The Role of SaaS Taxtech Solutions In the E-Commerce Landscape

Written by

Editorial TeamPublished on

The consumer world has experienced a profound revolution in recent years, largely driven by advancements in technology. This article explores the important role of technology in the growing e-commerce world, the demand for essential technologies, along with the challenges involved in the online world, the important role SaaS companies play in this ecosystem, and the role of empact’s VAT compliance Tax Tech SaaS platform in this equation helping businesses to streamline their operations and the contribution to the resilience to major challenges.

VAT Registration in the EU

In July 2021, the European Union implemented new e-commerce VAT rules, a challenging era for e-commerce businesses navigating varying regulations across EU member states while being liable for reporting, filling, and payment of the VAT collected on sales to private consumers.

Value Added Tax (VAT) registration holds significant importance for businesses venturing into commercial activities within the European Union (EU). While the EU operates under a harmonized system, individual member states maintain distinct VAT rates and regulations. This unique structure necessitates businesses to comprehend and adhere to the specific requirements of each country where they operate. Beyond geographical boundaries, VAT compliance becomes imperative for businesses exceeding a predefined annual turnover threshold. The VAT registration process involves the submission of an application to the tax authorities of each relevant country.

The challenges involved with the new EU VAT regulation

The new European e-commerce VAT rules present a complex regulatory landscape with different specifications for each EU state. As a result, businesses face a new reality where they must navigate through this landscape dealing with a lack of experience & knowledge, long and costly bureaucratic processes, costly professional resources, and financial constraints, with constant VAT exposures resulting in potential penalties exceeding 190 million EUR in 2021-2022.

The consequences include challenges with disrupted control over sales targets, budget, and profits, and a diversion of focus from core business activities. A very common use case that demonstrates the above related directly to the fact that businesses are obliged to register for VAT at least in one EU member state while additional VAT registration is mandatory in every country where local inventory is being managed. The implications for single VAT registration entail high fees with a long waiting of 100 days on average and in many cases, is being doubled and tripled when VAT registration in additional EU member states is required.

Technology is Transforming the Consumer

Technology has revolutionized the way consumers shop, access information, and connect with brands. From smartphones and tablets to voice-activated virtual assistants, technology has created a seamless and personalized shopping experience. Consumers can now browse, compare, and purchase products and services from anywhere and anytime.

Online shopping has become a norm, offering convenience, choice, and accessibility. Consumers can now explore a vast array of products, read reviews, and make purchases with a few clicks. The online transition has not only expanded consumer options but also enabled businesses to reach global audiences without the limitations of physical stores.

In addition, technology has become an essential tool for e-commerce businesses, helping them navigate through the competitive arena, to achieve constant growth and improve their performance.

EU e-commerce Market

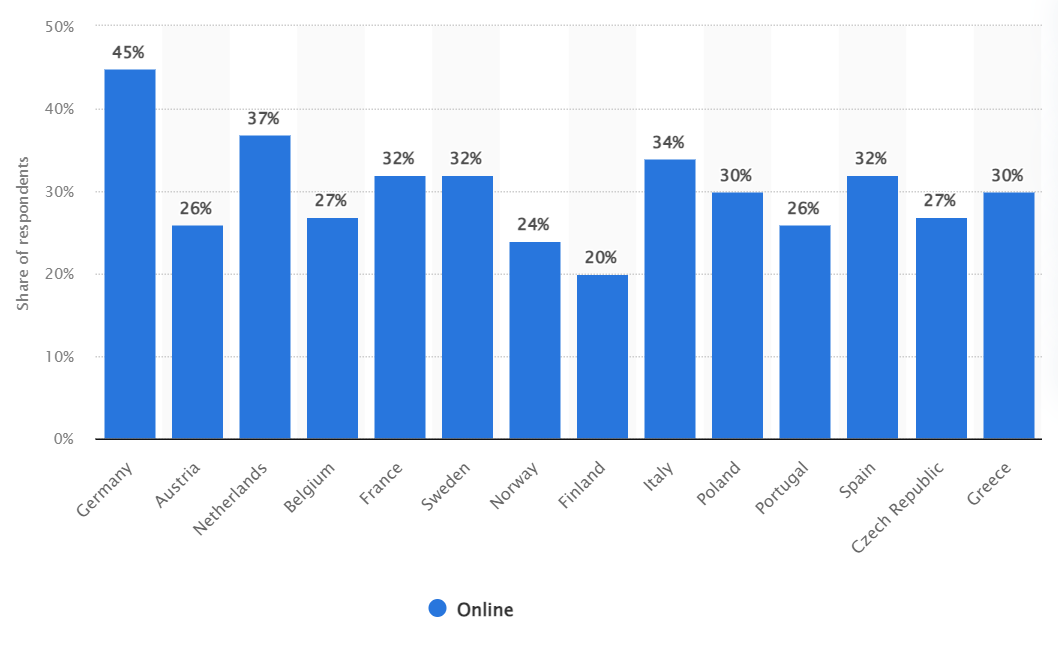

The European Union’s e-commerce market has experienced substantial growth, reaching €899 Billion in 2022, and is forecasted to reach approximately $1.5 Trillion by 2027. In 2022, an average of 62% of European consumers engaged with online shopping channels from key countries such as Germany, Italy, France, and the Netherlands. As these countries actively shape the evolving landscape of consumer behavior, the EU’s e-commerce market to grow in the coming years.

