16 leading marketplaces in Asia

Written by

Editorial TeamPublished on

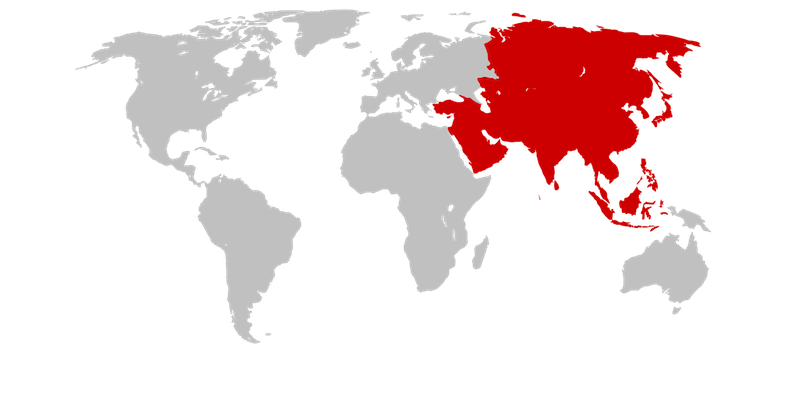

Discover the top marketplaces in Asia as we continue our 2024 overview of leading marketplaces across the globe. Check the unique scale and rapid growth of ecommerce in Asia, setting it apart from other regions worldwide

In our overview of leading marketplaces in different regions of the world, we already looked at top marketplaces in North America and top marketplaces in Europe.

Time for part three: Asia.

The e-commerce market in Asia is projected to continue expanding, with a value estimated at $1,947.00 billion in 2025.

China remains a leader in the global e-commerce sector. In March 2024 alone, China’s total retail sales of consumer goods reached 48,789.5 billion yuan, up by 3.5 percent year on year. This is definitely a part of a broader trend where digital transformation drives the shift from offline to online shopping.

Going further, Southeast Asia’s e-commerce revenue is expected to reach $133.60 billion in 2025. Here, the compound annual growth rate 2025 – 2029 is projected to show 8.80%.

Thanks to digital transformation, e-commerce in other Asian countries such as India, Indonesia, Malaysia, Philippines, Singapore, Thailand, or Vietnam is also growing exponentially.

For international sellers, Asia-based marketplaces are the first gateway to this region of the world, so we have collected 16 platforms that were the core of Asian e-commerce in 2025.

Let’s check them.

Alibaba

Alibaba is the giant of Chinese e-commerce and the World’s Largest B2B e-commerce marketplace. It also operates other huge and highly successful e-commerce sites such as AliExpress, TMall, and Taobao.

For the fiscal year that concluded on March 31, 2024, Alibaba Group reported total revenues of approximately 941.17 billion yuan, equivalent to around 130.35 billion U.S. dollars.

The Alibaba International Digital Commerce Group (AIDC) experienced significant growth, with revenues increasing by 32% year-over-year in the June quarter of 2024.

Alibaba’s Cloud Intelligence Group reported revenues of RMB26.55 billion (approximately US$3.64 billion) for the quarter ending June 30, 2024, marking a 6% year-over-year increase.

In February 2025, Alibaba entered into a strategic partnership with Apple to develop AI services for iPhones sold in China.

AliExpress

AliExpress is an Alibaba-owned marketplace that targets buyers outside China. It is Alibaba’s B2C international site offering international shoppers goods at factory prices without a minimum order size.

In January 2025, AliExpress.com attracted approximately 1.01 billion visits, with an average session duration of 9 minutes and 33 seconds. This reflects a slight decrease of 1.03% compared to December 2024. The platform’s top traffic sources include South Korea (11.15%), the United States (7.36%), Spain (5.96%), Brazil (5.72%), and France (4.05%).

AliExpress maintains a significant presence in European markets. In France, it ranks among the top online marketplaces, alongside Amazon and Cdiscount. In Spain, the AliExpress app had approximately 660,000 monthly active users as of January 2025.

AliExpress continues to expand its global footprint through strategic initiatives and a keen understanding of evolving consumer preferences, solidifying its role as a leading player in the international e-commerce arena.

JD.com

JD.com is a prominent Chinese B2C e-commerce platform that continues to show strong performance and user engagement. The categories the store offers include consumer electronics, home appliances, furniture and household goods, cosmetics, general merchandise products comprising food, beverage and fresh produce, baby and maternity products, jewelry, etc.

