European Ecommerce Overview: Slovenia

Written by

Kinga EdwardsPublished on

Gain valuable insights into Slovenia’s e-commerce sector. Learn about market dynamics, consumer preferences, social media, payments, and the future of online shopping in Europe.

Slovenia is a Central European country. It borders Italy, Hungary, Croatia, and Austria. It has access to the Adriatic Sea, too. Slovenia is placed on the route of major European roads, making it an important point on Europe’s logistics map.

In this article, you will find some information about Slovenian e-commerce, what are consumers’ habits, and many more aspects of this market. We will start with a quick e-commerce overview.

E-commerce overview in Slovenia

Slovenian e-commerce is small but growing fast and becoming an essential part of the country’s retail landscape. In 2025, the overall Slovenian e-commerce market was projected at around $1.07 billion, showing steady annual growth. It’s set to climb toward $1.16 billion in 2026 and $1.7 billion in 2031. The CAGR should reach 8.1%.

Consumers are shifting online, and internet penetration is high. According to Eurostat data from December 2025, 66.87% of residents ordered goods or services online — up from years past and not far behind many EU peers. This means two out of three Slovenians are interacting with e-commerce platforms at least occasionally.

Web sales are pushing up retail turnover too. In 2025, enterprises sold an estimated €1.668 million worth of goods and services via online channels to private customers. As digital habits mature, Slovenian e-commerce is increasingly part of everyday life.

The mix of local and international players is shaping the market. Domestic platforms capture the majority of transactions (77%), but cross-border shopping is rising fast within the EU Single Market. Categories are also diversifying. While fashion and electronics remain strong, segments such as home goods, beauty & wellness, and online grocery are gaining traction.

Mobile commerce is huge too — over 74% of site traffic comes from mobile devices in 2025, signaling that Slovenian e-commerce is fundamentally mobile first. For merchants, this means optimizing for small screens and quick checkouts isn’t optional anymore.

All this adds up to a market that’s still relatively young but evolving rapidly. Slovenian e-commerce offers opportunities for local brands and international partners alike, especially in tech-enabled services and mobile shopping experiences.

Slovenian consumer behavior

Understanding how Slovenians behave online is key to winning in Slovenian e-commerce. The profile of an online shopper is young, active, and broad — but there’s nuance by age and type of purchase.

In the first quarter of 2025, 53% of Slovenians aged 16–74 made at least one online purchase. That’s over half the population actively buying online. The rates are especially high among adults aged 25–44, where about 70% shop online. Even older adults (65–74) are coming online more — their share of buyers rose by several points compared to the previous year.

Slovenians love variety in what they buy. Fashion is dominant: 69% of e-buyers bought clothes, shoes, or accessories in that first quarter of 2025. Home goods, gardening tools, and furniture were popular too (28%). Roughly a quarter purchased sports equipment (24%), medicine or supplements, and a similar share paid for digital media subscriptions like streaming services. Nearly half of e-buyers also purchased services online — tickets for events, subscriptions, and so on.

Slovenians are cautious shoppers by nature. Around 26% of buyers encountered problems with online orders (late delivery, inability to order from abroad, damaged goods). That’s a signal for retailers — improve fulfillment and customer care and you’ll win repeat buyers fast.

Cross-border behavior is notable. Slovenian buyers aren’t afraid to shop outside the country, especially from EU markets. They tend to look for broader assortments, competitive prices, and delivery perks from bigger marketplaces.

Local preferences shape purchase decisions too. Many Slovenians prioritize supporting local brands and choose Slovenian sellers when quality and price align. This can be a strong advantage for domestic e-commerce players.

Overall, Slovenian e-commerce customers are digital, discerning, and increasingly confident with their online purchases. They expect seamless mobile experiences, transparent prices, and reliable delivery.

Payment methods in Slovenia

Payment behavior in Slovenia is a mix of tradition and modern tech. Even as digital payments rise, preferences vary widely by age and purchase type.

Cards are still central. In the broader Slovenian e-commerce market in 2025, credit and debit cards commanded the majority share of online payment value (51.63%). Traditional card networks (Visa, Mastercard) and co-branded local schemes are widely accepted online and in POS transactions.

Digital wallets and mobile payments are growing fast – here, digital wallets are the fastest-growing payment method, with a projected 10.39% CAGR to 2031 — even as cards remain dominant. Younger consumers, especially Gen Z and Millennials, are more comfortable with mobile and wallet options, favoring speed and convenience.

