaS pricing is essential for both SaaS providers and consumers.

Therefore, this article delves into the “State of German SaaS Pricing,” providing insights into the SaaS ecosystem in Germany.

Explore the 5 key takeaways from this post with us, or read the entire Valueships report here.

#1 Bet on pricing pages

Pricing pages are pivotal in the world of SaaS, but there’s no one-size-fits-all solution for them. The German market’s diversity necessitates tailored approaches.

For SMBs embracing product-led growth, transparent pricing and user-centric monetization models are key. The good-better-best model is popular for easy, no-fuss pricing.

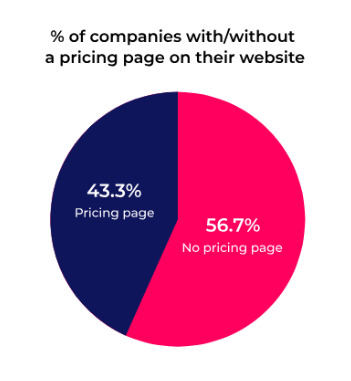

Moreover, enterprise sales-led growth should focus on value and create context-based pricing, avoiding false promises and keeping pricing information behind the scenes. Pricing pages are vital, and more than 50% of German SaaS companies lack them, presenting a missed opportunity.

Source: State of German SaaS Pricing Report

In the SMB segment, 44.1% have pricing pages, using transparent pricing predominantly. Enterprise companies are split, with 43.4% having pricing pages, whereas 32% are opaque.

Source: State of German SaaS Pricing Report

In this landscape, the pricing page is not just a transactional element; it’s a strategic tool to cater to varied customer preferences and organizational structures.

Source: State of German SaaS Pricing Report

#2 Keep a balance between entry barrier and price differentiation

In SaaS, balancing entry barriers and price differentiation is paramount. To excel in conversion and expansion revenue, understanding customer willingness to pay in both budget and premium segments is crucial.

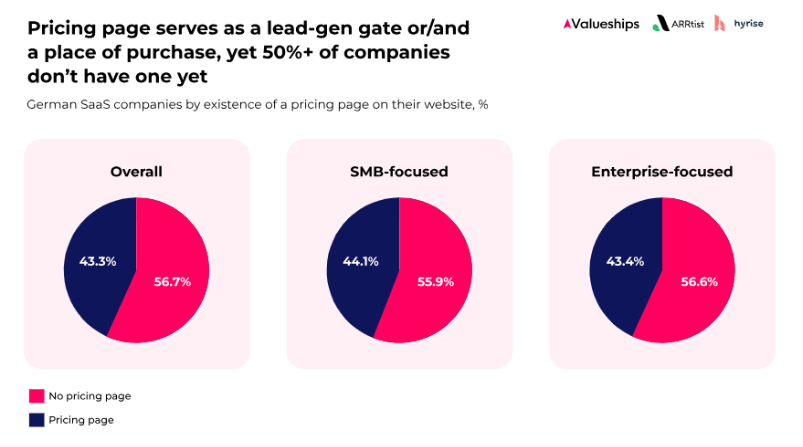

Pricing data reveals a delicate equilibrium between the two ends of the spectrum, with entry-level prices often more than half the cost of premium tiers across various industries.

Source: State of German SaaS Pricing Report

It is worth investigating whether the personas are correctly identified if there is so much variation within a single company. Using expansion revenue as an indicator can help us determine whether price points are correctly set.

This balance highlights a fundamental takeaway: Effective pricing should align with the overall company strategy, promoting expansion revenue.

Pricing strategies should evolve through the customer lifecycle, from acquisition and conversion, to retention and upselling.

Also, a multi-year perspective is key to crafting a successful pricing strategy while understanding customer needs is the starting point for any SaaS company.

#3 Decide between freemium and trials

Offering free products in the SaaS world can be a two-edged sword. On one side, it can boost user adoption and conversions. On the other side, it may diminish perceived value, potentially reducing the willingness to pay.

