European ecommerce overview: Austria

Written by

Kinga EdwardsPublished on

Learn about e-commerce Austria: in-depth analysis, consumer behavior, and essential facts to help your business thrive online.

Austria stands for an A in the DACH shortage. With over 9,111,924 inhabitants, this country is divided into eight federal states and is a member of the European Union, Schengen zone, and the United Nations.

What about the ecommerce Austria details? Do Austrians shop online very often? Do they have any habits? We discussed all the Austrian e-commerce aspects below.

Ecommerce Austria: overview

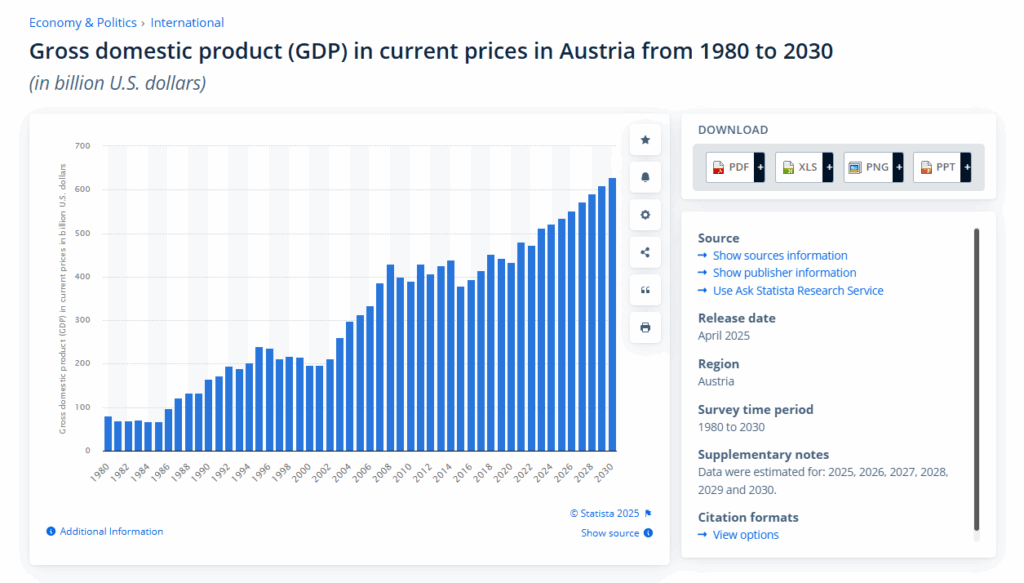

Austria is recognized for its robust economy, with a GDP of $521,64 bln in 2024. Moreover, its GDP is projected to increase by a total of $106.99 billion between 2024 and 2029. This growth represents an increase from previous years and highlights the expanding online shopping landscape in Austria.

The largest sectors in ecommerce Austria in 2024 were clothing (€2.4 billion), electrical appliances (€1.3 billion), and furniture (€0.9 billion). However, when it comes to online share, the highest was in categories like toys, sports, and then clothing – accordingly 35%, 34%, and 30%.

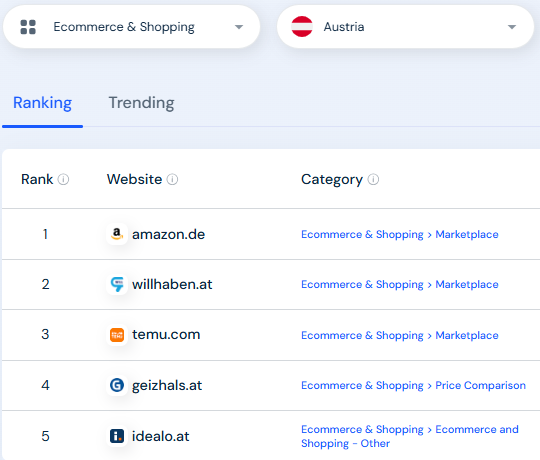

Not surprisingly, Amazon.de ranked first among Ecommerce & Shopping websites in Austria. At the podium are also willhaben.at, geizhals.at, and idealo.at.

These figures indicate a thriving e-commerce environment in Austria, driven by diverse product categories and the strong presence of e-commerce sites like Amazon.

Consumer behavior

Austrian shoppers are quite serious when it comes to online buying. Internet penetration is super high — about 95.7% of Austrians use the internet. That’s ~8.58 million people. Plus, in 2025, Austrians are expected to spend around €11.6 billion online. That’s roughly €1,270 per person.

Online’s share of total retail consumption is climbing, too. It was about 14%, now ~15.5%. It may reach new records next year.

We already know that Austrians buy mainly clothing. Yet, electronics are also strong (€1.3 billion). Furniture and home goods follow with €0.9 billion. Interestingly, leisure, hobby, and DIY stuff are doing well too. Toys, sporting goods, footwear — there’s real interest. These “lifestyle” categories pull in solid numbers.

Age plays a part. The 15-29 bracket is the most active online buyer. About 58% of their online spend goes to foreign webshops. Yet, buying abroad drops with age: only about 50% of people over 50 buy from foreign webshops. Thus, cross-border shopping is a big theme too. Why? Often better selection, sometimes lower price. Austrians are okay buying from abroad if shipping + delivery are reasonable.

