How embedded protection is enabling retailers to meet consumer needs

Written by

Editorial TeamPublished on

Today’s consumers are seeking more personalized shopping experiences while still enjoying the ease and convenience of shopping online. . In short, consumers want to feel as though the brands they care about, care about them. One way retailers can appeal to consumers is through embedded protection.

The embedded protection model provides insurance and warranty offers at the point of transaction, so customers don’t need to navigate away from their checkout to access protection. Not only does it facilitate a more convenient purchase journey, it also creates more meaningful touchpoints that deepen the relationship between the retailer and customer. For the retailer, that means increased customer satisfaction and brand loyalty, as well as repeat business.

In order for the embedded protection model to be truly impactful, the end-to-end experience must be thoughtfully crafted. The rise of insurtechs have heralded a more tech-focused approach to protection. From streamlined processes to APIs that do it all, protection is no longer an afterthought but an integral part of the customer journey.

Cover Genius, the insurtech for embedded protection, works with the world’s largest digital companies to deliver relevant protection to customers around the globe. Their solutions are available at Amazon, Flipkart, eBay, Wayfair, Shopee and more.

In this article, you’ll find a summary of a report on embedded insurance in retail — conducted by PYMNTS and commissioned by Cover Genius — as well as a case study with one of their retail partners showcasing the value of the embedded model.

The demand for embedded: The Embedded Insurance Report — Retail

The Embedded Insurance Report — Retail explores consumer sentiment toward embedded protection. Analyzing survey response data from more than 2,700 US consumers, it shows how the option to buy insurance and warranties, from the retailers they shop, can affect consumers’ spending habits. Respondents were also asked whether having the option to buy protection for items bought online might change their spending habits if offered for future purchases.

