European ecommerce overview: Sweden

Written by

Kinga EdwardsPublished on

Sweden is an interesting e-commerce market, but do you know details about it? Check out our article about Swedish e-commerce and improve your businesses in this country.

Welcome to Sweden, a Scandinavian country known for its exceptional quality of life, ranking 5th in the Human Development Index. With its strong social and economic conditions, it’s no wonder Sweden is a place many companies have their eye on. Nestled between Finland and Norway, and connected to Denmark by the iconic Öresund Bridge, Sweden’s strategic location is just one of its many advantages.

But how does this Nordic powerhouse fare when it comes to e-commerce? Is Sweden truly beneficial for online businesses? And what are its consumers really like?

Let’s find out about Swedish e-commerce today!

Swedish e-commerce overview

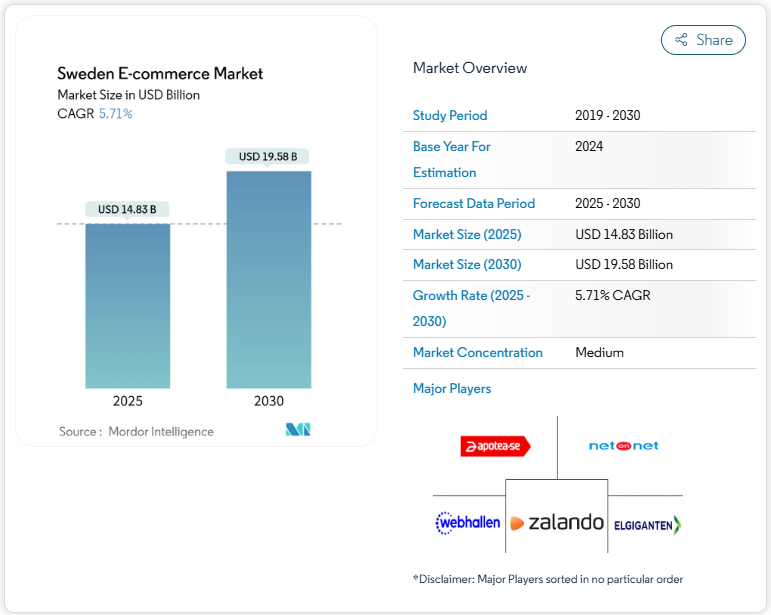

Sweden’s e-commerce market is on track to hit an impressive $14.83 billion in revenue. And it doesn’t stop there! The market is expected to grow steadily by 5.71% to 2030, reaching a whopping $19.58 billion. A surge like this reflects the changing nature of online shopping in Sweden and positions it as one of the most interesting players in the global e-commerce scene.

As for revenues by sector, Fashion, Beauty, and Groceries are expected to generate the most earnings:

- Fashion and Shoes continue to be a major driver of online sales (31%), as Swedish consumers turn to digital platforms for their clothing and accessory needs. This sector is driven by a strong preference for both local and international brands that offer trendy, sustainable, and personalized options.

- Meanwhile, Beauty and Health products are also seeing significant growth. 21% of shoppers said they buy them most frequently.

- Finally, Groceries – with 13% of people buying them online.

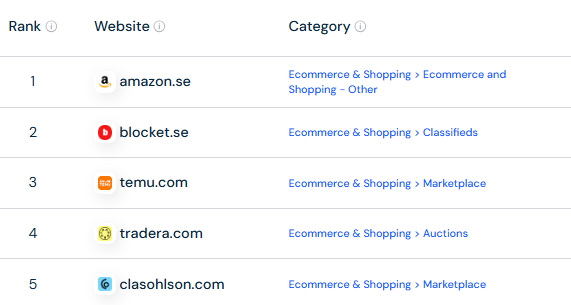

In Sweden, we can point out some of the top online retailers who make noise in the e-commerce world. According to SimilarWeb, the top 5 websites in e-commerce & shopping ranking are:

- amazon.se

- blocket.se

- tradera.com

- clasohlson.com

- temu.com

Amazon.se leads the pack and offers Swedish consumers access to a vast array of products with the convenience of fast delivery.

