Preparations for Peak Season 2023 Report

Written by

Editorial TeamPublished on

(Image Source: Parcel Monitor)

As we find ourselves at the beginning of the holiday shopping season, numerous online and e-commerce businesses spanning various sectors are gearing up for the anticipated surge in demand. However, navigating through the peak season entails both opportunities and challenges. Therefore, meticulous preparation and the implementation of a strategic plan are imperative to enhance the likelihood of a successful outcome.

In this comprehensive report, Parcel Monitor delivers a concise overview of the 2022 peak season and delves into essential aspects of gearing up for the ongoing peak season in 2023. The report not only provides valuable insights into the influencing factors behind purchase decisions but also addresses key considerations such as inventory management and delivery forecasting. Additionally, actionable tips are presented to assist businesses in thorough preparation, enabling them to capitalize on the opportunities of peak season 2023, ultimately boosting sales and surpassing customer expectations.

Top Consumer Retail Trends for Peak Season 2023

Understanding and anticipating consumer preferences is essential for the success of any business, particularly during peak season. Here are some pivotal retail trends influencing consumer behavior this season:

1. Product Price Reigns Supreme:

A recent survey highlights that nearly 80% of consumer purchasing decisions are swayed by competitive pricing. In the relentless pursuit of value, consumers actively seek great deals, prompting businesses to optimize their e-commerce pricing strategies. This optimization not only attracts more traffic but also wields influence over conversion rates and comparison engines.

2. Testimonials & Reviews Drive Trust:

(Image Source: Unsplash)

The influence of online reviews and testimonials is undeniable, with approximately 95% of customers relying on them before making a purchase. Whether positive or negative, online reviews significantly impact shopping choices for 93% of consumers. Beyond written testimonials, video testimonials are emerging as a powerful tool. By providing firsthand experiences, these testimonials allow potential buyers to hear and see the product or service in action, strengthening their trust in the purchasing decision.

3. The Power of Free Shipping:

The allure of free shipping remains a compelling factor for consumers, influencing their purchase decisions significantly. According to a recent survey, approximately 59% of shoppers identified free shipping as one of the top considerations impacting their choice to buy a product. Businesses and retailers stand to benefit by leveraging free shipping, not only enticing shoppers to spend but also streamlining the checkout process. Moreover, the implementation of free shipping can contribute to increased average order values and heightened conversion rates.

(Image Source: Pexels)

4. Delivery Timeframes and Consumer Patience:

The satisfaction of a consumer hinges on the delivery experience, making timely deliveries crucial for meeting expectations. While shoppers generally prefer swift deliveries, retailers must navigate the delicate balance during peak shopping seasons, often marked by heightened demand and logistical complexities.

In 2022, consumer expectations were distributed as follows:

- Approximately 24.9% found a delay of 1-2 days beyond the estimated delivery date (EDD) acceptable.

- Nearly 48.4% were willing to tolerate delays of 3-4 days.

- About 21.5% considered a delay of 5-7 days within the acceptable tolerance zone.

- Only 5.3% were patient enough to accept delays extending beyond one week from the EDD.

- In contrast, the landscape in 2023 reflects evolving expectations:

Conversely, in 2023, around 54% of customers now expect to receive their package within 1-2 days of the EDD, a notable increase from 24.9% in 2022. Likewise, 32% of shoppers are still able to remain patient for their orders within a 3-4 day window. Unfortunately, consumer’s patience for deliveries spanning 5-7 days has significantly plunged, with only about 11% of respondents prepared to accommodate delays of this extent.

Peak Season 2022 Recap

Instabilities in Parcel Volume Growth during Peak Season 2022

Despite economic uncertainties, U.S. consumers eagerly embraced online shopping during the 2022 Black Friday and Cyber Monday (BFCM) sales, spending up to $11.3 billion on Cyber Monday alone — a 5.8% increase from the previous year (2021). The surge in online shopping was complemented by a revival of in-store purchases, marking a shift in consumer behavior. Notably, parcel volumes during Black Friday and Cyber Monday 2022 increased by 54.4%, showcasing the evolving dynamics of consumer preferences.

In contrast, Europe witnessed a slowdown in peak season growth. Parcel volumes during BFCM 2022 only increased by about 64.2% as compared to nearly 69.7% in BFCM 2021. This reduction was in line with previous estimates of reduced growth during the peak season.

Meanwhile, Australia experienced a remarkable increment in parcel volumes during BFCM 2022. This occurred at a growth rate of 45.1%, exceeding the growth rate of 38.3%, which was witnessed in BFCM 2021. This growth can be attributed to the fact that Black Friday is becoming more popular across Australia. Several Australian shoppers now prefer “holding out for Black Friday, instead of buying on the sales that launched early.”

Delivery Challenges During Peak Season 2022

The surge in parcel volumes during peak season in 2022 brought about logistical challenges, with carriers and recipients adapting to unique strategies. In the Netherlands, 73.1% of delivery issues were attributed to carriers and logistics networks, while in Switzerland, carriers contributed to 32.9% of delivery problems. The United States faced delivery challenges, with carriers causing 77.0% of issues, and recipients responsible for 23.0% due to their absence during delivery.

(Image Source: Parcel Monitor)

Strategic Tips for Peak Season 2023 Readiness

1. Elevate Customer Satisfaction through Precision

First and foremost, the importance of providing precise EDDs cannot be overstated, especially during the bustling peak shopping season. In an era where consumers crave seamless online shopping, transparent package delivery with reliable EDDs allows them to plan effectively, reducing uncertainties and elevating their shopping experience.

Moreover, an accurate delivery forecast can contribute to customer satisfaction and empower retailers to optimize internal operations, encompassing warehousing, staffing, and transportation. This optimization not only reduces logistics and operating costs but also facilitates effective coordination with carriers and third-party logistics providers, ensuring the efficient dispatch, transport, and delivery of packages.

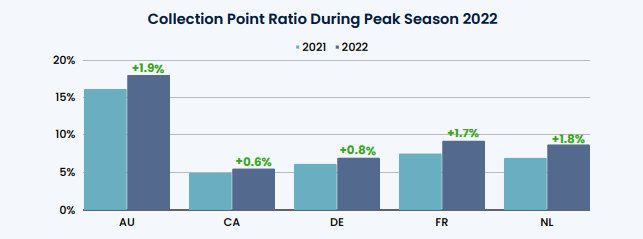

2. Embrace Sustainability with Collection Points

(Image Source: Unsplash)

Next, online retailers and businesses can champion sustainability during peak season by offering Collection Point (CP) options — providing consumers with parcel pickup locations or click-and-collect services as eco-friendly alternatives to traditional home delivery. This environmentally conscious choice allows customers to conveniently collect their packages from designated points, such as lockers or stores, promoting a greener approach.

(Image Source: Parcel Monitor)

The CP ratio, as illustrated in the accompanying chart, exhibits a noteworthy upward trend across multiple regions. Notably, Australia experienced an increase from a 16.1% CP ratio in 2021 to 18.0% in 2022, reflecting evolving consumer behavior and a growing environmental consciousness. Similar trends were observed in France, Germany, Canada, and the Netherlands, emphasizing a global shift towards sustainability in the logistics industry. This collective effort by retailers, shoppers, and logistic providers signifies a commitment to reducing the carbon footprint on the environment.

Download the full report here for more insights!

About Parcel Monitor

Parcel Monitor is a trusted source of e-commerce logistics data insights for professionals. Leveraging on proprietary data and technology, Parcel Monitor captures consumer trends, provides market visibility, and derives actionable insights while fostering collaboration across the entire e-commerce and logistics industry.

***