A Comprehensive Analysis of the Swiss E-commerce Landscape: The RetailX Switzerland E-commerce Report

Written by

Kinga EdwardsPublished on

The RetailX Switzerland E-commerce Report 2022 provides an in-depth analysis of the Swiss economy from an e-commerce and multichannel retail perspective. The report, released in September 2022, offers a wealth of insights into the Swiss market, consumer behavior, sustainability trends, and the future of e-commerce in the country.

Swiss Economy and E-commerce

Despite the downgraded growth forecast due to the Russian invasion of Ukraine, the Swiss economy is well-positioned for continued post-pandemic recovery. Characterized by a wealthy household sector, a resilient and well-diversified external sector, and a robust labor market, Switzerland’s economy is showing signs of strength. The Swiss franc has strengthened, and inflation remains relatively low, providing a stable environment for e-commerce growth.

Switzerland is a developed market for e-commerce, topping last year’s United Nations Conference on Trade and Development (UNCTAD) global e-commerce index. The affluent Swiss population is accustomed to online shopping, making Switzerland the world’s 21st-largest market for e-commerce. The report highlights a 13% increase in e-commerce in 2021, demonstrating the sector’s dynamic growth.

E-commerce Revenue and Sector Growth

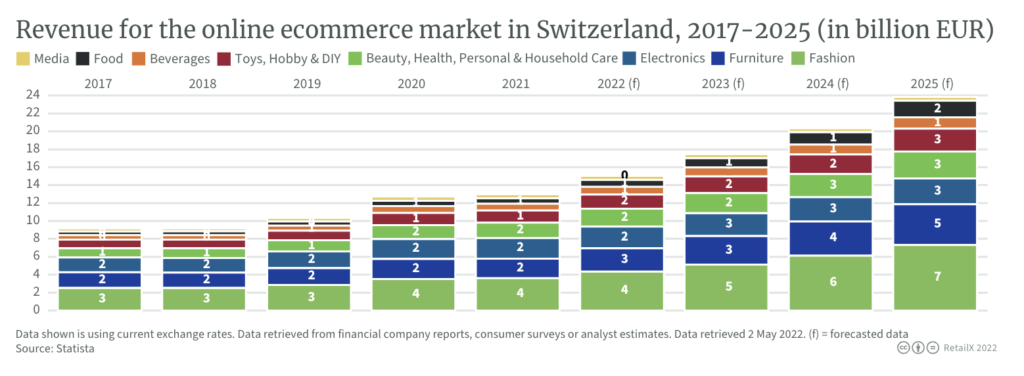

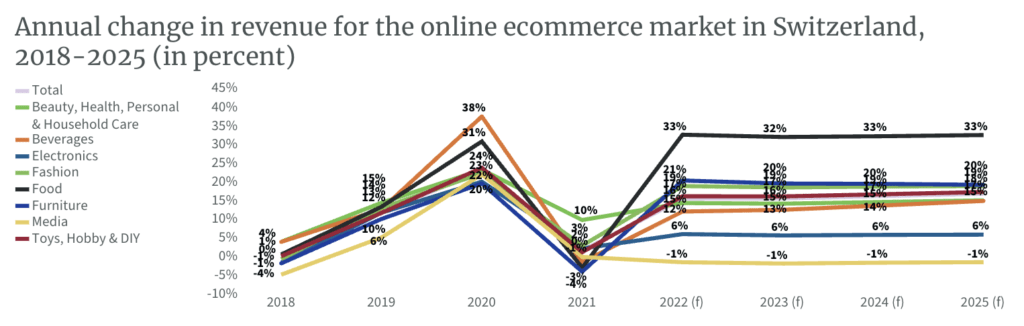

Total revenue from e-commerce in Switzerland is projected to reach an impressive €24bn by 2025. The nation boasted 6 million e-commerce users in 2021, with the lucrative fashion sector leading the charge, with a projected €3bn increase to €7bn. Furniture holds second place, with a projected increase from €3bn to €5bn. Meanwhile, the electronics sector looks set to increase its share from €2bn in 2022 to €3bn in 2025, as does the Beauty, Health, Personal & Household Care sector. The Toys, Hobby & DIY sector remains steady at €2bn.