For the twelve months ending September 30, 2024, JD.com reported consolidated revenues of approximately RMB1.12 trillion (US$156.56 billion), reflecting a 4.09% increase compared to the previous year. In the third quarter of 2024, the company achieved net revenues of RMB260.4 billion (US$37.1 billion), marking a 5.1% year-over-year growth.

JD.com also remains a dominant player in the global e-commerce landscape, not just within China. Its comprehensive logistics system and broad product offerings continue to attract a vast customer base and contribute to its status as a leading e-commerce platform.

Taobao

Taobao is a Chinese marketplace owned by Alibaba. Founded in 2003, Taobao Marketplace facilitates consumer-to-consumer (C2C) retail by providing a platform for small businesses and individual entrepreneurs to open online stores that sell to consumers in Chinese-speaking regions and abroad.

The platform has experienced significant growth, with its monthly active user (MAU) base reaching approximately 960 million in November 2024, an increase from 930 million in the third quarter of 2024.

Taobao’s user base is predominantly young, with over 60% of users born after 1995. This trend is evident in initiatives like the New Year wish-making activity launched in January 2025, where 60 million participants made wishes, and those born after 1995 accounted for more than 60% of the participants.

This platform continues to attract a broad audience with its extensive range of products and user-focused features. The top categories in this marketplace are Programming and Developer Software, Video Games Consoles and Accessories, as well as News & Media Publishers.

Tmall

Tmall is a Chinese B2C marketplace, also owned by Alibaba. Just like Taobao, it is one of the largest e-commerce marketplaces in the world. Tmall sells branded goods to customers in China and nearby countries through special warehouses provided by the platform. It provides a complete shopping solution, while merchants only have to supply the product.

As of January 2025, Tmall.com recorded approximately 62.1 million visits, with users spending an average of 8 minutes and 15 seconds per session. The platform’s audience is predominantly male (69.68%), with the largest age group being 25 to 34 years old. Geographically, the majority of traffic originates from China (83.21%), followed by Hong Kong (5.05%), Taiwan (3.83%), the United States (1.17%), and Singapore (1.11%).

This growth is part of Tmall’s ongoing strategy to triple the scale of resources dedicated to new products and enhance its offerings across various categories.

XiaoHongShu

XiaoHongShu, also known as Little Red Book or RedNote app, is a prominent social commerce platform in China. It has successfully integrated community-driven content with e-commerce, making it particularly popular among younger Chinese audiences.

In 2024, XiaoHongShu achieved significant financial milestones, with revenues reaching approximately $4.8 billion, a 30% increase from $3.7 billion in 2023. This growth propelled the company’s net profit to over $1 billion in 2024, doubling its profitability compared to the previous year.

The platform’s user base expanded notably, surpassing 300 million monthly active users (MAUs) by the end of 2024. This growth reflects XiaoHongShu’s appeal to a diverse audience, with over 60% of users aged 30 or younger, predominantly from first and second-tier cities in China.

Geographically, the majority of XiaoHongShu’s web traffic originates from China, with significant contributions from Hong Kong and the United States. Notably, in January 2025, the platform experienced a surge in U.S. downloads, becoming the most-downloaded free app on the U.S. App Store. This influx was largely driven by former TikTok users seeking alternative platforms amid potential bans.

Zalora

Zalora has solidified its position as a leading fashion e-commerce platform in Southeast Asia. The company’s strategic focus on data-driven marketing, personalized customer experiences, and technological innovation has been pivotal in its growth. In 2024, Zalora reported a 36% increase in orders and a 50% surge in sales, underscoring the effectiveness of its marketing strategies.

A significant aspect of Zalora’s success is its emphasis on understanding local markets and consumer behavior. By tailoring its offerings to resonate with regional cultures and trends, the platform has cultivated a strong connection with its diverse customer base. This localized approach is complemented by innovative marketing campaigns, such as the guerrilla marketing initiative during the 11.11 sales event, which effectively captured public attention and enhanced brand visibility.

In the Philippines, Zalora maintains a notable presence, with approximately 875,000 monthly website visits and 164,200 monthly app downloads on Android devices. This performance highlights the platform’s appeal in the region’s competitive e-commerce landscape.

Pinduoduo

Pinduoduo was founded in 2015 and offers a wide variety of products, ranging from the everyday groceries you need for your family to the appliances for your home.

In the third quarter of 2024, the company reported revenues of RMB99.35 billion (US$14.16 billion), marking a 44% increase from the same period in 2023. However, this figure fell short of market expectations, which had anticipated revenues of around RMB 102.65 billion.

