Payment methods in CEE

Written by

Editorial TeamPublished on

When you step into the dynamic landscape of payment methods in Central and Eastern Europe, you can’t help but be struck by the diversity and innovation at play.

It is an exciting time to be part of the CEE payment scene.

The region has become a hub for technological advancement, where new payment methods aren’t just emerging but flourishing. We’re talking about cutting-edge mobile wallets, real-time bank transfers, and… BLIK.

Today, we’re diving into this diversity, showcasing how the CEE is redefining payments. From the busy markets of Warsaw to the tech hubs of Tallinn or Budapest, we see a common thread – a drive to create payment experiences that are seamless, secure, and tailored to the digital natives’ lifestyle.

CEE payment landscape overview

In CEE, we’re seeing payment technologies being developed that are as user-friendly as they are secure.

And It is not happening in a vacuum. The drive for these advancements comes from a population that’s tech-savvy, sure, but also from a history of flexibility and adaptation. They’ve embraced change and made it their own, shaping a payment ecosystem that’s as diverse as the region’s cultural tapestry.

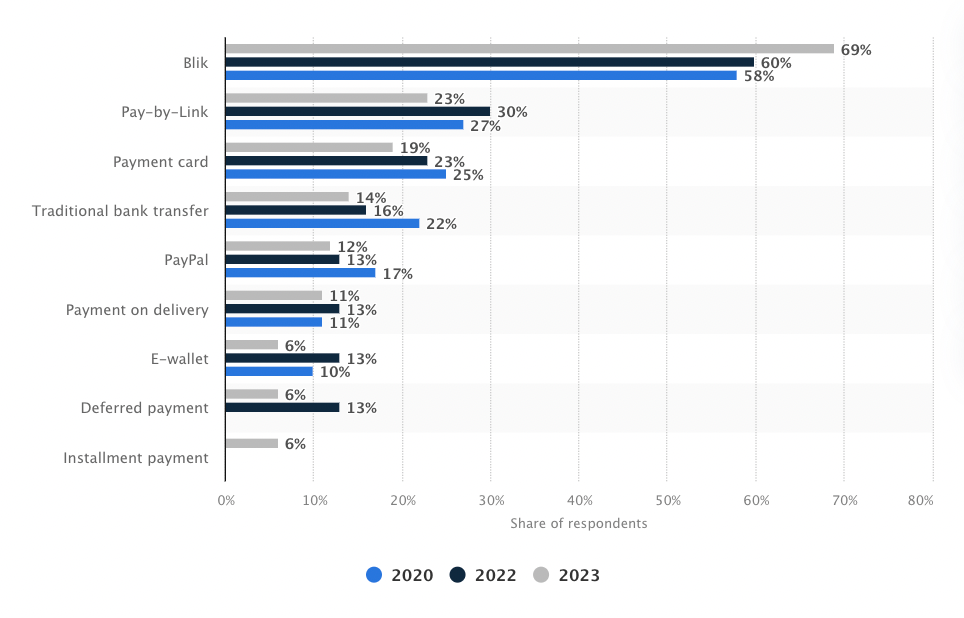

Check out the diversity that has shaped Poland’s payment ecosystem alone:

- BLIK: This method has seen some significant increase lately, from 58% in 2020 to 69% in 2023, making it the most popular payment method among respondents.

- Pay-by-Link: It also shows an upward trend, from 23% in 2020 to 30% in 2023.

- Payment card: The usage has slightly increased from 23% in 2020 to 25% in 2023.

- Traditional bank transfer: There’s a moderate increase from 14% in 2020 to 22% in 2023.

- PayPal: There’s an increase from 12% in 2020 to 17% in 2023.

- Payment on delivery: This method remains stable, with a slight fluctuation, but essentially unchanged in popularity, at around 11-13%.

- E-wallet: There’s a noticeable increase from 6% in 2020 to 13% in 2023.

- Deferred payment: It shows a significant increase from 6% in 2020 to 13% in 2023.

- Instalment payment: Remains the least popular, with no change, staying at 6% throughout the years.