(Source: Statista)

European Consumers Stand to Lose

The new regime imposed a new reality with significant consequences. Currently, e-commerce businesses who lack the high resources required for the complex initial VAT setup, must secure their business continuance by modification of the supply chain structure they’ve successfully managed to sustain by shifting from a wide presence in the market through inventory management in several EU member states to narrowed down presence of one or two countries. Such an inevitable decision has its consequences, of higher delivery costs and longer transit times to their end consumers. Those who have sufficient resources will face higher costs to avoid any changes in their supply chain structure and loss of income.

Regardless of their resilience, both will be struggling to keep their net profits and ability to compete in the local market with no change.

The Impact of SaaS Companies on Consumer Technology

The rise of Software as a Service (SaaS) companies has been a driving force behind the transformation of the consumer world. These companies offer cloud-based solutions, accessible on a subscription basis, offering instant solutions as well as eliminating the need for costly upfront investments. SaaS platforms have disrupted inefficient processes in traditional industries, providing businesses of all sizes with access to free-hassle sophisticated tools and services. SaaS companies have democratized technology and empowered entrepreneurs.

The rapid growth in the consumer technology landscape has created a demand for new essential technologies to meet new opportunities of innovation for businesses and consumers. These technologies can personalize customer and business experiences, optimize supply chains, enhance data security, and provide real-time insights. As businesses increasingly rely on SaaS solutions, the demand for robust infrastructure and compliance measures presents a promising market for essential technologies.

The Future of Europe’s E-commerce Market

e-Commerce is the present and future of commerce and trade. It’s in the interest of governments, retailers, and consumers that eCommerce will thrive.

Two years after the new EU VAT regulation came into force, the complexities of VAT compliance, coupled with potential financial risks and disruptions, create a pressing need for a seamless solution that simply eliminates the burdens associated with VAT compliance and empowers businesses despite the challenges.

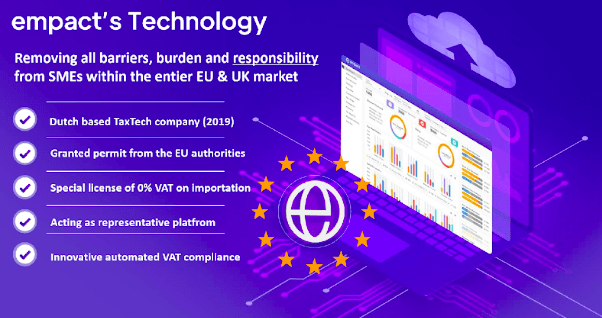

However, this reality is starting to change. New types of players are starting to emerge and provide an answer to the complexities involved in the regulatory landscape. One of the examples is empact, an innovative Dutch-based TaxTech SaaS company, positioned to remove these barriers while leading a significant transformation in the VAT compliance landscape through its innovative technology and approach, for e-commerce businesses and service providers across the EU and UK markets, with a clear mission and passion, to transform VAT compliance pains to gains, ensuring businesses remain in compliance effortlessly and more effectively while focusing on their core business.

Neomi Dov, Founder, and CEO at empact, explains: “We let international sellers act like local EU businesses, from afar while entirely removing all related VAT compliance responsibilities and burden from them to us, so they can offer competitive pricing and win more business. Our platform is especially useful for UK sellers who saw their sales and logistics crash one single day. With empact, sellers instantly get all VAT, IOSS, and OSS numbers, and within a day – sell in Europe, with full compliance. We integrate seamlessly with their marketplace stores and take all responsibility for their VAT in Europe. Everything is done automatically on our end to empower sellers to focus on their business. Sellers also get real-time transparency on all transactions, logistics, and tax filing.”

(Source: empact)

The path forward

In a landscape where regulatory complexities pose a threat to the growth and stability of businesses, there is an increasing demand for intelligent real-time tools tailored to the 24/7 pace of the eCommerce market. empact emerges as a solution, paving the way for e-commerce businesses and service providers to thrive in the EU and UK markets. With its innovative technology, global accessibility, and end-to-end managed services, empact positions itself as a strategic partner for businesses seeking to navigate the evolving world of e-commerce confidently.

Breaking geographical barriers, empact’s innovative technology allows businesses to remotely manage taxes and supply chain operations with a simple click. This comprehensive approach includes connecting businesses to a local payment gateway, enhancing their conversion rates, and providing full visibility into their sales and operations. In the face of challenges, empact ensures cost-effectiveness and efficiency, enabling businesses to compete and grow not only in the EU market but also in the UK market, which experiences a significant decrease in sales—by 40%—to the EU market.

For more info about empact and its EU VAT platform, visit https://empact.online

***