Shoppers in Austria also care more about sustainability and value than just flash. Many check for good quality, durability, ethical footprint. Brands that show responsibility tend to win trust.

Payment preferences

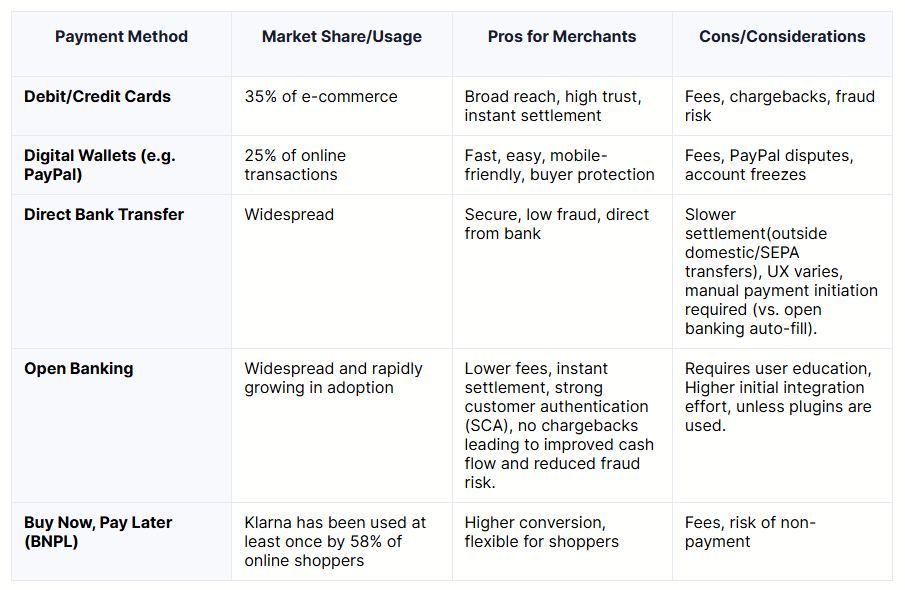

Payment in Austria is kind of in a sweet-spot: part tradition, part modern tech. People still trust old school ways (bank transfers, local systems), but digital and instant methods are catching up strong.

Cards are big. Debit cards are more commonly used than credit cards. Austrians seem to prefer “spend what you have” over going into credit. Debit + credit card payments made up about 35% of online transactions in recent years.

Digital wallets are also a thing. PayPal leads, but wallets like Apple Pay, Google Pay are getting more popular. They make checkout faster and feel safer for many people, especially when they already trust those brands.

Bank transfers are still strong. Austria has systems like EPS and SEPA, which many people use for online payments. For local shops, they’re trusted. For cross-border, bank transfers are used too, but often with slower settlement.

“Buy Now, Pay Later” (BNPL) is growing. More Austrians are interested in spreading payments over time, especially for bigger purchases (fashion, electronics). It’s not dominating yet, but it’s a rising star.

However, another widely used payment method is the EPS (e-payment standard) system, which allows secure online bank transfers directly from Austrian bank accounts. This method is particularly favored for its security and integration with local banks. With three million Austrian bank account holders, EPS is a trusted payment solution in the DACH region’s payment ecosystem.

Payment safety

The cybersecurity market is one of the fastest-growing ICT sub-sectors in Austria, with an estimated market volume of $745 million by 2028.

This country has established specialized anti-fraud units within the Federal Ministry of Finance. These units, including the Anti-Fraud Office and Financial Police, work to detect and prevent fraud, ensuring the protection of consumers and businesses.

Also, Austria enforces strict data protection regulations, aligned with the EU’s General Data Protection Regulation (GDPR), to safeguard consumer information and prevent misuse.

Social media

Austria’s social commerce market is heating up. In 2025, it’s expected to hit about $1.18 billion. That’s up ~12.5% over the prior year.