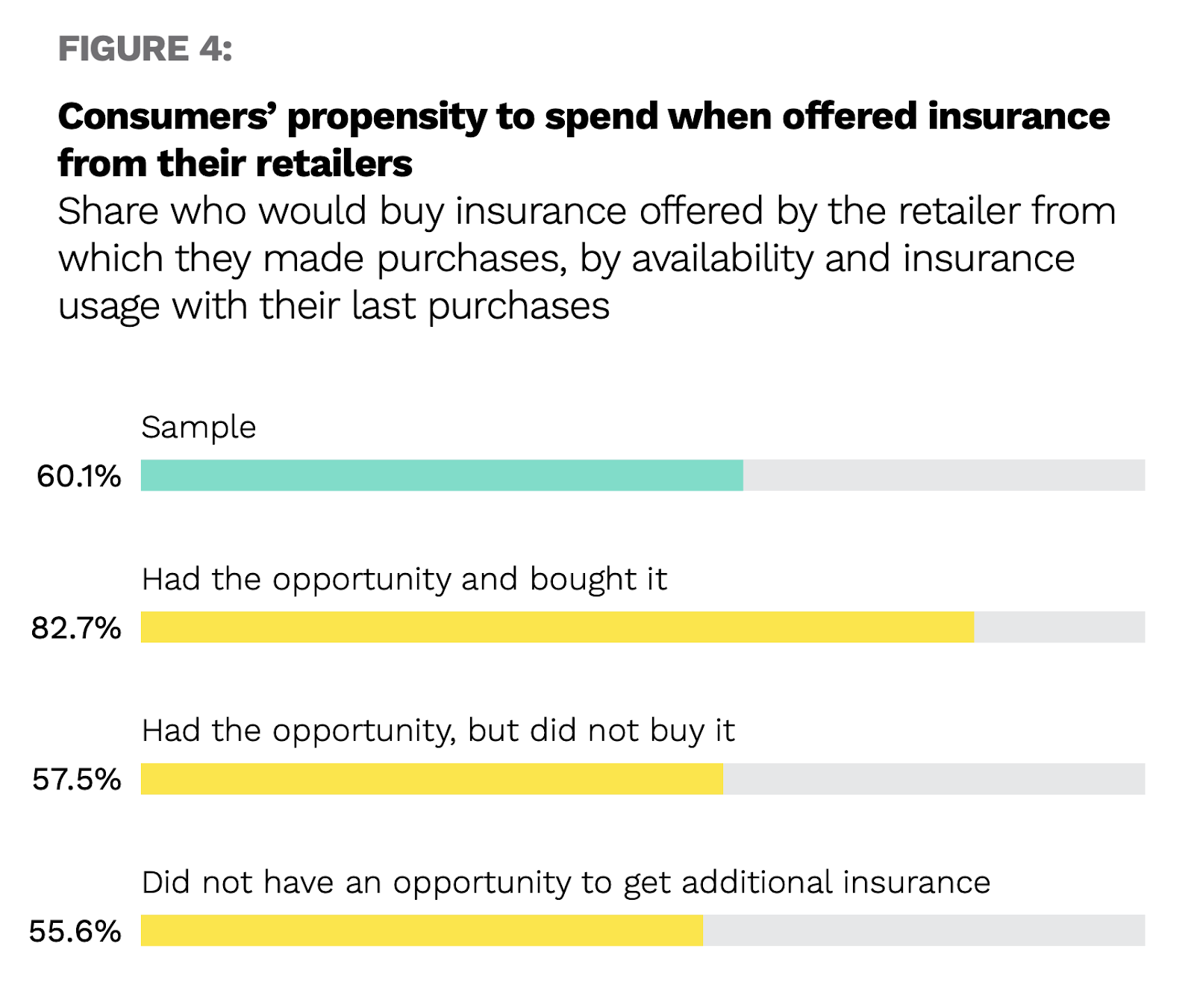

Results from the survey revealed consumers want protection from their retailers. 60.1% of consumers said they would buy protection from their e-commerce retailers if it were offered at checkout. 86.7% of respondents who were offered insurance with motor vehicle purchases and 48.1% of those with jewelry purchases bought it. The data suggests that consumers trust the retailers they shop from, and would be interested in purchasing value-added services and products directly from their favorite brands.

