European ecommerce overview: Switzerland

Written by

Kinga EdwardsPublished on

eCommerce in Switzerland is blooming! Read our blog post and find out everything you need to know about the Swiss e-commerce landscape.

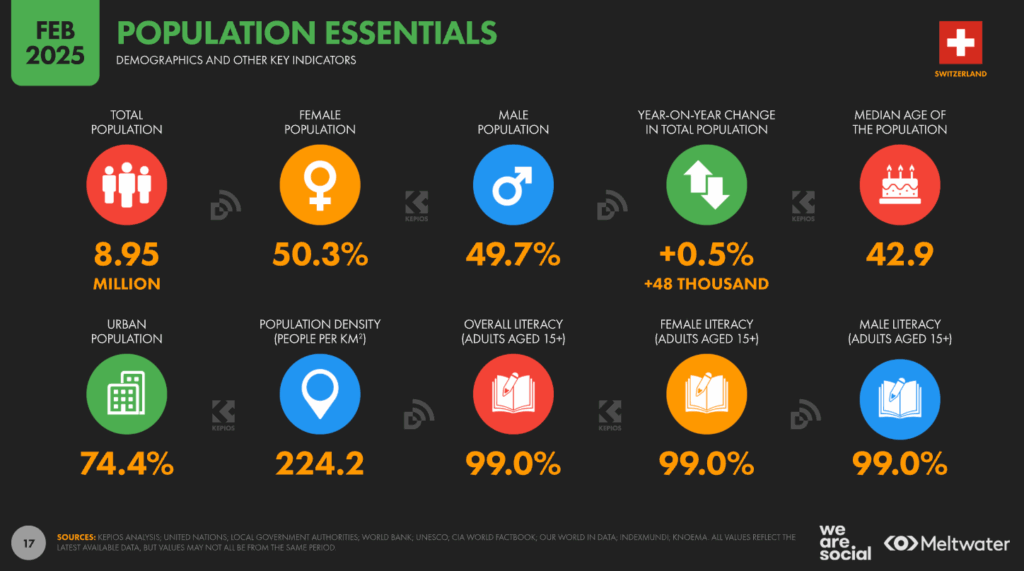

Switzerland sits at the heart of DACH (the “CH” in D-A-CH), with ~8.9 million residents and one of the world’s highest GDPs per capita. A wealthy, tech-ready population and reliable infrastructure keep Swiss ecommerce attractive for both local champions and cross-border sellers. The country remains outside the EU but is deeply integrated in global trade and logistics—conditions that continue to favor digital commerce.

Ecommerce in Switzerland — 2025 overview

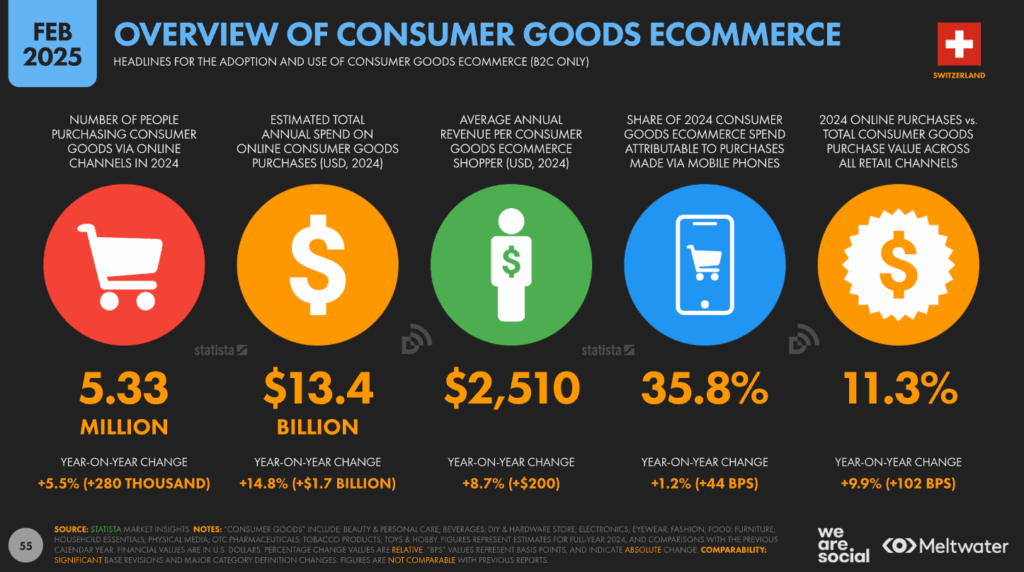

Swiss online retail generated US $16.36 billion in 2024, with the market trending +5–10% in 2025. Category mix still skews toward electronics, fashion, and hobby/leisure, and Switzerland ranks among Europe’s higher-value but concentrated markets.