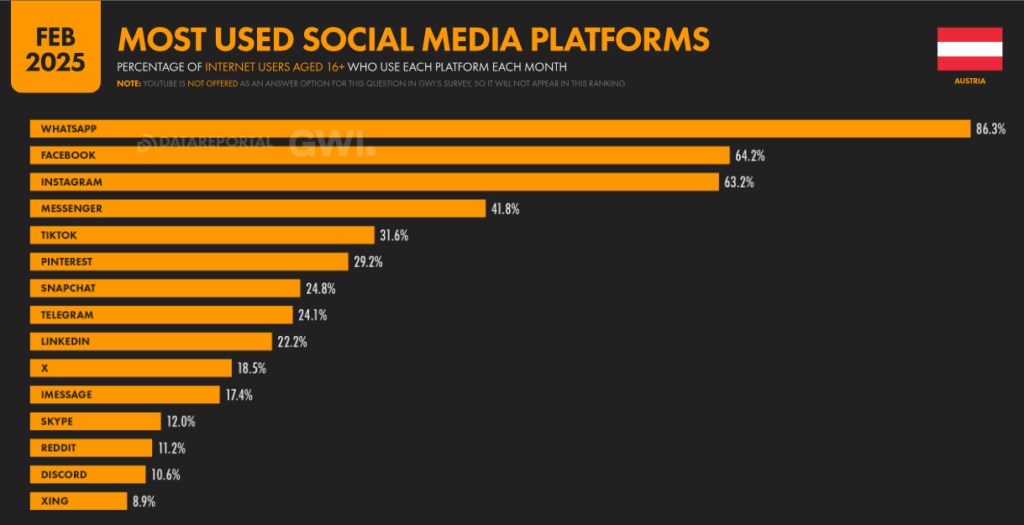

Austria’s consumers are on social media a lot — like, really a lot. As of early 2025, about 6.55 million users aged 18+ use social media. That’s ~86.6% of Austria’s adult population. Gender split is almost even: ~50.7% female, ~49.3% male.

What’s cool: growth hasn’t been just in usage, but in trust that you can buy via social platforms. Shoppers are increasingly comfortable seeing products in stories, reels, posts, and deciding, “hey, that’s it, I’ll click buy.” Features like embedded product tags, shops inside Instagram or Facebook are pushing that forward.

Among the top 5 most used social media are WhatsApp, Facebook, Instagram, Facebook Messenger, and TikTok.

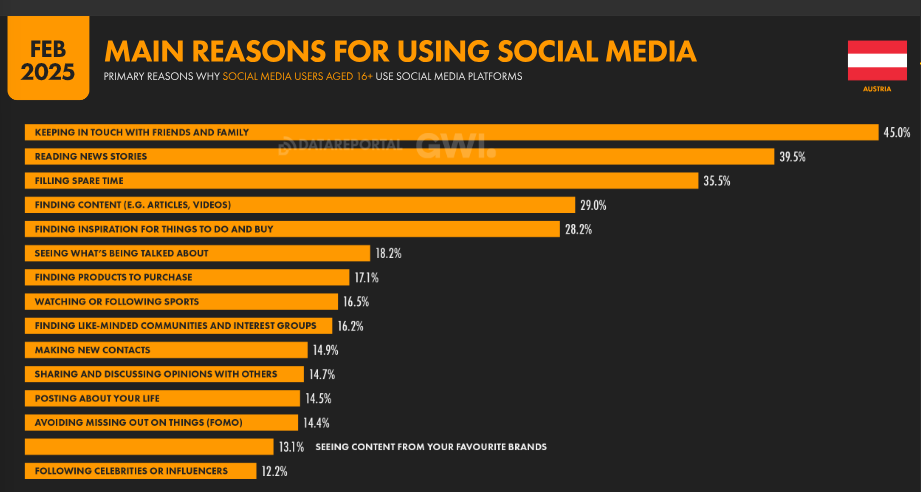

To the three top reasons of using social media we can count:

- Keeping in touch with friends and family

- Reading news stories

- And filling spare time

So, to reach potential customers here, you should create an account on Facebook, bet on Instagram, communicate via WhatsApp, or be present on TikTok. It’s your choice.

One more thing: Austrians care about relevance & authenticity.

If it’s clearly an ad or too salesy, they scroll past. But if a post from a brand or influencer feels genuine, maybe showing real use, UGC, or an honest review — that gets more clicks/conversions. So content has to “look right”, feel right.

Logistics in ecommerce Austria

The Austrian e-commerce market couldn’t thrive without support from logistics and fulfillment services. With internet penetration so high (95%) and online shopping growing, delivery, returns, and flexible pickup options are no longer just nice extras. They’re expected.

One big trend: out-of-home delivery & returns — parcel lockers, parcel shops, drop-off points. Many Austrian shoppers want options. They like getting parcels delivered to home, but they also care about convenience. DHL’s 2025 insights show that across Europe, 79% of shoppers return their unwanted items to a parcel locker or parcel shop. If a delivery provider or retailer doesn’t offer these alternatives, people might abandon carts.

Domestic delivery speeds are pretty solid. For example, in Q1 2025 Austria’s average transit time for domestic trade lanes was around 1.36 days, with 80.17% success on first delivery attempt. That’s good, but there’s room to improve “first go” delivery success. Missed first attempts add cost and reduce customer satisfaction.

Also, cross-border shipping/logistics plays a role. Austria has many neighbouring countries, so international deliveries are common. Transit times, customs, shipping costs matter more in this context. Retailers that optimize fulfillment networks, warehouses, and partner with reliable couriers tend to win more trust.

To sum up

Austria presents a dynamic and promising environment for e-commerce businesses. With a high internet penetration rate and a growing number of online shoppers, the market is well-primed for digital retail. Moreover, Austria’s diverse population, characterized by a significant inclination towards cross-border shopping, offers ample opportunities for businesses to tap into a broad and varied customer base.

As a part of the DACH region, ecommerce Austria shows some similarities with other countries. Logistics is at a very high level as in Germany, although its location differs greatly from that of the former. Also, just like the Swiss, Austrians like to spend their time online.

If you want to get to know the other DACH countries better – these articles about Germany and Switzerland are for you.

And if you’re hungry for more knowledge, subscribe to our newsletter for more industry insights.