In terms of user engagement, Pinduoduo’s website attracted about 19.69 million visits in January 2025, securing its position among the top e-commerce platforms in China. The platform’s audience is predominantly male (66.71%), with the largest age group being 25 to 34 years old.

The shopping function on Pinduoduo’s website has been removed. As a result, users could only browse and purchase items via its mobile app or a WeChat mini-program. This decision appears reasonable since over 86 percent of Chinese e-commerce purchases are made on mobile devices.

Mercari

Mercari continues to strengthen its position in the e-commerce market. Between October to December 2024, the company reported consolidated revenue of ¥49.2 billion (approximately $322 million), marking a 2% increase compared to the same period the previous year. Operating profit saw a significant rise, reaching ¥4.5 billion ($29.4 million), up from ¥1.3 billion ($8.5 million) in the previous quarter.

User engagement remains robust, with mercari.com attracting approximately 154.9 million visits in January 2025. The platform’s audience is predominantly male (54.84%), with the largest age group being 25 to 34 years old. Geographically, the majority of traffic originates from Japan (73.24%), followed by the United States (21.5%).

Analysts have adjusted their forecasts following these results, now projecting Mercari’s revenue for fiscal year 2025 to reach approximately ¥195.9 billion, a 3.6% improvement over the previous year. Earnings per share are expected to be around ¥97.59.

Lazada

Lazada is a marketplace that remains a significant player in the Southeast Asian e-commerce market. In July 2024, the company achieved its first monthly EBITDA profit, signaling a positive shift in its financial performance. By January 2025, Lazada’s annual revenue reached approximately $5 billion, reflecting its significant market presence.

In Thailand, Lazada reported a profit of around 604 million baht and earned approximately 21.5 billion baht in revenue in 2023. The platform’s popularity is evident, with home and lifestyle products generating the highest revenue, amounting to around 760 million Thai baht as of February 2024.

In Indonesia, Lazada’s revenue was forecasted to reach around $154 million in 2025, indicating a slight rebound from previous years. The platform’s Indonesian website, lazada.co.id, ranked #271 globally with 29 million visits in February 2025.

Shopee

Shopee demonstrates strong performance in the Southeast Asian e-commerce market. The platform, known for its hybrid model of consumer-to-consumer and business-to-consumer sales, has seen a significant increase. In 2024, the platform’s Gross Merchandise Volume (GMV) reached $23.3 billion in the second quarter, marking a 29.1% year-over-year increase. This surge contributed to a 34% rise in e-commerce revenue, totaling $2.8 billion for the same period.

Indonesia remains Shopee’s largest market, with 132.3 million total visits in January 2025. The platform’s popularity is further evidenced by its app being downloaded 144 million times in 2023.

In Vietnam, Shopee solidified its dominance by capturing 71.4% of the GMV market share by mid-2024, significantly outpacing competitors. This achievement underscores Shopee’s strategic focus on expanding its footprint in key Southeast Asian markets.

Amazon

Amazon is one of the largest online marketplaces in Japan. In August 2024, Amazon Japan’s website attracted approximately 692.96 million visitors, surpassing competitors like Rakuten. This popularity stems from its extensive product range, user-friendly experience, and strong brand trust.

Also, Amazon’s strategy in Asia includes a diverse range of services and infrastructure development, particularly through its AWS (Amazon Web Services) segment. This includes expanding AWS’s infrastructure footprint, introducing new cloud regions in Asia, and investing more than 190 billion baht ($5 billion) into this purpose by 2037.

In January 2025, AWS launched a new infrastructure region in Thailand, planning to invest over $5 billion, which is expected to contribute approximately $10 billion to Thailand’s GDP and support over 11,000 jobs annually.

Additionally, in February 2025, AWS opened its Asia-Pacific headquarters in Singapore, committing an extra S$12 billion (about $8.86 billion) to enhance its cloud infrastructure in the region by 2028.

Rakuten

Rakuten is a Japanese marketplace founded in 1997. It has expanded globally by acquiring well-known names such as Play.com in the UK, PriceMinister in France, Buy.com in the US, and many others.

In the fiscal year ending December 31, 2024, the company reported a revenue of ¥2.279 trillion, marking a 10% increase from the previous year. This growth was driven by strong performances across all segments, including Internet Services, FinTech, and Mobile.

The Internet Services segment saw revenue of ¥314.6 billion in the third quarter of 2024, a 4.4% year-over-year increase. Despite challenges in the domestic e-commerce sector, Rakuten maintained growth by diversifying its services and enhancing user engagement.

