Digitizing B2B Payments: The next leap for B2B commerce in the DACH market

Written by

Editorial TeamPublished on

Understand the strategic importance of digitizing payments for B2B businesses in the DACH region and the key elements required to deliver a best-in-class digital payment experience.

The DACH region is one of the world’s largest and most important B2B commerce markets, with a combined GDP of approximately $5.35 trillion. The region is home to industry giants and a thriving business ecosystem.

However, B2B enterprises in the region have been slow to embrace digital payment methods, trailing behind their counterparts in major markets such as the United States. One commonly cited reason for the resistance to digital transformation is the perceived importance that business customers place on in-person, face-to-face interactions. However, there are other reasons behind the inertia. Implementing new technologies can be expensive and complex, and businesses may not have the resources or expertise to do so. B2B businesses within the DACH region are also increasingly concerned about data security and privacy. This is due to several factors, such as the rise of cyberattacks and new data protection regulations, such as the General Data Protection Regulation (GDPR).

In addition, many businesses also rely on legacy systems that are incompatible with new technologies. Upgrading or replacing these systems can be a costly and time-consuming process. Larger and more established companies may have invested heavily in their existing systems and processes and may be reluctant to change. For smaller businesses, this reluctance to transform is also a result of a lack of expertise and know-how.

What is often overlooked is that millennials, the generation raised in the digital age, constitute a significant portion of B2B buying teams, with 73% holding leading roles in purchasing decisions. Having grown up in the digital age, they are accustomed to the ease and convenience of consumer e-commerce platforms. They value speed and convenience and expect the same user-friendly and convenient digital payment experiences they are familiar with shopping as a consumer when purchasing for their company.

B2B businesses in the DACH region must recognize these changing dynamics within their customer base and adapt to the new and emerging digital landscape, aligning their payment experiences with the expectations and preferences of the new generation of business customers.

The current state of B2B payments in DACH

Traditionally, B2B payments in the DACH region have relied mainly on conventional payment methods, such as invoices, credit cards, and debit cards. These methods have been the backbone of business transactions for many years, but they come with their own set of challenges and limitations.

Invoices, a prevalent payment method in B2B commerce, can be slow and inefficient and expose businesses to heightened risks. Firstly, the reliance on manual processes for generating and processing invoices is a key contributor to their sluggish nature. These manual data entry tasks are time-consuming and susceptible to errors, creating a cumbersome foundation for the payment process. Reconciliation presents a considerable challenge. The process of matching invoices with purchase orders and delivery receipts can be intricate and time-consuming, further delaying the payment cycle.

The need for invoices to traverse a complex approval workflow further compounds the inefficiency. This process often involves multiple stakeholders, each with its own considerations, leading to potential delays and bottlenecks that hinder timely payments. The persistence of paperwork in traditional invoice systems adds to the time lag. Whether invoices are physical or digital, the need for documentation handling and storage can introduce avoidable delays, particularly when documents must be physically mailed or faxed.

In addition, B2B invoices are frequently associated with extended payment terms, allowing buyers to defer payment. However, these protracted terms present a significant risk, as buyers and sellers do not necessarily know each other. Buyers want to get the goods first and pay later, but sellers are reluctant to ship without prepayment at the risk of default. Sellers often have to wait weeks or even months to receive payments. Late payments and defaults can significantly impact a business’s cash flow and liquidity, causing financial strain or worse.

Credit and debit cards offer consumers two key advantages: convenience and speed. However, they can be expensive for businesses to accept. Merchants in the DACH region typically pay higher fees for credit and debit card transactions than merchants in other parts of the world due to the high cost of processing payments in these countries. Credit and debit cards also have transaction limits, which can be problematic for businesses selling high-priced goods or services.

The imperative of digitizing B2B payments

The need to digitize B2B payments has become increasingly pronounced in the last decade, driven by the convergence of factors.

Changing customer preferences

The business landscape is evolving, driven by the changing demographics of both B2B buyers and decision-makers. Millennials, who are increasingly involved in procurement and financial decision-making within organizations, have different expectations. They prefer seamless, digital experiences and often opt for vendors who can offer convenient and efficient payment methods. By digitizing B2B payments, merchants can align with these preferences and gain a competitive edge in attracting these customers.

Rising competition

The DACH region is known for its strong emphasis on manufacturing and trade. However, as global markets become increasingly interconnected, the competition has intensified. Digitizing B2B payments offers a strategic edge for merchants, enabling them to conduct transactions swiftly and securely. Efficiency is critical in this highly competitive environment, and digitized payments can significantly enhance operational agility and the customer experience to drive sales and loyalty.

Global connectivity

In an era of international commerce, merchants in the DACH region are expanding their markets internationally. Digital B2B payments facilitate cross-border transactions and make it easier for merchants to engage with partners and customers worldwide. The ability to offer international payment options efficiently can enhance a company’s global reach and competitiveness.

Operational efficiency

Manual payment processes are not only time-consuming but also prone to errors. By embracing digital B2B payment solutions, businesses can automate and streamline their financial operations. This results in reduced administrative overhead, faster processing times, and fewer payment disputes. Efficient payment processes enable merchants to allocate more resources to their core business activities.

Reducing costs

The cost of doing business is on the rise. Traditional paper-based payment methods are expensive due to the associated administrative and logistical costs. By digitizing payments, merchants can significantly reduce expenses related to printing, mailing, and processing paper checks and invoices. Moreover, digital payments can help mitigate late payment issues and associated fees, further contributing to cost reduction.