Blocket.se, a popular online marketplace, continues to be a favorite for buying and selling second-hand items, and it caters to the Swedish love for sustainability and bargains.

Next is Tradera.com, an auction-based platform similar to eBay, where users can bid on various items, from electronics to collectibles.

ClasOhlson.com, known for its extensive home improvement and DIY products, is a go-to for Swedes looking to enhance their living spaces.

Consumers’ behavior in Sweden

A large portion of the Swedish population now relies heavily on e-commerce, with many consumers citing better deals, convenience, and accessibility as the main reasons for this shift. Mobile shopping is also on the rise, driven by the proliferation of retail apps. It’s a clear indication of the growing dominance of digital channels in Swedish retail.

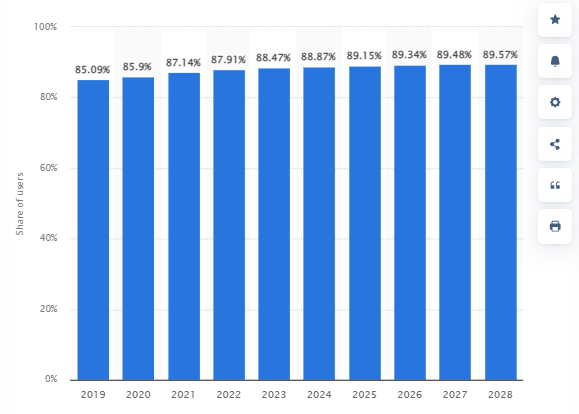

Swedes follow trends and love to try new products. The main determinants of the purchase are price and quality. They also pay attention to know-how and after-sales service. The user penetration rate stands at 89.15%, and it’s expected to rise to 89.5% by 2028. So yes, the adoption of online shopping among Swedes is steadily rising.

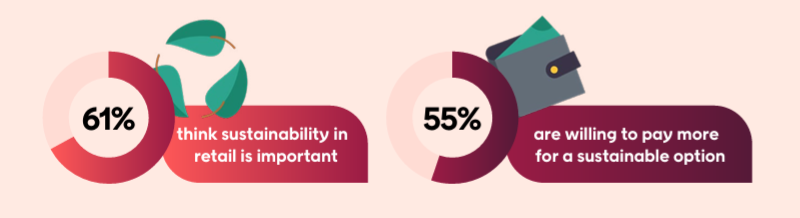

What’s obvious is that sustainability remains another top priority for Swedish consumers. 61% of them consider sustainability important in retail, and 55% are willing to pay more for sustainable products. And it’s evident across various sectors, like food, fashion, and electronics.

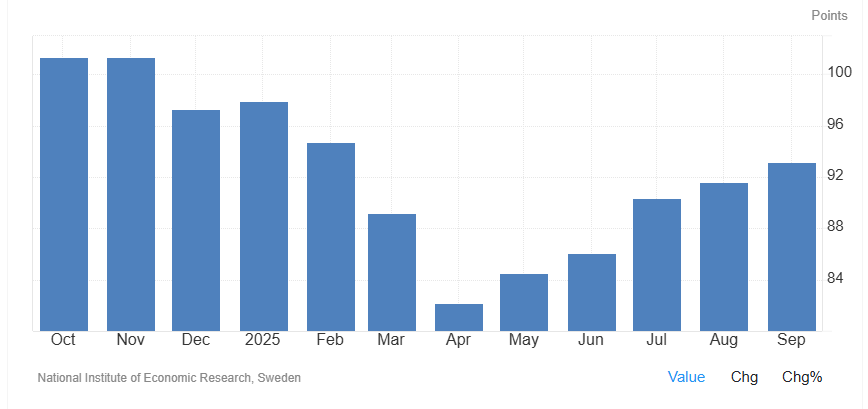

In terms of consumer confidence, it’s messy here. Sentiment in Sweden has improved slightly, rising to 93.2 in September 2025 from 91.6 in August, marking the best level since February – but it’s still below long-term norms.