Rakuten’s FinTech division also demonstrated robust growth, with third-quarter revenue reaching ¥208.2 billion, up 12.8% from the same period in the previous year. This surge was largely due to the expansion of Rakuten Card’s membership base.

Flipkart

Flipkart is a leading e-commerce company in India, founded in 2007 by Sachin Bansal and Binny Bansal. Known for its extensive range of products, Flipkart has become a household name in Indian online retail, offering everything from electronics and fashion to home essentials and groceries.

Just like Amazon, Flipkart first sold books, but it quickly started offering products in many different categories. Its success also stems from the fact that Flipkart was one of the first adopters of cash-on-delivery payments which proved successful in getting more customers to use the service. It has also invested in its own logistics service and own infrastructure to support the growing e-commerce industry in India.

In the fiscal year ending March 2024, Flipkart Internet, the company’s marketplace arm, reported revenues of ₹17,907.3 crore, marking a 21% increase from the previous year. Notably, losses were reduced by 41%, down to ₹2,358 crore. In terms of online presence, Flipkart.com attracted 216.17 million visits in January 2025, with 95.96% of this traffic coming from India.

Myntra

Myntra has solidified its position as a leading fashion e-commerce platform in India. It’s owned by Flipkart. In the fiscal year 2024, the company reported a net profit of ₹31 crore (310 million Indian Rupees), a significant turnaround from the ₹782 crore loss in the previous year.

This positive shift was driven by a 15% increase in operating revenue, reaching ₹5,122 crore, up from ₹4,465 crore in FY23. A notable contributor to this growth was Myntra’s advertising segment, which saw a 33% rise, generating ₹712.3 crore in revenue. The company’s focus on cost optimization, particularly in reducing material and advertising expenses, played a crucial role in achieving profitability.

User engagement metrics remained strong, with myntra.com receiving approximately 56.76 million visits in January 2025. The majority of this traffic, 91.18%, originated from India, followed by the United States at 2.05%. The platform’s audience is predominantly male (58.76%), with the largest age group being 25 to 34 years old.

Coupang

Coupang is a popular e-commerce site and marketplace in South Korea. Starting as a daily deals site in 2010, Coupang has become then the fastest-growing e-commerce company in the world. It has succeeded in the Asian market through innovations that meet the needs of local consumers. This includes such things as same-day delivery.

In the third quarter of 2024, Coupang pulled in a whopping $7.9 billion in net revenue, which is a solid 27% jump from the previous year. Their gross profit also saw a boost, hitting $2.3 billion, up 45% year-over-year. They’re planning to share their fourth-quarter results on February 25, 2025, so it’ll be interesting to see how they wrap up the year.

When it comes to user engagement, Coupang’s website saw nearly 998 million visits in January 2025. Most of their visitors are from South Korea, making up about 98.81% of the traffic. The audience is male (66.7%), with the 25 to 34 age group being the most active.

Top insights about e-commerce evolution in Asia and the Pacific

These insights are derived from Statista and the Asian Development Bank’s report, among others. They offer an in-depth analysis of the e-commerce landscape in this region.

Let’s check its top insights.

- Asia and the Pacific have solidified their position as the largest market for e-commerce globally. In 2020, the region accounted for more than half of the world’s retail e-commerce sales, a share expected to grow to 61% by 2025.

Source: E-commerce Evolution in Asia and the Pacific: Opportunities and Challenges. November 2023 report.

- This growth is driven by the widespread use of smartphones, the convenience of online shopping, and advancements in digital technologies such as artificial intelligence and augmented reality.

- In 2022, the fastest-growing retail economies in the world were Singapore, Indonesia, the Philippines, and India. 5 of the 10 fastest-growing economies in e-commerce retail are in Southeast Asia.

Source: E-commerce Evolution in Asia and the Pacific: Opportunities and Challenges. November 2023 report.

- As of January 2025, South Sudan, Guyana, and Libya are the fastest-growing economies. South Sudan’s rapid growth in 2025 is expected as it rebounds from a sharp economic contraction following a conflict in neighboring Sudan, Guyana’s expansion is fueled by a booming oil and gas sector, and Libya’s surge comes from the full resumption of oil production after resolving political disputes.

- Most of the fastest-growing economies belong to Africa, but Asia has as many as 6 countries on the above list.

- Technological advancements are pivotal in driving e-commerce growth. Innovations in blockchain, AI, and 5G are enhancing consumer experiences and operational efficiencies. For example, the widespread use of mobile devices in China has made mobile commerce a significant part of the e-commerce ecosystem, with 80% of e-commerce spending coming from mobile transactions.

