CEE delivery methods: likes, dislikes, and preferences

Written by

Kinga EdwardsPublished on

Delivery methods are not just a logistical concern – they are a pivotal aspect of customer satisfaction and business success. Initially, it was about IF the package is delivered, but now it’s also about HOW and WHEN it’s delivered. E-commerce players are forced to rethink their logistics and check if they are up to par.

This is especially true in the diverse market of Central and Eastern Europe.

Here, understanding and aligning with customer preferences in delivery can be the difference between a thriving e-commerce business and one that struggles to connect with its potential customers.

Our goal today is to walk you through delivery methods, customer preferences, and other interesting delivery facts that you need to know about CEE.

The Dominance of Parcel Machines and Eco-Friendly Trends

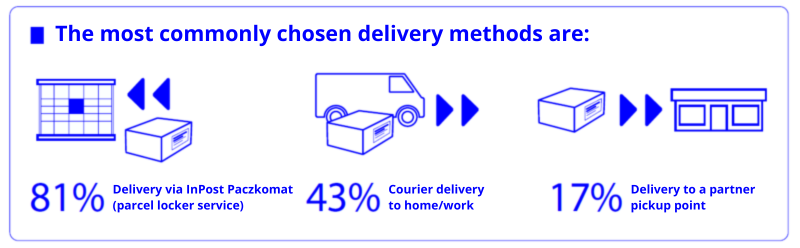

One of the most striking trends in the CEE region is the overwhelming preference for automated delivery methods, particularly parcel machines. In Poland, for instance, “Delivery to the parcel machine” saw an increase in preference from 81% in 2022 to 82% in 2023 (Statista).

Allegro, one of the largest CEE marketplaces, confirms this data right here, highlighting parcel machines as the most popular delivery method selected on their platform.

This delivery way is closely contested by “Delivery to a partner point (e.g., Zabka, Orlen, Ruch),” which decreased slightly from 18% in 2022 to 17% in 2023.

The data suggests a strong preference for automated and self-service delivery methods, such as parcel machines, which may indicate a trend towards convenience and flexibility in delivery options. However, it also reflects a growing consciousness towards eco-friendly delivery options. Automated parcel machines reduce the carbon footprint associated with traditional delivery methods, making them an attractive choice for the environmentally conscious consumer.

Does it mean that nobody uses post services? Well, traditional methods such as postal delivery and courier services remain significant but do not show substantial growth. This fact could be particularly useful for e-commerce businesses and logistics providers when considering the integration or expansion of automated parcel pickup points in CEE. E-commerce business owners might want to make this a mandatory part of their checklist when it comes to conquering CEE markets.

Home Delivery As A Constant in the Changing Landscape

Despite the rise of automated – or semi-automated – solutions, home delivery via courier remains a significant preference in the CEE region. In Poland, around 42-43% of consumers preferred this method in 2022 and 2023 (the same research as above from Statista). This consistency indicates that while consumers are open to innovative delivery methods, the reliability and personal touch of home delivery still hold substantial value. E-commerce businesses need to balance these traditional methods with emerging trends to cater to a diverse customer base.

All of the e-shops in Poland in 2020 offered courier service as a delivery method.