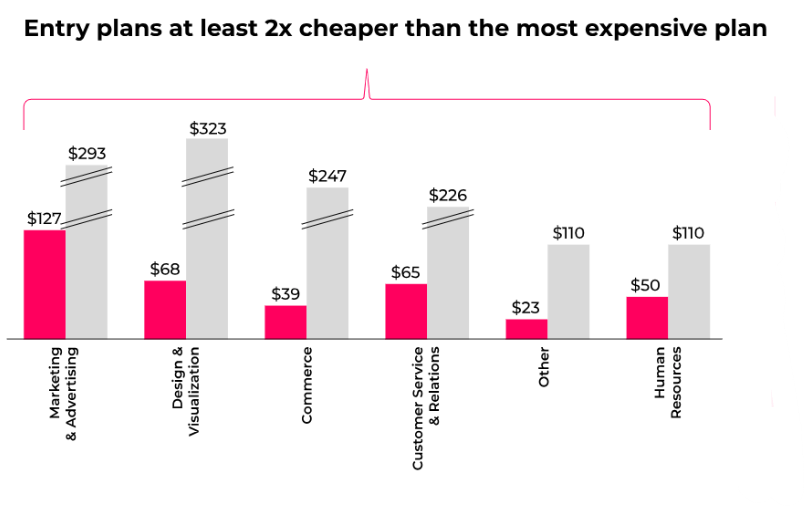

Source: State of German SaaS Pricing Report

The prevalence of freemium models is relatively low in Germany, and it significantly impacts pricing dynamics. Companies providing freemium options tend to charge less, with the most noticeable difference occurring in their highest-priced plans. Freemium models lower the entry barrier but can also reduce the perceived value, thus impacting willingness to pay.

Conversely, providing trial periods has a less pronounced impact on average prices. Approximately one-quarter of companies offer trials, with their duration varying between 20 to 29 days.

Source: State of German SaaS Pricing Report

These trials aid in converting potential clients who need to experience the product’s value before committing. The challenge lies in setting up trials effectively for upselling customers.

When deciding between freemium and trials, SaaS companies must weigh the benefits of boosting user adoption against the potential reduction in perceived value and willingness to pay.

#4 Try custom pricing strategies

In the realm of SaaS pricing, companies offering custom plans wield substantial pricing power.

Source: State of German SaaS Pricing Report

Research reveals that when custom plans are available, the priciest package is three times more expensive than the most affordable, signifying a broad pricing spectrum. This suggests that businesses offering tailored, enterprise-level solutions position their services at a higher value, potentially compensating for the overhead of customization.

Source: State of German SaaS Pricing Report

Interestingly, the entry-level pricing remains relatively unaffected. This customization insight underscores the role of personalized pricing in maximizing SaaS product revenue.

#5 Monetize SaaS product features with add-ons

Exploring the untapped potential in the realm of SaaS pricing, don’t forget about the significance of monetizing certain product features through add-ons. Despite being an uncommon practice among analyzed companies, it’s shown that the presence of add-ons doesn’t significantly impact mean prices. Instead, it opens doors to expansion revenue opportunities, making it a strategic move for SaaS businesses.

Source: State of German SaaS Pricing Report

While over 85% of German SaaS companies don’t openly mention add-on features, this represents a missed chance for monetization.

Add-ons allow businesses to tailor offerings to individual customer needs, catering to those with a high willingness to pay. This approach is key to enhancing monthly recurring revenue (MRR) and achieving customer-centric pricing.

For any SaaS company, recurring revenue and flexible pricing models such as add-on features or various tiers can all be managed through subscription management software in order to meet the needs of different clients.

Over to You

Understanding the intricacies of SaaS pricing in a market as diverse as Germany is essential for both providers and consumers. But with a report from Valueships, you already have valuable insight into the key information shaping the German SaaS ecosystem.

Do you like this report? Click here to jump to the other articles!