But Slovenia’s payment mix still reflects unique local habits. Many buyers in Slovenian e-commerce and outside it still use cash on delivery, especially for smaller everyday purchases. This preference owes to tradition and trust issues among older generations.

Prepaid cards were once hugely popular, covering large slices of online transactions. While in 2026 this may shift, the core story stays the same: Slovenians like options. They pay with cards online, but also seek mobile wallets, prepaid tools, and sometimes COD when they want extra reassurance.

For merchants, that means offering a range of methods — from cards and digital wallets like PayPal or local wallet services, to bank transfers, and flexible checkout flows — will reduce abandoned carts and build trust.

Overall, Slovenian e-commerce shoppers are moving steadily toward digital payment preferences, but traditional methods remain part of the picture. The key for retailers is to balance both sides: secure, fast digital checkout plus familiar, trustworthy fallback options for hesitant buyers.

Social media in Slovenia

Social media plays a major role in Slovenian e-commerce. Slovenians are active online, and social platforms are one of the biggest drivers of awareness, discovery, and traffic to online shops.

By early 2025, Slovenia had about 1.58 million social media user identities, which is roughly 74.6% of the total population of 2.12 million. That’s a big chunk of the public you can reach with smart social content and ads.

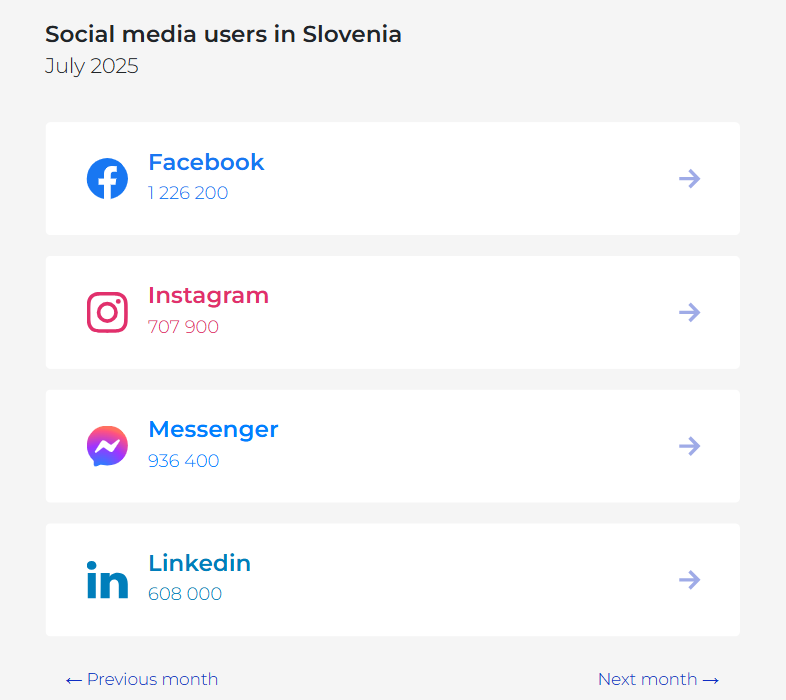

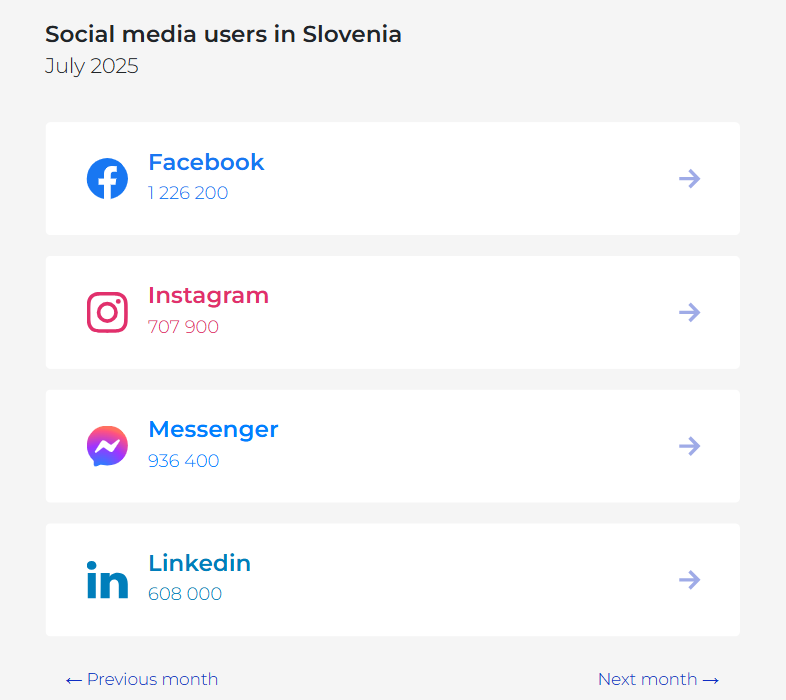

Breaking that down by platforms, mid-2025 stats show strong activity on the major networks:

- Facebook: over 1.22 million users.

