Top 500 European E-commerce Cross-border Players

Written by

Editorial TeamPublished on

Cross-Border Commerce Europe published its annual report ranking the top 500 European e-commerce players, focusing on their cross-border performance. Check out its key findings!

(Image Source: pixabay.com)

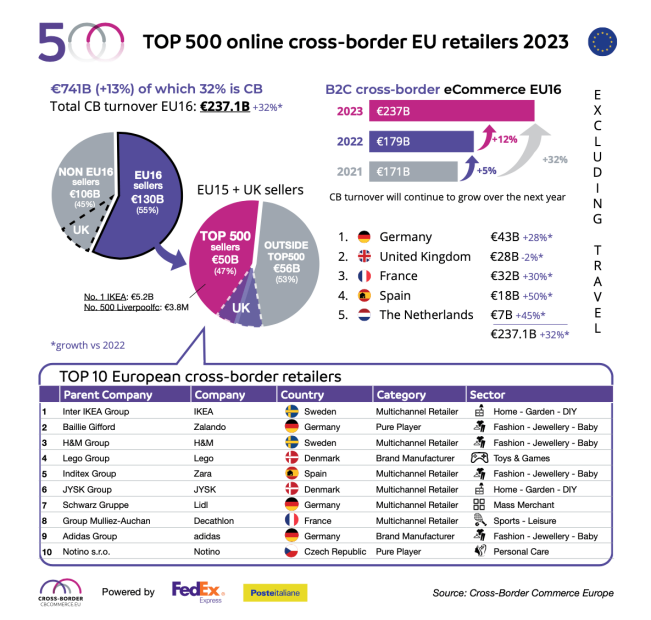

- In 2023, the EU’s online cross-border market surged to €237 billion (excluding travel), representing a remarkable 32% year-on-year increase, reports the latest release of the “TOP 500 B2C Cross-Border Retail Europe” compiled by Cross-Border Commerce Europe. This major research paper covers and ranks the 500 strongest European players with a focus on cross-border performance.

- According to the report, within this landscape, European webshops contributed €107 billion to cross-border turnover, while the overall B2C online turnover for goods in Europe witnessed a 13% growth, soaring to €741 billion.

However, despite these impressive figures, the Cross-Border TOP 500 report signals a decline in turnover, grappling with challenges stemming from an unstable macroeconomic environment, logistical complexities, and fierce competition from US and emerging Chinese brands such as Shein and TEMU. In 2023, the Gross Merchandise Value (GMV) of the TOP 500 plummeted by 18% to €50 billion.

Moreover, key findings from the TOP 500 report showcase the top 10 “Elite” European retailers for 2023 as follows:

- IKEA

- Zalando

- H&M

- Lego

- Zara

- Jysk

- Lidl

- Decathlon

- Adidas

- Notino

These top 10 entities collectively account for 19% of the TOP 500’s total sales, with IKEA leading the pack with €5.2 billion in cross-border turnover.

Other findings from the report:

- Brexit poses a significant challenge to the UK’s cross-border sales, which have dwindled to a historic low of -1.8%, generating €27.5 billion compared to €28 billion in 2022. Challenges stemming from Brexit-related VAT regulations, import duties, and logistical intricacies have contributed to this decline, resulting in Germany surpassing the UK as the leading cross-border market in Europe.

- Within the TOP 500, there’s a noticeable shift towards brand manufacturers, with an 8% increase observed in companies like Lego, Nespresso, Adidas, and Philips, strengthening their direct-to-consumer channels. Despite these shifts, pure players and marketplaces remain steadfast, collectively holding 42% of the TOP 500. Fashion, jewellery, and footwear continue to dominate the market with a 39% share, followed by home, garden, and DIY products at 13.3%.

- However, European marketplaces within the TOP 500 are facing stiff competition from American and emerging Chinese contenders, including marketplaces and social media apps, struggling to match the scale and agility of these formidable newcomers.

- Amidst aggressive pricing and a vast product selection from Chinese e-commerce platforms, European companies should prioritize quality, reliable delivery times, community engagement, and localized services to maintain their market presence amidst fierce competition. Notably, major European fast-fashion retailers like Inditex (Zara) and H&M have demonstrated resilience against the rising Chinese influence, with strategies such as store closures and digital enhancement to adapt to evolving industry trends.

- Last but not least, the emergence of social commerce platforms like TikTok Shop and Instagram represents a significant market disruption. It is imperative for European sellers to embrace social commerce as a strategic imperative to remain competitive in the ever-evolving retail landscape.