Swiss Post, commerce.swiss, and GfK put 2024 online spend at CHF 14.9 billion (+3.5% YoY), noting a sharp +18% rise in purchases from abroad—small parcels from Asia in particular—showing how cross-border continues to outpace domestic growth.

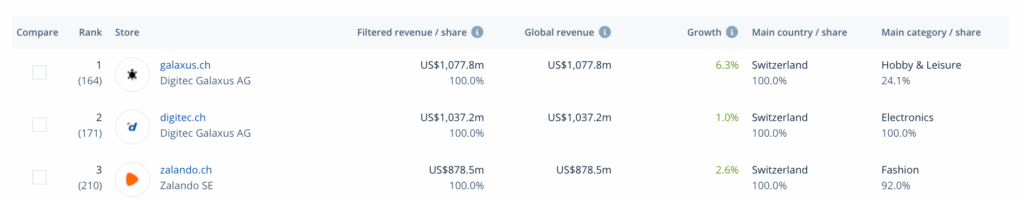

On the supply side, local leader Galaxus reported CHF 3.23 billion platform sales in 2024 (+18% YoY), growing share at home and next-door EU markets. ECDB’s 2024 store ranking likewise shows galaxus.ch and digitec.ch topping Swiss GMV.

Trade & policy conditions

Switzerland’s macro picture remains steady: high income, strong services, and sophisticated exports. For multinationals, the big 2024–2025 tax story is OECD Pillar Two. Switzerland implemented the Qualified Domestic Minimum Top-Up Tax (QDMTT) on 1 Jan 2024 and added the Income Inclusion Rule (IIR) from 1 Jan 2025; UTPR remains deferred. This staged rollout aligns Switzerland with global minimum tax rules while preserving predictability for investors.

Two urban hubs—Zurich and Geneva—still anchor trade and talent, while cantonal tax differences (e.g., Zug vs. Romandy) continue to draw tech and ecommerce operations looking for favorable setups.

Customer behavior in Switzerland

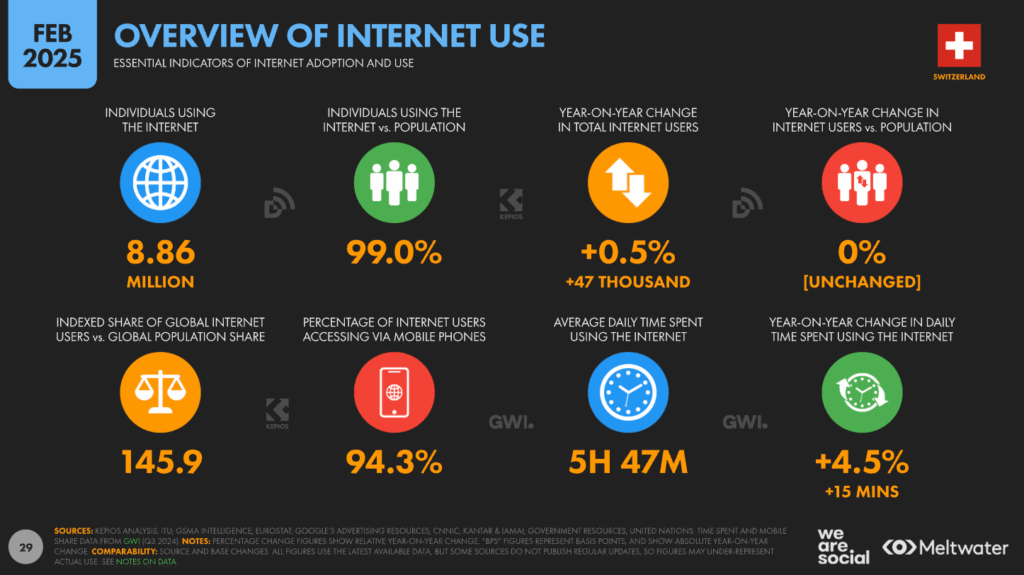

Connectivity is near-universal: ~99% of the population is online, with fast fixed (≈227 Mbps) and mobile (~100 Mbps) connections. A mature demographic profile (median age ~43; ~20% aged 65+) plus high purchasing power translates into fewer buyers overall but larger baskets.