Main Delivery Challenges: Reducing Wait Times and Costs

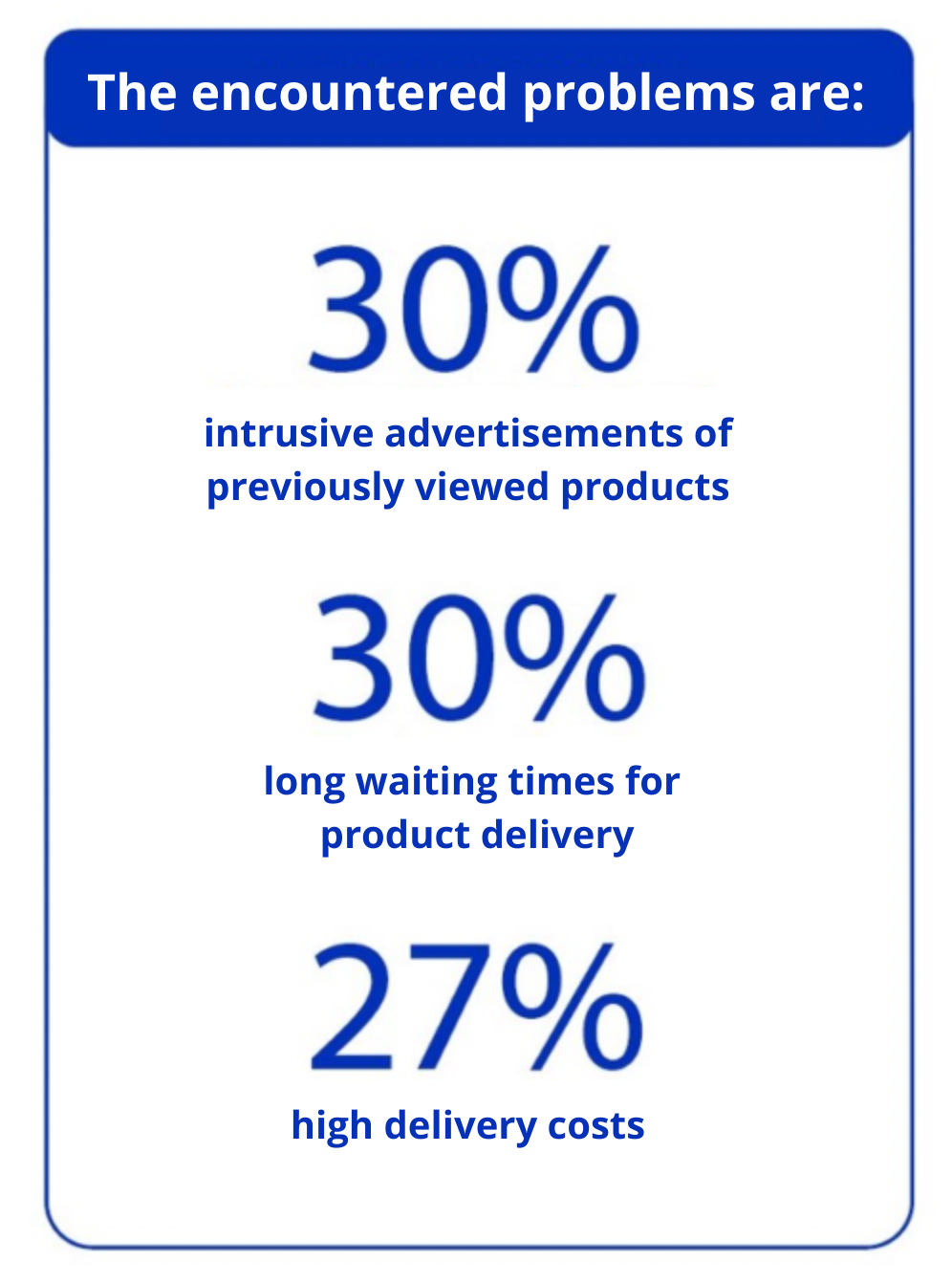

Long wait times and high delivery costs are significant pain points for many CEE consumers. The 2023 E-commerce Report by IAB Poland highlights that 30% of consumers are concerned about long delivery times, while 27% are deterred by high costs.

According to the same report, 53% of customers would happily complete their purchases if delivery costs were lower. This shows that e-commerce businesses shouldn’t become complacent when it comes to the delivery methods they offer. The things that work and are affordable today might not be the same tomorrow.

Addressing these challenges requires e-commerce businesses to optimize their logistics and perhaps consider local partnerships to expedite deliveries and reduce costs.

Consumer Drivers: Beyond Speed and Convenience

While speed and convenience are crucial, other factors also drive consumer preferences in CEE. And delivery should never be neglected – Barometr Retail indicates that 15% respondents prioritize that aspect in their shopping decisions.

According to expert comments in the Gemius report, it’s not only free shipping that can influence a particular customer choice.

Various forms of delivery are generally motivating for online shopping, with free delivery with free carrying, close proximity to a parcel machine, the ability to manage shipments from the app, as well as weekend delivery and instant same-day home delivery particularly motivating.

Delivery that takes place within 12 hours motivates 83% of respondents to shop more often. Free delivery, as we already mentioned, comes also as a motivating factor, with the higher the value of the products purchased, the more frequent the expectation of free delivery.

Many consumers are accustomed to ordering products at very late and early hours, and another thing that sparks satisfaction is delivery at the users’ designated location. E-commerce businesses must consider these varied preferences to enhance their appeal and encourage repeat purchases.

Vibrant and Competitive Array of Shipping Providers

Shipping providers in the Central and Eastern European (CEE) region offer unique opportunities for online businesses in the e-commerce delivery landscape.

In Lithuania, Omniva stands out as the preferred choice for over half of the online stores, commanding a 55.5% share. However, the market remains far from monopolistic. Other key players like Lietuvos Paštas, DPD, Venipak, and Itella carve out significant niches, ensuring a healthy competitive environment.

This scenario is mirrored in the Czech Republic, where Česká pošta leads with a 73.0% share, but companies like PPL, DPD, Zásilkovna, and GLS are also making substantial inroads. Interestingly, Zásilkovna and Czech Post are the most favored among Czech consumers, highlighting a slight divergence between merchant preferences and consumer choices.

The Slovakian market tells a similar story, with Slovenská pošta at the forefront, chosen by 36.8% of online stores. Yet, the presence of Packeta, DPD, Slovak Parcel Service, and GLS indicates a market ripe with options and opportunities for e-commerce businesses. Hungary’s e-commerce scene is dominated by GLS, which is preferred by 59.5% of online stores. However, Magyar Posta, FOXPOST, DPD, and Pick Pack Pont also hold considerable market shares, reflecting a diverse and dynamic market.