- Instagram: around 707 900 users.

- Messenger: about 936 400 active accounts.

- LinkedIn: roughly 608 000 users.

Those numbers give clear signals. Facebook still has broad reach, especially with older adults and community groups. Instagram is a must for lifestyle, fashion, beauty, and other lifestyle categories within Slovenian e-commerce. Messenger keeps conversation easy, while LinkedIn gives B2B brands a space to connect with professionals and decision-makers.

Across social platforms, the audience is quite balanced by gender too — roughly 48.5% female and 51.5% male among adults in 2025. That’s useful to know when you tailor your content or ads by demographic.

Social media also shapes buying behavior. Slovenians regularly check social feeds for product inspiration, reviews, and direct links to stores. That’s why interactive formats (reels, stories, short video) are vital in Slovenian e-commerce marketing. Good social content brings traffic, but it also builds trust — and trust converts to sales.

In 2025, about 89% of residents reported having digital skills, ranging from basic to advanced. That means people don’t just lurk on social platforms — they interact, research, and often click through to buy.

For Slovenian e-commerce brands, social trends offer a clear lesson: social presence is a core channel for visibility, engagement, and direct conversion. Ignoring social platforms means missing out on three-quarters of potential customers who could be ordering through your online store.

Slovenian logistics

Logistics is where the back-end meets the front door — and in Slovenian e-commerce that connection has gotten more sophisticated.

Slovenia is small geographically, but consumers today expect fast delivery and easy returns. Because of this, logistics providers are stepping up with speed and choice. Strategic partnerships and Central European freight links mean retailers can offer competitive shipping times within Slovenia and beyond. For example, local carriers work with regional and international partners to streamline parcel movement across borders.

Delivery options are now a key part of how Slovenians decide where to shop. Same-day delivery around Ljubljana and express options in Maribor and Celje are emerging as differentiators — especially for urban buyers. Shorter delivery windows reduce abandonment at checkout and boost repeat sales in Slovenian e-commerce.

Returns are part of the logistics story too. In 2025, many retailers improved reverse logistics (returns processing), with clearer policies and simpler steps for customers — this increases trust and reduces hesitation about buying online. Customers increasingly expect a smooth returns experience as standard.

For smaller merchants, third-party logistics (3PL) providers have become an essential partner. They handle warehousing, pick-and-pack, and delivery coordination, without requiring sellers to build expensive infrastructure. That lets even niche Slovenian e-commerce brands compete on delivery quality.

Post-purchase communication — like shipment tracking and delivery windows — is another area where logistics connects back to Slovenian e-commerce success. Customers who can track their parcel in real time are more likely to feel confident buying again.

One challenge remains rural delivery.

Less-densely-populated areas still see longer transit times and higher costs. Retailers that carve out clever solutions — pick-up points, locker systems, or local courier hubs — can appeal to these customers without eroding margins.

All in all, logistics in Slovenia in 2025 is flexible, evolving, and increasingly customer-centric. Speed, transparency, and reliable returns are table stakes for any online shop if you want loyal buyers and strong conversion rates.

To sum up

Slovenian e-commerce is small compared to some bigger European markets, but it’s growing steadily with solid digital adoption and rising online buyer confidence:

- consumers are savvy

- most Slovenians use the internet

- a strong majority buy online

- a large portion engage with digital channels daily

- mobile use and digital skills are high.

That means your Slovenian e-commerce store needs a slick mobile experience, clear product info, and easy checkout flows to keep visitors and turn them into buyers.

But it’s not only the front end that matters. Behind the scenes, logistics and delivery are shaping customer impressions and trust. Fast shipping, flexible returns, and transparent tracking are key differentiators in the market — and logistics partners can make or break satisfaction.

In this evolving landscape, Slovenian e-commerce rewards those who meet consumers where they are. Grow those strengths and you’re tapping into a market that’s small but rich with opportunity.

If you want to read about Slovenia’s neighbors here, you can read about Austria, Croatia, and Hungary.