E-shopping penetration is broad and still rising: industry trackers place online shoppers above two-thirds of the population and climbing toward roughly three-quarters by the end of the decade. Resale/recommerce participation is notably high, reflecting Swiss price-value focus and sustainability norms.

Cross-border appetite is a durable trait. The 2024–2025 data shows outbound spend to foreign sites accelerating (see above), and Swiss Post continues to position the market as a “cross-border pearl” thanks to high per-capita imports and willingness to buy abroad.

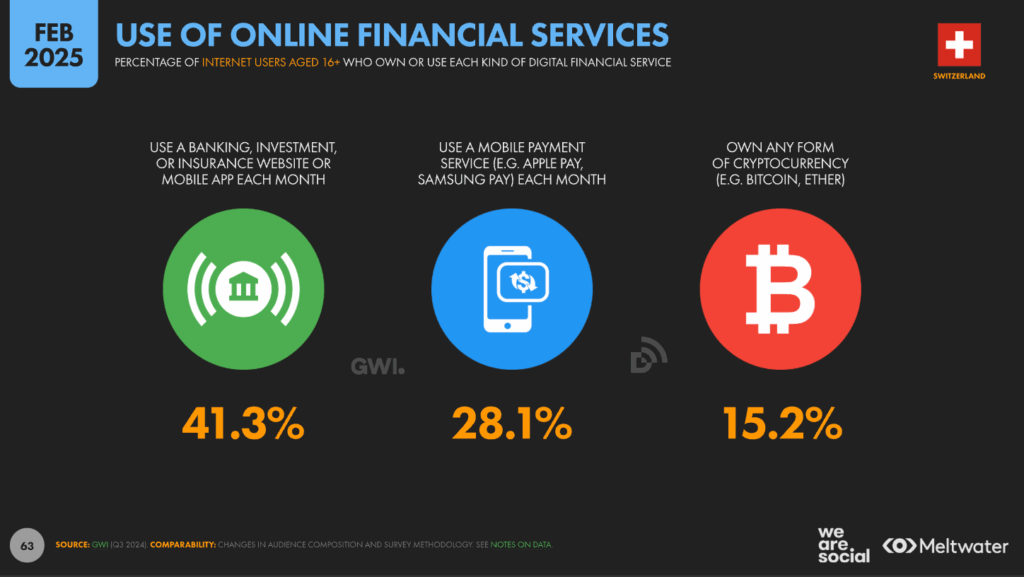

Payment methods: what actually gets used in 2025

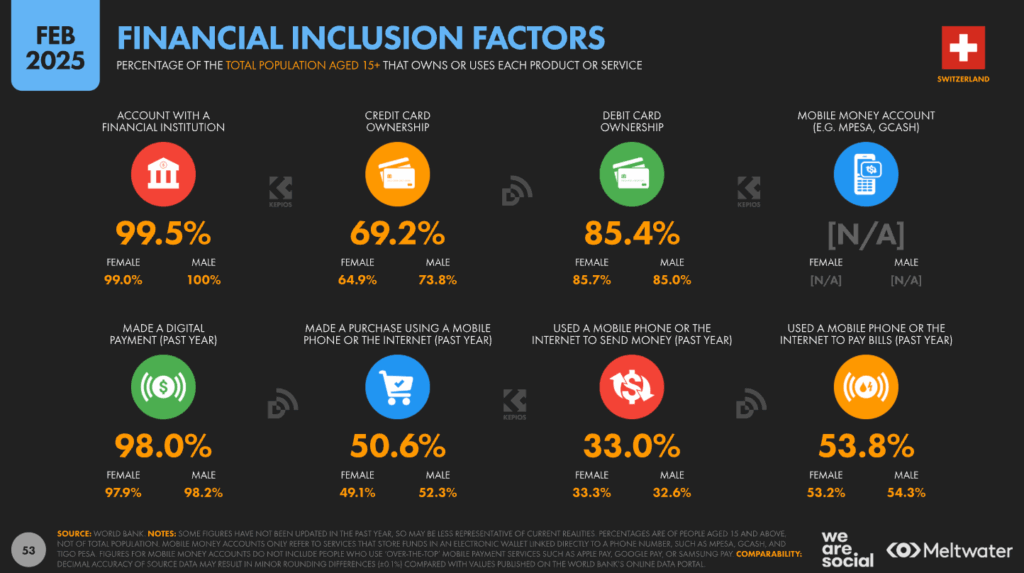

Mobile payments have become Switzerland’s most common payment method overall (by number of transactions and by turnover), according to the Swiss Payment Monitor 2025 and an OECD note submitted by Switzerland. The share of payments made on phones, watches, and other devices sits around one-third of all costs—overtaking cards and cash in aggregate usage.

