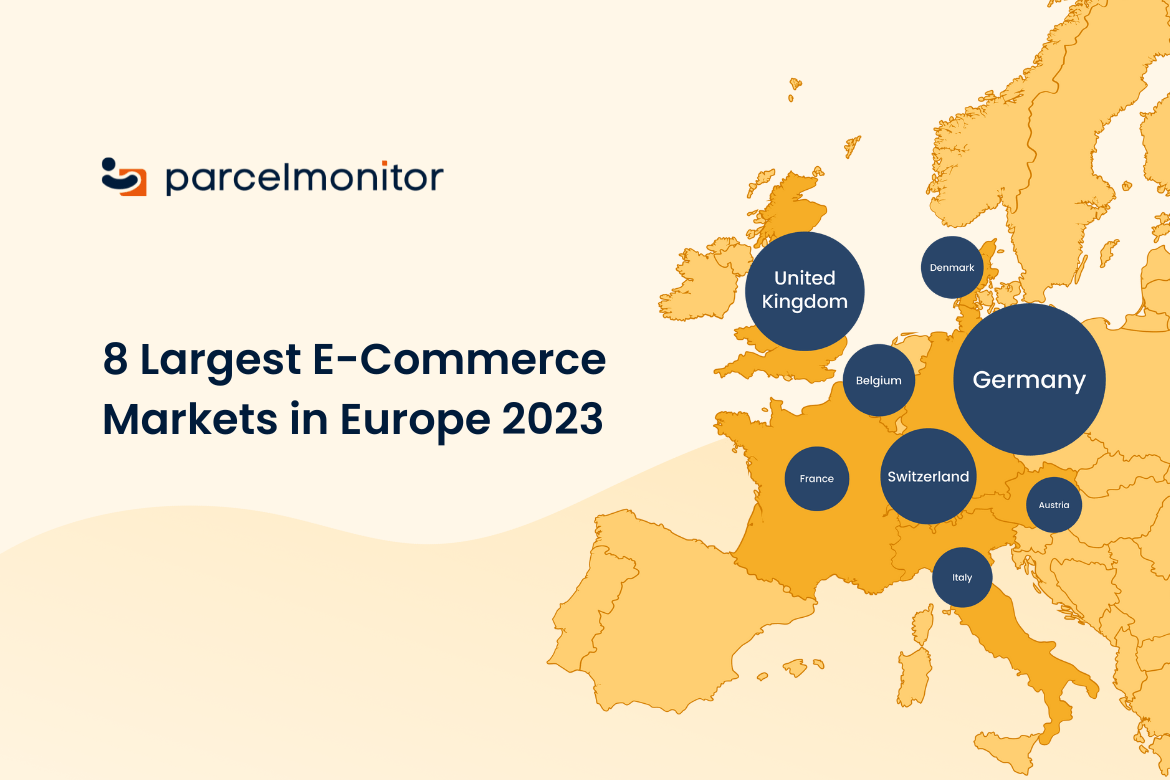

Parcel Monitor: 8 Largest E-Commerce Markets In Europe 2023

Written by

Editorial TeamPublished on

(Image Source: Parcel Monitor)

In the dynamic landscape of global commerce, Europe stands out as a formidable force, boasting a diverse and thriving e-commerce ecosystem. As the curtain falls on the year 2023, it’s time to cast a retrospective glance at the e-commerce landscape in Europe and assess the transformative journey that unfolded over the past twelve months.

From the bustling streets of London to the vibrant markets of Berlin, the e-commerce revolution has permeated every corner of the continent, reshaping the way businesses operate and consumers shop. As we explore the intricate web of online commerce, it becomes evident that each country brings its own unique flavor to the digital table, contributing to the richness and complexity of the European e-commerce tapestry.

Germany

Germany is presently the sixth biggest market in the world, making it a powerful force in the e-commerce industry. According to eCommeceDB’s forecasts, by 2023, income would reach an astounding US$114.8 billion, exceeding even that of countries such as India. The German e-commerce industry is expected to develop at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2027, and by that time, it will have grown to a sizable market size of US$137.1 billion.

(Image Source: Unsplash)

Offering a wide range of items for almost any need, Amazon.de is the clear leader among the major companies in the German online retail market. Amazon’s dominance has surely been aided by its Prime shipping option, which guarantees speedier delivery for subscribers. The fact that fashion giant Zalando and multichannel German e-retailer Otto are in the top three online giants further emphasizes the competitiveness and variety of Germany’s e-commerce market.