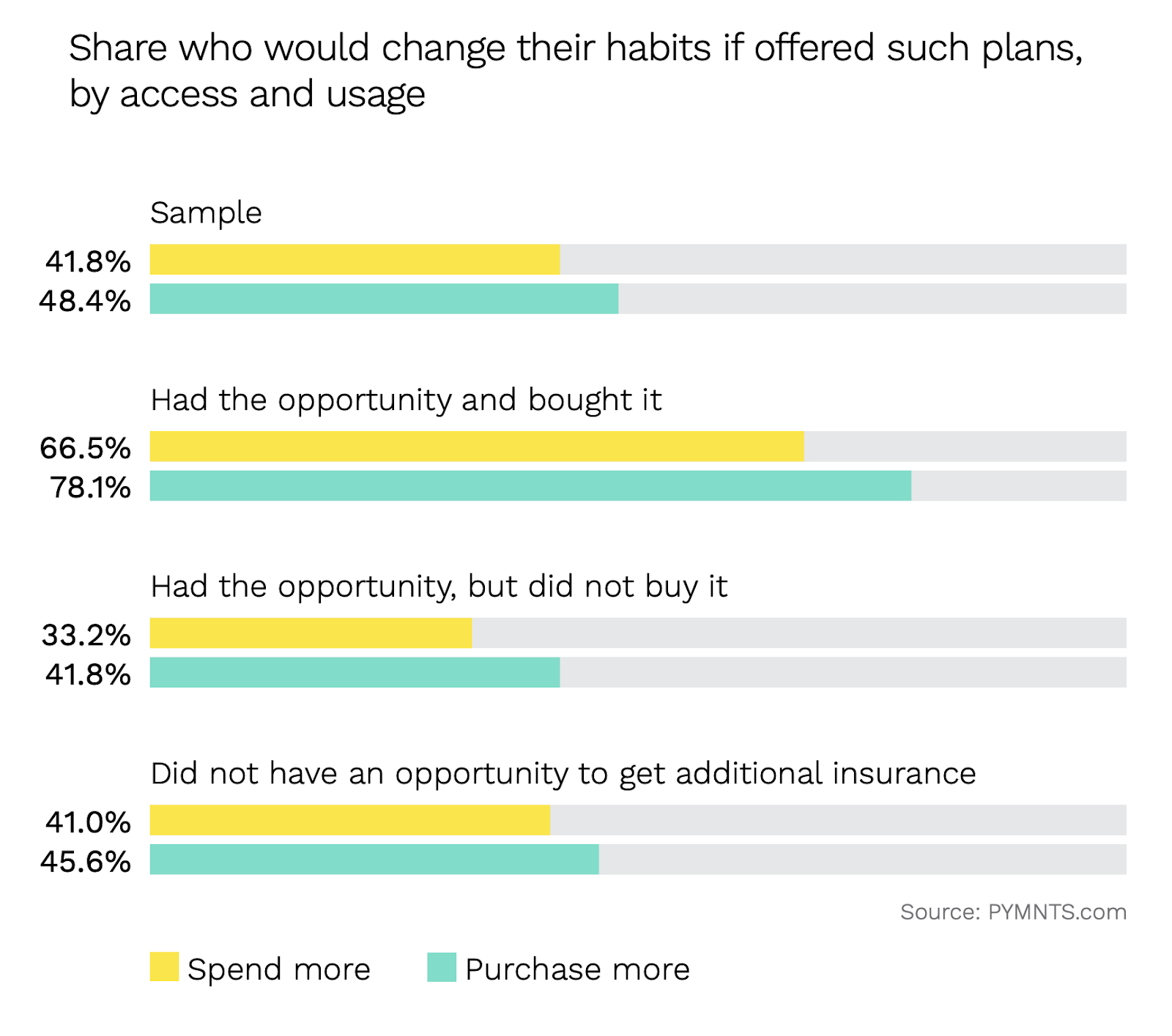

This significant ‘halo’ effect extends to their overall shopping behavior as well. Approximately 66% of consumers say that having the option to get insurance at the checkout would entice them to spend more, leading to an overall higher average order value.

Additionally, consumers who are offered protection options at checkout for their online purchases appear willing to buy a higher volume of goods from e-commerce retailers than those who are not. 78% of customers said they would have a greater propensity to buy more goods online if offered warranties and insurance at the checkout, as it ensures a sense of security that their items are protected in the case something goes wrong, especially with more expensive items.