The local super-app TWINT underscores this shift, reporting 6 million+ active users with 99% awareness among adults—an enormous reach in a nation of ~8.9 million. For ecommerce checkouts, expect TWINT alongside debit/credit cards; bank transfers persist for high-value purchases; cash-on-delivery is now niche.

Debit and credit cards remain important, especially for international purchases and for the rewards programs they offer. Bank transfers are still favored for high-value transactions, reflecting the trust placed in Swiss banking institutions. Cash-on-delivery, once common, now survives mainly among cautious buyers dealing with lesser-known sellers. Alongside these, prepaid cards, gift cards, peer-to-peer payments, and even cryptocurrencies are carving out niche roles.

(Sources: Swiss Payment Monitor 2025, OECD, ZHAW, Uni SG, TWINT)

Reality check for merchants: despite mobile’s lead overall, on-site (in-store) splits still show debit and cash prominent, with mobile apps ranking just behind cards in some breakdowns. Takeaway: offer TWINT + cards, and keep bank transfer for big-ticket orders and B2B.

Payment safety & privacy

Security and control remain decisive. The Payment Monitor series shows Swiss consumers gravitating to methods perceived as secure and private, while national bodies emphasize strong competition and oversight in the mobile-payments space (COMCO, OECD). Clear SCA/3-D Secure, transparent fees, and trusted local options (TWINT) are conversion levers.

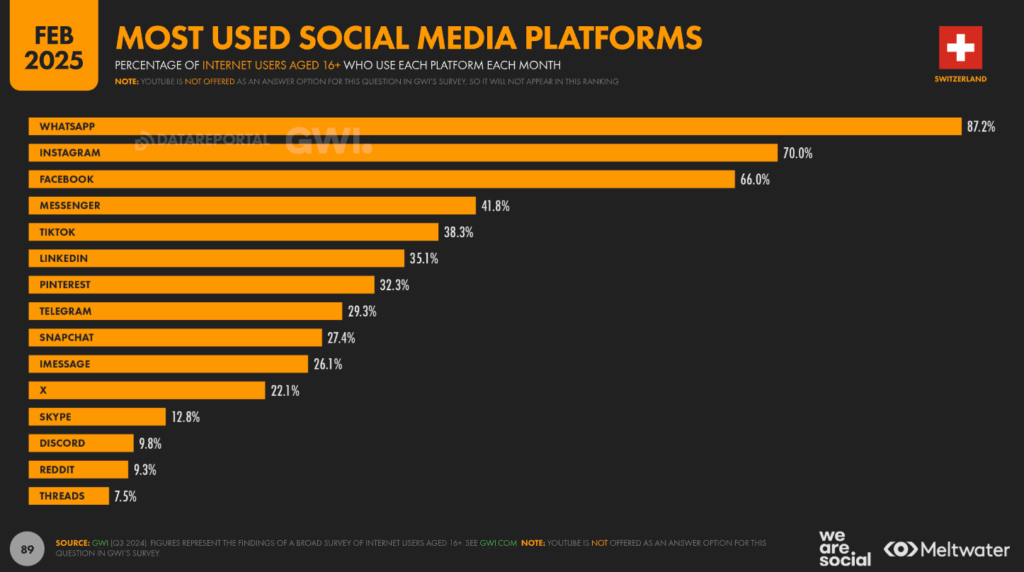

Social media in Swiss ecommerce

In early 2025, Switzerland counted ~6.7 million social media identities (~75% of the population). Instagram reaches roughly 3.7 million, LinkedIn has surged to ~4.9 million members, and TikTok ad reach covers ~24% of internet users—useful markers for channel planning, content, and retail media buys.

Marketers should pair Meta/Instagram for reach, LinkedIn for B2B/B2C-premium, and YouTube for product discovery and longer-form ads; TikTok is increasingly relevant for younger cohorts and cross-border deal discovery.