People feel a bit better about their household finances, though they remain cautious about spending on bigger items. Expectations for the broader economy are less negative than before, and job insecurity has eased, with fewer Swedes expecting higher unemployment. Still, worries about inflation and borrowing costs continue to weigh on optimism and keep confidence from fully rebounding.

Swedes increasingly embrace cross–border shopping, which is a trend seen across the Nordic region. With well-established international platforms like Zalando and Amazon, Swedish consumers have developed a strong preference for global brands. This is especially evident in the fashion sector, where 47% of Swedish consumers have an experience of purchasing clothing, shoes, or accessories online.

Payment methods in Swedish e-commerce

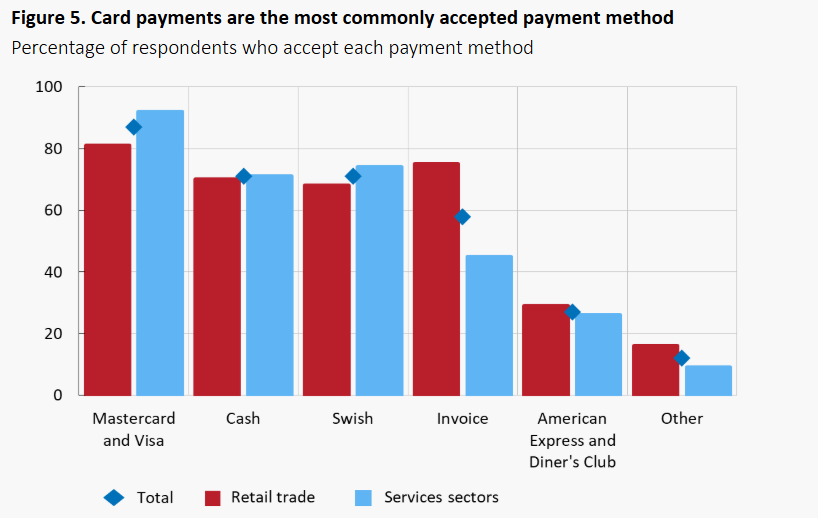

Swedes are pretty serious about digital payments — cash is vanishing fast, and convenience rules the day. One of the biggest names? Swish, a mobile app for instant transfers that ties to the user’s phone number and bank account. It’s used heavily for in-person purchases, sending money to friends, and increasingly in e-commerce checkouts.

Cards (Visa, Mastercard, etc.) are still a staple. Many merchants accept them for both offline and online purchases. In fact, among small businesses, card payments are the most accepted method.

Then there’s open invoices. Swedes like the flexibility of being able to review goods before paying, so invoicing remains a strong contender in the mix of e-commerce options.

Another method popping up is direct bank transfers via systems like Trustly, which lets customers pay straight from their bank accounts without needing to enter card details. There’s also Autogiro, which is Sweden’s version of direct debit — especially handy for recurring payments like subscriptions or utilities.

And cash? It’s still around, but barely. It’s estimated to account for only a small sliver of total transactions.

Payment safety

Payments in Sweden are generally considered safe and efficient. But as always, there are concerns regarding fraud and the accessibility of payment services. The cash infrastructure heavily relies on two private entities, which poses some vulnerabilities that need to be addressed for overall safety improvements.

However, there are many aspects that contribute to Sweden’s payment safety. These include, for example:

- Mobile payment security: Mobile apps and services have rigorous security measures in place. They rely on customer authentication, often through mobile banking apps, which use biometrics (like fingerprint or facial recognition) or two-factor authentication (2FA) for verification.

- Data encryption and protection: Sweden has stringent data protection laws, which align with the General Data Protection Regulation. This means that payment providers must handle customer information with the highest security standards.

- Strong banking infrastructure: Swedish banks are known for their reliability and security protocols. Technologies like SSL encryption and PCI DSS compliance ensure that sensitive information is encrypted during transmission.

- Fraud prevention systems: These systems use machine learning algorithms to detect unusual transaction patterns, helping to prevent fraudulent activities in real-time.