During 2020, some online shops reported an increase in turnover of up to 1,500 percent. The data shows a dramatic uptick in revenue for Switzerland’s e-commerce market during the Covid-19 Pandemic year of 2020. This was followed by a period of readjustment in 2021, with steady growth predicted thereafter.

Consumer Behavior and Preferences

Swiss consumers still have a significant preference for offline shopping, but this is steadily eroding. In 2017 only 11% had a preference for online shopping, but in 2022 this is forecast to rise to 22%, increasing to a projected 27% by the middle of the decade. With no major population changes, the total number of users for Switzerland’s online e-commerce market is set to remain at 6 million.

Electronics is the big winner of the past five years, having risen from 3 million to 5 million users, and projected to reach 6 million by 2025. Fashion continues to rise, from 3 million in 2017 to a projected 5 million in 2025. Most of the other sectors are projected to gain an additional 1 million users over the next three years.

Examining the share of users for the online e-commerce market in Switzerland, a full 70% of users are from the 25-54 age range, with the splits between 25-34, 35-44, and 45-54 being remarkably equal. The smallest share of users is also the youngest (18-24) while the next smallest is the oldest group (55-64).

Cross-Border E-commerce

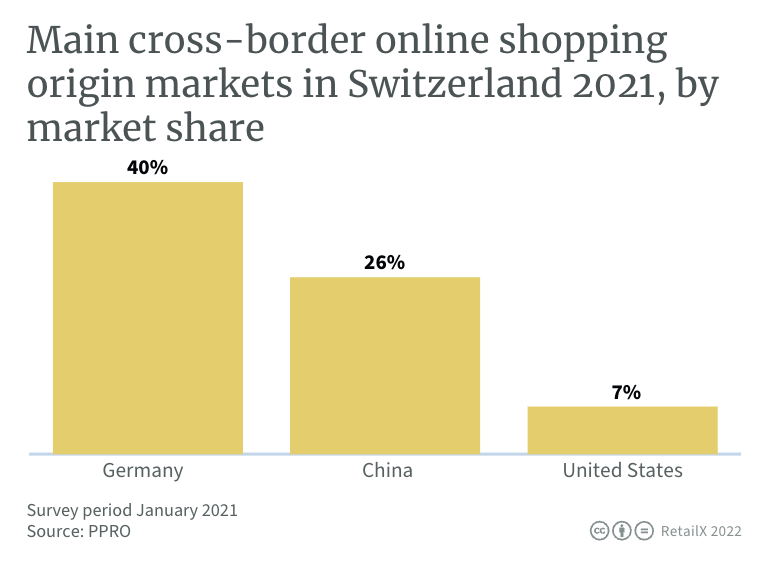

Switzerland’s neighbor Germany dominates in this sphere, with a predictably competitive performance. Germany, China, and the United States are the main cross-border online shopping origin markets in Switzerland in 2021, with market shares of 40%, 26%, and 7%, respectively.

Swiss consumers have long had a tradition of crossing the border into Germany for shopping trips, lured by lower prices and the tantalizing prospect of a refund for VAT. The rise of e-commerce means that Swiss shoppers can now take advantage of German markets without having to leave their homes.

Unlike neighboring Germany, global trade rivals China and the United States are separated from Central Europe by vast geographical distances. However, these two powerhouses have the requisite economic muscle to make trading with Switzerland a favorable prospect.

For items ordered online for shipping to Switzerland from the US, it’s all about the brands – including such names as Gap, Ralph Lauren, and Victoria’s Secret. In principle, Swiss customers need to pay customs duties and Swiss VAT on any product ordered from abroad. However, as the information portal of the Swiss authorities points out, “In practice, customs duties and VAT below CHF5 are not invoiced. You can also avoid these charges if the value of your order does not exceed CHF200 (including packaging and delivery.”

Conclusion

The RetailX Switzerland E-commerce Report 2022 is a valuable resource for any e-commerce brand or retailer looking to understand and navigate the Swiss market.

***

Are you looking to stay in the loop with the latest news, trends, and interviews? Look no further! We’ve got the ideal answer for you!