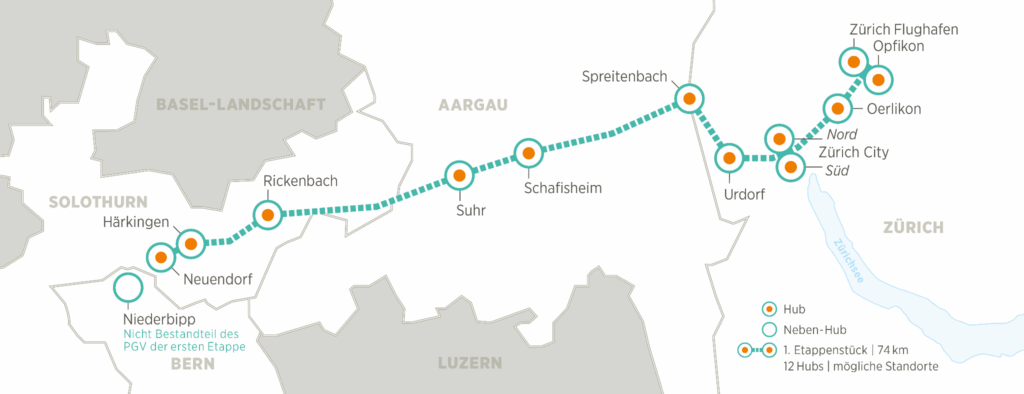

Logistics in Switzerland

A signature infrastructure project—Cargo Sous Terrain (CST)—advanced in June 2025 as the Federal Council adopted the first stage of the sectoral plan for underground freight. The initial 70 km Härkingen–Zurich section remains slated for 2031, part of a planned 500 km automated network enabling low-emission, high-reliability trunk freight. For ecommerce, this points to future capacity and sustainability gains on dense Swiss corridors.

In day-to-day parcel delivery, Swiss operators continue pushing collection points, returns convenience, and greener last mile—a competitive edge for conversion given Swiss expectations on service and sustainability.

Who’s winning online

While giants like Galaxus dominate, Switzerland is also seeing a rise in specialized marketplaces. In Zurich especially, multi-vendor platforms dedicated to sustainable fashion, zero-waste groceries, artisanal decor, wellness services, and digital learning are gaining traction. These verticals resonate with Swiss values of quality, sustainability, and craftsmanship.

Niche marketplaces and ecosystem shifts

While giants like Galaxus dominate, Switzerland is also seeing a rise in specialized marketplaces. In Zurich especially, multi-vendor platforms dedicated to sustainable fashion, zero-waste groceries, artisanal decor, wellness services, and digital learning are gaining traction. These verticals resonate with Swiss values of quality, sustainability, and craftsmanship.

At the same time, the broader ecosystem is preparing for a shake-up. Swiss Marketplace Group (SMG)—operator of Homegate, Immoscout24, and Autoscout24—is heading toward an IPO. With CHF 291 million in 2024 revenue and double-digit growth forecasts for 2025, SMG is set to inject fresh capital and competition into Swiss classifieds and beyond.

What changed since last year (and what to act on)

The past 12 months confirmed several trends:

- Mobile wallets have overtaken cards and cash as the leading payment method.

- Recommerce has gone mainstream, no longer a niche but a fast-growing market.

- Cross-border demand is still accelerating, especially in fashion and small electronics.

- Policy clarity arrived with Pillar Two, giving businesses firmer ground for tax planning.

- Niche marketplaces and classifieds are gaining importance, broadening the ecosystem.

- Logistics innovation is reshaping delivery expectations, from collection points now to underground freight later.

Practical tips for market entry

- Localize trust: show prices in CHF, offer TWINT, and display Swiss-friendly delivery times & returns up-front.

- Win cross-border carts with DDP: shipping Delivered Duty Paid improves completion and reviews; Swiss Post and partners provide turnkey flows.

- Merch where it matters: prioritize categories with strong Swiss online shares (electronics/fashion) and test recommerce-adjacent offers or trade-in.

- Mind data & tax housekeeping: align to Swiss data protection nuances and confirm Pillar Two registrations (OMTax) where in scope.

Conclusion

Switzerland in 2025 is a small market with big baskets: high income, high trust, and high expectations. Mobile payments—especially TWINT—have crossed the tipping point; cross-border demand remains strong; and the policy/logistics backdrop looks stable with long-term upside. Brands that localize payment/returns, price transparently (DDP), and invest in the right channels will keep winning Swiss consumers in the year ahead.

Do you want to find more info about DACH countries?

Click here to read about e-commerce in Germany and follow our blog, as we are going to publish more country reports soon.

And if you’re hungry for more knowledge, subscribe to our newsletter for more industry insights.