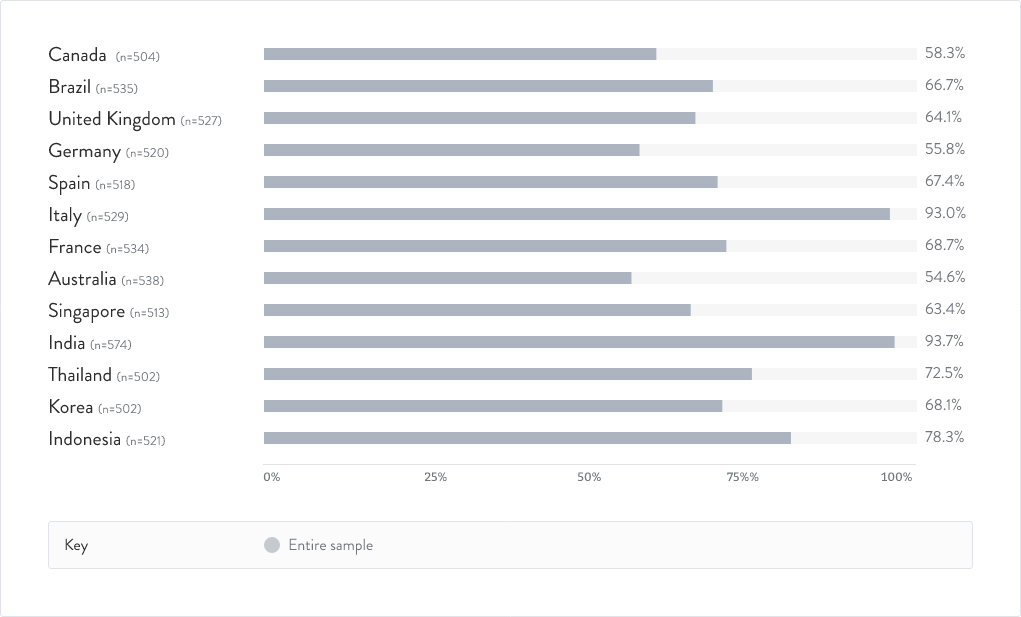

These findings are further supported by follow-up studies commissioned by Cover Genius in 14 countries on consumers’ appetite for receiving embedded insurance offers via their bank or other fintech apps. The groundbreaking Embedded Insurance Report For Banks, Neobanks and Fintechs found that 70% of global consumers who made major purchases showed a strong preference for receiving transaction-based offers. This preference for embedded shows up in other industries as well, including travel and property, driven by a consumer desire for convenience.

Offering protection at checkout can boost customer engagement and overall CLTV, as these protection products can be auto-renewed or set as a subscription service to ensure customers keep coming back. Data shows that once customers purchase protection for their items, there is a strong likelihood of a repurchase — 82% of respondents who bought protection from a retailer would do so again in the future.

Case study: Global online retailer sees 513% revenue growth from warranty sales in four weeks

As a large global online retailer that has long prioritized its customer experience, Cover Genius’ partner understood the value that a multi-line insurance and warranty distribution platform could bring to both its customers and its business. Through integrating with Cover Genius’ award-winning global distribution platform, XCover, the partner can now provide its customers with warranties and insurance across a variety of product categories.