Poland’s e-commerce delivery landscape is led by InPost, which has captured the preference of 62.8% of online stores. Yet, the market is far from being a one-player game. DPD, DHL, Poczta Polska, and UPS (United Parcel Service) also play huge roles, contributing to a multifaceted and competitive environment.

As e-commerce matures in the CEE region, this diversity is a sign of both competition and development. You can read more about it here.

Click and Collect with Increasingly More Trust

In recent years, the ‘click and collect’ service has emerged as a favored choice among Europe’s leading retailers, with an impressive 73% adoption rate. This method allows customers to conveniently retrieve their online purchases at designated physical locations, offering a practical alternative to traditional home deliveries.

The shift towards such innovative delivery options reflects a changing landscape in consumer preferences and retail strategies. The onset of the pandemic further accelerated this trend, as ‘click and collect’ provided a viable solution for businesses to maintain operations while adhering to safety protocols. Looking ahead, with projections indicating a substantial turnover of $86.1 billion in 2023, it’s clear that ‘click and collect’ is set to become a staple in the European e-commerce scene.

The Future of Fulfillment in E-Commerce

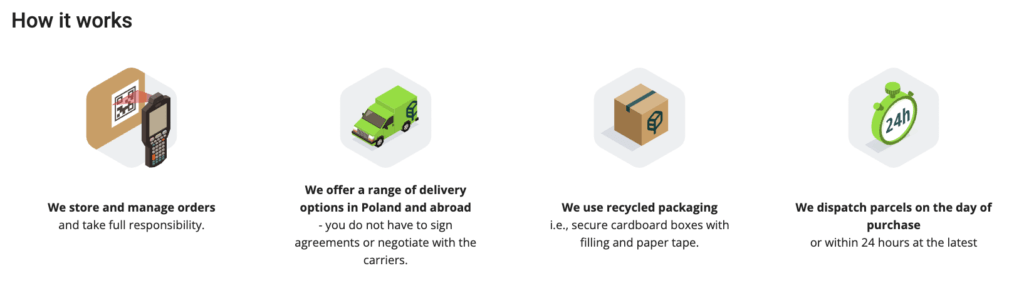

Efficient delivery is fundamental in e-commerce – and now, fulfillment services are at the heart of this efficiency. Allegro’s One Fulfillment stands out as a powerful tool for business growth, as it streamlines both the order processing and shipping process.

Consider the impact of Allegro’s One Fulfillment on sales: a significant 56% increase for Allegro’s top 60 sellers. This impressive statistic highlights the effectiveness of integrating a well-oiled fulfillment system into your business operations.

Allegro’s service is particularly notable for its expansive reach, too.

With One Fulfillment, your products gain exposure to over 22 million monthly online visits and over 14 million active buyers in Poland. And now, the expansion into the Czech market and beyond opens new doors for your business, offering opportunities for international commerce at no additional cost.

For you as a seller, this means more time to focus on developing and sourcing your products. While Allegro takes care of the logistics, from warehousing to delivery, your attention can remain on expanding your product line and enhancing your brand. It’s a strategic move that places your business in a position to thrive amidst market competition.

Adopting Allegro’s One Fulfillment goes beyond mere logistical convenience. This decision comes with broader market access and a boost in sales, which can transform your business.

An integrated fulfillment service like Allegro’s is becoming increasingly important to a successful online business model in the e-commerce industry. So, how about giving it a go?

Allegro’s One Fulfillment team will assist you in expanding your delivery options in Central and Eastern Europe to maximize your growth.

Innovative Delivery – The Next Frontier in E-Commerce

The future of e-commerce delivery in CEE looks poised for innovation. We might see an increase in AI-driven logistics, drone deliveries, and hyper-local distribution centers – and CEE is not afraid of adapting these! These advancements could revolutionize how products reach consumers, offering unprecedented speed and convenience. Staying abreast of these trends and being ready to adopt new technologies will be crucial for e-commerce businesses aiming to lead in the CEE market.

Building Confidence through Transparency

Transparent delivery processes play a vital role in building this trust. Providing customers with real-time tracking information and ensuring clear communication can enhance customer satisfaction. The EU authorities require the whole delivery cost to be specified before the purchase. Customer loyalty is encouraged through this approach, which not only builds trust, but also fosters a sense of reliability and professionalism.

Conclusion

How can e-commerce businesses not only meet but exceed customer expectations, paving the way for long-term success in the vibrant CEE market? Delivery plays a huge part here.

Businesses should focus on providing timely and accurate delivery information, as well as offering convenient payment options. They should also strive to create an enjoyable customer experience by providing excellent customer service.

In addition, they shouldn’t be afraid of new delivery options and flexibility for their current and prospective clients. Clients in CEE are increasingly looking for convenient delivery options. Allegro Smart! – a free delivery program with over 5 million users – comes as one of the most popular options across e-commerce customers not only in Poland, but in the entire CEE area. Join Allegro and boost sales with the biggest marketplace in Central Eastern Europe.

Delivery is only one component of your e-commerce success in CEE, though. You need to take care not only for your products to be delivered, but also seen and promoted. Check out our blog for more articles on e-commerce in CEE and beyond!

***