When it comes to its size and constant growth, all of that translates into a market value that makes Poland one of the best e-commerce hubs.

And other CEE countries are to follow, as you’ll see later on.

Cards: (still) for the win

Let’s not forget the good old plastic. Debit and credit cards in CEE aren’t just holding their ground, but are rising. And with most cards being debit, It is clear that we love the control they offer.

For this reason, we’ll also analyze Adyen‘s data on payment methods. Needless to say, it gives us a lot of great examples to follow!

Poles have almost two cards per person – more than Czechs, for example.

It is interesting that Czechs do not use their “wallet” as extensively as Poles, despite having fewer cards per capita:

The Czechs’ preferences for global cards are also similar to the Slovaks’:

And Hungarians:

Cards are forecasted to grow at a compound annual growth rate of 25 percent and will take almost 30 percent of the payment market. As people turn away from cash payments, card usage is rapidly growing in these countries, and Mastercard and Visa are well established.

The list of payment methods does not end there, however.

BLIK: new checkout experience with stellar growth in e-commerce

BLIK is making serious waves in the Polish e-commerce sea. Starting as a local hero it is now a powerhouse, having doubled its user base in just two years. From 2019 to 2021 it exploded, reaching 10 million Polish active users.

BLIK dominates the Polish – and soon, CEE’s – market because it is fast, convenient, and cooperates with all major Polish banks. Maybe comparing the payment experience to being as smooth as silk may sound a bit over the top. Still, it is actually that. The bank app generates a unique 6-digit code, and to pay, you simply enter this code at the checkout on a website or app that accepts BLIK. And that’s it!

Securing online deals, managing bill payments, or peer-to-peer transfers – BLIK covers it all.

Pay-by-Link: The convenient Click-to-Pay solution gaining ground in CEE

You’re shopping online, you hit checkout, and then, with just a few clicks, you select your bank, authenticate yourself, and confirm the transaction. That’s how pay-by-link works. As simple as that. No digging around for cards, no typing out lengthy details. That’s why many people in CEE opt for this method of payment.

In Poland, the pay-by-link method shows an upward trend, with 30% of buyers using it in 2023.

Pay-by-link is available in most Polish banks, extending its reach into Czechia, Slovakia, and even offered to clients of several German banks.

Allegro Pay: New payment method on the block

Allegro Pay is a new, flexible payment option for shoppers on Poland’s most popular online shopping platform, Allegro.

Designed for convenience, it allows users to buy now and pay later, either in full within 30 days or through a choice of installment plans ranging from 2 to 20 months. Such flexibility helps shoppers manage their budgets more effectively, fitting their purchases into their financial plans without immediate pressure.

Setting up Allegro Pay is straightforward and linked to your history on Allegro, using data from both the platform and external databases to determine your starting budget. The service is free to activate and use, with no charges applied if you choose not to make a purchase.

When you use Allegro Pay, your available balance adjusts according to your spending and repayments. This dynamic system encourages responsible spending while providing a buffer for larger or unexpected purchases.

Repayments can be made through various methods like BLIK, bank transfers, or payment cards, ensuring convenience and security. Also, Allegro Pay offers support for refunds and complaints, adding an extra layer of consumer protection.

Want to offer Allegro Pay to your clients? Start selling on Allegro today.

Banking on tradition: shoppers show renewed trust in bank transfers

Alright, let’s talk bank transfers. Old school? Maybe a little. Reliable? Absolutely. Nearly a third of all online transactions in Poland happen through this channel.

Bank transfers have this comforting, old-world charm about them. It is like the financial equivalent of a trusted old friend. Now, in the CEE, that friend is getting quite a bit of attention.

In Poland alone, bank transfers are the reigning champs of e-commerce, raking in a whopping €5 billion in sales. That’s half of all online transactions—pretty impressive, right?

Across the CEE, we’re witnessing a renewed trust in bank transfers. People are leaning into their familiar keyboards to enter IBAN numbers, finding a blend of modern efficiency and traditional security that’s hard to beat. And even with the convenience of cards, bank transfers in the CEE hold their own with an expected annual growth rate of eight percent.

