European Ecommerce Overview: Romania

Written by

Kinga EdwardsPublished on

Scroll down for Romania’s e-commerce overview, featuring essential data on market trends, consumer habits, payments, social media, and more.

Romanian e-commerce in 2026 feels like that moment when a local street market suddenly gets a sleek app and next-day delivery. People already live online, so shopping online is a normal habit.

If you’re selling into Romania (or building a store for Romanian buyers), the usual pain points are: trust, delivery speed, returns, and pricing transparency. Romanian e-commerce is growing, but it still has gaps you can use. For example: only 12% of Romanian SMEs sell online, which means buyers still face uneven choice in some categories, and new entrants can stand out with sharper service.

The fastest wins tend to be unglamorous. Clear delivery promises. Clean product info in Romanian. A support flow that answers real questions, not scripted ones. Do those well and Romanian e-commerce customers reward you with repeat orders and word of mouth.

In this guide you’ll get a clear snapshot of Romanian e-commerce, how people shop, and how they like to pay, so you can make decisions without guessing.

Romanian e-commerce overview

Zoom out and you’ll see Romanian e-commerce sitting in an interesting spot in Europe. It’s big enough to matter, and still young enough that good execution wins. Local analysts quoted by Ziarul Financiar estimate Romania’s e-commerce market reaches about €12.8 billion in 2025, with growth expected to keep going into 2026.

Another way to look at the same story is the share of the economy. Romania’s e-commerce sector was expected to hit 3.5% of GDP in 2025, placing it in the EU Top 10 by “E-GDP” (e-commerce as a slice of GDP), and it ranks 3rd in Central and Eastern Europe after Poland and the Czech Republic.

Marketplaces matter here because they shape expectations and pricing pressure. eMAG is a good example of the scale Romanian e-commerce can reach: a Base.com overview cites 56,000+ sellers, 120 million+ monthly visits, 7.4 million+ active customers in the last 12 months, and 30 million+ listed products in 2024.

That marketplace gravity means shoppers compare very hard. If your prices float, your conversion drops. If your stock story looks messy, they bounce. Consistency is your competitive edge here.

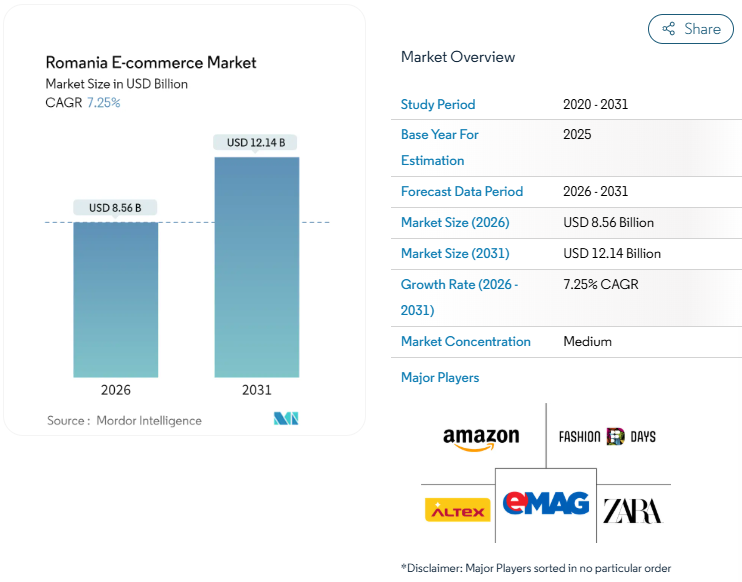

Depending on how a report counts marketplace sales, services, and cross-border orders, you’ll also find smaller “market size” estimates. Mordor Intelligence pegs Romania’s e-commerce market at $8.56 billion in 2026 and $12.14 billion in 2031.

So what does that mean for your strategy? Romanian e-commerce rewards basics done well.

- Clear product pages. Fast answers. Simple returns. And a checkout that doesn’t fight the customer.

- It also rewards patience. In many categories, the demand is there, but buyer routines are still forming, so your brand gets remembered when you don’t mess up the boring parts.

Customer behavior in Romania

Romanian e-commerce buyers are online a lot, and they’re getting more comfortable clicking “buy” across more moments in their day. In 2025, 74.3% of internet users aged 16–74 bought goods or services online over the previous year, based on Romania’s National Institute of Statistics.

Shopping intensity matters too, because it shapes your campaign cadence and inventory planning. Almost 59% of internet users made an online purchase in the last three months, while 26.6% bought something between three months and one year ago.