The German e-commerce logistics system is renowned for its efficiency, which is demonstrated by the comparatively fast packet transit time of 1.26 days. With a first-attempt success record of 94.8%, this dedication to operational excellence is further demonstrated and sets the standard for successful deliveries. 7.41% of parcels in Germany are routed to pick up stations, demonstrating the strategic nature of the country’s parcel management system.

Furthermore, 50.2% of these shipments are remarkably picked up within the first twenty-four hours, suggesting a quick and effective procedure for client pickups. This timely collection rate indicates the efficiency of the German parcel collection system while also improving consumer fulfillment.

United Kingdom

Currently ranked as the third-largest e-commerce industry globally, the United Kingdom is expected to generate an impressive US$157.4 billion in sales by 2023, with additional growth expected to reach US$187.0 billion by 2027. Fashion holds a prominent position in the UK market, accounting for the highest portion of overall e-commerce sales with a remarkable 28.7%.

Electronics comes in second, with 16.8%, while Hobby & Leisure comes in third, with a healthy 15.9%. A 2022 poll offers insights into the complex preferences of UK consumers beyond the numbers. Remarkably, 96% of customers consider the option to pay with cash on delivery to be a critical component, highlighting the importance of alternative payment methods in the UK e-commerce market.

(Image Source: Unsplash)

With 93% of customers viewing eco-friendly delivery options (such as parcel lockers) as a crucial component of online purchasing, sustainability emerges as a major theme. Beyond delivery options, UK internet consumers are also environmentally sensitive, with a preference for items with sustainable features and eco-friendly packaging.

When it comes to operational effectiveness, the UK sets high standards. The average parcel transit time of 1.6 days indicates a dedication to prompt and efficient delivery. Furthermore, the success rate for first-attempt deliveries is a noteworthy 94.3%, demonstrating a high level of success in delivering products on the first try.

France

France, a thriving center of the European e-commerce market, is the eighth largest market, expected to generate US$70.2 billion in revenue by 2023—more than Indonesia. With a projected CAGR of 4.7%, the market is expected to rise steadily and reach a value of US$84.3 billion by 2027. The anticipated 1.2% rise in France in 2023 makes a substantial contribution to the global growth rate of 8.7%, which is in line with the global upsurge in e-commerce sales.

(Image Source: Unsplash)

Even though France has a thriving e-commerce industry, operational effectiveness is still crucial. With an average packet transit time of 1.9 days, the French e-commerce industry places a strong emphasis on punctual delivery. The logistics system’s ability to successfully complete deliveries on the first try is demonstrated by the impressive 90% first-attempt success rate.

Furthermore, the CP ratio, which stands out at 8.37%, suggests that parcel management is being approached strategically. In the context of e-commerce logistics, dwell time is a critical parameter. In France, it is 47.8%. This measure shows the percentage of packages that are held at collecting locations prior to being picked up by clients. One of the reasons France is regarded as a leader in e-commerce operations is the effectiveness of its package transit times and its strategic parcel management.

Belgium

(Image Source: Pexels)

Located at the intersection of Europe, Belgium is now the 39th largest e-commerce market and is expected to surpass Algeria by 2023 with projected sales of US$7.16 billion. With a dominant 24.2% of the nation’s overall e-commerce income, Hobby & Leisure is the market leader in Belgium.

In Belgium, online shopping has increased significantly over the years; by 2022, over two-thirds of the population will be doing their shopping online. The proportion of e-commerce in retail sales in Belgium is growing as the trend of online shopping continues, highlighting the growing significance of digital commerce in the nation’s retail environment. Belgium is a leader in the field of operational efficiency. Belgian e-commerce demonstrates its dedication to timely deliveries, with parcels arriving in 1.21 days or less.

Impressively, the first-attempt success rate is 92.7%, demonstrating how well the logistics system works to ensure successful delivery on the first try. Furthermore, the ratio of collecting points (CP) is 10.2%, and an astounding 46.9% of shipments from these locations are picked up within a day.

Belgium’s year-over-year package volume rise of 3.65%, which indicates a vibrant and growing e-commerce scene, adds to this efficiency. This expansion strengthens Belgium’s position as a major player in the global e-commerce story by highlighting its agility and endurance in satisfying the growing expectations of its online customer base.

Check out Parcel Monitor’s full article for the rest of the list!

About Parcel Monitor

Parcel Monitor is a trusted source of e-commerce logistics data insights for professionals. Leveraging on proprietary data and technology, Parcel Monitor captures consumer trends, provides market visibility, and derives actionable insights while fostering collaboration across the entire e-commerce and logistics industry.

***