Social media in Sweden

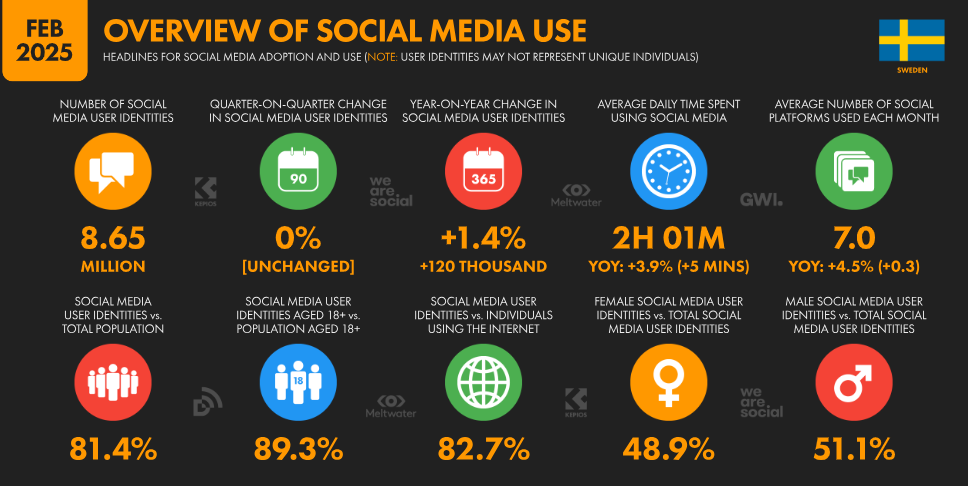

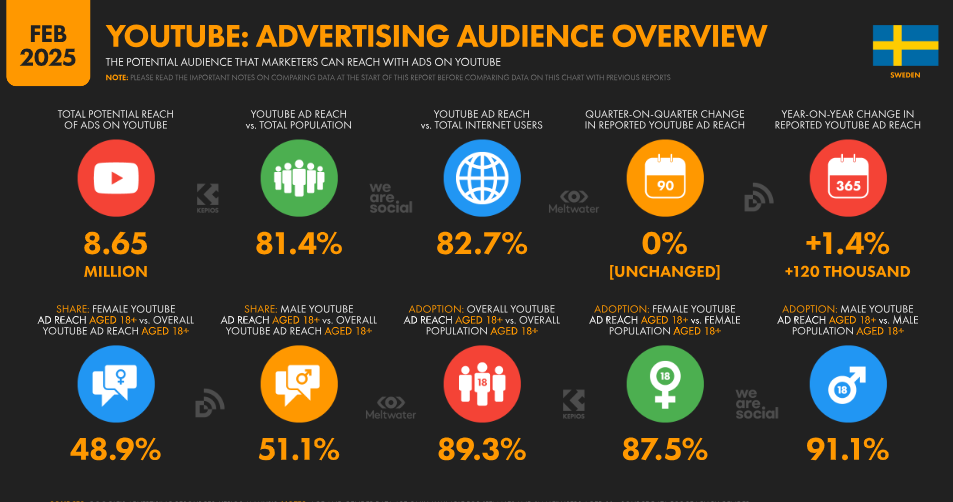

Swedish e-commerce couldn’t rise that fast without social media. They remain a significant part of daily life in Sweden, with 8.65 million users accounting for 81.4% of the population. The average daily time spent on using social media hit 2h 01 min. And the majority of social media users are male, with 51.1%. Sure, it’s a bit above half, but still.

This widespread adoption is supported by nearly universal online penetration at 98.3%. So almost everyone in Sweden has access to these digital spaces.