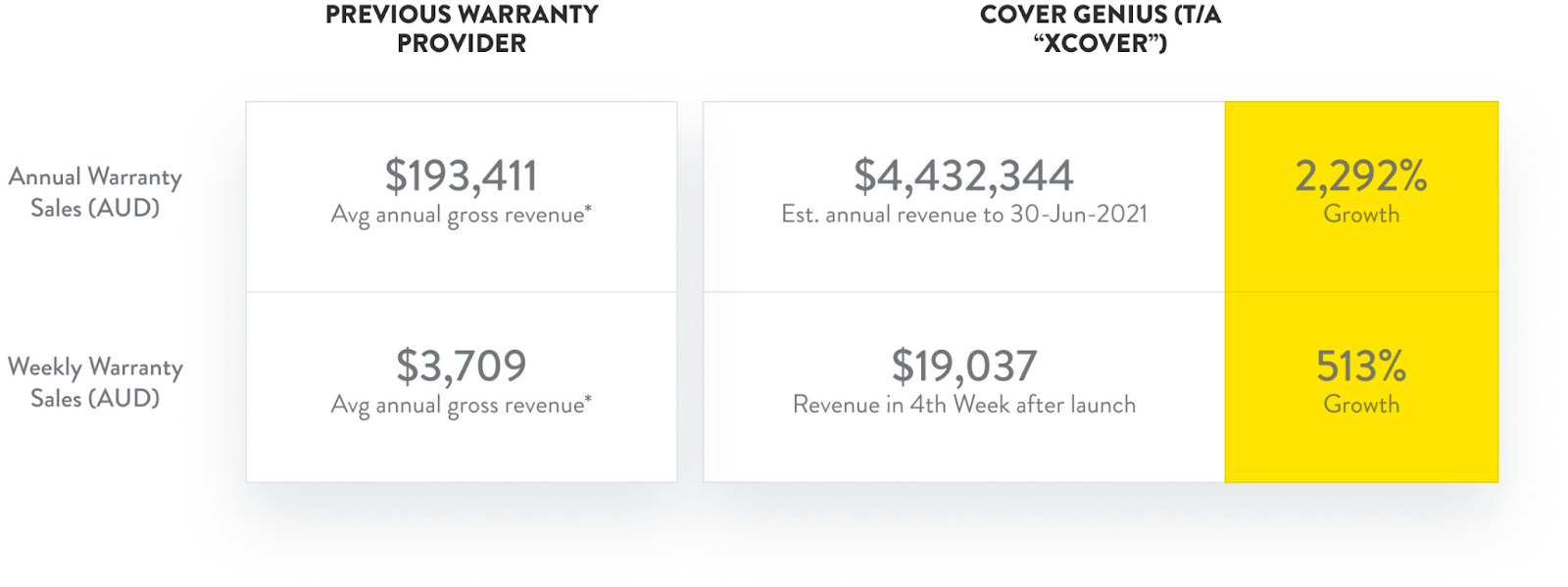

The introduction of tailored product protection through the partnership led to significant growth for the partner within just a few short weeks of launch, as seen here in the side-by-side comparison of the predecessor warranty provider and XCover.

*All sales have been extrapolated based on publicly available data as sales volume and prices are available for all items in our partner’s marketplace

Since integrating with the XCover platform to offer multiple types of product insurance and warranties in the purchase path, the partner achieved 513% growth in the sales of protection products almost immediately after launch, with sales increasing from an average of $3,709 per week with the previous warranty provider to $19,037 per week by Week 4.

The data suggest a further 41% increase in warranty sales by the end of 2021, and, given much of the sales are annual policies sold as a subscription, on a lifetime value basis the number is expected to compound each year, with 2023 achieving 3X the sales figures for 2021.

Customization

Using its BrightWrite data analytics and experimentation platform, Cover Genius examined historical and real-time sales data to determine optimal pricing on each line of product insurance offered to customers. In this way, they were able to encourage conversions by offering prices that best suit a diverse range of customers. Profitability was improved by removing expensive coverages. For example, damage was removed from drones and bikes and a light depreciation schedule was added for some categories after a claims loss ratio review.

They increased the addressable market by introducing more types of protection suitable for 12 new categories — including jewelry, merchandise and musical equipment — that the partner previously did not offer.

The addition of these categories allowed the partner to capture a wider pool of customers making different types of purchases. Approximately one in three categories now offer XCover Protection, with more categories added continually. Cover Genius also added tailored protection, in particular benefits for theft and shipping, to build trust for customers who are newer to online shopping. The results broadly concur with research from the Embedded Insurance Report — Retail that showed average order value increases when warranties are available at checkout.

Automation

Following the success of Apple Care, Cover Genius launched one of the world’s first independent subscription warranty programs. The program ensures that customers receive protection for the life of the item. At any time, whether it’s because the item has been sold or consigned to the trash can, customers can cancel their policy that otherwise automatically renews each year (XCover ensures that the term is configurable too).

The recurring protection is coupled with a streamlined claims process to ensure high customer satisfaction and uninterrupted coverage with zero retention costs and very low churn rates. The partner’s customers also benefit from easy-to-understand policy documents, a fully digital process for repairs and replacement, and instant payments of approved claims.

Expansion

As an insurtech that can quickly create and adjust products to changing circumstances and customer needs, Cover Genius was able to make adjustments that led to immediate impact. Using Natural Language Processing, they identified a significant number of insurable items with prices as low as $30, meaning customers were missing out on the benefits of XCover. Thousands of other categories and items are also parsed using NLP to assess their insurability, ensuring sustained growth for the foreseeable future.

Future Growth

Further initiatives include additional warranty products for categories including jewelry, memorabilia and auto parts. BrightWrite’s dynamic pricing engine will also further optimize yield and BrightWrite will help ensure that AOV (average order value) improves by offering additional protection and various incentives and offers that drive up attach rates while reducing subscriber churn.