Despite the robust growth, several challenges hinder the full potential of e-commerce in the region. Key barriers include:

- Lack of internet access. Internet access across Asia varies significantly by region. East Asia boasts a penetration rate of 115.6%, indicating multiple devices per person, while South Asia lags behind with only 79.2% of its population online. Despite these advancements, a considerable portion of Asia’s population remains without internet access.

- An evident disparity in Asian e-payment platforms. Some economies have pioneered nationwide e-payment services (like Singapore and China), but some still struggle to adopt them. Some of the barriers include largely unbanked consumers.

- Logistics and last-mile delivery. Efficient logistics and delivery systems are critical for e-commerce success. Geographic remoteness and poor infrastructure connectivity are major bottlenecks, particularly in rural areas. Innovative solutions like drone deliveries and automated systems can be explored to address these challenges.

- Regulatory environment. Effective e-commerce legislation is crucial for fostering a secure and inclusive digital marketplace. While many countries have laws on electronic transactions and cybercrime, comprehensive consumer protection and data privacy regulations are still needed.

FAQ

What is an online marketplace, and how does it differ from traditional e-commerce platforms?

An online marketplace serves as a digital platform where multiple third-party sellers can offer their products or services, unlike traditional e-commerce platforms which typically represent a single brand or business. This model provides direct access to a diverse range of goods, from consumer goods to fresh food, catering to various consumer needs.

Why are online marketplaces becoming increasingly popular in Southeast Asia?

Southeast Asia’s rapidly growing internet penetration and the rise in digital payments have made online marketplaces more accessible. The region’s diverse logistics infrastructure also supports efficient cross-border e-commerce, which allows local sellers to connect with Chinese consumers and other international markets easily.

What are some of the largest online marketplaces in Southeast Asia and how do they impact the e-commerce space?

Some of the largest online marketplaces in Southeast Asia include Lazada and Shopee. They contribute to the region’s e-commerce market by offering a platform for both local and international businesses. This enhances the gross merchandise volume and expands the reach of Southeast Asian countries in the global market.

How do cross-border e-commerce platforms benefit sellers in Southeast Asia?

Cross-border e-commerce platforms provide Southeast Asian sellers with the opportunity to expand their market reach beyond local consumers to international audiences, including the lucrative Chinese market. This expansion helps them leverage the first-mover advantage in emerging product categories and target a broader audience.

What role does logistics infrastructure play in the success of online marketplaces in Southeast Asia?

A robust logistics infrastructure is a must for the success of online marketplaces in Southeast Asia. It ensures efficient handling of orders, from same-day delivery to international shipping, thereby enhancing customer satisfaction and facilitating the growth of the e-commerce market in the region.

How do online marketplaces cater to the needs of Chinese consumers?

Online marketplaces cater to Chinese consumers by offering a wide range of product categories, including popular consumer goods and fresh food items. They also provide multiple payment methods, including digital payments and escrow services, ensuring a seamless shopping experience for Chinese buyers.

What advantages do online sellers have in using popular e-commerce platforms in Southeast Asia?

Online sellers benefit from the established storefronts of popular e-commerce platforms. They gain direct access to a large base of monthly visitors and a diverse target audience. This gives sellers a competitive edge in the rapidly evolving internet economy of Southeast Asia.

In what ways do international businesses leverage the e-commerce market in Southeast Asia?

International businesses leverage the e-commerce market in Southeast Asia by partnering with top online marketplaces to gain exposure in the region. This allows them to tap into the growing consumer base in this region and benefit from increasing cross-border e-commerce activities.

How does the business model of third-party marketplaces differ from traditional e-commerce platforms?

Third-party marketplaces operate on a business model that allows multiple sellers, including global brands and local businesses, to list their products on a single platform. This contrasts with traditional e-commerce platforms where a business sells its own products through an established storefront.

What future trends are expected in the e-commerce space in Asia Pacific, particularly in South Korea and other countries?

Future trends in the e-commerce space in Asia Pacific, including South Korea and other countries, are likely to focus on enhancing the customer experience through advanced digital payments, expanding product categories, and improving logistics for faster delivery. Additionally, there’s an increasing emphasis on integrating AI and machine learning for personalized shopping experiences, as well as a growing interest in sustainable and ethical business practices within the e-commerce sector.

Read more from E-commerce Germany News:

12 leading marketplaces in Europe

13 leading marketplaces in North America

***