Key Takeaways from the “Amazon Determines Consumer Behavior Online and Offline” Report

Written by

Kinga EdwardsPublished on

The ECC KÖLN study delves into consumer behavior on prevalent online marketplaces. It particularly focuses on Amazon’s influence, which extends from online to offline shopping behaviors. The study is part of the Trend Check Handel Vol. 8 series and explores the current state of online marketplace business in Germany.

Amazon’s Dominance in Online Marketplaces

Consumer Preference

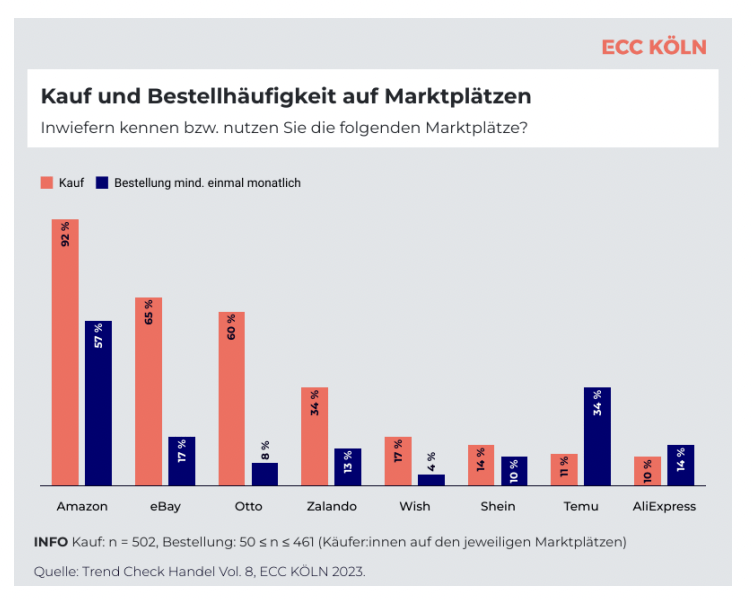

The study reveals that 73% of consumers find online marketplaces to be a convenient option for shopping. This high percentage indicates a strong consumer inclination towards online marketplaces as their preferred shopping destination. Amazon, in particular, benefits from this trend, being the first choice for the majority of these consumers. Its user-friendly interface and vast product range make it the go-to platform for online shopping.

First Choice for Many

Amazon stands as the go-to platform for most consumers, overshadowing other established marketplaces like eBay and Zalando. This dominance is not just in numbers but also in consumer trust and reliability. Amazon’s extensive product range and customer-centric policies make it a preferred choice, pushing other marketplaces to the periphery.

Amazon’s Influence Extends to Physical Retail

Primary Source of Information

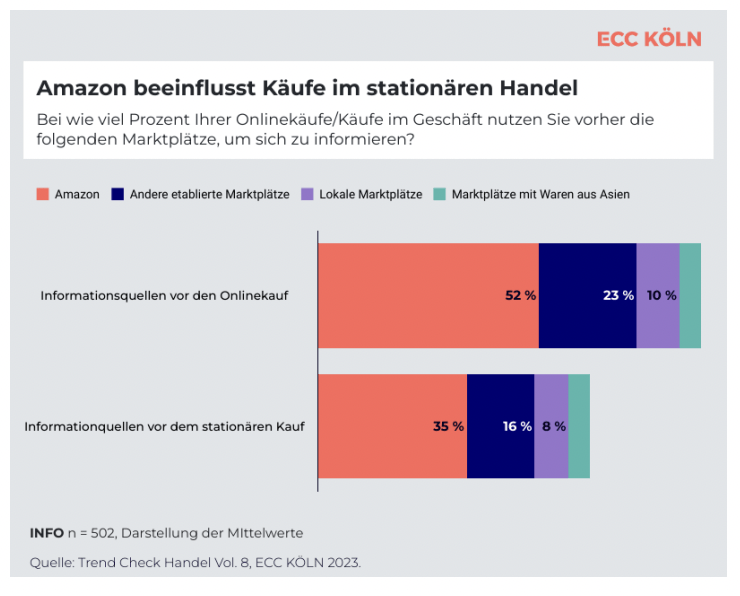

Before making any purchase, consumers seek various types of information, and Amazon serves as the primary source. This highlights Amazon’s role not just as a marketplace but also as an information hub. Consumers rely on Amazon for product reviews, price comparisons, and other details, which significantly influences their final purchasing decisions.

Influence on Purchases

About one-third of all in-store purchases are made after consumers have sought information on Amazon. For online purchases, this influence is even more significant, affecting one in every two purchases. This dual role of Amazon, as both a marketplace and an information source, amplifies its impact on consumer behavior across both online and offline retail.

The Impact of Amazon on Consumer Spending

Reduced Spending

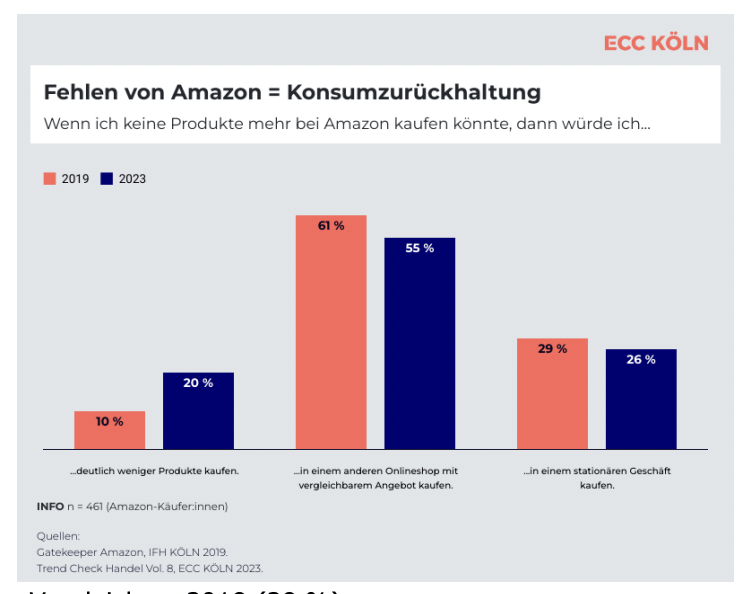

If Amazon were not available as a shopping channel, 20% of consumers would reduce their spending. This is a significant increase from 10% in 2019 and indicates Amazon’s growing influence on consumer spending habits. The platform’s absence would not only affect online shopping but also have ripple effects on overall consumer expenditure.

Alternative Shopping Channels

While 61% would have considered other online shops as an alternative to Amazon four years ago, that number has now decreased to 55%. This decline suggests that Amazon’s grip on the online retail market is tightening, leaving fewer consumers willing to consider alternatives.

No Real Competition from Asian Marketplaces

Consumer Skepticism

Despite rising user numbers for platforms like Wish, Shein, or Temu, 41% of consumers state they would never shop from these Asian marketplaces. This skepticism could be attributed to concerns about product quality, shipping times, or customer service. These platforms have yet to gain the level of trust that consumers place in more established marketplaces like Amazon.

Emerging Player

Temu is making strides with its gamification approach and has already surpassed eBay and Otto in terms of regular monthly orders.

This innovative approach to consumer engagement shows promise and could potentially disrupt the marketplace landscape. However, it’s worth noting that despite this success, Temu has not yet reached a level where it could pose a significant threat to Amazon.

***