People also buy more than “stuff.” In 2025, transport services were the most common online purchase type (65.4%), followed by tickets for events (52.2%). That’s a useful signal for any brand selling goods: Romanian shoppers already trust online checkout for time-sensitive needs, so your job is to make physical products feel equally low-risk.

There’s a clear urban–rural split, but it’s not a “don’t bother” situation. In 2025, 77.6% of internet users in urban areas shopped online, versus 70.6% in rural areas. That gap is real, yet it also hints at easy wins: clearer product info and calmer customer support can pull rural shoppers over the line when competitors look unreliable.

Age and education shape behavior as well, and this is where segmentation can get simple. In 2025, 86.4% of people aged 16–34 bought online, compared with 55.1% among people aged 55–74. Online buying is also far more common among people with higher education (93.7%).

Device habits are another quiet driver. Romania had 25.3 million mobile connections at the beginning of 2025, equal to 133% of the population. Mordor Intelligence also estimates smartphones accounted for 73.85% of the Romania e-commerce market size in 2025.

If you want to reduce friction for these shoppers, focus on how they decide. Make comparisons easy. Show delivery dates early. Put sizing, warranty, and return terms where the thumb can reach. Romanian e-commerce customers don’t need fancy promises. They need proof that you’ll deliver what you show.

Romanian payment methods

Payment is where Romanian e-commerce can surprise outsiders, mostly because “cash culture” still shows up in modern checkout flows. A Business Review report on 2025 peak-season payments notes that cash on delivery remains around 51% of total orders, and the value of COD orders rose by about 5%.

Cards are still a major pillar, especially in bigger cities and for repeat buyers. Credit and debit cards held a 45.62% share of Romania’s e-commerce payment methods in 2025.

Under the hood, the digital payments market is scaling fast, which usually pushes more buyers toward online card payments and wallet-style checkouts over time. An OECD competition working paper cites a projected total transaction value of about $38.31 billion for Romania’s digital payments sector in 2025.

Cash rules also nudge businesses toward non-cash flows. A 2025 overview of Romania’s cash ceilings lists a fine of 25% on the amount that exceeds the cap, which is one reason many merchants prefer to keep transactions traceable and tidy.

If you’re building a checkout for 2026, keep an eye on installment options too. BNPL in Romanian e-commerce payments is expected to grow at an 11.68% CAGR through 2031.

What to do with this as a merchant? Treat COD as a trust tool. Use it to win first orders, then move people to cards with small incentives and clear communication. Keep card payments smooth, with local-friendly gateways and fewer redirects. And keep the failure rate low: in Romanian e-commerce, a failed payment often means a lost customer, not a “try again later.”

Social media in Romania

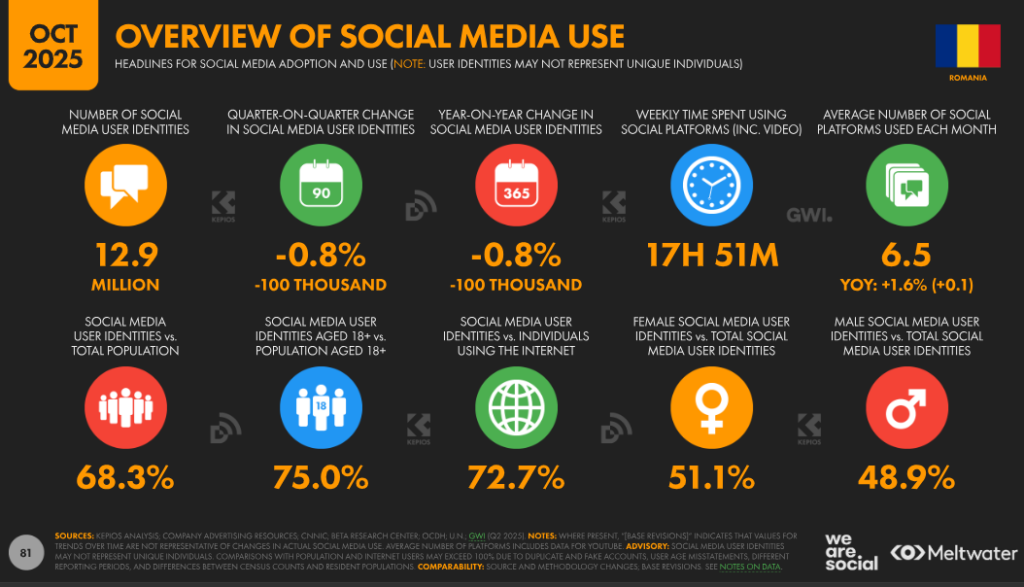

If you want Romanian e-commerce to move, you need to show up where people scroll. In late 2025, Romania had 12.9 million social media user identities. That is a huge audience for product discovery, reviews, and “I’ll buy it later” wishlists.