It also turns out bank transfers have a bit of a stealth advantage. They’ve managed to fly under the radar of fraudsters. So, while the rest of the world is busy eyeing the next big thing, shoppers here in the CEE are happy to give a nod to tradition – yet, they are still open to innovative payment methods.

PayPal: expanding its reach in CEE’s digital wallets

PayPal’s appeal lies in its simplicity and ease of use. With just a few taps on a smartphone, transactions are completed in a flash. However, it might not have been the go-to choice for the older generations, who are somewhat hesitant to shift from traditional payment methods. However, as the digital wave swept across the CEE region, PayPal’s convenience and intuitive design began to resonate, especially with the mobile-savvy crowd.

That may be why more and more online e-commerce shops across CEE have integrated PayPal as a payment option, contributing to its rising popularity. There’s been a rise in PayPal’s usage, jumping from 12% in 2020 to 17% in 2023. The steady growth reflects the change in consumers’ preferences towards more agile and secure digital payment solutions.

While bank transfers still have their charm and reliability, in countries like Poland, where they dominate e-commerce transactions, the digital payment environment is changing.

The surge in PayPal’s popularity is a clear indicator that the consumers in CEE are not just clinging to the old but are also accepting the new, seeking a balance between traditional security and modern efficiency.

Pay on delivery: European consumers’ unwavering choice

Pay on delivery is sometimes called cash on demand or cash on delivery. It involves straightforward cash exchange for goods at the doorstep.

In the CEE context, and particularly in Poland, pay on delivery is quite common. The method gives peace of mind to consumers who are wary of online fraud or who don’t have access to online payment systems.

Between 2020 and 2023, payment on delivery has shown a remarkable constancy in its popularity, with just a whisper of fluctuation. The stats speak of a steadfast choice, with 11% to 13% – a range that suggests reliability rather than changes.

E-wallets: The digital surge in payment preferences

Mobile wallets, or e-wallets, are the preferred payment method in many European countries, including Germany. And speaking numbers, 44% of Europeans say they opt for e-wallet apps.

For example, in Poland, back in 2020, e-wallets were just a blip on the radar, accounting for a modest 6% of the payment scene. Fast forward to 2023, and their popularity doubled, snatching up 13% of the market.

On top of that, e-wallets now hold a solid 22% of Poland’s online transactions.

And there are several digital wallets available as diverse as the vibrant streets of Warsaw: such as PayPal, Google Pay, and Apple Pay – all of which can be used both online and on mobile devices.

Buy Now, Pay Later: Deferred payment’s rising popularity in CEE

About one in eight Poles used digital deferred payments for subscriptions in 2023 (15%). It is similar, or even lower, in other CEE countries.

“Buy Now, Pay Later” (BNPL) services are redefining the shopping experience, echoing a global trend that’s reshaping consumer credit. Without the immediate financial pinch, shoppers embrace the flexibility of deferred payments.

The rising trend is clear. This surge in popularity speaks to the evolving mindset of Polish consumers who value the breathing room in their budgets. It is a smart play in today’s economy — get what you need, when you need it, and spread the cost over time. With the promise of manageable instalments, often without added costs, this payment method is not just a temporary blip.

Cash: The enduring contender in the payment landscape

Some might call it a relic, but It has staying power. Cash is tactile and immediate, and for many, it is how business has been done for generations. In Poland, cash on delivery for e-commerce might seem quaint, but for those who shun digital, It is a lifeline.

Cash is no longer as popular in many CEE countries as it used to be, though, as digital payment methods are often just more.

Conclusion

When it comes to online shopping, having lots of different ways to pay is key.

Marketplaces like Allegro lead the way in this aspect, showcasing a versatility that resonates with a broad spectrum of consumers. Each payment method, from traditional bank transfers to innovative solutions like Allegro Pay, adds a unique brushstroke that enhances the overall shopping experience.

Expanding the range of payment options is a strategic move for businesses looking to increase their sales and market presence. It is about tapping into different customer segments’ varied preferences and conveniences. By embracing this diversity in payment methods, you’re not just opening doors to a wider audience but also sending a message of inclusivity and customer-centricity.

***