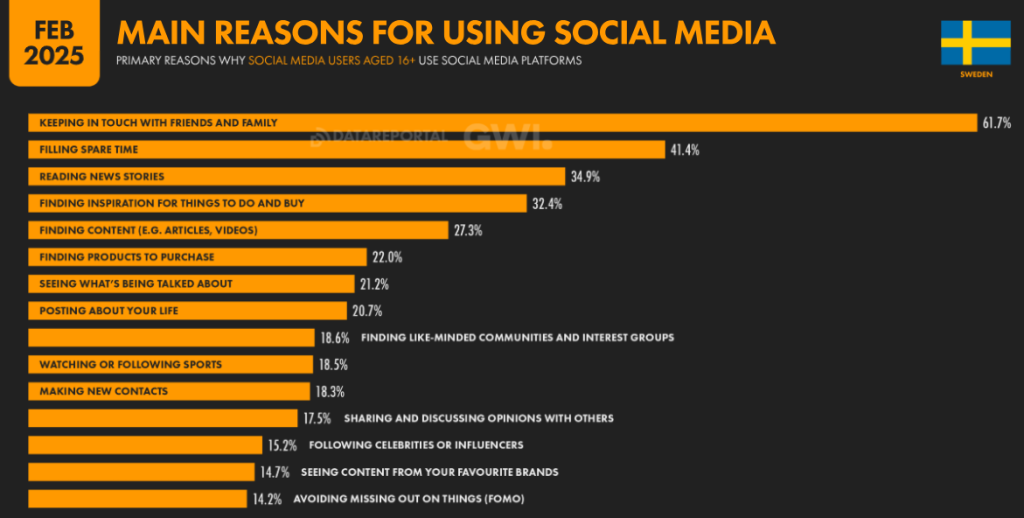

Swedes are active participants who engage with content, brands, and friends across various platforms. The top three reasons for using social media are:

- staying in touch with friends and family

- taking advantage of spare time

- news reading

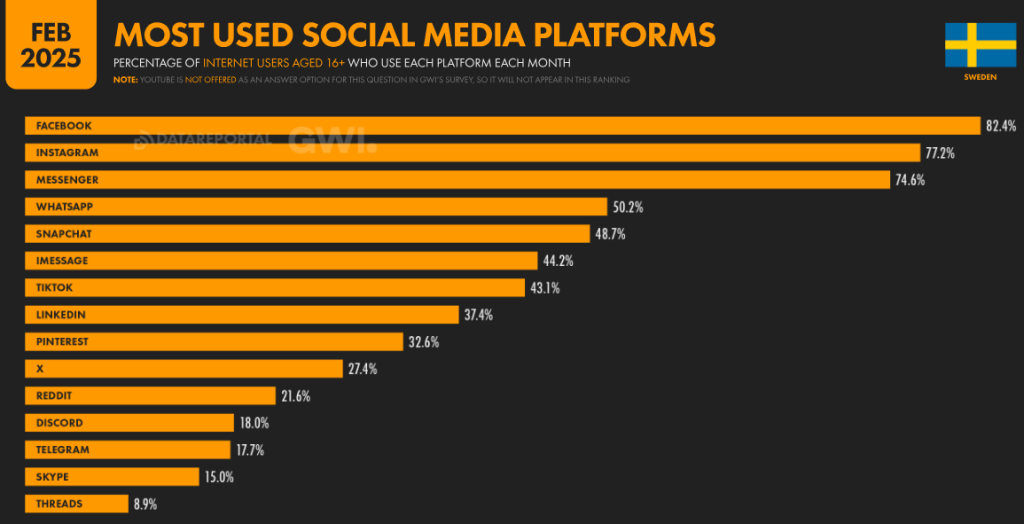

Of course, some popular platforms have an advantage over others. These include YouTube, Facebook, Facebook Messenger, and Instagram. They all provide a variety of content, from entertainment to educational resources. In addition, many mobile connections (139% of the population) indicate a mobile-first approach – Swedes are increasingly using their smartphones for social media.

Key social media platforms in Sweden in 2025

Sweden’s top social media platforms are, for example:

#1 YouTube (8.65 million users): YouTube stands out as the most popular social media platform in Sweden, reaching 81.4% of the population. Its extensive library and easy access to different types of content make it a go-to platform for both consumers and creators.

#2 Facebook (5.80 million users): Next, there is Facebook. Its integration of various features, such as groups, marketplace, and events, makes it an indispensable tool for staying connected with friends, family, and local communities. Its messaging app – Facebook Messenger, is also widely used.