Key elements of digitization

Real-Time Decisioning: The cornerstone of digitization

One critical component of digitizing B2B payments is the implementation of real-time decisioning. The ability to provide a comprehensive assessment of a buyer’s creditworthiness helps businesses make informed decisions regarding credit extension. By using real-time credit checks, B2B businesses can approve credit for buyers who might have been denied through traditional methods or shorten sales cycles, which otherwise may have taken weeks to approve or even lost completely.

Short-term financing solutions for diverse shopping patterns

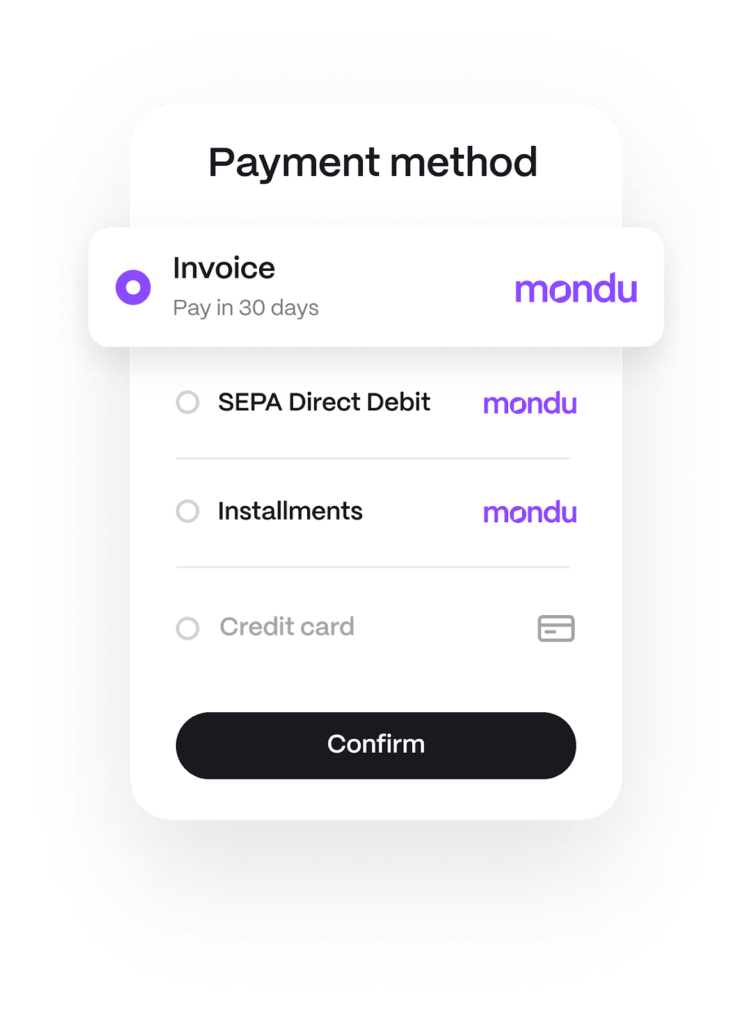

To accommodate the various purchasing needs in B2B commerce, businesses should consider offering a range of short-term financing options. These options can cater to different types of buyers and their unique shopping patterns. Here are some key short-term financing solutions:

Buy Now, Pay Later (BNPL): BNPL solutions are ideal for businesses that make occasional purchases. Buyers can defer their payments, enhancing their cash flow and making purchases more cost-effective.

Installments for large carts and long-term commitments: For substantial investments, such as machinery or equipment, installment plans can be an excellent choice. These plans spread the cost over time, reducing financial strain on buyers and encouraging long-term commitments.

Trade Accounts for Frequent Purchases: Trade accounts facilitate frequent and recurring transactions by offering a simple way to consolidate multiple purchases into one invoice, which can be paid later with net terms. This approach improves efficiency, reduces friction in the buying process, and helps build stronger relationships between businesses.

The future of B2B payments is digital

The digitization of B2B payments in the DACH region is inevitable, driven by a confluence of factors, including changing customer preferences, rising competition, global connectivity, and the need to enhance operational efficiency.

Businesses in the region must recognize the shifting dynamics and adapt to the new and emerging digital landscape by aligning their strategies with the expectations and preferences of the new generation of business customers.

Implementing real-time decision-making and offering a range of flexible short-term financing solutions are critical elements in digitizing B2B payments. Ultimately, by fully embracing the transition to digital payment solutions, B2B businesses in the DACH region can strategically position themselves to compete and succeed in an ever-evolving and fiercely competitive regional and global marketplace.

About the authors

Mondu is a European Fintech company that enables B2B merchants and marketplaces to offer Buy Now, Pay Later (BNPL) payment options to their business customers in online and offline sales channels. These payment options enable buyers to purchase goods and services and pay for them at a later date, while sellers get paid upfront and are protected from payment defaults. Mondu’s payment methods include payment upon invoice with flexible net terms, installments, and digital trade accounts.

Mondu GmbH was founded in Berlin in 2021 by entrepreneurs Malte Huffmann, Philipp Povel, and Gil Danziger. The company has a team of over 130 talented professionals and has raised $90 million in equity and debt financing from leading investors.

If you’re interested in learning more about Mondu, please find us at our booth F3.2 at E-Commerce Berlin EXPO – we are looking forward to meeting you.

***