Facebook still matters for Romanian e-commerce, mostly because it’s where broad audiences hang out. Meta’s tools showed 10.3 million Facebook users in Romania in late 2025.

What works here is simple: clear product photos, short copy, and a direct next step. Your ad can sell, but it also needs to answer basic questions fast. Size, delivery time, warranty. People will ask in comments, and those comments can turn into free FAQs.

Instagram is your “taste” channel. It’s the spot where brands win on look, vibe, and social proof. DataReportal reports 6.0 million Instagram users in Romania in late 2025.

For Romanian e-commerce, this is a strong match for fashion, beauty, home, fitness, and giftable stuff. Think short Reels that show the product in real life. Not polished studio magic. Real hands, real rooms, real results.

TikTok is a discovery engine now. DataReportal shows 8.71 million TikTok users aged 18+. It was used by 62% of users at least once in September 2025.

It also skews young. A Reuters report from 2025 cited TikTok data showing about 64.6% of TikTok’s Romanian user base was aged 18–24.

So, if your Romanian e-commerce plan targets students, first-job budgets, trend-driven buys, or impulse categories, TikTok can carry a lot of weight. Keep videos tight. Show the “before vs after” or “problem vs fix.” Put the price and the hook early.

LinkedIn is smaller, but it’s loud in the right circles. DataReportal lists 5.30 million LinkedIn members in Romania in late 2025.

If your Romanian e-commerce play is B2B (wholesale, office supplies, business software, packaging, equipment), LinkedIn can bring leads that convert with fewer clicks. Post case notes. Share quick numbers from a client story. Keep the tone plain and practical.

One last thing: don’t treat social as “top of funnel only.” In Romanian e-commerce, people use social media to check trust. They look for comment sections, creator reviews, and how a brand reacts when something goes wrong. Reply like a human. Be fast. Be clear. That’s half the battle.

Logistics in Romania

Okay, but people can love your product and still abandon the cart if delivery looks messy. The good news: Romania’s delivery networks keep getting denser, and lockers are turning into the default for a lot of buyers.

A big signal comes from SAMEDAY. In a 2025 press release, the company said it invested over €80 million in 2025 across tech, capacity, and network growth. They were also ready to process up to 1 million parcels per day during the Black Friday rush. Plus, their easybox network in Romania passed 7,700 active points after growing by over 20%.

They also shared a detail that tells you how “normal” lockers have become: one SAMEDAY locker per 3,500 residents, and an average 6-minute walk to an easybox nationwide (4 minutes in Bucharest).

During Black Friday, SAMEDAY expected over 4 million parcels delivered to easyboxes across the campaign period.

FAN Courier tells a similar story from another angle. In its January 2026 press release, FAN Courier said it invested about €40 million in 2025, with around €20 million directed to expanding its locker network.

It also highlighted a new sorting system with a capacity of 30,000 parcels per hour. And it shared a forward-looking number that matters for Romanian e-commerce planning: in 2026, FAN Courier estimated 25% of total deliveries would happen via lockers.

So what do you do with this, as a store owner or a brand entering Romanian e-commerce?

Start with the checkout. Make delivery choices easy to compare. Put locker pickup next to home delivery, not hidden behind extra clicks. People pick the option that feels predictable.

Then focus on clarity. Show dispatch time in plain language. Share tracking early. Set expectations for peak weeks. A buyer who knows what’s happening is less likely to spam your support inbox.

Also, plan returns like a real process, not a “later problem.” In many categories, the return experience is part of the product. Labels, drop-off options, status updates. Keep it simple for the shopper.

If cross-border is part of your plan, note that the infrastructure keeps moving. SAMEDAY said it began shipping parcels to any EU country via its web platform or app in 2025.

That does not remove all the hard parts (customs, rules, customer service), but it’s a sign the network is thinking beyond local routes.

To sum up

Romanian e-commerce in 2026 feels fast and very practical. Social media drives discovery and trust. Logistics decides if the sale sticks.

If you’re building in Romanian e-commerce, keep your social content real and responsive. Then make delivery look easy, with lockers and clear tracking front and center.

Do those two things well, and you’ll spend less time fixing problems after the order. You’ll spend more time growing.

If you are interested in other Balkan countries, you can find similar articles about Bulgaria and Croatia.