#3 Instagram (5.45 million users): Instagram is particularly popular among younger demographics and is known for its visually appealing content. The platform’s focus on image and video sharing allows users to express themselves creatively.

#4 TikTok (3.30 million users aged 18 and above): TikTok’s growth reflects its popularity among younger audiences who are drawn to its short, engaging video format. Its algorithm personalizes content to user preferences, making it addictive and highly engaging.

#5 LinkedIn (5.90 million members): LinkedIn has carved out a niche as the professional network of choice in Sweden, with 5.90 million members. It’s particularly interesting for its role in career development, networking, and business-to-business interactions.

Swedish logistics

Taking into account the terrain and climate, logistics is concentrated in the southern part of the country. This is also the reason why freight logistics is so well-developed in Sweden. Its most important points are Malmö, Helsingborg, Gothenburg, Norrköping, and Stockholm. Swedish companies provide such services as logistics & supply chains, logistics management, 3rd party logistics services, freight forwarding, packaging, warehousing, storage and distribution, corporate logistics, and pallet trucks.

The country’s well-developed road and rail networks, efficient ports, and strong focus on sustainability make it a key player in the European logistics landscape. For example, the Port of Gothenburg, the largest port in Scandinavia, handles 57% of Sweden’s container trade, making it a vital hub for goods entering and leaving the region. Aside from that, Sweden’s extensive rail network also facilitates the transport of goods across the country and to neighboring countries. Thus, it reduces reliance on road transport and carbon emissions.

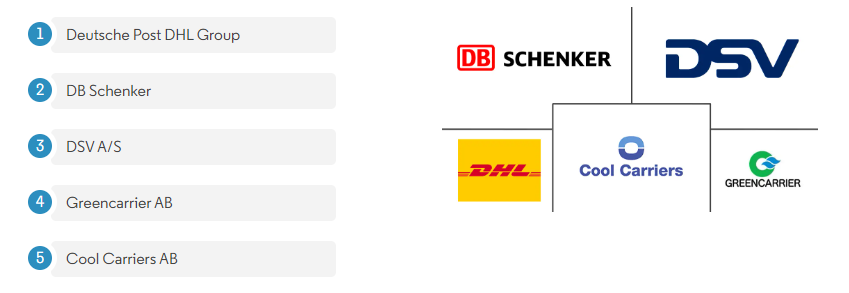

The top companies in Sweden’s freight and logistics market are Deutsche Post DHL Group, DB Schenker, DSV A/S, Greencarrier AB, and Cool Carriers AB. These companies are known for their extensive networks, reliable service, and innovative approaches to logistics management.

However, the Swedish logistics market remains highly competitive, with no single player dominating the landscape. Each of these companies brings unique strengths to the table and caters to different market segments.

Challenges in Swedish logistics

Despite its strengths, logistics in Sweden face several challenges. The country’s northern regions, characterized by harsh winters and sparse populations, pose significant obstacles to transportation and delivery. Snow, ice, and extreme cold can disrupt supply chains, cause delays, and increase costs. Further, the need for specialized vehicles and equipment to operate in these conditions adds complexity and expense to the region’s logistics operations.

Another challenge is the growing demand for e-commerce, which pressures logistics companies to provide faster and more efficient delivery services. As consumers increasingly expect same-day or next-day delivery, logistics providers must innovate and invest in technologies like automation and artificial intelligence to meet these expectations.

To sum up

Now that you’re familiar with the Swedish e-commerce landscape, you know that this sector is thriving and expanding. While some retailers may hesitate, fearing logistical challenges or the high standards of Scandinavian consumers, the reality is far more encouraging.

Swedish e-commerce is expanding rapidly, supported by efficient logistics, consumers who like to try new things, and widespread internet adoption. So, if you’re considering entering this market, don’t hesitate – translate your site into Swedish, tap into this dynamic market, and watch your fanbase grow!

And if you want to get more market insights, sign up for our newsletter about e-commerce and not only!

***